Zero-Based Budgeting (ZBB) is a method where every expense must be justified for each new period. It starts from a “zero base,” and every function within an organization is analyzed for its needs and costs.

Zero-Based Budgeting stands out as a highly disciplined approach to budgeting and financial planning, requiring managers to scrutinize all spending. Unlike traditional budgeting methods that adjust previous budgets to account for new expenses, ZBB forces a comprehensive review from the ground up, ensuring that resources are allocated based on necessity and efficiency.

This method encourages organizations to identify cost-saving opportunities and reallocate resources to areas with higher potential returns. By focusing on operational efficiency and strategic allocation of funds, Zero-Based Budgeting helps organizations to achieve more sustainable growth and financial stability. It’s a powerful tool for businesses looking to optimize expenses, enhance accountability, and drive strategic financial planning.

Credit: www.ramseysolutions.com

Introduction To Zero-based Budgeting

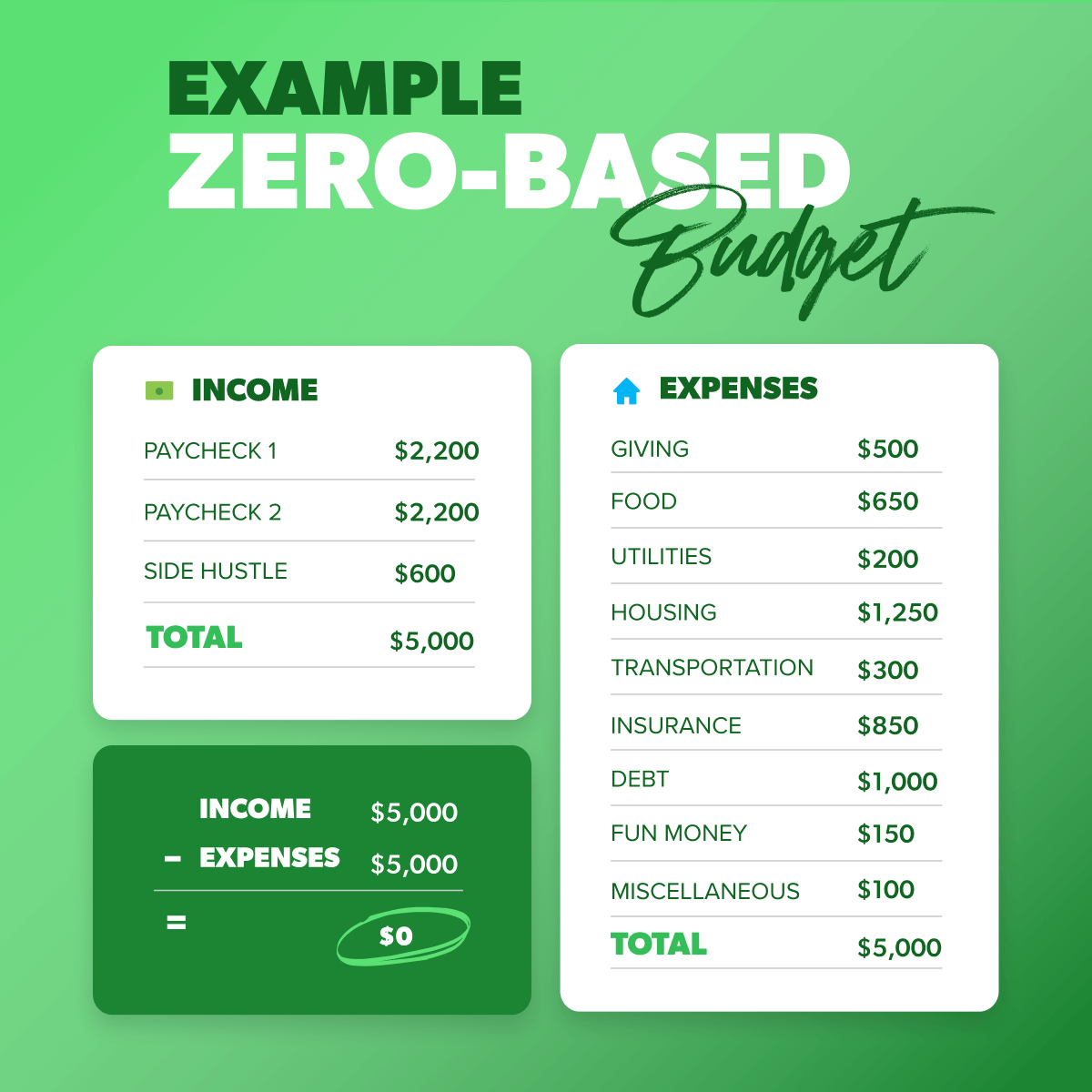

Imagine planning your money from scratch every month. That is Zero-Based Budgeting (ZBB). You give every dollar a job. This method makes sure you use money wisely. It helps you save more and spend less.

The Basics Of The Zero-based Budgeting Approach

ZBB starts fresh each time. You look at your money as if it’s new. Here’s how it works:

- Start from zero: Pretend you start with no money. Then, plan every dollar.

- Needs first: Pay for needs like food and home first.

- Plan savings: Decide how much to save. Put money there.

- Wants come last: If there’s money left, you can think about fun stuff.

Contrasting Traditional Budgeting With Zero-based Budgeting

Let’s see how ZBB differs from the usual way of budgeting:

| Aspect | Traditional Budgeting | Zero-Based Budgeting |

|---|---|---|

| Starting Point | Looks at last year’s budget | Begins at zero every time |

| Focus | On past expenses | On current needs and goals |

| Savings | Not always planned | Planned from the start |

| Flexibility | Less | More, adapts to changes |

The Philosophy Behind Zero-based Budgeting

The philosophy of Zero-Based Budgeting stands on a simple yet powerful idea. Instead of relying on past budgets, it starts anew. This method demands justifying every expense. It ensures money use aligns with current goals and needs.

Starting From Scratch: A Fresh Financial Outlook

Zero-Based Budgeting wipes the financial slate clean. It ignores previous spending patterns. Each budget cycle begins at zero. This approach requires critical thinking about every cost. It asks a key question: “Is each expense necessary and beneficial today?”

Allocating Every Dollar A Purpose

Every dollar must work hard in this budgeting method. Expenses must match personal or business goals. Each dollar gets a specific role. This precision cuts waste and boosts financial health.

- Needs like housing and food are funded first.

- Wants come after essentials are covered.

- Savings are planned, not left to chance.

This budgeting creates a clear money path. It aligns spending with priorities.

Preparing Your Zero-based Budget

Starting a zero-based budget sets a strong financial foundation. This method gives every dollar a job. It starts from zero and adds expenses based on needs and values. Let’s prepare your zero-based budget with easy steps.

Cataloging Monthly Income Sources

Know what you earn to manage your money well. Start by listing all income sources. Include your salary, side hustles, and passive income. Use a simple table to keep track:

| Income Source | Amount | Frequency |

|---|---|---|

| Main Job | $3000 | Monthly |

| Part-Time Work | $500 | Weekly |

Listing And Categorizing Expenses

Expenses need clear categories. Start by listing all monthly bills and needs. Split expenses into groups like ‘Housing’, ‘Food’, and ‘Utilities’. Here’s how to do it:

- Housing: Rent, mortgage, insurance.

- Food: Groceries, dining out.

- Utilities: Electricity, water, internet.

Add more categories as needed

Give every dollar a purpose. Remember to include savings and debt payments. This makes sure you stay on track with financial goals.

Strategies For Effective Zero-based Budgeting

Zero-Based Budgeting (ZBB) stands as a method to drive financial discipline. It involves building a budget from scratch, or “zero base.” Here, every expense must justify its existence. Below are key strategies for making ZBB work for you.

Prioritizing Expenses

With ZBB, prioritization is crucial. Begin by listing all monthly costs. Next, rank these from most to least important. Shelter, food, and utilities often top the list. Next come transportation and insurance. Leisure and subscriptions may rank lower.

Essentials come first; luxuries can wait. This ensures critical needs get funds before anything else.

Managing Irregular Expenses

Some costs don’t come monthly. These might include annual subscriptions or maintenance fees. To manage these, divide the total yearly cost by 12. This gives the monthly amount to set aside.

Creating a savings buffer for such expenses can prevent financial surprises. As a result, you’re ready for these costs when they arise.

| Expense | Annual Cost | Monthly Allocation |

|---|---|---|

| Car Insurance | $1200 | $100 |

| Property Taxes | $2400 | $200 |

By following these strategies, ZBB can be an effective tool for managing finances. It helps ensure every dollar is working towards your financial goals.

Implementing Zero-based Budgeting In Personal Finances

Many individuals seek better control over their finances. Zero-based budgeting can be a powerful tool for this. It involves allocating every dollar of income to specific expenses, savings, or debt repayments. This method ensures a clear financial plan with no wasteful spending. Here is how to apply it to personal finances.

Setting Realistic Financial Goals

Financial goals guide spending and saving. Begin by listing all financial targets. These could include saving for a vacation, paying off debt, or building an emergency fund. Next, prioritize these goals. Essential needs come first, such as rent and groceries. Then, allocate funds to other priorities. This approach ensures each dollar has a purpose that aligns with personal ambitions.

- Essential expenses: Rent, utilities, groceries

- Financial priorities: Debt repayment, savings

- Personal goals: Vacation fund, home improvements

Adjusting The Budget Monthly

Life is unpredictable. Expenses change month to month. Therefore, review and adjust the budget regularly. Start by tracking actual spending. Compare it against the planned budget. Identify any variances. Adjust the next month’s budget accordingly. This might mean cutting back on non-essentials or reallocating funds. The key is to stay flexible and responsive to financial changes.

| Month | Income | Essential Expenses | Financial Priorities | Discretionary Spending |

|---|---|---|---|---|

| January | $3000 | $1500 | $800 | $700 |

| February | $3000 | $1500 | $1000 | $500 |

By continuously monitoring and adjusting, you can stay on top of finances. Embrace changes and refine the budget to fit current needs. This proactive approach helps avoid debt and saves for future goals.

Credit: www.wallstreetmojo.com

Zero-based Budgeting In Action

Zero-Based Budgeting in Action shows how this method works. It starts every budget from zero. This means every cost needs approval, not just new expenses. This helps businesses and people control spending better.

Case Studies Of Successful Zero-based Budgeters

- Company A: Saved 30% on marketing costs. They reviewed all expenses. Only useful activities got funds.

- Family B: Reduced unnecessary shopping by 40%. They planned all purchases. No money was spent without a plan.

Common Challenges And Solutions

| Challenge | Solution |

|---|---|

| Time-consuming | Use software for budget tracking. |

| Hard to start | Begin with main expenses. Add details later. |

Tools And Resources For Zero-based Budgeting

Zero-Based Budgeting (ZBB) is a method where every expense must be justified. To start, you need the right tools and resources. These help you track every dollar you earn and spend. With ZBB, every new period is a chance to re-assess your spending. This ensures that your money aligns with your current financial goals.

Budgeting Apps And Software

Finding the right app or software is key to ZBB success. Many are user-friendly and sync with bank accounts. They offer real-time tracking of your expenses. Some popular ones include:

- You Need A Budget (YNAB) – It gives every dollar a job.

- Mint – It tracks expenses and suggests budgets.

- EveryDollar – It’s designed for zero-based budgets.

Worksheets And Templates

Worksheets and templates can simplify ZBB. They guide you through the process. You can find many free options online. Or create custom ones in Excel or Google Sheets. Key features include:

| Feature | Benefit |

|---|---|

| Expense Categories | Organize spending easily. |

| Income Tracking | Record all sources of income. |

| Monthly Overview | See your financial picture. |

Evaluating The Impact Of Zero-based Budgeting

Zero-based budgeting rethinks spending from scratch. It ensures every dollar has a purpose. This method can transform finances. But first, assess its impact.

Measuring Financial Progress

Tracking success with zero-based budgeting is key. Start with these steps:

- Set clear goals: Know what to achieve financially.

- Record expenses: Write down all spending. Do this daily.

- Review regularly: Check budgets versus actuals often.

- Adjust as needed: Update budgets for better control.

Use graphs or charts to visualize progress. Seeing results can motivate.

When To Revise Your Zero-based Budgeting Approach

Zero-based budgeting needs flexibility. Look for these signs:

- Income changes: New job or pay cut? Update the budget.

- Life events: Marriage or moving? Time to revise.

- Financial goals shift: Aiming for something new? Alter the plan.

- Unexpected expenses: Sudden costs mean budget tweaks.

Regular reviews keep the budget useful. Adapt when life changes.

Credit: www.vertex42.com

Frequently Asked Questions

What Is An Example Of A Zero-based Budget?

A zero-based budget example involves allocating every dollar of income to expenses, savings, and debt payments until the balance is zero.

What Is A Zero-based Budgeting Approach To Budgeting?

Zero-based budgeting is a method where every expense must be justified for each new period, starting from a “zero base” without reference to prior budgets.

What Is A Zero-based Budgeting System?

A zero-based budgeting system requires every expense to be justified for each new period. It starts from a “zero base,” and every function within an organization is analyzed for its needs and costs. Businesses allocate funding based on current needs without reference to previous budgets.

What Are The 5 Steps In Creating A Zero-based Budget?

Identify your monthly income. List all your expenses. Differentiate between wants and needs. Allocate funds to each category, starting from zero. Regularly review and adjust your budget as necessary.

Conclusion

Embracing zero-based budgeting can transform your financial approach, fostering discipline and clarity. By starting fresh each period, you scrutinize every dollar, ensuring strategic allocation. Ready to revamp your budgeting strategy? Adopt zero-based budgeting and watch your financial goals align with your expenditures, leading to a more empowered economic future.