Personal finance is crucial for securing your future. It helps you manage money, reduce debt, and build wealth.

Managing your personal finances effectively ensures financial stability and independence. It involves budgeting, saving, investing, and planning for retirement. With good financial habits, you can avoid unnecessary debt and achieve your financial goals. You gain control over your financial future and can handle unexpected expenses with ease.

Financial literacy empowers you to make informed decisions about investments and savings. Understanding personal finance can also help you build a safety net for emergencies. This foundation supports a comfortable lifestyle and prepares you for life’s uncertainties. Prioritizing personal finance today secures a prosperous tomorrow.

Credit: blog.shoonya.com

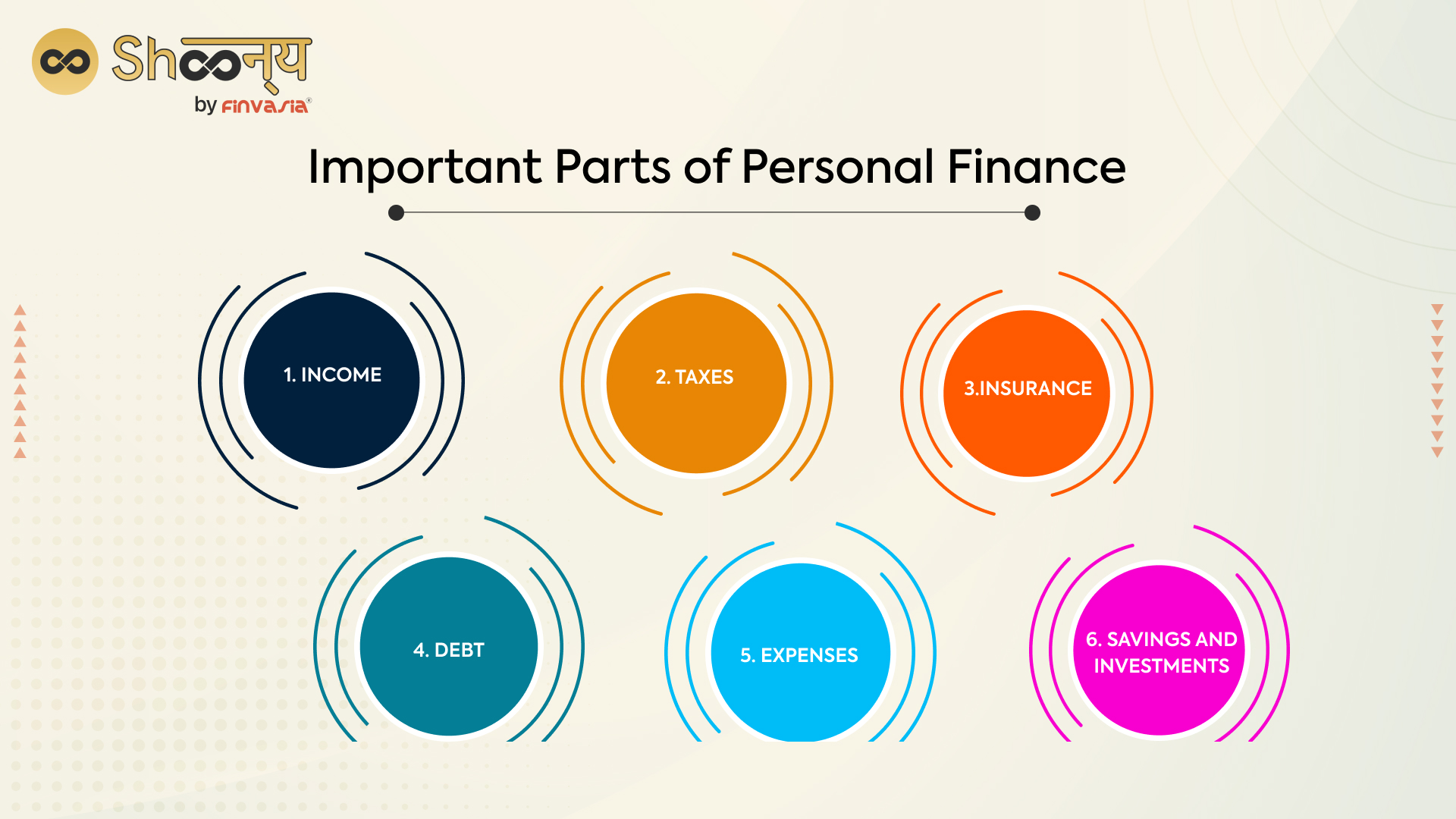

Importance Of Personal Finance

Personal finance is a crucial part of life. Managing your money well leads to a stable future. It helps you make informed decisions and achieve your goals. Understanding personal finance means knowing how to save, invest, and spend wisely.

Financial Independence

Financial independence means having enough money to live without working. It allows you to retire early or pursue your passions. Saving and investing wisely can help you reach this goal. You can enjoy life without worrying about bills or debts. Financial independence gives you freedom and peace of mind.

Stress Reduction

Managing personal finance reduces stress. Knowing your finances are in order helps you feel secure. You can handle emergencies without panic. Budgeting allows you to plan for future expenses. This means no more sleepless nights over money worries.

Credit: wealthface.com

Setting Financial Goals

Setting financial goals is crucial for a secure future. It helps you manage your money better. You can achieve both your short-term and long-term dreams. Let’s explore how to set these goals effectively.

Short-term Goals

Short-term goals are achievable within a year. They are small steps towards bigger dreams. Examples include saving for a vacation, buying a gadget, or building an emergency fund. These goals keep you motivated and focused.

- Saving for a vacation: Plan and save a fixed amount monthly.

- Buying a gadget: Set aside a part of your income each month.

- Building an emergency fund: Save money for unexpected expenses.

Use a budget to track your progress. This way, you can see how close you are to reaching your goal. Adjust your spending if needed to stay on track.

Long-term Goals

Long-term goals take more than a year to achieve. These goals require careful planning and patience. Examples include buying a home, saving for retirement, or funding a child’s education.

- Buying a home: Save for a down payment and closing costs.

- Saving for retirement: Contribute regularly to a retirement account.

- Funding a child’s education: Start a college savings plan early.

Divide your long-term goals into smaller milestones. This makes them easier to manage and achieve. Review your goals regularly to ensure you are on the right path.

| Goal | Time Frame | Action Plan |

|---|---|---|

| Vacation | 6 months | Save $200 monthly |

| Home Down Payment | 5 years | Save $500 monthly |

| Retirement | 30 years | Contribute 10% of income |

Setting financial goals helps you stay focused and motivated. Whether short-term or long-term, each goal brings you closer to financial security. Start setting your goals today for a better tomorrow.

Budgeting Basics

Understanding budgeting basics is crucial for managing personal finances. It helps in planning and controlling your money. This ensures that you can meet your financial goals.

Tracking Expenses

Start by tracking your expenses. Knowing where your money goes is essential. List every expense. This includes groceries, rent, and entertainment. You can use a notebook or an app.

Here is a simple table to help track expenses:

| Category | Amount |

|---|---|

| Groceries | $200 |

| Rent | $800 |

| Entertainment | $100 |

Allocating Funds

After tracking, the next step is allocating funds. This helps in managing your income wisely. Divide your money into categories like savings, bills, and leisure.

Consider using the 50/30/20 rule:

- 50% for needs (rent, groceries, utilities)

- 30% for wants (dining out, movies)

- 20% for savings and debt repayment

Following this rule helps in balancing your budget effectively.

Here’s an example:

- Income: $2000

- Needs: $1000

- Wants: $600

- Savings and Debt: $400

By mastering budgeting basics, you ensure a secure financial future. Track expenses and allocate funds wisely.

Credit: www.amazon.com

Saving Strategies

Saving strategies are crucial for managing your personal finances. They help you prepare for unexpected expenses and ensure a secure future. Below, we explore key saving strategies that everyone should consider.

Emergency Fund

An emergency fund is your financial safety net. It covers unexpected costs like medical bills or car repairs. Aim to save at least three to six months’ worth of expenses. This fund should be easily accessible but separate from your main account.

- Start small, even $10 a week adds up.

- Use a high-yield savings account.

- Automate your savings to make it effortless.

Retirement Savings

Saving for retirement ensures you can live comfortably in your later years. The earlier you start, the more you benefit from compound interest. Consider using retirement accounts like 401(k)s or IRAs.

Here are some tips for effective retirement savings:

- Contribute to your employer’s 401(k) plan.

- Maximize contributions if possible.

- Consider a Roth IRA for tax-free growth.

Remember to review your retirement plan annually. Adjust your contributions as your income grows.

Investing Wisely

Investing wisely is crucial for securing your future. Making smart investments helps grow your wealth. It provides financial stability and security. Let’s explore some investment options.

Stock Market

Investing in the stock market can be a great way to build wealth. Stocks represent ownership in a company. When the company grows, your investment grows too.

- Stocks can provide high returns.

- They offer ownership in big companies.

- They are easy to buy and sell.

But, stocks can be risky. Prices can go up and down quickly. Always research before investing in stocks.

Real Estate

Real estate is another popular investment option. It involves buying property like houses or land.

| Advantages | Disadvantages |

|---|---|

| Steady income from rent | High initial cost |

| Property value can increase | Maintenance costs |

Investing in real estate provides a steady income through rent. Property value can increase over time. But, it requires a big initial investment. There are also maintenance costs.

Investing wisely means understanding risks and benefits. Make informed decisions for a secure future.

Managing Debt

Understanding and managing debt is crucial for your financial well-being. Good debt management can improve your credit score and financial stability. Learn about the different types of debt and how to manage them effectively.

Good Vs. Bad Debt

Not all debt is created equal. Good debt can help you invest in your future. Examples include student loans and mortgages. These debts often come with lower interest rates and potential long-term benefits.

Bad debt usually has high interest rates and offers no future returns. Credit card debt and payday loans fall into this category. They can quickly spiral out of control if not managed properly.

| Type of Debt | Interest Rate | Potential Benefits |

|---|---|---|

| Student Loans | Low | Higher Education |

| Mortgages | Moderate | Property Ownership |

| Credit Cards | High | None |

| Payday Loans | Very High | None |

Debt Repayment Plans

Creating a debt repayment plan can help you get out of debt faster. Here are some common strategies:

- Snowball Method: Pay off the smallest debts first. Gain momentum as you go.

- Avalanche Method: Pay off debts with the highest interest rates first. Save money on interest in the long run.

- Debt Consolidation: Combine multiple debts into one. Often comes with a lower interest rate.

These strategies can help you manage your debt more effectively. Choose the one that best fits your situation and stick to it.

Credit Score Importance

Your credit score is like a report card for your financial health. It tells lenders how reliable you are with money. A good credit score opens doors to better financial opportunities. You get better loan terms, lower interest rates, and can even rent a nicer home. Let’s explore how to build and maintain a good credit score.

Building Credit

Building credit starts with understanding what affects your score. Here are key factors:

- Payment history: Pay bills on time.

- Credit utilization: Use less than 30% of your credit limit.

- Length of credit history: Keep old accounts open.

Start small by getting a secured credit card. Use it for small purchases. Pay the balance in full each month. This builds your credit history safely.

Maintaining Good Credit

Maintaining good credit means being consistent. Here are some tips:

- Check your credit report annually. Look for errors.

- Pay all bills on time, every time.

- Keep your credit card balances low.

- Do not close old credit accounts.

Set up automatic payments to avoid late fees. Monitor your credit score regularly. This helps you catch problems early.

Financial Education

Financial education is the foundation of personal finance. It teaches you how to manage money wisely. With proper financial knowledge, you can make informed decisions. This helps secure your financial future.

Let’s explore some key aspects of financial education:

Books And Courses

Books and courses are great resources for learning about finance. Many books cover topics like budgeting, saving, and investing. Some popular titles include:

- Rich Dad Poor Dad by Robert Kiyosaki

- Your Money or Your Life by Vicki Robin

- The Total Money Makeover by Dave Ramsey

Online courses also offer valuable insights. Websites like Coursera and Udemy provide many finance courses. These courses can help you build a strong financial foundation.

Professional Advice

Seeking professional advice can make a big difference. Financial advisors offer personalized guidance. They help you create a tailored financial plan. This plan considers your goals, income, and expenses.

Advisors can also assist with investments and retirement planning. Their expertise ensures you make smart financial choices. Remember, a small fee for advice can save you money in the long run.

Here’s a simple table to highlight the benefits of professional advice:

| Benefits | Description |

|---|---|

| Personalized Plans | Advisors create plans tailored to your needs. |

| Expert Guidance | Receive advice from experienced professionals. |

| Long-term Savings | Proper advice can save you money over time. |

Frequently Asked Questions

How Does Personal Finance Help You In Your Future?

Personal finance helps you manage money, save for emergencies, and invest for future goals. It ensures financial stability and security.

Why Do You Think Personal Finance Is Important?

Personal finance is vital for managing money, avoiding debt, and achieving financial goals. It ensures financial security and stability. Proper budgeting, saving, and investing are key aspects. Understanding personal finance helps make informed decisions and prepares for emergencies.

How Can Personal Finance Benefit Me As A Student?

Personal finance helps students manage money wisely, avoid debt, and save for future expenses. It builds budgeting and saving skills.

Why Is It Important To Build A Financial Future?

Building a financial future ensures security, stability, and independence. It helps achieve long-term goals and handle emergencies.

Conclusion

Mastering personal finance is crucial for a secure future. It helps you manage debt, save, and invest wisely. By prioritizing financial education, you can achieve long-term goals and enjoy peace of mind. Start today and build a stable financial foundation.

Your future self will thank you for making informed decisions now.