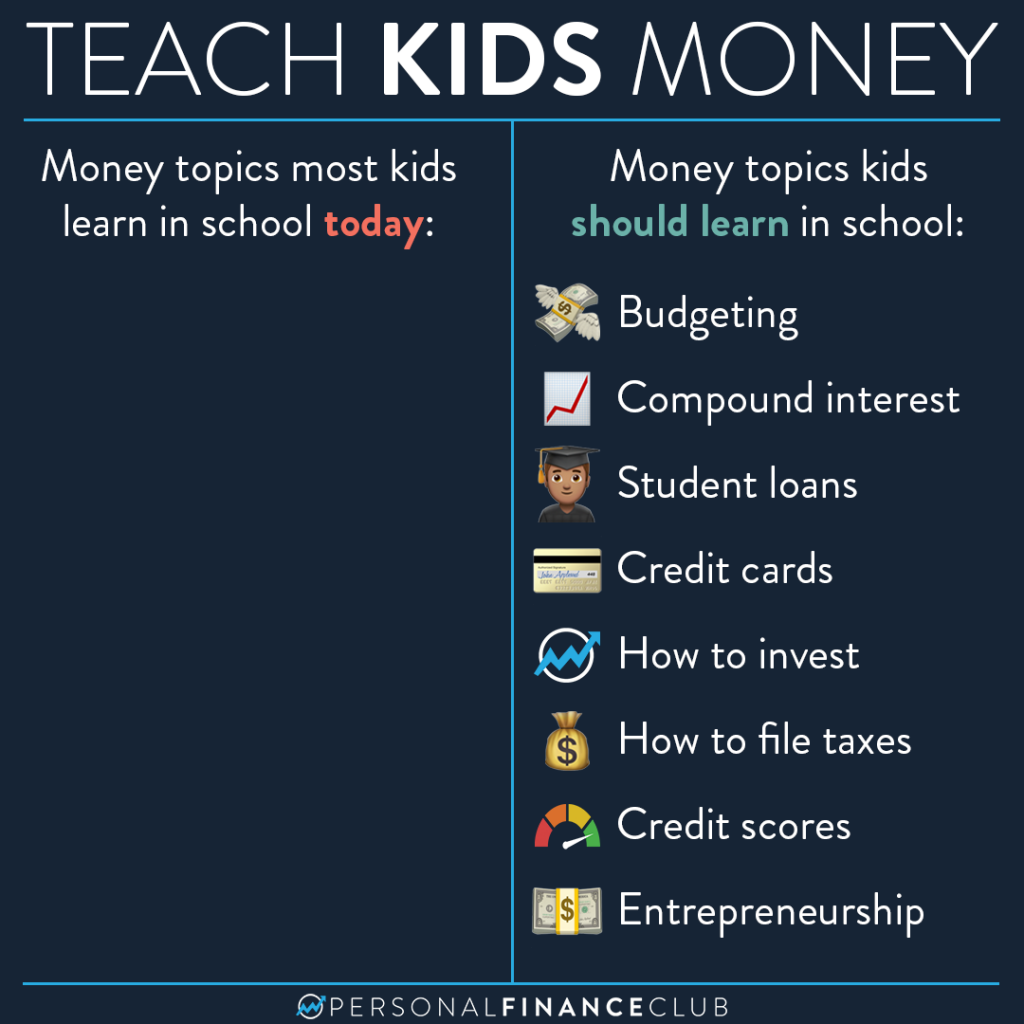

Schools often neglect personal finance due to outdated curriculums and limited resources. Educators may also lack the necessary training.

Understanding personal finance is crucial for long-term financial stability. Despite its importance, many schools fail to include it in their curriculum. Outdated educational systems focus more on traditional subjects. Limited resources and lack of trained educators also contribute to this gap.

Personal finance knowledge helps individuals manage budgets, save for the future, and make informed financial decisions. Without this foundation, students may struggle with debt and financial planning later in life. Integrating personal finance into school curriculums can equip students with essential life skills. Teaching these concepts early can foster financial literacy and responsibility.

Credit: www.personalfinanceclub.com

Importance Of Financial Literacy

Understanding personal finance is crucial for everyone. Financial literacy helps people make smart decisions about money. Learning about finance in school can change lives.

Building A Strong Foundation

Early education in finance helps children build a strong foundation. Basic concepts like saving, budgeting, and investing are essential. Schools should teach these skills to prepare students for the future.

Parents sometimes lack time or knowledge to teach finance. Schools can fill this gap. Students can learn about credit scores, loans, and interest rates. These topics are important for financial success.

| Financial Concept | Importance |

|---|---|

| Saving | Helps in emergencies and future plans |

| Budgeting | Prevents overspending and promotes smart spending |

| Investing | Grows wealth over time |

Long-term Benefits

Learning finance early has long-term benefits. Students who understand money make better life choices. They avoid debt and plan for retirement.

Financially literate people are less stressed about money. They have better relationships and live happier lives. Schools should prioritize teaching finance to create a financially stable society.

- Less debt

- Better job prospects

- Increased savings

- Smarter investments

Teaching finance in schools ensures everyone gets the same knowledge. This leads to a more equal and fair society. Investing in financial education pays off for everyone.

Current Education System

The current education system often overlooks personal finance. Schools focus heavily on traditional subjects. This creates significant gaps in practical life skills. Financial literacy is a crucial skill. Yet, it remains absent from most school curriculums.

Curriculum Gaps

Many schools have outdated curriculums. They don’t include essential personal finance topics. Students graduate without knowing how to manage money. They lack understanding of budgeting, saving, and investing.

- No lessons on how to create a budget

- No guidance on saving for emergencies

- Investment basics are not taught

These gaps leave students unprepared for real-world financial challenges. They enter adulthood without necessary financial skills.

Focus On Traditional Subjects

Schools prioritize traditional subjects like math, science, and literature. These subjects are important but don’t cover everyday financial needs. Personal finance is rarely a priority in school curriculums. This leads to a lack of financial literacy among young adults.

| Traditional Subject | Personal Finance Topics |

|---|---|

| Math | Budgeting |

| Science | Saving |

| Literature | Investing |

While traditional subjects are taught, personal finance is ignored. This imbalance leaves students unprepared for financial independence.

Impact Of Lack Of Financial Education

Financial education is a crucial skill for life. Yet, many schools skip it. Without proper financial knowledge, students face many challenges. They struggle with budgeting, saving, and investing. The impact is evident in many areas of their lives.

Debt And Financial Mismanagement

Many young adults fall into debt early. They use credit cards without understanding interest rates. This leads to high debt and stress. Without financial education, they don’t know how to manage their money. They may spend more than they earn. This can lead to serious financial problems.

Student loans are another issue. Many students take out loans without knowing the repayment terms. They graduate with a huge debt burden. Without knowledge, they can’t plan repayments effectively. This leads to long-term financial struggles.

Delayed Financial Independence

Without financial education, young adults take longer to become financially independent. They may rely on parents for longer. This can delay important life milestones. For instance, buying a house or starting a family.

Savings and investments are key for financial independence. Many young people don’t know how to save or invest. They miss out on the benefits of compound interest. This means they have less money for future needs.

The lack of financial education affects overall economic growth. A financially literate population contributes to a stronger economy. Teaching personal finance in schools can make a huge difference.

Benefits Of Teaching Personal Finance

Teaching personal finance in schools can have many benefits. It helps students manage money better. They learn to save, budget, and invest early on. This knowledge can shape their future positively.

Early Financial Habits

Children form habits early. Teaching personal finance helps them build good money habits. They learn the value of saving and spending wisely.

- Saving: Students learn to save a part of their money.

- Budgeting: They understand how to plan for expenses.

- Investing: Early knowledge of investments can grow their money.

These habits can lead to a secure financial future. It reduces the risk of debt and financial stress.

Empowering Future Generations

Teaching personal finance empowers young minds. It gives them control over their financial choices. They learn to avoid financial pitfalls.

- Confidence: Knowledge builds confidence in managing money.

- Independence: They become financially independent sooner.

- Responsibility: Understanding finances makes them more responsible.

Empowered students can make informed decisions. They can plan for their dreams and goals.

| Benefit | Description |

|---|---|

| Financial Security | Better money management leads to financial stability. |

| Reduced Debt | Understanding credit prevents excessive debt. |

| Future Planning | Students can save for future goals like college or a home. |

Teaching personal finance in schools is crucial. It prepares students for real-world challenges. They become financially savvy adults.

Challenges In Implementing Financial Education

Teaching personal finance in schools faces many hurdles. Implementing financial education encounters various challenges that schools must tackle.

Resource Constraints

Schools often have limited resources. Budget restrictions make it hard to add new subjects. Textbooks and learning materials cost money. Financial education needs specific resources. These include software, books, and guest speakers. Schools struggle to allocate funds for these.

Classrooms need to be equipped with technology. This helps in practical financial lessons. Many schools do not have enough computers. They also lack internet access. This hampers the quality of financial education.

Need For Trained Educators

Qualified teachers are essential for effective learning. Financial education needs specially trained educators. Many teachers lack the knowledge of personal finance. They are not prepared to teach this subject.

Training programs for teachers are necessary. These programs cost time and money. Schools find it challenging to arrange these training sessions. Without proper training, teachers cannot deliver quality financial lessons.

Here is a table summarizing the challenges:

| Challenge | Details |

|---|---|

| Resource Constraints | Limited budgets, lack of textbooks, and insufficient technology. |

| Need for Trained Educators | Teachers lack personal finance knowledge and require special training. |

Successful Models And Case Studies

Understanding personal finance is crucial for success. Some countries and schools have successful models. These models can serve as examples for others.

Countries With Effective Programs

Some countries have effective personal finance education programs. These programs help students manage money better. Here are a few examples:

| Country | Program Highlights |

|---|---|

| Finland | Focus on real-life skills and budgeting. |

| Australia | National curriculum includes financial literacy. |

| Singapore | Students learn saving and investment strategies. |

Schools Leading The Way

Some schools excel in teaching personal finance. These schools use innovative methods. Here are some top examples:

- EverFi: Offers interactive financial education modules.

- Next Gen Personal Finance: Provides free resources and curriculum.

- Utah’s Granite School District: Requires personal finance course for graduation.

These models and case studies show what’s possible. They can inspire other schools to adopt similar programs.

Role Of Parents And Guardians

Parents and guardians play a crucial role in teaching personal finance.

They are often the first to introduce the concept of money to children.

Their influence can help shape a child’s understanding and habits.

Home As First School

The home is the first school for personal finance education.

Children observe and mimic their parents’ financial behaviors.

This makes parents the primary role models for money management.

Parents can teach kids how to save money.

They can also explain the importance of budgeting.

Simple activities like grocery shopping can be educational.

Use a piggy bank to teach children about saving.

This is a fun and effective way to introduce the concept of saving.

Collaborative Efforts With Schools

Schools and parents should work together to teach personal finance.

Collaboration enhances the learning experience for children.

Schools can provide structured lessons on financial topics.

Parents can reinforce these lessons at home with real-life examples.

Both parties can use educational resources to support learning.

Books, apps, and games can make learning about money fun.

| Role | Activities |

|---|---|

| Parents |

|

| Schools |

|

Credit: freedomsprout.com

Steps Towards Integration

Integrating personal finance education into schools is crucial. It equips students with essential life skills. The following steps can help achieve this integration.

Policy Changes

Policy changes are the first step towards integration. Governments need to mandate personal finance education. This can be done at both state and national levels. Policies should ensure personal finance is a core subject. Schools should be required to teach budgeting, saving, and investing. Proper policies will make personal finance a priority.

Teacher training should be part of these policies. Teachers need proper tools and resources. This ensures they can effectively teach personal finance. Policies should also provide funding for these resources. Schools need the support to implement these changes.

Community Involvement

Community involvement plays a vital role in integrating personal finance education. Local businesses can offer workshops. Financial experts can volunteer to teach classes. Parents can support schools by reinforcing lessons at home.

Creating partnerships with financial institutions can provide real-world insights. Schools can host events that involve the community. These events can focus on practical financial skills. Community support strengthens the learning process.

| Step | Description |

|---|---|

| Policy Changes | Mandate personal finance as a core subject. |

| Teacher Training | Provide tools and resources for teachers. |

| Community Involvement | Engage local businesses and experts. |

To make a change, both policies and community efforts are essential. Together, they can integrate personal finance into education effectively.

Credit: www.cnbc.com

Frequently Asked Questions

Why Is Personal Finance Not Taught In Schools?

Personal finance isn’t taught in schools due to outdated curriculums and lack of trained teachers. Schools often prioritize traditional academic subjects over practical life skills.

Do They Teach Personal Finance In High School?

Yes, some high schools teach personal finance. The curriculum varies by state and school district.

Why Don’t They Teach Investing In School?

Schools often prioritize traditional subjects over financial education. Limited resources and standardized curriculums also contribute. Many educators lack investing expertise. Financial literacy is often left to parents and self-learning.

What Schools Don’t Teach About Money?

Schools often don’t teach budgeting, investing, saving, taxes, and managing debt. Financial literacy remains largely overlooked in curriculums.

Conclusion

Personal finance education is essential for future financial stability. Schools should prioritize teaching these crucial life skills. Understanding budgeting, saving, and investing can empower students. Let’s advocate for personal finance to be part of the curriculum. This knowledge will help create financially responsible and confident adults.