Understanding personal finance is crucial for managing money effectively and achieving financial stability. It empowers individuals to make informed financial decisions.

Personal finance knowledge helps people budget, save, and invest wisely. It enables better debt management and prepares individuals for unexpected expenses. By understanding financial principles, individuals can set realistic goals and work towards financial independence. Knowledge of personal finance also reduces financial stress, improves credit scores, and ensures a secure future.

With informed financial decisions, people can avoid common pitfalls like excessive debt and poor investment choices. Mastering personal finance is a lifelong skill that provides peace of mind and enhances overall quality of life. By prioritizing financial literacy, individuals can build a solid foundation for a prosperous future.

:max_bytes(150000):strip_icc()/FinancialLiteracy_Final_4196456-74c34377122d43748ed63ef46a285116.jpg)

Credit: www.investopedia.com

Introduction To Personal Finance

Personal finance is the management of money. It includes budgeting, saving, and investing. Understanding personal finance helps you make smart money choices. This can lead to financial stability and success.

The Basics Of Personal Finance

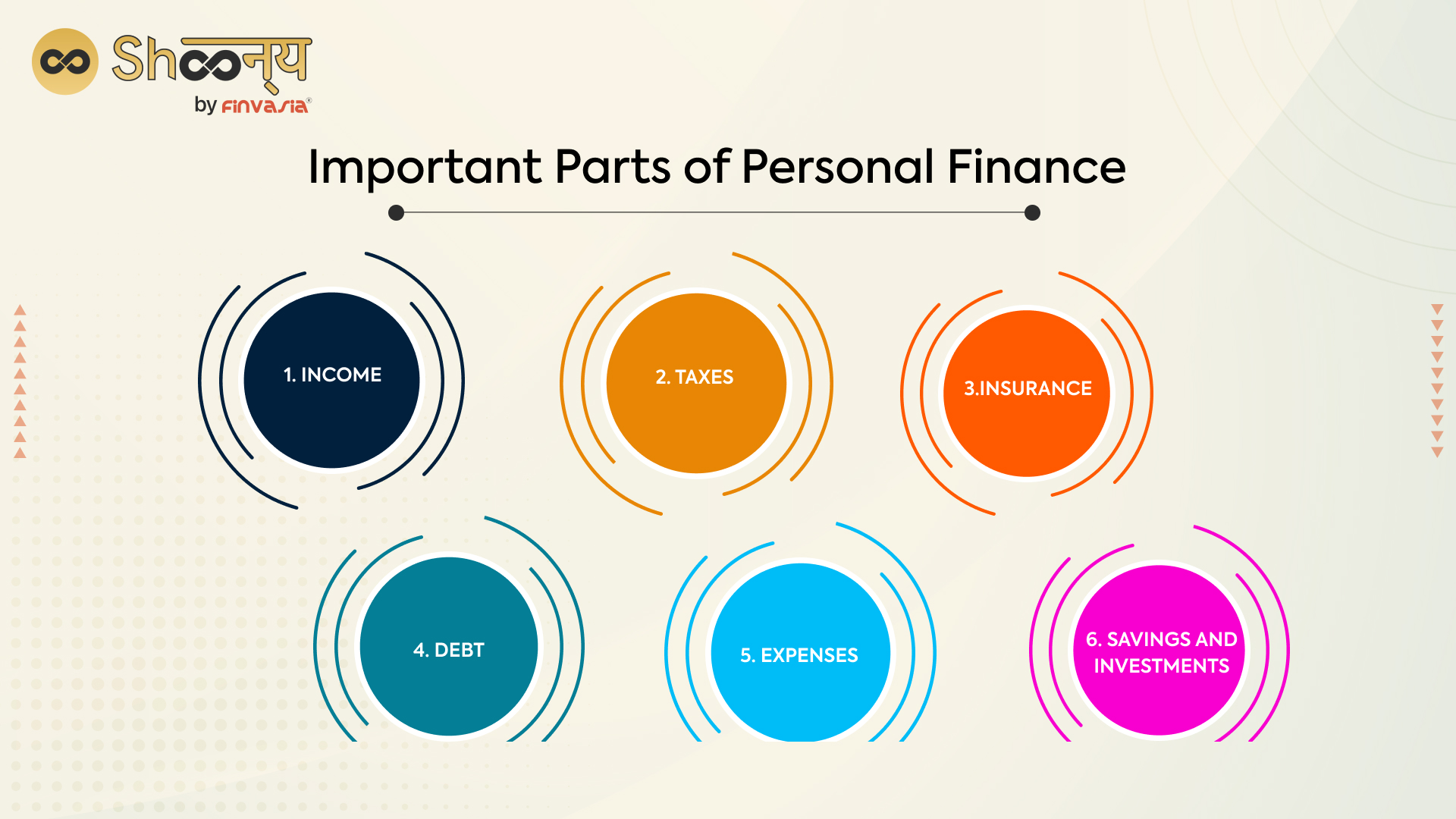

Personal finance covers many areas. Here are the basics:

- Income: Money you earn from work or other sources.

- Expenses: Money you spend on needs and wants.

- Budgeting: Planning how to spend your money.

- Savings: Money you set aside for future use.

- Investing: Using money to earn more money.

Why Personal Finance Matters

Personal finance is important for many reasons. Here are a few:

- Helps you avoid debt.

- Ensures you have savings for emergencies.

- Allows you to plan for big expenses.

- Helps you build wealth over time.

- Provides peace of mind.

Understanding personal finance gives you control over your money. It helps you meet your financial goals. You can enjoy a more secure future.

Credit: www.financialeducatorscouncil.org

Creating A Budget

Understanding personal finance is crucial. One essential aspect is creating a budget. A budget helps manage your money. It ensures financial stability. Let’s dive into how to create a budget effectively.

Setting Financial Goals

First, set clear financial goals. Goals give your budget purpose. They help you stay focused. Your goals can be short-term or long-term. Here are some examples:

- Short-term goals: Saving for a vacation, buying a new gadget.

- Long-term goals: Purchasing a home, saving for retirement.

Write down your goals. This makes them more real. Review them regularly.

Tracking Expenses

Next, track your expenses. This shows where your money goes. Use a spreadsheet or app. Here’s a simple table to start:

| Category | Amount Spent |

|---|---|

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $300 |

| Entertainment | $150 |

Keep track of every expense. This helps identify spending habits. Adjust your budget as needed.

Saving Strategies

Understanding personal finance is crucial for financial health. A key component of personal finance is saving strategies. By adopting effective saving strategies, you can secure your future and achieve your financial goals.

Building An Emergency Fund

One of the most important saving strategies is building an emergency fund. An emergency fund is money set aside for unexpected expenses. These can include medical bills, car repairs, or job loss.

Experts suggest saving at least three to six months of living expenses. This helps you cover bills without stress. Start by setting aside a small amount each month. Increase the amount as your financial situation improves.

Here is a simple plan:

| Months | Amount to Save |

|---|---|

| 1-3 | $50/month |

| 4-6 | $100/month |

| 7-9 | $150/month |

| 10-12 | $200/month |

Keep the fund in a separate, easily accessible account. This ensures you can use it when needed. Avoid using this money for non-emergencies.

Long-term Savings Plans

Another crucial strategy is developing long-term savings plans. These plans help you achieve bigger financial goals like buying a house or retiring comfortably.

Start by identifying your goals. Then, create a plan to save regularly. Here are some steps to follow:

- Set clear, achievable goals.

- Determine the amount needed for each goal.

- Create a timeline to achieve these goals.

- Save a specific amount each month towards each goal.

Consider using different types of savings accounts or investment options to grow your money. Some options include:

- High-yield savings accounts

- Certificates of deposit (CDs)

- Retirement accounts like 401(k) or IRA

- Mutual funds or stocks

Regularly review and adjust your savings plans. This ensures you stay on track and meet your goals. Long-term savings plans require patience and discipline. But the rewards are worth the effort.

Managing Debt

Understanding personal finance is crucial for managing debt effectively. Debt can be overwhelming, but knowing the types and repayment methods can help. Proper management prevents financial stress and promotes stability.

Types Of Debt

Debt comes in various forms, and each has its own impact. Here are some common types:

- Credit Card Debt: This is a high-interest debt. It can accumulate quickly if not managed.

- Student Loans: Loans taken for education. These often have lower interest rates.

- Mortgages: Loans used to buy a home. These usually have long terms and lower rates.

- Auto Loans: Loans for purchasing vehicles. These can vary in interest rates.

- Personal Loans: These are unsecured and can be used for various purposes. Interest rates can be higher.

Debt Repayment Methods

There are several strategies to repay debt. Choose one that fits your financial situation:

- Debt Snowball Method: Pay off the smallest debts first. This builds momentum and motivation.

- Debt Avalanche Method: Focus on the highest interest rate debts first. This saves money on interest.

- Debt Consolidation: Combine multiple debts into a single loan. This can simplify payments and reduce interest rates.

- Balance Transfer: Transfer high-interest debt to a lower-interest credit card. This can reduce interest payments.

- Negotiating with Creditors: Sometimes, you can negotiate lower interest rates or payment plans. Always communicate with creditors if you face difficulties.

Understanding these methods helps in choosing the best approach. Managing debt effectively leads to financial freedom and peace of mind.

Investing Fundamentals

Understanding personal finance is crucial for financial stability. Investing is a key component of personal finance. It can help grow your wealth. This section covers the basics of investing.

Types Of Investments

There are various types of investments. Each has its own characteristics and benefits. Here are some common ones:

- Stocks: Represent ownership in a company. They offer high returns.

- Bonds: Loans given to companies or governments. They are less risky than stocks.

- Mutual Funds: Pools of money from many investors. Managed by professionals.

- Real Estate: Investing in property. Offers rental income and appreciation.

- Commodities: Physical goods like gold and oil. Used to hedge against inflation.

Risk And Return

Investing always involves risk and return. Understanding this balance is vital. Here’s a simple table to illustrate:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low to Medium |

| Mutual Funds | Medium | Medium |

| Real Estate | Medium | Medium to High |

| Commodities | High | High |

Higher risk investments often offer higher returns. Lower risk investments provide more stability. Balancing these is key to a healthy portfolio.

Credit: blog.shoonya.com

Retirement Planning

Planning for retirement is crucial. It ensures you have money in your later years. Understanding personal finance helps in making smart retirement decisions. Below, we’ll discuss important aspects of retirement planning.

Retirement Accounts

Retirement accounts are special savings plans. They help you save money for the future. Common types include:

- 401(k) – Offered by employers, often with matching contributions.

- IRA – Individual Retirement Account, with tax benefits.

- Roth IRA – Contributions are taxed, but withdrawals are tax-free.

Knowing about these accounts helps you choose the best option. They offer tax advantages and help your money grow.

Saving For Retirement

Saving for retirement means putting money away now. This ensures you have funds later. Here are some tips to save effectively:

- Start Early – The sooner you start, the more you save.

- Set Goals – Know how much you need for retirement.

- Automatic Savings – Set up automatic transfers to your retirement account.

- Budget – Keep track of your spending and save more.

Creating a savings plan helps you stay on track. Over time, small savings grow into a large fund.

Use these tips to ensure you have a secure retirement. Starting now makes a big difference.

Insurance And Protection

Understanding personal finance includes knowing about insurance and protection. This helps shield you from unexpected financial burdens. Insurance is like a safety net for your finances. It covers various aspects of your life and assets.

Types Of Insurance

There are many types of insurance you can consider:

- Health Insurance: Covers medical expenses and emergencies.

- Life Insurance: Provides financial support to your family if you pass away.

- Auto Insurance: Covers car accidents and damages.

- Home Insurance: Protects your home from damage or theft.

- Disability Insurance: Supports you if you can’t work due to injury or illness.

Choosing The Right Coverage

Selecting the right insurance coverage is essential. Here are some tips:

- Assess Your Needs: Identify what you need to protect.

- Compare Plans: Look at different insurance plans and their features.

- Check Costs: Make sure you can afford the premiums.

- Read Reviews: Find out what others say about the insurance company.

- Consult Experts: Talk to a financial advisor for guidance.

Insurance is crucial for financial security. It helps you manage risks and protect your assets. Understanding personal finance can improve your overall financial well-being. Make informed choices about insurance and protect yourself and your family.

Financial Literacy Resources

Understanding personal finance is crucial for managing your money effectively. Financial literacy resources can help you gain the knowledge you need. Let’s explore some essential resources to boost your financial literacy.

Books And Courses

Books and courses provide in-depth knowledge about personal finance. Here are some recommended resources:

- Books:

- “Rich Dad Poor Dad” by Robert T. Kiyosaki – A classic in personal finance.

- “The Total Money Makeover” by Dave Ramsey – Focuses on debt reduction and budgeting.

- “Your Money or Your Life” by Joe Dominguez and Vicki Robin – Teaches how to transform your relationship with money.

- Courses:

- Khan Academy – Offers free courses on personal finance basics.

- Coursera – Provides courses from top universities on investing and money management.

- Udemy – Features affordable courses on various personal finance topics.

Online Tools And Apps

Online tools and apps make managing your finances easier. Here are some useful tools:

| Tool/App | Description |

|---|---|

| Mint | A free app for budgeting, tracking expenses, and setting financial goals. |

| YNAB (You Need A Budget) | A budgeting tool that helps you plan and control your spending. |

| Personal Capital | An app that combines budgeting with investment tracking. |

These resources can empower you to make informed financial decisions. By using books, courses, and online tools, you can improve your financial literacy and manage your money better.

Frequently Asked Questions

Why Is It So Important To Understand Your Personal Finances?

Understanding personal finances helps you manage money effectively. It prevents debt, aids savings, and ensures financial stability.

What Are The Benefits Of Knowing Personal Finance?

Knowing personal finance helps you manage money, save effectively, reduce debt, and achieve financial goals. It enhances budgeting, investment decisions, and retirement planning, leading to financial security and independence. Understanding personal finance also improves credit scores and prepares you for emergencies.

Why Is Understanding Finance Important?

Understanding finance helps you make informed decisions, manage money effectively, and achieve financial goals. It ensures better budgeting, saving, and investing. Financial literacy reduces stress and enhances your financial security.

Why Is Learning About Personal Finance Important To Your Well Being?

Learning about personal finance boosts financial security, reduces stress, and empowers smarter money decisions. It ensures a stable future.

Conclusion

Understanding personal finance is crucial for securing your financial future. It helps in managing debts and increasing savings. A good grasp of personal finance leads to better decision-making. It ensures a comfortable lifestyle and peace of mind. Start learning today to achieve financial freedom and stability.