Public finance deals with government revenue and expenditure. Private finance focuses on individual, family, or corporate financial management.

Public and private finance are essential aspects of the economic landscape. While public finance involves the allocation and management of resources by the government, private finance pertains to the financial decisions and activities of individuals, families, and businesses. Public finance includes taxation, government spending, budgeting, and debt management.

It aims to provide public goods and services and ensure economic stability. Private finance covers personal budgeting, savings, investments, and corporate financial strategies. It seeks to optimize financial well-being and profitability. Understanding the differences between these two types of finance helps in comprehending their roles in the broader economy.

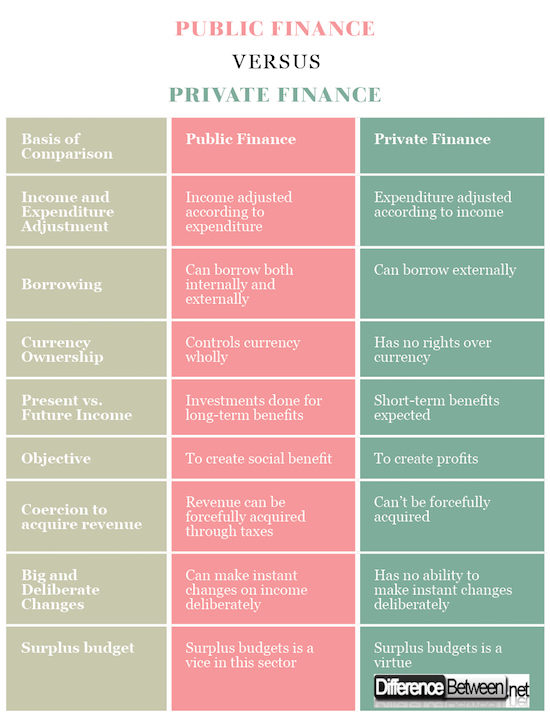

Credit: www.differencebetween.net

Introduction To Finance

Finance is the management of money. It includes activities like investing, borrowing, lending, budgeting, saving, and forecasting. Finance can be categorized into public and private finance.

Basics Of Finance

Finance has two main branches: public and private. Public finance deals with the government’s income and expenses. Private finance involves individuals, businesses, and corporations.

- Public Finance: Government budgets, taxes, and expenditures.

- Private Finance: Personal savings, loans, and investments.

Importance Of Finance

Finance is essential for economic stability. It helps in the proper allocation of resources. Public finance ensures that the government can fund public services. Private finance allows individuals and businesses to grow and prosper.

| Aspect | Public Finance | Private Finance |

|---|---|---|

| Scope | National level | Individual and corporate level |

| Control | Government-controlled | Individually or privately controlled |

| Objective | Public welfare | Personal or business profit |

Public Finance

Public finance is the study of government revenue and expenditures. It examines how governments allocate resources and manage public funds. Understanding public finance helps us see how governments fund essential services like healthcare and education.

Definition

Public finance is the management of a country’s revenue, expenditures, and debt. Governments use public finance to provide public goods and services. This involves collecting taxes, borrowing, and managing public assets.

Major Components

| Component | Description |

|---|---|

| Revenue | Money collected from taxes, fees, and other sources. |

| Expenditure | Money spent on public services and infrastructure. |

| Budget | Plan for revenue and expenditure for a fiscal year. |

| Debt Management | Handling government borrowing and debt repayment. |

Examples

- Healthcare: Funding hospitals and clinics.

- Education: Building schools and hiring teachers.

- Infrastructure: Constructing roads and bridges.

- Public Safety: Financing police and fire departments.

Governments use these funds to improve citizens’ quality of life. Public finance ensures that essential services are available for everyone.

Private Finance

Understanding private finance is crucial for managing individual or business finances. Unlike public finance, which deals with government and public sector economics, private finance focuses on personal and corporate financial management.

Definition

Private finance refers to the management of funds by individuals or private entities. It involves budgeting, saving, investing, and planning for future expenses. The aim is to maximize wealth while minimizing risks.

Major Components

Private finance encompasses several key components:

- Income Management: Handling all sources of income.

- Expenditure Planning: Tracking and controlling spending.

- Savings: Setting aside money for future use.

- Investments: Allocating money to generate returns.

- Risk Management: Insuring against unforeseen events.

- Retirement Planning: Preparing financially for retirement.

Examples

Here are some examples of private finance activities:

- Personal Budgeting: Creating a monthly budget to track income and expenses.

- Investing in Stocks: Buying shares to earn dividends and capital gains.

- Saving for Education: Setting up a fund for children’s education.

- Buying Insurance: Purchasing life, health, or property insurance to manage risks.

- Retirement Accounts: Contributing to pension plans or 401(k) accounts.

Understanding these components helps in effective financial planning. It ensures a secure and prosperous future.

Credit: www.youtube.com

Key Differences

The world of finance can be divided into public and private sectors. Understanding the differences helps in grasping their unique roles. Let’s explore the key differences between public and private finance.

Objective

Public finance aims to provide public goods and services. It ensures the welfare of the community. Governments focus on economic stability and growth. Their main goal is to serve the public interest.

Private finance focuses on profit and wealth maximization. Individuals and businesses aim to increase their financial assets. Their main goal is to achieve personal or organizational financial success.

Sources Of Revenue

Public and private finance have different revenue sources. This is a fundamental distinction.

| Public Finance | Private Finance |

|---|---|

| Taxes | Sales and Services |

| Government Bonds | Investments |

| Grants and Aid | Loans and Credits |

Expenditure Patterns

Public finance expenditures are focused on public welfare. This includes infrastructure, healthcare, and education. Governments allocate funds for defense and public safety too.

Private finance expenditures focus on personal or business needs. Individuals spend on housing, food, and entertainment. Businesses invest in operations, marketing, and employee salaries.

Both public and private finance play crucial roles in our economy. Understanding their differences helps in managing financial activities effectively.

Roles And Responsibilities

Understanding the differences between public and private finance involves knowing their distinct roles and responsibilities. These roles shape how finance is managed and utilized in different sectors.

Government’s Role

The government plays a crucial role in public finance. It is responsible for collecting taxes, managing public expenditures, and ensuring economic stability. Governments use public finance to provide essential services like healthcare, education, and infrastructure. They also regulate economic activities to promote growth and stability.

| Public Finance | Private Finance |

|---|---|

| Funded by taxes | Funded by private investments |

| Managed by government | Managed by individuals or corporations |

| Aims for public welfare | Aims for profit |

Individual’s Role

In private finance, individuals manage their personal finances. This includes budgeting, saving, investing, and planning for the future. Individuals aim to maximize their wealth and financial security. They make decisions on spending, saving, and investing based on their personal goals and financial situations.

- Budgeting

- Saving

- Investing

- Financial Planning

Corporate’s Role

Corporations handle private finance on a larger scale. They aim to increase shareholder value and ensure profitability. Corporations manage their finances through investments, capital budgeting, and financial planning. They also focus on cost management and revenue generation to sustain and grow their business.

- Investment Strategies

- Capital Budgeting

- Financial Planning

- Cost Management

- Revenue Generation

In summary, the roles and responsibilities in public and private finance differ significantly. Governments focus on public welfare, individuals manage personal finance, and corporations aim for profitability. Understanding these differences helps in grasping the broader financial landscape.

Impact On Economy

Understanding the difference between public and private finance can reveal their impact on the economy. Public finance relates to government spending and revenue collection. Private finance focuses on individual and business financial activities. Both sectors influence economic stability and resource allocation.

Economic Stability

Public finance aims to ensure economic stability by managing government revenue and expenses. Governments use tools like taxes and subsidies to control inflation and unemployment. By doing this, they aim to keep the economy stable.

Private finance affects economic stability through investment and consumption. When businesses invest in new projects, they create jobs. This, in turn, boosts the economy. Similarly, individual spending can stimulate economic growth.

Resource Allocation

Public finance helps in the allocation of resources to public goods and services. This includes infrastructure, education, and healthcare. Governments decide where to allocate resources based on societal needs.

Private finance influences resource allocation through market mechanisms. Companies allocate resources to profitable ventures. This can lead to innovation and economic efficiency.

| Aspect | Public Finance | Private Finance |

|---|---|---|

| Focus | Government spending and revenue | Individual and business finances |

| Tools | Taxes, subsidies | Investments, savings |

| Goal | Economic stability, public welfare | Profit, wealth creation |

Challenges And Opportunities

Understanding the challenges and opportunities in public and private finance is crucial. Each sector faces unique hurdles and potential growth areas. Let’s explore these aspects in detail.

Public Sector Challenges

The public sector often struggles with budget constraints and limited resources. Governments must balance public needs with available funds. Political changes can also disrupt financial plans.

- Bureaucratic delays: Slow decision-making can halt progress.

- Transparency issues: Public funds require strict oversight, which can be complex.

- Political instability: Changes in leadership can affect financial stability.

Private Sector Challenges

The private sector aims for profit, but faces its own issues. Market competition is fierce, and companies must innovate constantly. Financial risks are higher here.

- Market fluctuations: Economic changes can impact revenues.

- Regulatory compliance: Adhering to laws can be costly and time-consuming.

- Resource management: Efficient use of resources is vital for success.

Future Opportunities

Both sectors have unique opportunities for growth and improvement. Technology plays a crucial role in shaping these opportunities.

- Public Sector: Digital transformation can enhance service delivery.

- Private Sector: Innovation can lead to new markets and products.

- Collaboration: Public-private partnerships can solve major challenges.

Credit: www.scribd.com

Frequently Asked Questions

What Is The Difference Between Public Finance And Private Finance?

Public finance deals with government revenue and expenditure. Private finance focuses on individual or corporate financial management. Public finance aims to provide public goods and services. Private finance seeks profit maximization and personal financial growth.

What Is The Difference Between Public And Private Markets In Finance?

Public markets involve trading securities on exchanges, accessible to all investors. Private markets involve direct, negotiated transactions, limited to select investors.

What Is The Difference Between Public And Private Funding?

Public funding comes from government sources, such as grants or subsidies. Private funding comes from individuals, corporations, or private investors. Public funding often requires compliance with specific regulations. Private funding offers more flexibility but might demand equity or returns. Both have unique advantages and limitations based on the project’s needs.

What Is The Difference Between Private And Public Side Finance?

Private finance deals with individual or corporate financial activities. Public finance involves government revenue, expenditure, and debt management.

Conclusion

Understanding the difference between public and private finance helps in making informed financial decisions. Public finance deals with government activities, while private finance focuses on individual and business finances. Both play crucial roles in the economy. Knowing their distinctions can enhance financial planning and economic strategies.