Personal finance involves managing individual money matters, such as budgeting and investing. Financial literacy is understanding financial concepts and applying them wisely.

Understanding the difference between personal finance and financial literacy is crucial for financial well-being. Personal finance focuses on practical aspects like budgeting, saving, and investing. It deals with how individuals manage their money day-to-day. Financial literacy, on the other hand, is the knowledge and understanding of financial principles.

It empowers people to make informed decisions about their finances. By being financially literate, individuals can better navigate the complexities of personal finance. This knowledge helps in setting realistic financial goals and avoiding common financial pitfalls. Ultimately, both concepts are essential for achieving financial stability and growth.

Personal Finance Basics

Understanding personal finance basics is essential for managing your money effectively. It involves various aspects, from how you earn money to how you spend it. The goal is to make sure you are in control of your finances and can make informed decisions.

Income Management

Income management refers to how you handle the money you earn. This includes your salary, bonuses, and any other sources of income. It’s crucial to plan how you will use your income to meet your financial goals.

- Create a budget: A budget helps you allocate your income wisely.

- Save regularly: Set aside a portion of your income for savings.

- Invest wisely: Consider different investment options to grow your wealth.

Expense Tracking

Expense tracking is all about monitoring your spending habits. Knowing where your money goes helps you identify areas where you can cut back and save more.

| Type of Expense | Examples |

|---|---|

| Fixed Expenses | Rent, mortgage, insurance |

| Variable Expenses | Groceries, utilities, entertainment |

- Track daily spending: Write down everything you spend money on each day.

- Review monthly: Look at your expenses monthly to find patterns.

- Adjust as needed: Make changes to reduce unnecessary spending.

Mastering these personal finance basics sets the foundation for better financial health. It helps you build a secure future and achieve your financial goals.

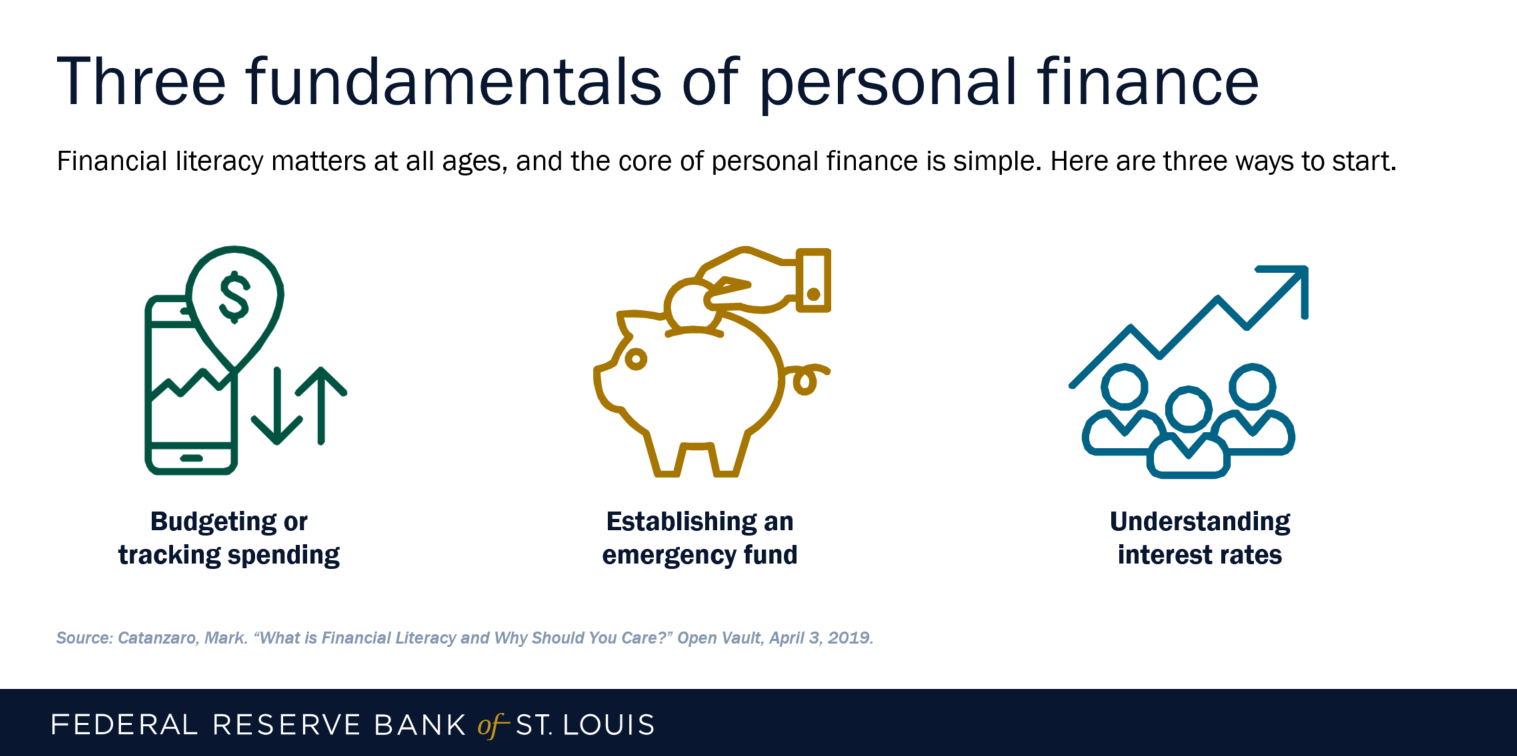

Credit: www.stlouisfed.org

Financial Literacy Essentials

Understanding the basics of financial literacy is crucial. It helps in making informed decisions about money. Let’s explore the essentials of financial literacy.

Understanding Financial Concepts

Financial literacy involves understanding basic financial concepts. These include:

- Budgeting: Planning how to spend money.

- Savings: Setting aside money for future use.

- Investing: Putting money into assets to grow wealth.

- Debt Management: Handling borrowed money wisely.

Knowing these concepts helps manage personal finance better.

Importance Of Education

Education plays a key role in financial literacy. Learning about money early helps in making better financial decisions.

Here are some ways to educate oneself:

- Read books on personal finance.

- Attend workshops or seminars.

- Take online courses.

Understanding financial literacy can lead to better financial health.

Key Differences

Understanding the difference between personal finance and financial literacy is essential for managing money effectively. Both terms often get used interchangeably, but they focus on different aspects of financial well-being.

Scope And Focus

Personal finance deals with individual financial management. This includes budgeting, saving, investing, and retirement planning. Its scope is broad and covers all aspects of managing money at a personal level. Financial literacy, on the other hand, focuses on the knowledge and skills needed to make informed financial decisions. It involves understanding financial concepts like interest rates, inflation, and credit scores.

Practical Application

In personal finance, the practical application involves creating a budget, saving money, and planning for retirement. It requires actionable steps to manage one’s financial resources effectively. In contrast, financial literacy involves educating oneself about financial principles. This could include learning about different types of investments or understanding how loans work. While personal finance is more about practice, financial literacy is about acquiring knowledge.

Skills And Knowledge

Understanding personal finance and financial literacy requires grasping essential skills and knowledge. Each has unique aspects that help manage money effectively.

Personal Finance Skills

Personal finance skills involve managing your own money. These skills include:

- Budgeting: Creating and maintaining a budget to track income and expenses.

- Saving: Setting aside money for future needs and emergencies.

- Investing: Allocating funds to grow wealth over time.

- Debt Management: Understanding and managing loans and credit.

- Retirement Planning: Preparing financially for retirement.

Financial Literacy Skills

Financial literacy skills are about understanding financial concepts. These skills include:

- Understanding Interest Rates: Knowing how interest affects loans and savings.

- Recognizing Financial Products: Identifying different financial tools like stocks and bonds.

- Risk Management: Assessing and managing financial risks.

- Tax Knowledge: Understanding taxes and their impact on income.

- Economic Indicators: Recognizing factors that influence the economy.

Both personal finance and financial literacy are crucial for financial well-being. Mastering these skills helps in making informed financial decisions.

Tools And Resources

Understanding the difference between personal finance and financial literacy is crucial. Both areas require specific tools and resources to manage effectively. Below, we delve into the various tools and resources available for each.

Budgeting Tools

Budgeting tools help you manage your personal finances. These tools allow you to track your income and expenses. Popular budgeting tools include:

- Mint: Tracks all your financial activities.

- YNAB (You Need A Budget): Helps you plan each dollar.

- Personal Capital: Focuses on wealth management.

These tools provide easy-to-read reports. They help you see where your money goes. They also offer tips for improving your spending habits.

Educational Resources

Financial literacy involves understanding financial concepts. Educational resources are key to improving financial literacy. These resources come in various forms:

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki.

- Online Courses: Coursera offers many finance courses.

- Podcasts: “The Dave Ramsey Show” covers financial advice.

These resources cover topics like budgeting, investing, and saving. They help build a strong foundation in financial knowledge. Here is a table summarizing some top resources:

| Resource Type | Example |

|---|---|

| Books | Rich Dad Poor Dad |

| Online Courses | Coursera Finance Courses |

| Podcasts | The Dave Ramsey Show |

Using these tools and resources effectively can help you master both personal finance and financial literacy. They provide the knowledge and skills needed for financial success.

Credit: blog.herrealtors.com

Impact On Decision Making

Understanding the difference between personal finance and financial literacy can greatly impact your decision-making. Both concepts play distinct roles in how you handle your money. Personal finance focuses on managing your money, whereas financial literacy is about understanding how money works. Let’s explore how each influences your decisions in the short and long term.

Short-term Decisions

Personal finance affects your daily spending and budgeting. It involves tracking your expenses and managing your income. This helps you avoid overspending and ensures you have enough money for essentials.

On the other hand, financial literacy helps you make informed choices. It enables you to understand interest rates, credit scores, and financial products. This knowledge helps you choose the best options, like selecting a credit card with low interest.

Consider this table illustrating the impact of both on short-term decisions:

| Personal Finance | Financial Literacy |

|---|---|

| Budgeting daily expenses | Understanding interest rates |

| Managing bills and payments | Choosing financial products |

Long-term Planning

Personal finance also impacts your long-term goals. This includes saving for retirement, investing, and building an emergency fund. These actions ensure financial stability and security for the future.

Financial literacy enhances your ability to plan for the long term. It provides the knowledge to make smart investments and understand market trends. This wisdom helps you grow your wealth over time.

Here’s a list of long-term planning aspects influenced by both:

- Saving for retirement

- Building an emergency fund

- Investing wisely

- Understanding market trends

In summary, personal finance and financial literacy both play crucial roles in decision-making. Personal finance manages your money, while financial literacy provides the knowledge to make informed choices. Together, they help you achieve financial well-being.

Common Misconceptions

There are many common misconceptions about personal finance and financial literacy. People often confuse these terms. Understanding the differences can help you manage your money better.

Myths About Personal Finance

Many believe personal finance is only for the wealthy. This is not true. Personal finance is for everyone. It helps you manage money, save, and plan for the future.

Another myth is that you need to be good at math. While math helps, basic skills are enough. Personal finance is more about habits and decisions.

Some think personal finance is boring. It can be fun and rewarding. Creating a budget, saving for a goal, and watching your money grow can be exciting.

Misunderstandings Of Financial Literacy

Financial literacy is often seen as just knowing financial terms. It is much more. It involves understanding how money works and how to make it work for you.

Some think financial literacy is only for adults. Kids and teens can learn too. Early education can set a strong foundation for the future.

Another misunderstanding is that financial literacy takes too much time. Learning can fit into daily life. Small steps can lead to big changes.

People often assume financial literacy is not important. It is crucial for making informed decisions. It helps avoid debt and build wealth.

Comparison Table

| Aspect | Personal Finance | Financial Literacy |

|---|---|---|

| Definition | Managing your own money and finances | Understanding how money works |

| Scope | Budgeting, saving, investing | Knowledge and skills about finance |

| Application | Daily financial decisions | Long-term financial understanding |

Improving Financial Health

Improving financial health involves understanding the difference between personal finance and financial literacy. Personal finance covers managing your money, including budgeting, saving, and investing. Financial literacy means knowing how money works, making informed decisions.

Building Good Habits

Building good habits is key to improving financial health. Start by creating a monthly budget. Track your income and expenses. Use tools like spreadsheets or budgeting apps. Prioritize saving a part of your income. Aim for at least 10% savings.

Another good habit is to reduce debt. Pay off high-interest debts first. Avoid taking on new debt unless necessary. Use a debt repayment plan. Small steps make a big difference over time.

It’s important to review your finances regularly. Set aside time each month to check your progress. Adjust your budget as needed. This keeps you on track and helps you achieve your goals.

Continual Learning

Continual learning boosts your financial literacy. Read books on personal finance. Follow blogs and podcasts by financial experts. Take online courses to deepen your knowledge.

Understanding investment basics is crucial. Learn about different types of investments. Know the risks and returns. Diversify your investments to spread risk. Start investing early to benefit from compound interest.

Stay updated on financial trends. Read financial news. Understand economic indicators like inflation and interest rates. This helps you make informed decisions and adapt to changes.

| Personal Finance | Financial Literacy |

|---|---|

| Managing money | Understanding money |

| Budgeting | Making informed decisions |

| Saving and investing | Knowing investment basics |

| Debt management | Staying updated on trends |

Improving financial health is a journey. Build good habits and keep learning. Your future self will thank you!

Credit: www.quora.com

Frequently Asked Questions

Does Personal Finance Count As Financial Literacy?

Yes, personal finance is a key component of financial literacy. It involves managing money, budgeting, and investing. Understanding personal finance helps individuals make informed financial decisions and achieve financial stability.

What Is The Difference Between Khan Academy Personal Finance And Financial Literacy?

Khan Academy personal finance focuses on managing money, budgeting, and investing. Financial literacy covers broader concepts like understanding financial systems and economic principles.

What Does Financial Literacy Mean?

Financial literacy means understanding financial concepts and skills. These include budgeting, saving, investing, and managing debt. It helps make informed financial decisions.

What Is The Meaning Of Personal Finance?

Personal finance involves managing your money, including budgeting, saving, investing, and planning for retirement. It helps achieve financial goals.

Conclusion

Understanding the difference between personal finance and financial literacy is crucial. Personal finance focuses on managing individual finances. Financial literacy involves the knowledge to make informed financial decisions. Both are essential for financial stability and growth. Prioritize learning both to secure a brighter financial future.