Personal finance management can be time-consuming and stressful. It often requires strict discipline and constant monitoring.

Managing personal finances involves tracking expenses, budgeting, and planning for future financial goals. While effective management can lead to financial stability, it demands considerable effort and time. Many people find it challenging to maintain the discipline required for consistent tracking and budgeting.

Moreover, the stress of managing money can affect mental well-being. Balancing immediate needs with long-term goals often creates conflicts, making it hard to stick to a plan. Additionally, the constant vigilance needed to monitor spending and adjust budgets can become overwhelming. Effective personal finance management also requires a good understanding of financial principles, which not everyone possesses.

Complexity And Time Consumption

Managing personal finances can be a daunting task for many. The complexity and time required often discourage people from taking control of their financial health. This section will focus on the main drawbacks, including the steep learning curve and time-consuming processes.

Steep Learning Curve

Personal finance management involves understanding various financial terms, tools, and strategies. The learning curve can be steep for beginners. People need to grasp concepts like budgeting, investing, and debt management.

This often requires a significant amount of time and effort. Many individuals may feel overwhelmed by the sheer volume of information available. Additionally, financial literacy is not commonly taught in schools, making it harder for people to get started.

Time-consuming Processes

Effective personal finance management demands regular monitoring and updating. Keeping track of expenses, income, and investments can be a time-consuming activity. People often need to dedicate hours each week to maintain accurate financial records.

Balancing a budget, planning for future expenses, and adjusting financial goals all take considerable time. For those with busy schedules, this can be a significant drawback. Below is a table summarizing common time-consuming tasks:

| Task | Time Required (Weekly) |

|---|---|

| Budgeting | 1-2 hours |

| Expense Tracking | 1 hour |

| Investment Monitoring | 2-3 hours |

| Debt Management | 1 hour |

These tasks can quickly add up, making personal finance management seem like a part-time job. For many, this extensive time commitment is a major disadvantage.

Credit: medium.com

Overemphasis On Budgeting

Budgeting is crucial for managing personal finances. But focusing too much on it has drawbacks. An overemphasis on budgeting can lead to stress and financial mistakes. Let’s explore the disadvantages of rigid budget constraints and unrealistic financial goals.

Rigid Budget Constraints

Setting strict budgets can cause stress. It may limit flexibility in spending. Life is unpredictable, and rigid budgets don’t account for sudden needs. This can lead to frustration and failure to stick to the budget.

Rigid budget constraints can also stifle enjoyment. If every penny is accounted for, there is no room for fun. This can lead to burnout and resentment towards financial planning.

| Disadvantage | Impact |

|---|---|

| Stress | Constant worry about sticking to the budget |

| Lack of Flexibility | Inability to handle unexpected expenses |

| Stifled Enjoyment | No room for leisure activities |

Unrealistic Financial Goals

Setting unrealistic financial goals can be discouraging. It may lead to failure and demotivation. People often set high targets without considering their actual income and expenses. This can create a cycle of setting and failing to meet goals.

Unrealistic goals can also lead to poor financial decisions. To meet these goals, people may cut essential expenses. This can affect their well-being and quality of life.

- Discouragement from unmet goals

- Poor financial decisions

- Reduced quality of life

A balanced approach to budgeting and goal-setting is key. Flexibility and realistic targets can lead to better financial health.

Psychological Stress

Managing personal finances can bring psychological stress. This stress affects many aspects of life. It can lead to anxiety and guilt.

Anxiety Over Finances

Anxiety over finances is a common issue. People worry about paying bills. They fear not having enough money. This anxiety can disturb sleep. It can also cause health problems.

Here are some signs of financial anxiety:

- Constant worrying about money.

- Feeling overwhelmed by debt.

- Struggling to make financial decisions.

Managing this anxiety is crucial. It helps to create a budget. This provides a clear picture of finances.

Guilt From Overspending

Many feel guilt after overspending. This guilt can be intense. It can lead to regret and stress.

Common sources of overspending guilt include:

- Impulse buying.

- Unnecessary purchases.

- Exceeding budget limits.

Here are some tips to manage overspending:

- Create a spending plan.

- Avoid impulse buys.

- Track all expenses.

Managing guilt from overspending is important. It helps maintain mental well-being.

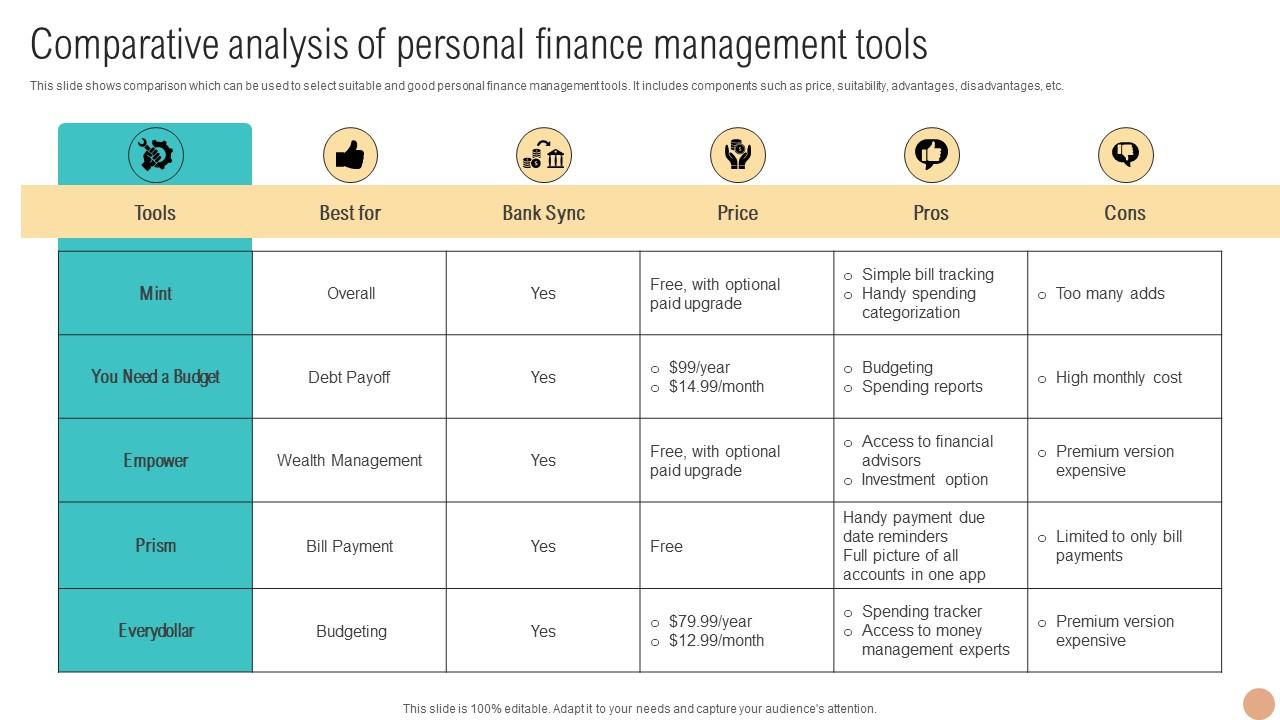

Credit: www.slideteam.net

Limited Flexibility

Personal finance management is crucial for financial health. Yet, it comes with certain disadvantages. One major downside is limited flexibility. This limitation impacts several aspects of financial life.

Restricted Financial Freedom

With rigid financial plans, you face restricted financial freedom. Strict budgets leave little room for spontaneous spending. Unplanned expenses can disrupt your financial stability. Following a strict plan means sacrificing immediate pleasures.

Inability To Adapt

Financial plans often lack room for sudden changes. This results in an inability to adapt to unexpected events. Emergencies like medical bills or car repairs can strain your budget. You might struggle to cover these costs without flexibility. Financial plans should allow for these unexpected expenses.

Risk Of Inaccurate Information

Personal finance management is crucial for anyone’s financial well-being. However, it has its disadvantages. One major drawback is the risk of inaccurate information. This can lead to poor financial decisions and economic loss.

Misleading Financial Advice

Getting the right advice is important. But sometimes, people receive misleading financial advice. This can come from unqualified sources. Examples include friends, family, or even some online forums. It’s vital to check the source of any financial advice.

| Source | Reliability |

|---|---|

| Certified Financial Planners | High |

| Online Forums | Low |

| Friends and Family | Varies |

Data Entry Errors

Another issue is data entry errors. These can happen easily. A small mistake can lead to big problems. For example, entering the wrong number in a budget spreadsheet.

- Incorrect income entries

- Wrong expense amounts

- Misrecorded dates

These errors can make your financial picture look different than it is. Always double-check your entries to avoid these mistakes.

Dependence On Technology

Managing personal finance often relies on technology. This can be convenient but has its drawbacks. Dependence on technology can lead to issues that may complicate financial management.

Software Glitches

Finance apps and software may have software glitches. These can disrupt your financial planning. Bugs and errors can cause incorrect data and financial calculations. This can lead to wrong budgeting and financial forecasting.

Security Concerns

Using technology for personal finance management raises security concerns. Your financial data is stored online. This makes it vulnerable to hacking and data breaches. Personal information like bank details and passwords can be stolen. This can result in identity theft and financial loss.

| Issue | Impact |

|---|---|

| Software Glitches | Incorrect financial data and calculations |

| Security Concerns | Risk of hacking and identity theft |

- Software glitches can mislead your budgeting.

- Security breaches can expose your personal data.

Understanding these disadvantages helps in better financial planning. Being aware of the risks associated with technology is crucial. Always stay informed and cautious when using financial management tools.

Potential For Over-optimization

Managing personal finance is crucial. Yet, over-optimization has its flaws. Trying to perfect every detail can lead to stress and mistakes.

Paralysis By Analysis

Over-optimization can cause paralysis by analysis. You may focus too much on data. This can result in delayed decisions. You might spend hours comparing small details. This wastes time and energy. Simple choices become complex problems. The constant analysis can be exhausting. It leaves little room for action.

Neglecting Big Picture

Over-optimization can make you miss the big picture. You might overlook important goals. Focusing on tiny details can make you forget long-term plans. This can harm your overall financial health. It’s vital to keep a balance.

Consider a table to summarize these points:

| Disadvantage | Description |

|---|---|

| Paralysis by Analysis | Too much data analysis delays decisions. |

| Neglecting Big Picture | Over-focus on details can harm long-term goals. |

To avoid over-optimization, stay focused on key objectives. Balance detail with broad goals. This ensures a healthier financial life.

Hidden Costs

Managing personal finance has many hidden costs. These costs can surprise you. Let’s explore some of these hidden costs. They can impact your budget more than you expect.

Subscription Fees

Many finance tools come with subscription fees. These fees can add up over time. Some tools offer free trials. But, you may forget to cancel them. This leads to unexpected charges. Always read the fine print.

Here’s a table to show typical subscription fees:

| Service | Monthly Fee | Yearly Fee |

|---|---|---|

| Budget Tracker | $5 | $50 |

| Investment App | $10 | $100 |

| Credit Monitoring | $15 | $150 |

Unexpected Expenses

Life is full of surprises. Unexpected expenses can disrupt your budget. These include medical bills, car repairs, or home fixes.

- Medical Bills

- Car Repairs

- Home Fixes

These costs can be high. Always have an emergency fund. This fund can help cover unexpected expenses.

Here’s a list of common unexpected expenses:

- Emergency Room Visit – $1,000

- Car Transmission Repair – $2,500

- Roof Leak Repair – $1,200

Plan ahead for these costs. It will save you stress and money.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Are The Effects Of Poor Personal Financial Management?

Poor personal financial management leads to debt, low credit scores, stress, missed opportunities, and lack of savings for emergencies.

What Are The Disadvantages Of Being A Financial Manager?

Being a financial manager involves high stress, long hours, and significant pressure. Job responsibilities can be overwhelming. The role requires constant upskilling to stay updated with financial regulations. Decision-making impacts the entire organization, leading to potential blame for financial setbacks.

Balancing work-life can be challenging.

What Are The Limitations Of Financial Management?

Financial management faces limitations like limited data accuracy, fluctuating market conditions, regulatory changes, human errors, and resource constraints. Effective planning and risk management can mitigate these challenges.

What Are The Disadvantages Of Financial Planning?

Financial planning can be time-consuming and costly. It may also lead to overconfidence or stress due to strict budgeting.

Conclusion

Managing personal finances has its drawbacks, including stress and time consumption. Balancing expenses can be overwhelming. Mistakes can lead to financial losses. Yet, understanding these challenges helps improve financial decisions. Prioritize learning and seek expert advice for better outcomes. Effective management requires commitment but offers long-term benefits.