Start saving for retirement as early as possible. Maximize contributions to retirement accounts like 401(k)s and IRAs.

Saving for retirement is essential to ensure financial security in your later years. Starting early allows your savings to grow through compound interest. Contribute regularly to retirement accounts such as 401(k)s and IRAs, taking full advantage of employer matches. Budget wisely and prioritize saving over unnecessary expenses.

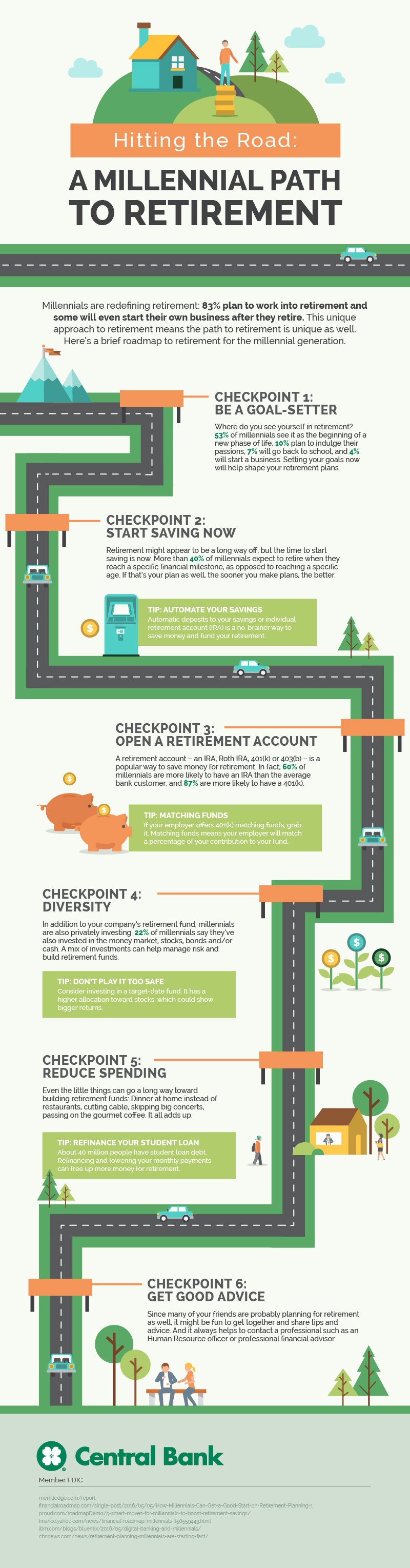

Diversify your investment portfolio to mitigate risks and maximize returns. Regularly review and adjust your retirement plan to stay on track. Seek professional financial advice if needed. By implementing these strategies, you can build a robust retirement fund and enjoy peace of mind in your golden years.

Credit: www.sensefinancial.com

Importance Of Early Planning

Planning for retirement early is crucial. It sets the foundation for a secure future. Starting early allows your savings to grow over time. This ensures you have a comfortable retirement.

Benefits Of Starting Young

Starting young offers many benefits. You have more time to save. This means smaller, regular contributions can grow significantly. You also develop good savings habits early in life.

- More time for savings to grow

- Smaller, regular contributions are effective

- Develop good savings habits

Compound Interest Advantages

Compound interest is powerful. It allows your money to earn interest on interest. This means your savings grow faster over time.

Here is a table to illustrate the power of compound interest:

| Age Started | Monthly Contribution | Retirement Age | Total Savings |

|---|---|---|---|

| 25 | $100 | 65 | $380,000 |

| 35 | $100 | 65 | $180,000 |

The difference is clear. Starting at age 25 results in much higher savings. This is due to compound interest over time.

Early planning and saving are key. They ensure a secure and comfortable retirement.

Assessing Financial Goals

Planning for retirement starts with assessing your financial goals. It involves understanding your future needs and setting achievable targets. This ensures you live comfortably during retirement without financial stress.

Determining Retirement Needs

Begin by estimating your retirement needs. Consider your current lifestyle and future aspirations. Ask yourself:

- What will be my monthly expenses?

- How much will I spend on healthcare?

- Do I plan to travel frequently?

These questions help you understand your financial requirements. Create a detailed budget to outline your expected costs. Here’s a simple table to get started:

| Expense Category | Estimated Monthly Cost |

|---|---|

| Housing | $1,200 |

| Healthcare | $300 |

| Groceries | $400 |

| Travel | $200 |

| Entertainment | $150 |

Sum up these expenses to get a clear picture of your monthly needs. Remember to adjust for inflation and unexpected costs.

Setting Realistic Targets

Once you determine your needs, set realistic savings targets. These targets should align with your income and current savings. Use the following steps to set achievable goals:

- Calculate your current savings.

- Determine your annual savings rate.

- Project your savings growth using a conservative interest rate.

Example: If you save $5,000 annually and earn 5% interest, your savings will grow steadily. Use this formula to estimate:

Savings = Current Savings + (Annual Savings Years) + (Interest Earned)Break down your goals into smaller, manageable milestones. This makes it easier to track progress and stay motivated.

Assessing financial goals is crucial for a secure retirement. By understanding your needs and setting realistic targets, you ensure a comfortable and stress-free future.

Diversifying Investments

Planning for a secure retirement requires smart strategies. One key strategy is diversifying investments. Spreading your money across various asset classes minimizes risk. This ensures a balanced and stable growth over time.

Stocks And Bonds

Investing in stocks and bonds offers a mix of growth and safety. Stocks provide higher returns but come with higher risks. Bonds offer stability and lower returns.

Consider a balanced portfolio with both stocks and bonds. This helps in achieving consistent growth while safeguarding your principal amount.

| Investment Type | Risk Level | Expected Return |

|---|---|---|

| Stocks | High | 8%-12% |

| Bonds | Low | 2%-4% |

Real Estate Options

Real estate can be a great addition to your retirement portfolio. It provides steady income through rent and potential property value appreciation.

Consider investing in rental properties or REITs (Real Estate Investment Trusts). REITs allow you to invest in real estate without managing properties. This offers a simpler way to gain real estate exposure.

- Rental Properties: Direct ownership, potential rental income, property management needed.

- REITs: Indirect ownership, dividend income, professionally managed.

Diversifying with real estate can balance your portfolio. This reduces overall risk and enhances returns.

Utilizing Retirement Accounts

Maximizing your retirement savings involves choosing the right retirement accounts. Different accounts offer unique benefits. Understanding these can help you grow your nest egg efficiently.

401(k) Plans

A 401(k) plan is a popular retirement savings option. Employers often offer these plans. They allow you to save money directly from your paycheck.

One major benefit of 401(k) plans is employer matching. Many employers match a portion of your contributions. This is essentially free money added to your retirement savings.

401(k) contributions are made with pre-tax dollars. This reduces your taxable income for the year. Additionally, the money in your 401(k) grows tax-deferred until withdrawal.

| 401(k) Plan Benefits |

|---|

| Employer Matching |

| Pre-tax Contributions |

| Tax-deferred Growth |

Ira Options

Individual Retirement Accounts (IRAs) offer another way to save for retirement. There are two main types: Traditional IRA and Roth IRA.

A Traditional IRA allows you to make contributions with pre-tax dollars. This can lower your taxable income for the year. The money grows tax-deferred until you withdraw it in retirement.

A Roth IRA is different. Contributions are made with after-tax dollars. The benefit here is that withdrawals in retirement are tax-free.

Each IRA type has its own advantages:

- Traditional IRA: Immediate tax benefits and tax-deferred growth.

- Roth IRA: Tax-free withdrawals in retirement.

Understanding these options can help you choose the best account. This ensures you maximize your retirement savings potential.

Budgeting For Savings

Saving for retirement can feel overwhelming. A solid budget helps ensure you set aside money regularly. This section will cover key strategies to help you budget effectively for retirement savings.

Tracking Expenses

Tracking expenses is the first step in budgeting for savings. Keep a detailed record of all your spending. This helps identify where your money goes each month. Use a spreadsheet or a budgeting app to log each expense.

Here’s a simple table to organize your expenses:

| Category | Monthly Amount |

|---|---|

| Rent/Mortgage | $ |

| Utilities | $ |

| Groceries | $ |

| Transportation | $ |

| Entertainment | $ |

Cutting Unnecessary Costs

Once you have tracked your expenses, identify areas to cut costs. Small changes can make a big difference over time. Consider the following tips:

- Cancel unused subscriptions.

- Cook at home instead of eating out.

- Shop for groceries with a list to avoid impulse buys.

- Use public transportation or carpool.

- Buy generic brands instead of name brands.

By reducing unnecessary costs, you free up more money for savings. Every dollar saved can go towards your retirement fund.

Seeking Professional Advice

Saving for retirement can be overwhelming. Seeking professional advice can help you achieve your financial goals. Experts can offer personalized strategies and guidance. Let’s explore how different professionals can assist you.

Financial Planners

Financial planners create comprehensive plans tailored to your needs. They analyze your current financial situation and future goals. Their advice covers budgeting, debt management, and savings.

Here are some key services they offer:

- Developing a retirement savings plan

- Assessing insurance needs

- Creating a budget

- Managing debt

Financial planners are often certified by professional organizations. Look for designations like Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC). These certifications ensure they have the expertise needed.

Investment Advisors

Investment advisors focus on growing your wealth. They provide advice on stocks, bonds, and other investments. Their goal is to maximize returns while managing risks.

Some key services include:

- Portfolio management

- Investment strategy development

- Risk assessment

- Market analysis

Investment advisors are often registered with regulatory bodies. Look for Registered Investment Advisor (RIA) designations. This ensures they follow ethical standards and have the necessary skills.

Both financial planners and investment advisors can play crucial roles in your retirement planning. Seeking their advice ensures you have a well-rounded approach to saving.

Staying Informed

Staying informed is crucial for successful retirement savings. Knowledge helps you make better decisions. Keeping track of market trends and policy changes can make a big difference. Let’s dive into these key areas.

Market Trends

Understanding market trends can help you optimize your investments. Markets fluctuate due to various factors. Knowing these can help you prepare better.

- Follow major financial news outlets.

- Subscribe to investment newsletters.

- Utilize financial apps for real-time updates.

Here is a quick look at some current market trends:

| Trend | Description |

|---|---|

| Stock Market | Stocks are showing steady growth. |

| Cryptocurrency | High volatility but potential for high returns. |

| Real Estate | Increasing demand and rising prices. |

Policy Changes

Policy changes can impact your retirement savings significantly. Keeping up with these changes ensures you adjust your strategy accordingly.

- Check government websites for updates.

- Consult with a financial advisor.

- Join financial forums and discussions.

Recent policy changes to be aware of:

- New tax regulations affecting retirement accounts.

- Changes in Social Security benefits.

- Updates to healthcare policies.

Staying informed about these aspects will keep your retirement savings on track.

Credit: www.centralbank.net

Maintaining Financial Discipline

Financial discipline is essential for a comfortable retirement. It requires consistent effort and smart decisions. By maintaining financial discipline, you can secure your future. This involves avoiding impulsive spending and regularly reviewing your plans.

Avoiding Impulsive Spending

Impulsive spending can drain your savings quickly. To avoid this, create a budget and stick to it. Track your expenses daily. Identify unnecessary purchases and cut them out. Use cash instead of credit cards to limit spending. When you feel the urge to buy something, wait 24 hours before deciding. This gives you time to think if you really need it.

Regularly Reviewing Plans

Regularly reviewing your financial plans is crucial. Set a schedule to review your retirement plans every six months. Check if your investments are performing well. Adjust your contributions based on your current financial situation. Make sure you are on track to meet your retirement goals.

| Review Frequency | Actions |

|---|---|

| Monthly | Track expenses, adjust budget |

| Quarterly | Review investments, rebalance portfolio |

| Bi-annually | Check retirement plan progress, adjust contributions |

By avoiding impulsive spending and regularly reviewing your plans, you maintain financial discipline. This ensures a secure and comfortable retirement.

Credit: www.seniorlifestyle.com

Frequently Asked Questions

What Is The $1000 A Month Rule For Retirement?

The $1000 a month rule suggests saving $240,000 for every $1,000 of monthly retirement income desired. This assumes a 5% annual withdrawal rate.

What Is The 3 Rule In Retirement?

The 3% rule in retirement suggests withdrawing 3% of your retirement savings annually to ensure funds last.

What Is The 4 Rule For Retirement Savings?

The 4% rule suggests withdrawing 4% of your retirement savings annually. This helps ensure your money lasts 30 years.

Can I Retire With $300000 In Savings?

Retiring with $300,000 is possible but challenging. Consider downsizing, budgeting, and maximizing Social Security benefits. Consult a financial advisor.

Conclusion

Planning for retirement is essential for financial security. Start early, budget wisely, and explore various investment options. Regularly review and adjust your plan. Stay informed and seek professional advice if needed. Taking these steps will help ensure a comfortable and stress-free retirement.

Make your future a priority today!