Creating a monthly budget helps women manage their finances effectively. Prioritize essential expenses and track spending to stay on course.

Budgeting is a crucial skill for women looking to gain financial stability and independence. By creating a monthly budget, you can allocate funds to necessary expenses, savings, and discretionary spending. This organized approach helps in avoiding overspending and ensures that you are prepared for unexpected costs.

Tracking your expenses allows you to identify spending patterns and adjust your budget accordingly. This financial discipline not only reduces stress but also empowers you to achieve your financial goals, whether it’s saving for a vacation, paying off debt, or investing in your future. Start budgeting today to take control of your financial journey.

Credit: m.youtube.com

Setting Financial Goals

Setting clear financial goals is crucial for effective budgeting. It helps you understand what you want to achieve with your money. This section will guide you on setting both short-term and long-term financial goals.

Short-term Goals

Short-term goals can be achieved within a year. They are usually smaller and more immediate. Here are some examples of short-term financial goals:

- Build an emergency fund: Save at least $500 for unexpected expenses.

- Pay off credit card debt: Aim to clear your balance within six months.

- Save for a vacation: Allocate a portion of your income monthly for your dream trip.

Using a budgeting app can help track your progress. It makes managing short-term goals easier.

Long-term Goals

Long-term goals take more than a year to achieve. These goals often require more planning and discipline. Some common long-term financial goals include:

- Save for retirement: Contribute regularly to a retirement account like a 401(k) or IRA.

- Buy a house: Start saving for a down payment and research mortgage options.

- Fund a child’s education: Set up a college savings plan early to maximize growth.

Tracking your progress towards long-term goals is essential. Use a spreadsheet or financial software to keep everything organized.

Setting both short-term and long-term financial goals ensures you stay focused. It makes budgeting more effective and rewarding.

Tracking Your Income

Tracking your income is essential for effective budgeting. It helps you understand how much money you have and plan your expenses wisely. For women, keeping track of different income sources can be empowering and ensures financial stability. Let’s dive into the basics of tracking your income.

Sources Of Income

Understanding your sources of income is the first step in budgeting. Here are some common sources:

- Salary: Your monthly paycheck from your job.

- Freelance Work: Payments for any freelance projects.

- Investments: Income from stocks, bonds, or other investments.

- Rental Income: Money earned from renting out property.

- Side Gigs: Extra money from side jobs or hobbies.

Regular Vs. Irregular Income

It is crucial to distinguish between regular and irregular income. Regular income is consistent and predictable, while irregular income varies each month.

| Type of Income | Description |

|---|---|

| Regular Income |

|

| Irregular Income |

|

Regular income helps in planning monthly expenses. Irregular income should be saved or invested wisely.

Tracking your income is the foundation of a successful budget. Knowing where your money comes from helps you manage it better.

Categorizing Expenses

Effective monthly budgeting starts with categorizing your expenses. This helps in tracking your spending habits. By dividing expenses into categories, you can manage your finances better. Let’s break them down into Fixed Expenses and Variable Expenses.

Fixed Expenses

Fixed expenses are those that remain constant each month. These are essential expenses that you cannot avoid. Some common examples include:

- Rent or Mortgage: Your monthly housing payment.

- Utilities: Electricity, water, and gas bills.

- Insurance: Health, car, and home insurance premiums.

- Loan Payments: Car loans or student loans.

- Subscriptions: Monthly subscriptions like gym memberships.

Knowing your fixed expenses helps in setting a baseline for your budget. You can plan your other expenses around these.

Variable Expenses

Variable expenses change from month to month. These are often more flexible and easier to adjust. Some common examples include:

- Groceries: Monthly food and household supplies.

- Transportation: Gas, public transit, or ride-sharing costs.

- Entertainment: Movies, dining out, and hobbies.

- Clothing: Seasonal or occasional clothing purchases.

- Miscellaneous: Unexpected or irregular expenses.

Tracking variable expenses helps in identifying areas where you can save money. It also gives flexibility in your budget.

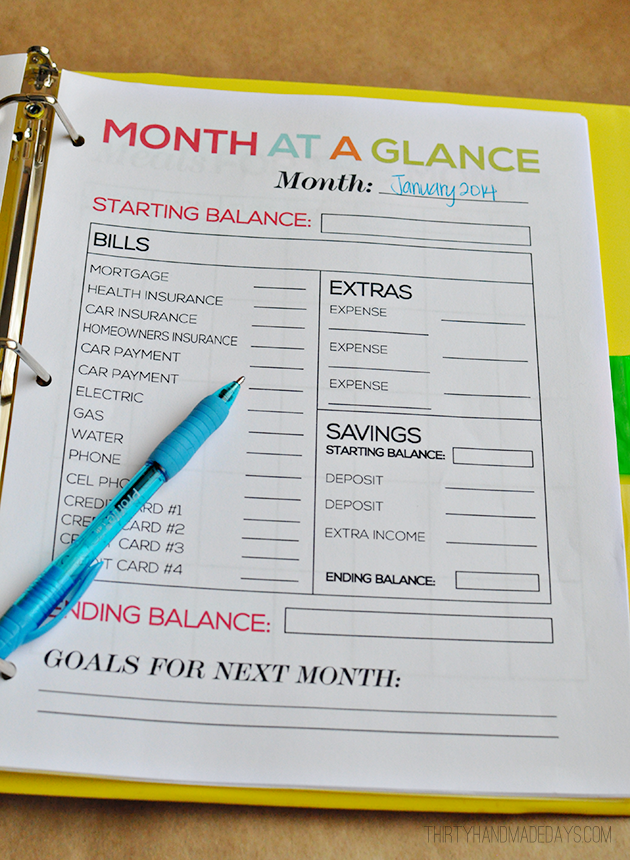

Credit: www.thirtyhandmadedays.com

Creating A Budget Plan

Creating a budget plan helps women manage their finances effectively. It ensures that money is allocated wisely and goals are met. Below are some effective methods to create a budget plan.

Zero-based Budget

The Zero-based Budget method ensures every dollar is accounted for. You start with your total income and assign every dollar to a category. This way, your income minus expenses equals zero. It’s a powerful way to track spending and save money.

- List all sources of income.

- Write down all expenses, including savings.

- Ensure the total income equals total expenses.

| Category | Amount |

|---|---|

| Income | $3000 |

| Rent | $1000 |

| Groceries | $300 |

| Savings | $500 |

| Utilities | $200 |

| Entertainment | $200 |

| Miscellaneous | $800 |

50/30/20 Rule

The 50/30/20 Rule is a simple budgeting method. It divides your income into three categories: needs, wants, and savings.

- 50% of your income goes to needs like rent and groceries.

- 30% goes to wants like dining out and entertainment.

- 20% is allocated to savings and debt repayment.

This rule helps balance your spending and saving habits. It is easy to follow and very effective.

By using these methods, women can create a budget plan that suits their needs. It will help them save money, reduce debt, and achieve financial stability.

Saving Strategies

Effective saving strategies can help you manage finances better. They ensure you have enough money for emergencies and retirement.

Emergency Fund

An emergency fund is crucial for unexpected expenses. Aim to save at least three to six months of expenses. This fund should cover medical bills, car repairs, or job loss.

Set up a separate savings account for your emergency fund. Automate transfers to this account each month. Even small amounts add up over time.

| Monthly Income | Suggested Emergency Fund |

|---|---|

| $2,000 | $6,000 – $12,000 |

| $3,500 | $10,500 – $21,000 |

| $5,000 | $15,000 – $30,000 |

Retirement Savings

Retirement savings are essential for a secure future. Start saving early to take advantage of compound interest. Consider contributing to a 401(k) or IRA.

Maximize employer contributions if your company offers matching funds. This is free money for your future. Review your retirement plan annually and adjust as needed.

Here are some steps to boost your retirement savings:

- Set clear retirement goals.

- Automate contributions to your retirement accounts.

- Reduce unnecessary expenses to save more.

- Consult a financial advisor for personalized advice.

By following these saving strategies, you can build a solid financial foundation. This will help you handle life’s uncertainties and enjoy a comfortable retirement.

Managing Debt

Managing debt is crucial for financial health. Women often balance many responsibilities. Effective debt management helps reduce stress and improve financial stability. Two popular methods for managing debt are the Debt Snowball Method and the Debt Avalanche Method.

Debt Snowball Method

The Debt Snowball Method focuses on paying off the smallest debts first. This method builds momentum and motivation. Here is how it works:

- List all debts from smallest to largest.

- Make minimum payments on all debts except the smallest.

- Pay as much as possible on the smallest debt.

- Once the smallest debt is paid off, move to the next smallest debt.

- Repeat until all debts are paid off.

This method provides quick wins. It helps build confidence and keeps you motivated.

Debt Avalanche Method

The Debt Avalanche Method focuses on paying off debts with the highest interest rates first. This method saves money on interest over time. Here is how it works:

- List all debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Pay as much as possible on the debt with the highest interest rate.

- Once the highest interest debt is paid off, move to the next highest interest debt.

- Repeat until all debts are paid off.

This method may take longer to see progress. But it saves money on interest in the long run.

| Method | Focus | Benefit |

|---|---|---|

| Debt Snowball Method | Smallest Debt First | Quick Wins, Motivation |

| Debt Avalanche Method | Highest Interest First | Saves on Interest |

Choose a method that fits your personality and financial goals. Both methods are effective for managing debt.

Utilizing Budgeting Tools

Managing finances can feel overwhelming. But with the right tools, it becomes easier. Utilizing budgeting tools can help women track expenses, save money, and achieve financial goals. Let’s explore some effective tools.

Budgeting Apps

Budgeting apps are a powerful tool for managing finances. They offer real-time tracking of income and expenses. Some popular budgeting apps include:

- Mint: This app syncs with your bank accounts. It categorizes your spending automatically.

- YNAB (You Need A Budget): Focuses on helping you live within your means. It encourages proactive budgeting.

- PocketGuard: Shows how much spendable money you have after bills and savings.

These apps provide visual charts and reports. They make it easy to understand your spending habits. You can set savings goals and get alerts for bill due dates. This helps in avoiding late fees.

Spreadsheets

Spreadsheets offer a customizable way to track finances. They can be as simple or detailed as you need. Here’s how to use them:

- Create Categories: List all income sources and expense categories.

- Enter Data: Record your income and expenses regularly.

- Analyze: Use formulas to calculate totals and differences.

Spreadsheets can be made in Excel, Google Sheets, or similar software. They allow you to create pivot tables, graphs, and charts. This helps in visualizing your financial data effectively.

Here’s an example table layout for a monthly budget:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Rent | $1000 | $1000 | $0 |

| Groceries | $300 | $280 | $20 |

| Utilities | $150 | $145 | $5 |

| Entertainment | $100 | $120 | -$20 |

Spreadsheets offer flexibility and control. They are an excellent tool for those who prefer manual tracking.

Reviewing And Adjusting

Reviewing and adjusting your budget is crucial for financial health. It helps you stay on track and manage unexpected expenses. Let’s explore how you can review and adjust your monthly budget effectively.

Monthly Reviews

Conducting monthly reviews ensures you know where your money goes. Start by tracking your expenses and income for the month. Use a budgeting app or a simple spreadsheet.

Steps for Monthly Reviews:

- List all income sources.

- List all expenses.

- Compare income and expenses.

- Identify areas of overspending.

Benefits of Monthly Reviews:

- Spot spending patterns.

- Adjust spending habits.

- Save more money.

Adjusting For Life Changes

Life changes can affect your budget. Adjust your budget to reflect these changes. Whether you get a raise, lose a job, or have a baby, your budget should adapt.

Common Life Changes:

- New job or promotion

- Job loss

- Marriage or divorce

- Having a baby

Steps to Adjust Your Budget:

- Recalculate your income and expenses.

- Identify new financial goals.

- Allocate funds to priority areas.

- Review and adjust savings plans.

A budget is a living document. It should grow and change with you. Regular reviews and adjustments keep your finances on track.

Credit: funcheaporfree.com

Frequently Asked Questions

What Is The 50 30 20 Budget Rule?

The 50 30 20 budget rule divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings.

What Are The 3 Things That Should Be Included In A Monthly Budget?

Include income, expenses, and savings in a monthly budget. Track earnings, list all costs, and set aside money.

What Is The 30 60 10 Rule Budget?

The 30 60 10 rule budget allocates 30% of income to needs, 60% to wants, and 10% to savings. This budgeting method helps manage finances effectively, ensuring essential expenses are covered while allowing for discretionary spending and future savings.

How To Budget $4000 A Month?

Create a budget by allocating funds for essentials: housing, utilities, food, transportation, and savings. Track spending monthly.

Conclusion

Mastering monthly budgeting empowers women to achieve financial goals. Implement these tips to manage money wisely and reduce stress. Stay consistent, track expenses, and adjust as needed. Your financial future is in your hands. Take control and watch your savings grow.

Happy budgeting!