Cutting back on expenses can help families save money. Simple changes in daily habits can lead to significant savings.

Raising a family comes with many financial challenges. Many families struggle to balance their budgets while meeting all their needs. Implementing money-saving tips can ease this burden and improve financial health. Small adjustments in spending habits can make a big difference.

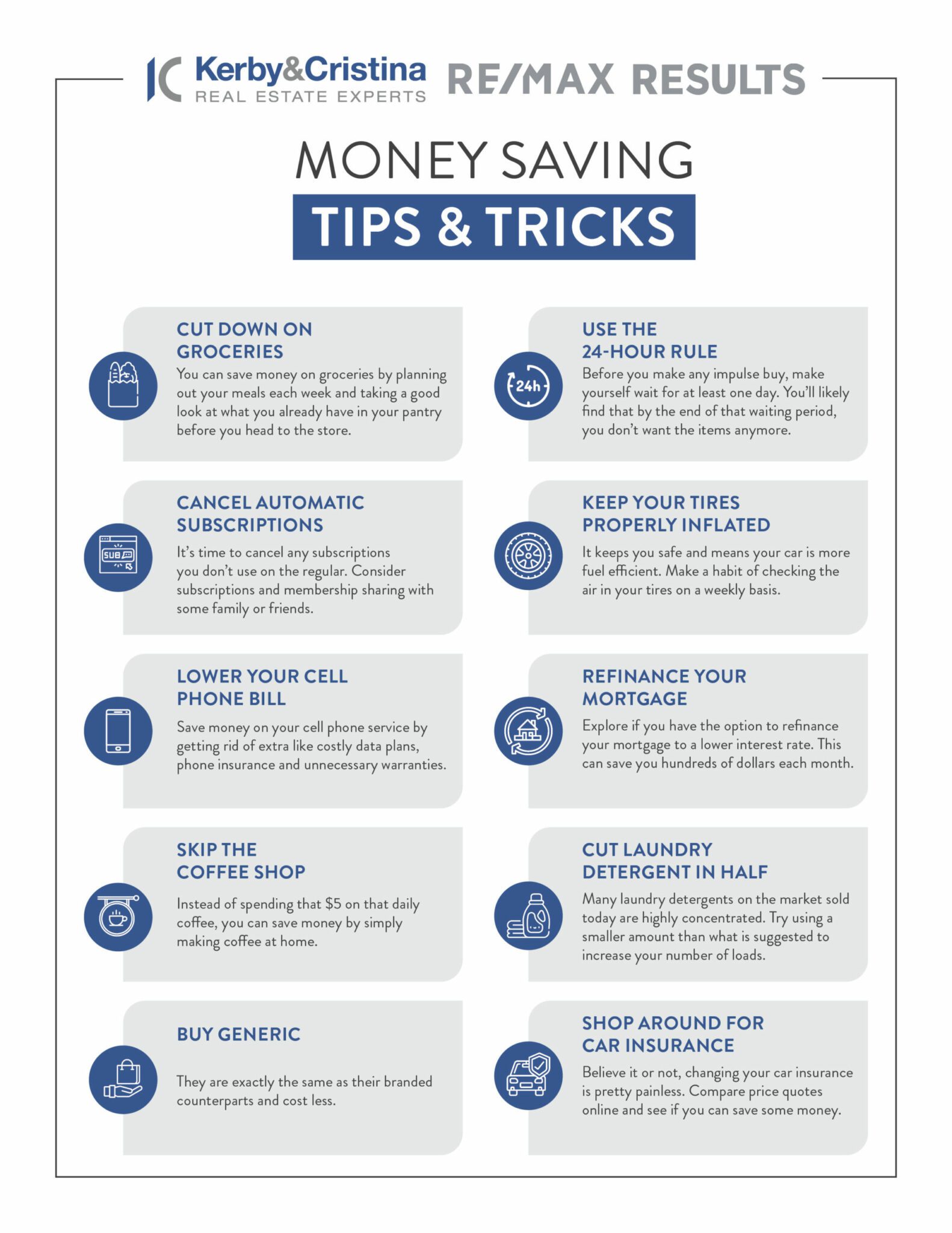

For instance, creating a budget helps track expenses and identify areas for savings. Cooking at home instead of dining out saves money and promotes healthier eating. Shopping with a list prevents impulse purchases. These strategies are simple yet effective in managing finances better. Prioritizing savings ensures a more secure future for the entire family.

Budgeting Basics

Understanding budgeting basics is crucial for every family. It helps manage money efficiently. Following a budget ensures you save and spend wisely. Let’s explore some essential tips.

Track Expenses

First, track your expenses. Write down every purchase. Use a notebook or an app. This helps identify spending habits. You can see where the money goes. Track daily, weekly, and monthly expenses.

- Note down every small purchase.

- Use color codes for different categories.

- Review your expenses regularly.

| Category | Daily Expense | Weekly Expense | Monthly Expense |

|---|---|---|---|

| Groceries | $10 | $70 | $300 |

| Utilities | $5 | $35 | $150 |

Set Financial Goals

Next, set financial goals. Goals provide direction. They help prioritize spending. Set short-term and long-term goals. Short-term goals might be saving for a trip. Long-term goals could be a child’s education fund.

- Identify your goals.

- Write them down.

- Attach a timeline to each goal.

Setting goals keeps you motivated. It makes budgeting more meaningful. Celebrate small achievements. This encourages you to stay on track.

Smart Shopping

Smart shopping helps families save more money. It involves simple strategies. This section covers using coupons and buying in bulk. These tips can reduce expenses significantly.

Use Coupons

Coupons are a great way to save money. Always check for coupons before shopping. Many stores offer digital coupons. You can find them on store websites or apps. Some common places to find coupons include:

- Store websites

- Manufacturer websites

- Coupon apps

- Newspapers

Using coupons can add up to big savings. Combine coupons with sales for even more discounts. Clip or download coupons regularly. This habit ensures you never miss a deal.

Buy In Bulk

Buying in bulk saves money on many items. This method is ideal for non-perishables. Examples include:

| Item | Benefit |

|---|---|

| Toilet paper | Long-lasting supply |

| Cleaning supplies | Lower cost per unit |

| Canned goods | Extended shelf life |

Warehouse stores offer bulk items at lower prices. Membership can be worth it for frequent shoppers. Always compare unit prices to ensure you get the best deal. Buying in bulk can save money and reduce shopping trips.

Energy Efficiency

Energy efficiency is a great way to save money. It also helps the planet. Families can reduce energy use with a few simple changes. Let’s explore some easy tips to save energy and money.

Upgrade Appliances

Old appliances use more energy. Newer models are more efficient. Look for the ENERGY STAR label. This label means the appliance saves energy. Here are some appliances to consider upgrading:

- Refrigerators

- Washers and dryers

- Dishwashers

- Air conditioners

Upgrading can be a big investment. But, it pays off over time. You will see lower energy bills. Plus, new appliances often have better features.

Reduce Utility Bills

Reducing utility bills is easy with some small changes. These tips can help:

- Seal windows and doors: Use weather stripping to stop drafts.

- Use energy-efficient light bulbs: LED bulbs use less energy and last longer.

- Unplug electronics: Devices still use power when turned off.

- Install a programmable thermostat: Set it to save energy when you are not home.

Simple changes can lead to big savings. Keeping the house warm in winter and cool in summer uses less energy with these tips. Energy efficiency is easy and saves money.

| Tip | Potential Savings |

|---|---|

| Seal windows and doors | Up to 10% on heating bills |

| Use LED bulbs | Up to 75% less energy |

| Unplug electronics | Save up to $100 a year |

| Programmable thermostat | Save up to 10% on heating and cooling |

These tips are simple and effective. Families can save money and help the environment. Start with one change today and see the difference.

Meal Planning

Meal planning can save families a lot of money. By organizing meals, you reduce food waste and avoid expensive takeout. Here are some tips to help your family save money through effective meal planning.

Cook At Home

Cooking at home is one of the best ways to save money. Homemade meals are often healthier and cheaper than restaurant food. You can control the ingredients and portion sizes. This helps manage both your budget and your family’s health.

Start by making a list of your favorite recipes. Keep it simple, especially if you are new to cooking. Choose recipes that use common ingredients. This way, you can buy in bulk and save more.

Plan Weekly Menus

Planning your weekly menu can help you stay organized. It reduces the need for last-minute grocery trips. Here’s a simple table to help you get started:

| Day | Breakfast | Lunch | Dinner |

|---|---|---|---|

| Monday | Oatmeal | Chicken Salad | Spaghetti |

| Tuesday | Scrambled Eggs | Turkey Sandwich | Grilled Cheese |

| Wednesday | Pancakes | Caesar Salad | Tacos |

| Thursday | Fruit Smoothie | Veggie Wrap | Chicken Stir Fry |

| Friday | Yogurt and Granola | BLT Sandwich | Pizza |

| Saturday | French Toast | Soup | Burgers |

| Sunday | Bagels | Leftovers | Roast Chicken |

Creating a weekly menu helps you stay focused. It ensures you buy only what you need. This reduces impulse buys and food waste. Stick to your menu to maximize your savings.

These meal planning tips can help your family save money. Cooking at home and planning weekly menus are effective strategies. They make it easy to manage your grocery budget.

Transportation Savings

Transportation costs can eat up a family’s budget. Finding ways to save on transportation can make a big difference. Here are some practical tips to help families cut down on transportation costs.

Carpooling Benefits

Carpooling is a fantastic way to save money. By sharing rides, families can cut down on fuel costs. It’s also good for the environment.

- Save on Fuel: Sharing a ride means fewer cars on the road and less fuel used.

- Reduced Wear and Tear: Your car will last longer if you use it less.

- Social Benefits: Carpooling can build stronger community ties.

Creating a carpool schedule is easy. Use a calendar or a carpool app to coordinate rides. This ensures everyone knows their turn to drive.

Public Transport

Using public transport can significantly reduce transportation costs. Buses, trains, and trams are usually cheaper than driving.

- Cost-Effective: Public transport fares are often lower than fuel and parking costs.

- Convenience: Many cities offer extensive public transport networks.

- Environmental Impact: Fewer cars mean less pollution.

| Transport Type | Average Cost | Benefits |

|---|---|---|

| Bus | $2 per ride | Economical and frequent stops |

| Train | $5 per ride | Fast and efficient |

| Tram | $3 per ride | Comfortable and scenic routes |

Consider purchasing a monthly pass for additional savings. Many transit systems offer discounted rates for regular users.

Encourage children to use public transport. It can be a fun and educational experience for them.

Credit: kerbyandcristina.com

Entertainment On A Budget

Finding fun activities without spending much is possible. Families can enjoy great times together without breaking the bank. Here are some money-saving tips for entertainment that your family will love.

Free Activities

Many free activities are both fun and engaging. You don’t need to spend money to have a good time. Some options include:

- Park Visits: Enjoy a day at the park. Bring a picnic and games.

- Library Trips: Libraries often have free events and storytimes.

- Community Events: Check your local community calendar for free events.

- Hiking Trails: Explore nature trails and enjoy the outdoors.

Affordable Subscriptions

Subscription services can be affordable and entertaining. Many options offer family-friendly content at a low cost. Here are some affordable subscriptions:

| Service | Cost | Description |

|---|---|---|

| Netflix | $8.99/month | Access to movies and TV shows for all ages. |

| Disney+ | $7.99/month | Family-friendly content, including Disney classics. |

| Amazon Prime | $12.99/month | Movies, TV shows, and free shipping on Amazon orders. |

Clothing And Accessories

Families often spend a lot on clothing and accessories. Finding ways to save can help stretch the budget. Here are some simple tips to save money on clothing and accessories.

Thrift Shopping

Thrift shopping is a great way to find affordable clothes. Thrift stores offer gently used items at a fraction of the cost of new ones. Here are some tips for successful thrift shopping:

- Check local thrift stores regularly for new items.

- Look for quality brands that last longer.

- Try on clothes to ensure they fit well.

- Wash and sanitize items before wearing.

Thrift stores also carry accessories like hats, belts, and bags. You can find unique pieces that add style to any outfit.

Seasonal Sales

Buying clothes during seasonal sales can save a lot of money. Stores offer discounts at the end of each season to make room for new inventory. Here are some tips to make the most of seasonal sales:

- Shop for winter clothes in spring and summer clothes in fall.

- Sign up for store newsletters to get sale notifications.

- Use coupons and loyalty points for extra savings.

Seasonal sales are also a good time to buy accessories like scarves, gloves, and sunglasses. Plan ahead and buy items that you will need for the next season.

Credit: fastercapital.com

Emergency Fund

Creating an emergency fund is crucial for any family. It serves as a financial safety net during unexpected events like medical emergencies, car repairs, or job loss. Here’s how to build and maintain an emergency fund efficiently.

Importance Of Saving

An emergency fund offers peace of mind and financial security. Without it, families might rely on credit cards or loans, leading to debt. Having money set aside helps you handle unforeseen expenses without stress. It ensures that your daily life is not disrupted by unexpected costs.

Building A Fund

Start by setting a clear savings goal. Aim to save at least three to six months’ worth of living expenses. Begin with small, manageable amounts. Consistency is key.

| Steps | Action |

|---|---|

| 1 | Set a savings goal |

| 2 | Open a separate savings account |

| 3 | Automate monthly contributions |

| 4 | Review and adjust your budget |

Consider the following tips to boost your savings:

- Cut unnecessary expenses

- Use cashback apps

- Sell unused items

- Take advantage of discounts and coupons

Remember, the goal is to build your fund steadily. Stay committed and watch your savings grow. An emergency fund is a cornerstone of financial stability for families.

Credit: www.pinterest.com

Frequently Asked Questions

How Can I Help My Family Save Money?

Create a budget, track expenses, and eliminate unnecessary costs. Use coupons, buy in bulk, and cook at home.

What Is The 50 20 30 Savings Rule?

The 50/20/30 savings rule is a budgeting guideline. Allocate 50% of income to needs, 20% to savings, and 30% to wants. This method helps manage finances effectively.

How Much Should A Family Put In Savings?

Families should save at least 20% of their income. This includes emergency funds, retirement, and future expenses. Prioritize building a 3-6 month emergency fund first.

How To Survive With Very Little Money?

Create a strict budget and stick to it. Cook meals at home. Use public transportation. Buy second-hand items. Avoid unnecessary expenses.

Conclusion

Saving money as a family can be simple with the right strategies. Implementing these tips will help stretch your budget. Focus on smart spending and prioritizing essentials. Small changes can lead to significant savings over time. Start today and watch your family’s savings grow.

Your wallet will thank you.