**Loan Approval Tips** Maintain a good credit score and provide accurate documentation. Reduce existing debt to improve your loan approval chances.

Securing a loan can be challenging, but with the right strategies, it becomes manageable. A strong credit score is crucial, as it reflects your creditworthiness to lenders. Accurate and complete documentation helps streamline the approval process. Reducing your existing debt can significantly enhance your approval prospects.

Consistent financial habits, like timely payments and a stable income, also play a vital role. Lenders seek assurance that you can repay the loan without financial strain. Thorough preparation and understanding the lender’s criteria can increase your chances of obtaining a loan. Focus on these key aspects to navigate the loan approval process successfully.

Know Your Credit Score

Your credit score plays a crucial role in loan approval. Lenders use it to gauge your creditworthiness. A higher score increases your chances of approval. It’s essential to know your credit score and keep it in good shape.

Check Regularly

Always check your credit score regularly. This helps you stay aware of your financial health. You can use free tools online to monitor it. Here are a few tips to remember:

- Use reputable websites to check your score.

- Look for any errors or discrepancies.

- Report any mistakes immediately.

Frequent checks help you catch issues early. This way, you can fix them before they become problems.

Improve Your Score

Improving your credit score is vital. Here are some steps you can take:

- Pay bills on time: Timely payments boost your score.

- Reduce debt: Lowering your debt helps increase your score.

- Avoid new credit: Too many new accounts can hurt your score.

- Maintain old accounts: Older accounts show a longer credit history.

Implement these tips to see a positive change in your credit score. Better scores lead to better loan terms and more approvals.

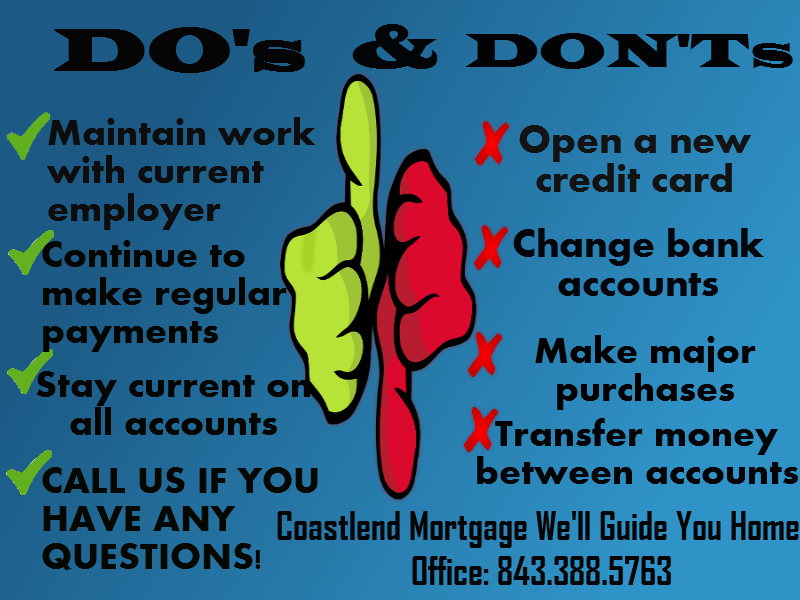

Credit: coastlendmortgage.com

Choose The Right Loan Type

Choosing the right loan type is essential for your financial health. Different loans serve different purposes, so understanding them is crucial. Below, we will break down two common loan types: Personal Loans and Mortgages.

Personal Loans

Personal loans are versatile and can be used for various needs. They often have a fixed interest rate and a set repayment period. Here are some benefits and considerations:

- Flexible Use: You can use personal loans for almost anything.

- Quick Approval: These loans often have a fast approval process.

- Fixed Rates: Predictable monthly payments make budgeting easier.

Before applying, ensure you have a good credit score. A higher score can get you better interest rates. Also, compare offers from different lenders to find the best deal.

Mortgages

Mortgages are loans specifically for buying property. They usually have longer repayment terms, often up to 30 years. Here’s what you need to know:

| Type | Description |

|---|---|

| Fixed-Rate Mortgage | Interest rate stays the same throughout the loan term. |

| Adjustable-Rate Mortgage | Interest rate can change over time. |

Consider your financial stability before choosing a mortgage. A fixed-rate mortgage offers stability in monthly payments. An adjustable-rate mortgage may offer lower initial rates but can increase over time.

Check your credit score and financial documents before applying. This will speed up the approval process. Always read the terms carefully to understand your obligations.

Gather Necessary Documents

Gathering necessary documents is crucial for loan approval. Lenders need to verify your identity and financial status. This ensures you can repay the loan. Here are the key documents you need:

Identification Proof

Identification proof shows who you are. It helps lenders trust you. Here are some examples:

- Passport

- Driver’s License

- State ID

Make sure your ID is up-to-date. Check the expiry date. Lenders will not accept expired IDs.

Income Verification

Income verification proves you can repay the loan. Lenders need to see your earnings. Here are common documents:

- Pay Stubs from the past three months

- Bank Statements showing direct deposits

- Tax Returns for the last two years

Ensure these documents are clear and accurate. They should reflect your current income.

| Document Type | Examples |

|---|---|

| Identification Proof | Passport, Driver’s License, State ID |

| Income Verification | Pay Stubs, Bank Statements, Tax Returns |

Calculate Your Debt-to-income Ratio

Understanding your debt-to-income ratio is crucial for loan approval. This ratio shows how much of your income goes towards paying debts. Lenders use it to assess your ability to repay the loan.

Understand The Ratio

The debt-to-income ratio, or DTI, measures your monthly debt payments against your gross monthly income. It helps lenders gauge your financial health.

To calculate your DTI, follow these simple steps:

- Sum up all your monthly debt payments.

- Include mortgage, car loans, student loans, and credit cards.

- Divide the total monthly debt by your gross monthly income.

- Multiply the result by 100 to get a percentage.

For example, if your monthly debts are $1,500 and your income is $5,000, your DTI would be 30%.

Optimal Ratios

Lenders prefer lower DTI ratios. A lower ratio means you manage your debts well. The optimal DTI ratio for loan approval is below 36%.

Here is a quick reference table for optimal DTI ratios:

| DTI Ratio | Loan Approval Likelihood |

|---|---|

| < 36% | High |

| 36% – 43% | Moderate |

| > 43% | Low |

Aim to reduce your DTI ratio before applying for a loan. Pay down existing debts and increase your income if possible. This will improve your chances of loan approval.

Research Lenders

Researching lenders can make a big difference in your loan approval journey. Knowing who to trust and which offers are best can save you money. Let’s explore some key steps to finding the right lender.

Compare Rates

Comparing rates is crucial. Different lenders offer different interest rates. A small difference in rates can save you thousands over time. Use online tools to compare rates from multiple lenders. Look for the Annual Percentage Rate (APR) as it includes all fees.

| Lender | Interest Rate | APR |

|---|---|---|

| Lender A | 3.5% | 3.8% |

| Lender B | 3.6% | 3.9% |

| Lender C | 3.7% | 4.0% |

Read Reviews

Reading reviews gives you insight into lender reliability. Look for reviews on trusted websites. Pay attention to customer feedback. It tells you about the lender’s customer service and loan process.

Check for red flags like hidden fees and poor support. Positive reviews often mention transparency and ease of communication. Here are some key points to consider:

- Customer service quality

- Transparency of terms

- Speed of loan approval

- Hidden fees

Use this information to choose a lender that fits your needs.

Credit: www.tpcu-blog.com

Prepare A Strong Application

Getting a loan approved can be a daunting task. A well-prepared application can make a significant difference. This section will guide you on how to prepare a strong loan application. Follow these tips to increase your chances of approval.

Fill Out Completely

Ensure every section of the application is completed. Lenders need all information to assess your eligibility. Missing details can delay your application. Provide accurate and updated information. Use the checklist to ensure nothing is overlooked:

- Personal Information

- Financial Details

- Employment History

- Credit Information

Double-check Information

Errors in your application can lead to rejection. Double-check all entries before submission. Verify your personal details, financial data, and contact information. Ensure all figures are correct. You can use this table to keep track:

| Information | Status |

|---|---|

| Personal Details | Verified |

| Financial Data | Verified |

| Employment History | Verified |

| Credit Information | Verified |

Double-checking ensures the accuracy of your application. A complete and accurate application speeds up the approval process.

Consider A Co-signer

Securing a loan can sometimes be challenging. Considering a co-signer can be a helpful strategy to improve your chances of getting approved. A co-signer agrees to take on the responsibility of the loan if you default. This provides the lender with additional security. Let’s dive deeper into this option.

When To Use

You might need a co-signer if:

- Your credit score is low.

- You have limited credit history.

- Your income doesn’t meet the lender’s requirements.

Using a co-signer can help you qualify for better loan terms. It can also lower your interest rates.

Finding A Co-signer

Finding the right co-signer is crucial. Here are some tips:

- Choose someone with a strong credit history.

- Ensure they have a stable income.

- Discuss the responsibilities with them.

- Make sure they understand the risks involved.

A good co-signer can make a big difference in your loan approval process.

| Criteria | Importance |

|---|---|

| Credit History | High |

| Stable Income | High |

| Understanding of Responsibilities | Medium |

| Willingness to Help | Medium |

Consider a co-signer to boost your chances of loan approval. It can make a significant difference in your financial journey.

Credit: colablending.com

Understand Loan Terms

Understanding loan terms is essential for getting approved. You must know the details of interest rates and repayment plans. This knowledge will help you make informed decisions.

Interest Rates

Interest rates are key to your loan. They determine the cost of borrowing. Lower rates mean you pay less over time. Here are some common types:

- Fixed Interest Rate: Stays the same for the loan’s life.

- Variable Interest Rate: Changes over time based on market conditions.

Check the current rates before applying. Compare rates from different lenders. A small difference can save you money.

Repayment Plans

Repayment plans outline how you will pay back the loan. They include the amount and frequency of payments. Common plans are:

| Plan Type | Description |

|---|---|

| Standard Plan | Fixed monthly payments until the loan is paid off. |

| Graduated Plan | Payments start low and increase over time. |

| Income-Driven Plan | Payments are based on your income level. |

Choose a plan that fits your budget. Consistent payments are crucial for good credit. Missing payments can hurt your credit score.

Frequently Asked Questions

How Can I Increase My Loan Approval Chances?

Improve your credit score, maintain steady employment, reduce existing debts, save for a larger down payment, and provide all required documents.

How To Easily Get Approved For A Loan?

To easily get approved for a loan, maintain a good credit score, provide proof of stable income, reduce existing debt, offer collateral if required, and ensure all documents are accurate and complete.

How To Boost Your Chances Of Getting A Loan?

To boost your chances of getting a loan, improve your credit score. Pay off debts promptly. Maintain a stable income. Provide accurate financial documents. Avoid multiple loan applications.

What Are The Four C’s Of Approval For A Loan?

The four C’s of loan approval are Character, Capacity, Capital, and Collateral. Character assesses credit history. Capacity evaluates income and debts. Capital looks at savings and investments. Collateral considers assets securing the loan.

Conclusion

Securing a loan can be straightforward with the right approach. Follow these tips to improve your chances of approval. Maintain a good credit score, provide accurate documentation, and understand lender requirements. With these strategies, you’ll be better prepared for a successful loan application.

Good luck with your financial journey!