Financial planning has limitations, including unpredictability of future events and reliance on accurate data. It cannot foresee economic changes and personal emergencies.

Financial planning is essential for individuals and businesses to manage resources effectively. It helps set financial goals, allocate resources, and mitigate risks. Despite its benefits, financial planning has inherent limitations. Unpredictable future events, such as economic downturns or personal emergencies, can disrupt even the most well-crafted plans.

Financial planning also heavily relies on accurate data and assumptions, which may not always hold true. These limitations highlight the need for flexibility and continuous reassessment in financial strategies. Understanding these constraints enables better preparation and more resilient financial planning.

Credit: www.slideshare.net

Introduction To Financial Planning

Financial planning is about managing your money. It helps you achieve your goals. You can plan for your future needs. It involves budgeting, saving, and investing. Proper planning ensures financial security.

Importance Of Financial Planning

Financial planning is crucial for everyone. It helps you control your expenses. You can save for emergencies. It ensures you meet your long-term goals. You can avoid debt and manage risks better.

- Helps in budgeting

- Ensures savings for emergencies

- Assists in long-term goal setting

- Prevents debt accumulation

- Manages financial risks

Common Assumptions

People often make assumptions in financial planning. They think expenses will stay the same. They assume their income will always increase. Some believe they can always save more later. These assumptions can lead to mistakes.

| Assumption | Reality |

|---|---|

| Expenses remain constant | Expenses can rise unexpectedly |

| Income will always increase | Income can fluctuate |

| More savings can be done later | Delaying savings reduces benefits |

Market Volatility

Financial planning has its challenges, especially with market volatility. Market volatility can disrupt even the most well-thought-out financial plans. This section will explore the impact of market volatility on investments and the unpredictable trends that make financial planning difficult.

Impact On Investments

Market volatility can have a significant impact on investments. Prices of stocks and bonds can fluctuate widely. These fluctuations can erode the value of your investments. A sudden drop can cause panic and lead to poor decision-making.

Consider the following table to understand the impact of market volatility:

| Investment Type | Stable Market | Volatile Market |

|---|---|---|

| Stocks | Steady growth | Frequent ups and downs |

| Bonds | Predictable returns | Variable returns |

| Mutual Funds | Consistent performance | Erratic performance |

Investors need to stay calm during volatile times. Avoid making hasty decisions based on short-term market movements. Focus on long-term goals and stick to your financial plan.

Unpredictable Trends

Market trends can be unpredictable. Economic events, political changes, and natural disasters can all impact the market. These events are beyond the control of any investor.

Here are some unpredictable trends that can affect financial planning:

- Economic downturns: Recessions can lower investment returns.

- Political instability: Political changes can create market uncertainty.

- Natural disasters: Events like earthquakes can disrupt markets.

Investors should diversify their portfolios to mitigate risks. Diversification spreads risk across different asset classes. This strategy can help protect your investments from unpredictable trends.

Inflation Concerns

Financial planning helps people manage their money. But it has limitations. One big limitation is inflation. Inflation reduces the value of money over time. This makes it hard to predict future costs and savings. Let’s explore this issue further under specific headings.

Erosion Of Purchasing Power

Inflation means prices go up over time. This reduces the value of money. For example, a loaf of bread costs more today than ten years ago. This is called the erosion of purchasing power. It affects savings and investments. People can buy less with the same amount of money.

Here is a simple table to show this:

| Year | Price of Bread |

|---|---|

| 2010 | $2.00 |

| 2020 | $3.00 |

| 2030 (Estimated) | $4.50 |

As you see, prices rise. Your money buys less. This affects financial plans. Savings lose value over time. Investments may not grow fast enough to keep up.

Adjusting For Inflation

Financial plans must adjust for inflation. This is called inflation-adjustment. It means updating your plans to factor in rising prices. Here are some ways to adjust:

- Revisit your budget: Increase the budget for future expenses.

- Invest in assets: Choose assets that grow faster than inflation.

- Review savings goals: Increase savings to match future costs.

It is important to revisit your plan regularly. This ensures it remains effective. Financial advisors often use inflation rates to adjust plans. They may recommend different investments. This helps protect your money’s value over time.

For example, consider two investment options:

- Fixed deposit with 2% interest

- Stock market with 7% return

If inflation is 3%, the fixed deposit loses value. The stock market option may protect your money better.

Understanding inflation is key to effective financial planning. It helps you make better choices. This protects your money’s future value.

Changing Life Circumstances

Financial planning helps manage money and future goals. But, life is unpredictable. Plans need adjustments as circumstances change. This section explores how unforeseen events and the need for flexibility impact financial planning.

Unforeseen Events

Unpredictable events can disrupt plans. These include job loss, health issues, or natural disasters. Such events can drain savings and create financial stress. They require quick financial adjustments.

- Job Loss: Losing a job affects income and savings. It may lead to using emergency funds.

- Health Issues: Medical emergencies can be costly. They may require tapping into savings or insurance.

- Natural Disasters: Disasters can damage property. They may necessitate significant financial resources for recovery.

Flexibility In Plans

Financial plans must be flexible. They should adapt to new circumstances. Rigid plans can cause stress and financial strain.

| Aspect | Reason for Flexibility |

|---|---|

| Emergency Fund | Provides a safety net for unexpected expenses. |

| Insurance Coverage | Protects against unforeseen health or property issues. |

| Investment Strategy | Allows adjustment based on market conditions. |

Flexibility helps manage unexpected changes. It keeps financial plans realistic and achievable. Always review and adjust your plan regularly.

Behavioral Biases

Behavioral biases are mental shortcuts or tendencies that affect decision-making. They can lead to poor financial decisions. Understanding these biases helps improve financial planning.

Emotional Decision-making

Emotions play a big role in financial choices. Fear and greed often drive investment actions. This can cause irrational decisions.

For example, fear of losing money may lead to selling stocks too early. Greed might push someone to invest in risky ventures. Both actions can hurt financial health.

Another common emotion is regret. People often regret missed opportunities. This can lead to chasing past winners, which is not always smart.

| Emotion | Impact |

|---|---|

| Fear | Leads to early selling |

| Greed | Encourages risky investments |

| Regret | Causes chasing past winners |

Overconfidence Risks

Overconfidence is believing too much in one’s abilities. Many investors think they can beat the market. This belief can be dangerous.

Overconfident investors may trade too often. Frequent trading increases costs and reduces returns. They may also take on too much risk.

Overconfidence can lead to ignoring expert advice. It can also cause overlooking important details. Both can harm financial plans.

Here are common risks due to overconfidence:

- Excessive trading

- High transaction costs

- Ignoring expert advice

- Overlooking details

Understanding and managing these biases can improve financial outcomes. It helps in creating a more balanced and thoughtful financial plan.

Regulatory Changes

Financial planning is an essential part of managing personal and business finances. However, it has its limitations. One significant limitation is regulatory changes. These changes can impact financial strategies and require constant vigilance to stay compliant.

Impact On Strategies

Regulatory changes can disrupt well-laid financial plans. For instance, new tax laws may affect investment returns. This forces individuals and businesses to adjust their strategies. Financial planners must constantly revise plans to align with new regulations.

Consider the following table to understand the impact:

| Regulatory Change | Impact on Strategy |

|---|---|

| New Tax Laws | Alters tax-efficient investments |

| Updated Compliance Rules | Requires more documentation |

| Changes in Pension Plans | Affects retirement savings |

Keeping Up With Laws

Keeping up with laws is a challenge for financial planners. Laws change frequently, and missing an update can be costly. Staying informed is essential to avoid penalties and fines.

Here are some tips to stay compliant:

- Subscribe to regulatory updates.

- Attend seminars and webinars.

- Consult with legal experts.

- Use compliance software.

Being proactive helps in adapting to new regulations quickly. This ensures that financial plans remain effective and compliant.

Hidden Costs

Financial planning is vital for a secure future. But, it has hidden costs. These costs can surprise you and strain your budget. Knowing these hidden costs helps in better planning.

Fees And Charges

Many financial planners charge fees. These fees can be high. There are different types of fees:

- Flat Fees: A fixed amount for services.

- Hourly Fees: Charges based on time spent.

- Commission Fees: Fees based on product sales.

Review the fee structure before hiring a planner. Compare different planners to find the best deal.

Tax Implications

Financial decisions can impact your taxes. Some investments have tax benefits. But, others may increase your tax burden. Understanding tax rules is crucial. Here are some tax-related hidden costs:

- Capital Gains Tax: Tax on profit from selling assets.

- Income Tax: Tax on earnings from investments.

- Estate Tax: Tax on inherited assets.

Consult a tax advisor for better tax planning. This helps in minimizing tax-related hidden costs.

Credit: www.slideshare.net

Technology Limitations

Financial planning has advanced significantly with the use of technology. Yet, these advancements come with their own set of challenges. Understanding these limitations can help in creating more effective financial strategies.

Reliance On Tools

Financial planning tools are essential for accurate forecasts. But there are limitations. Reliance on tools can sometimes lead to errors. These tools are only as good as the data entered. If the data is wrong, the results will be wrong too. Additionally, tools often have limitations in their algorithms. They may not account for unique personal financial situations.

Here is a simple table to highlight some common issues with financial tools:

| Tool | Limitation |

|---|---|

| Budget Planners | Can’t predict unexpected expenses |

| Investment Calculators | Depend on market conditions |

| Retirement Planners | Assume constant income |

Data Security Issues

Data security is a major concern in financial planning. Sensitive data is often stored in digital formats. This makes it vulnerable to cyber-attacks. Financial planners must ensure strong security measures. Encrypting data and using secure passwords are key steps.

Here are some tips for enhancing data security:

- Use two-factor authentication.

- Regularly update software.

- Back up data frequently.

By following these tips, you can reduce the risk of data breaches.

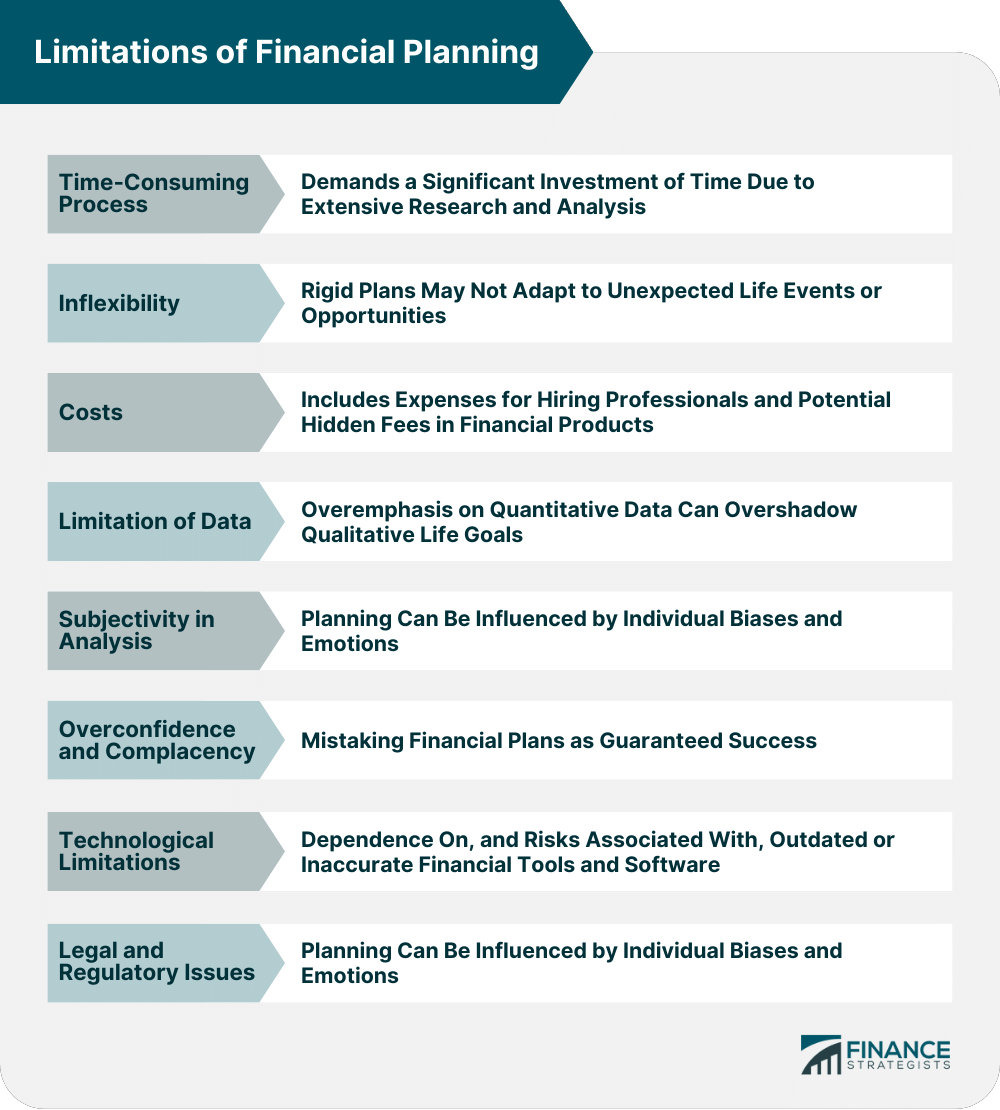

Credit: www.financestrategists.com

Frequently Asked Questions

What Are The Limitations Of Financial Management?

Financial management faces limitations like market volatility, inaccurate forecasting, regulatory changes, limited resources, and human errors. These factors can impact decision-making and financial outcomes. Effective strategies and continuous monitoring help mitigate these challenges.

What Are The Five Limitations Of Planning?

1. Planning can be time-consuming and costly. 2. It may lead to rigidity and inflexibility. 3. It relies heavily on the accuracy of forecasts. 4. Resistance to change can hinder implementation. 5. Unforeseen events can render plans ineffective.

What Are The Three Limitations Of Planning?

Planning has three main limitations: it can be time-consuming, may lead to rigidity, and can be based on inaccurate assumptions.

What Are The 5 Limitations Of Financial Statement Analysis?

1. Financial statements use historical data, not future projections. 2. They may not reflect current market conditions. 3. Different accounting methods can affect comparability. 4. Non-financial factors are often ignored. 5. Potential for management manipulation exists.

Conclusion

Financial planning has its limitations, but understanding these can help mitigate risks. It’s crucial to stay informed and adaptable. Regular reviews and adjustments can enhance your financial strategy. By recognizing potential pitfalls, you can make more informed decisions. Remember, flexibility and awareness are key to successful financial planning.