Yes, personal finance software is worth it. It helps manage finances efficiently and saves time.

Managing personal finances can be challenging. Personal finance software simplifies this task by offering tools for budgeting, tracking expenses, and planning savings. These programs provide real-time insights into your financial health, helping you make informed decisions. Many software options also offer features like bill reminders, investment tracking, and goal setting.

This comprehensive approach can lead to better financial habits and improved money management. Users often find that the initial investment pays off through better financial control and reduced stress. In a world where time is valuable, having a tool that streamlines financial tasks can be immensely beneficial.

Credit: www.pensiontimes.co.uk

Ease Of Budgeting

Personal finance software can simplify your budgeting process. It helps you manage your money efficiently. With the right tools, you can track expenses and set financial goals. Let’s explore how this software can make budgeting easier.

Automated Expense Tracking

One key feature is automated expense tracking. The software connects to your bank accounts. It automatically categorizes your spending. This saves you time and reduces errors. You can see where your money goes without manual entry.

- Automatic updates from bank accounts

- Spending categorized into predefined groups

- Real-time financial snapshot

Customizable Budget Plans

Another benefit is customizable budget plans. You can create budgets tailored to your needs. Adjust plans based on your income and expenses. This flexibility helps you stay on track with your financial goals.

| Feature | Benefit |

|---|---|

| Predefined Budget Templates | Quick setup for common expenses |

| Custom Categories | Personalized to match your spending |

| Goal Setting | Helps you save for specific objectives |

With these features, budgeting becomes straightforward. You can make better financial decisions daily.

Financial Goal Setting

Financial goal setting is crucial for anyone aiming to manage their money better. Personal finance software can assist in setting both short-term and long-term financial goals. This software provides tools to track progress and stay on target.

Short-term Goals

Short-term goals are usually set for one year or less. These goals can include saving for a vacation, buying a new gadget, or building an emergency fund. Personal finance software helps in tracking expenses and monitoring savings progress.

- Track daily expenses: Keep an eye on where your money goes.

- Set reminders: Get alerts to stay on track with your savings.

- Visual aids: Use charts and graphs to understand your spending.

Long-term Financial Planning

Long-term financial goals usually span several years. These goals include buying a house, retirement planning, or saving for a child’s education. Personal finance software can help in creating a detailed plan for achieving these goals.

- Set milestones: Break down big goals into manageable steps.

- Investment tracking: Monitor your investments and returns.

- Retirement calculator: Use tools to estimate retirement savings needs.

| Feature | Short-term Goals | Long-term Goals |

|---|---|---|

| Expense Tracking | Daily | Monthly |

| Reminders | Frequent | Periodic |

| Visual Aids | Charts | Graphs |

Using personal finance software for financial goal setting can make the process easier and more efficient. Whether you are focusing on short-term objectives or planning for the long run, the right tools can make all the difference.

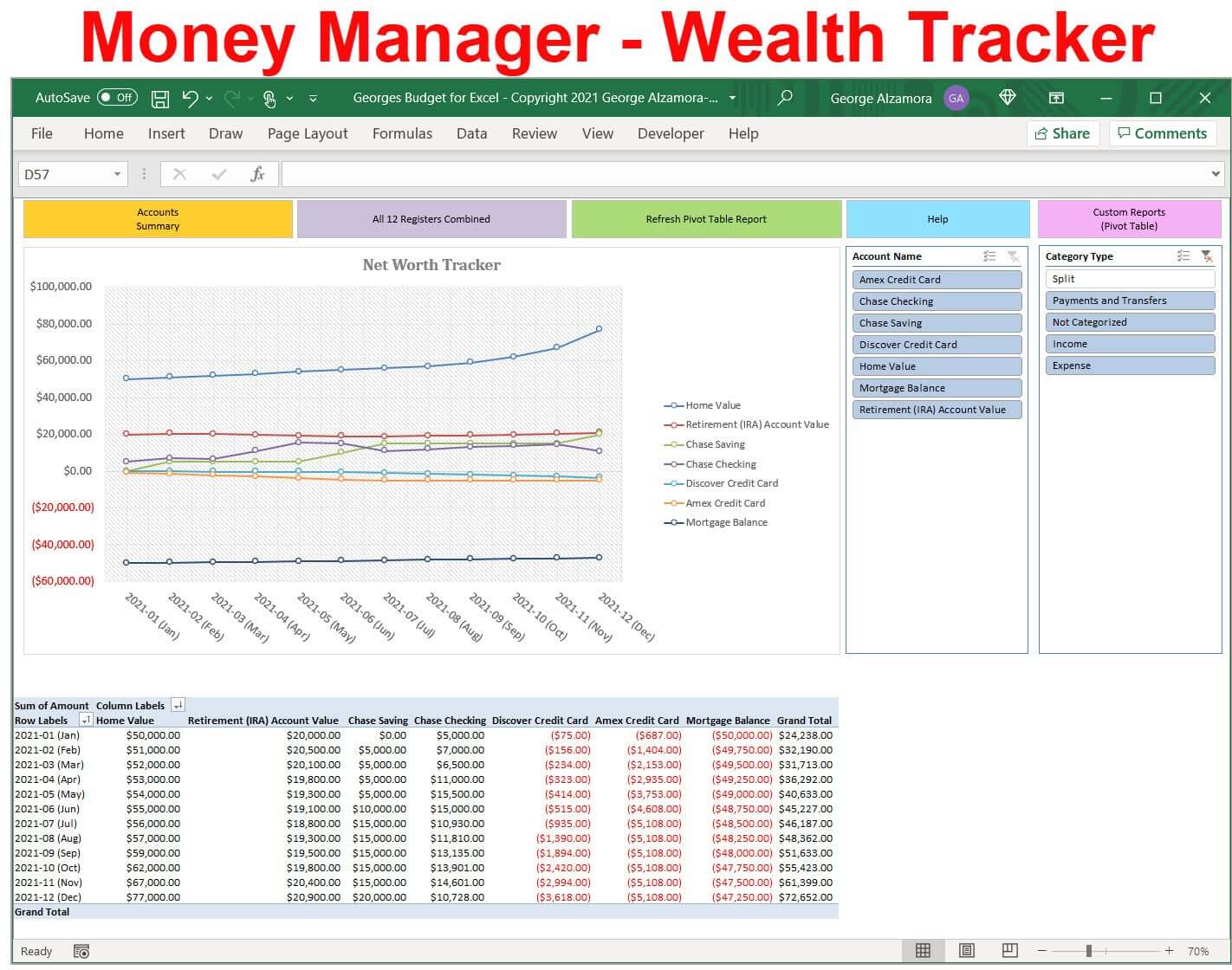

Investment Tracking

Investment tracking is essential for anyone serious about growing their wealth. Personal finance software can simplify this task. It offers tools to monitor and analyze your investments. This helps you make informed decisions.

Portfolio Management

Managing a diverse portfolio can be daunting. Personal finance software helps by organizing your investments. It provides a clear view of your stocks, bonds, and mutual funds. You can easily see which assets are performing well.

Automated tracking reduces the risk of human error. The software updates your portfolio with real-time data. This ensures you always have the latest information at your fingertips.

Many tools offer visual aids like charts and graphs. These help you understand your portfolio’s health at a glance. They also make it easier to spot trends and patterns.

Performance Analysis

Performance analysis is crucial for evaluating your investments. Personal finance software helps you track returns and compare them against benchmarks. This allows you to see if your investments are meeting your goals.

With performance analysis, you can identify underperforming assets. This helps you decide if you should hold or sell them. The software also provides detailed reports. These reports offer insights into your portfolio’s strengths and weaknesses.

Many tools offer customizable metrics. You can track specific performance indicators that matter to you. This ensures you focus on the most relevant data for your investment strategy.

Credit: www.buyexceltemplates.com

Debt Management

Managing debt can be challenging. Personal finance software offers tools to simplify debt management. This software helps users track and reduce their debt effectively. Let’s explore how personal finance software assists in debt management.

Consolidation Tools

Debt consolidation is a key feature in personal finance software. It combines multiple debts into one. This makes it easier to manage and pay off. The software calculates the total debt and interest rates. It then suggests the best consolidation options. This can lead to lower monthly payments and reduced interest rates.

| Feature | Description |

|---|---|

| Debt Tracker | Tracks all your debts in one place |

| Interest Calculator | Calculates interest on consolidated debt |

| Payment Reminders | Sends alerts for upcoming payments |

Repayment Strategies

Personal finance software also offers various repayment strategies. These strategies help users pay off their debt faster. The software analyzes your financial situation. It then recommends the best repayment plan. This could include the avalanche method or the snowball method.

- Avalanche Method: Pay off debts with the highest interest rate first.

- Snowball Method: Pay off the smallest debts first for quick wins.

The software tracks progress and provides motivation. This helps users stay on track. It also offers budgeting tools to prevent new debt. This way, users can achieve financial freedom faster.

Security Features

Personal finance software offers many benefits. One crucial aspect is its security features. These features ensure your financial data stays safe. Let’s explore some of these key security features.

Data Encryption

Data encryption protects your sensitive information. It converts your data into unreadable code. Only authorized users can decode it. This process keeps your data safe from hackers.

Most personal finance software uses 256-bit encryption. It’s one of the most secure methods available. This level of encryption is the same used by banks.

Here’s a simple table to understand encryption levels:

| Encryption Level | Security Strength |

|---|---|

| 128-bit | Good |

| 192-bit | Better |

| 256-bit | Best |

Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security. It requires two steps to verify your identity. First, you enter your password. Second, you provide a unique code sent to your device.

This method makes it harder for unauthorized users to access your account. 2FA ensures that even if someone knows your password, they can’t log in without the second factor.

Here are the benefits of using 2FA:

- Increases account security

- Prevents unauthorized access

- Protects sensitive data

Most personal finance software supports 2FA. It’s a simple yet effective way to enhance security.

User Experience

The user experience is crucial for any personal finance software. Users need an intuitive interface and reliable customer support. This section explores these aspects in detail.

Interface Design

An excellent interface design ensures users can navigate easily. The best personal finance software offers a clean, simple layout.

Key features of a good interface:

- Easy-to-read fonts

- Clear icons and buttons

- Logical menu organization

- Customizable dashboards

A user-friendly interface reduces the learning curve. It allows users to focus on their finances rather than learning the software.

Customer Support

Customer support is vital for any software. Users need help resolving issues quickly.

Top personal finance software providers offer:

- 24/7 live chat support

- Email assistance

- Detailed FAQs

- Video tutorials

Quality customer support enhances the overall user experience. It ensures users can make the most of their software.

In summary, a smooth user experience involves a well-designed interface and reliable customer support. Investing in good personal finance software can make managing finances easier and more enjoyable.

Cost Vs. Benefits

Is personal finance software worth it? The answer depends on the cost vs. benefits. Understanding what you pay for and what you get in return is crucial. Let’s dive into this comparison.

Subscription Models

Personal finance software often uses subscription models. These models can vary greatly.

| Software | Monthly Cost | Annual Cost |

|---|---|---|

| Software A | $5 | $50 |

| Software B | $10 | $100 |

| Software C | $15 | $150 |

Most software offers a monthly or annual subscription. Monthly plans give flexibility. Annual plans often offer discounts.

Value For Money

The value you get should justify the cost. Consider these factors:

- Features: Does the software offer budgeting, tracking, and goal setting?

- Ease of Use: Is the software easy to understand and use?

- Support: Is customer support available and helpful?

- Security: Does the software protect your data effectively?

Features like automatic tracking save time. Budgeting tools help manage money better. Goal-setting features keep you on track. These features can be worth the cost.

Ease of use is another key factor. User-friendly software reduces frustration. Good customer support can solve issues quickly. Data security is critical to protect your financial information.

Choose software that balances cost with benefits. Look for features that meet your needs. A little investment can lead to better financial management.

Credit: www.linkedin.com

Frequently Asked Questions

What Is The Most Used Personal Finance Software?

The most used personal finance software is Quicken. It offers budgeting, investment tracking, and bill management features.

Are Financial Apps Worth It?

Yes, financial apps are worth it. They help manage budgets, track spending, and improve financial literacy. Many offer security features.

Is A Personal Finance Class Worth It?

Yes, a personal finance class is worth it. It teaches essential money management skills, budgeting, and investing. These skills help improve financial stability and future planning.

Do You Really Need A Budget App?

A budget app helps track expenses, save money, and achieve financial goals. It’s beneficial for better money management.

Conclusion

Personal finance software simplifies budgeting and tracking expenses. It offers valuable insights and helps achieve financial goals. Investing in such tools can save time and reduce stress. Whether you’re a novice or expert, personal finance software can enhance financial management.

Make informed decisions and consider adopting it for a more organized financial future.