To save money each month, create a budget and track your spending. Prioritize savings by setting aside money as soon as you get paid.

Saving money each month may seem like a daunting task to many, but with the right strategy, it’s entirely achievable. The key lies in understanding your finances and being proactive about where your money goes. By making a few adjustments to your spending habits and being mindful of your financial goals, you can slowly but surely build a substantial savings account.

This not only provides a safety net for unexpected expenses but also brings you closer to achieving your long-term financial aspirations. Whether you’re saving for a rainy day, a major purchase, or securing your future, the journey to financial freedom starts with these simple yet effective steps. Remember, the art of saving is not about depriving yourself but about making smart choices that align with your financial goals.

The Importance Of Saving Money

Saving money is key to a strong future. It helps us feel safe. It lets us enjoy big moments without worry. Let’s explore how to save every month.

Why Every Penny Counts

Saving starts with small steps. Each penny saved today can grow. It can turn into dollars tomorrow. Small savings lead to big amounts over time.

- Cut down on small expenses.

- Watch savings grow.

- Feel proud of your money.

Long-term Benefits Of A Healthy Savings Account

A big savings account gives you freedom. It opens doors to dreams. Let’s see why it matters.

- Emergency fund: Money ready for surprises.

- Big purchases: Buy things you’ve dreamed of without debt.

- Retirement: Enjoy old age with no money worries.

Start saving today. Even small amounts matter. Your future self will thank you.

Setting Realistic Financial Goals

Saving money every month can be a challenge. Yet, it becomes easier with clear, achievable financial goals. To start, break down your finances. Understand where you stand today. Then, set goals that align with your financial reality and ambitions.

Identifying Priorities And Needs

Begin by listing your expenses. Separate needs from wants. Needs include rent, groceries, and bills. Wants might be eating out, gadgets, and subscriptions. Prioritize your spending to ensure needs are met first.

- Rent or mortgage – A roof over your head

- Utilities – Keep the lights on

- Food – Healthy, home-cooked meals

- Transport – To work, school, or errands

- Medical – Insurance and emergency funds

Short-term Vs Long-term Savings Targets

Goals vary in time. Short-term goals might be saving for a vacation, while long-term goals could be retirement. Know the difference. Plan accordingly.

| Short-term Goals | Long-term Goals |

|---|---|

| Emergency fund | Retirement savings |

| Vacation | Home ownership |

| Debt reduction | Education fund |

Set a timeline for each goal. Create a savings plan. Stick to it. Adjust as needed.

Creating A Foolproof Budget

Mastering money management starts with a budget. A foolproof budget guides you to financial freedom. It helps you make smart choices with your money. Let’s break it down into simple steps.

Tracking Your Income And Expenses

Know what you earn and spend. Start with tracking your income. Include your salary, side hustles, and any other earnings. Next, track your expenses. Write down everything you buy. Use apps or spreadsheets to stay organized.

| Income Sources | Monthly Amount |

|---|---|

| Main Job | $3000 |

| Side Job | $500 |

| Other Income | $200 |

| Total Income | $3700 |

| Expense Categories | Monthly Amount |

|---|---|

| Rent/Mortgage | $1200 |

| Groceries | $300 |

| Utilities | $150 |

| Total Expenses | $1650 |

Allocating Funds Wisely

Use your income and expense data to allocate funds wisely. Prioritize needs over wants. Set aside money for savings first. Then, cover your bills and essentials. What’s left can go to wants and entertainment.

- Save: Aim for at least 20% of your income.

- Needs: Limit these to 50% of your income.

- Wants: Keep these under 30% of your income.

Follow these steps to keep your spending in check and grow your savings. With discipline and a clear plan, you’re on your way to a brighter financial future.

Trimming The Fat: Cutting Unnecessary Expenses

In the quest to save money, spotting and slashing needless costs is key. This process, often referred to as ‘trimming the fat,’ can substantially boost your savings. Let’s identify common money wasters and make smarter choices to keep your wallet happy.

Spotting Money Wasters

Money wasters lurk in everyday habits. To find them, review your bank statements. Look for subscriptions you no longer use. Check for frequent dining out expenses. Notice any impulse buys. All these can drain your funds without you realizing.

- Unused memberships: Gym, magazines, streaming services

- Daily luxuries: Coffee shops, vending machines snacks

- Impulse purchases: Items bought on a whim

Making Cost-effective Choices

After identifying the wasters, focus on cost-effective choices. Opt for home-cooked meals over takeout. Switch to public transport or carpooling. Choose generic brands for staples. These choices can lead to significant savings over time.

| Expense | Cost-Effective Alternative |

|---|---|

| Takeout | Home-cooked meals |

| Cabs | Public transport |

| Name brands | Generic brands |

Smart Grocery Shopping Tactics

Smart grocery shopping is key to saving money each month. With a few simple tactics, you can trim your food budget significantly. Let’s explore how meal planning and using coupons can make a big difference.

Planning Meals And Snacks

Meal planning stops impulse buys. It ensures you buy only what you need.

- Write down meals for the week.

- Check what you have at home first.

- Make a shopping list based on your meal plan.

- Stick to the list at the store.

Planning snacks is also important. Choose healthy, affordable options. Buy in bulk to save more. Portion snacks at home to avoid overeating and overspending.

Leveraging Coupons And Discounts

Using coupons slashes grocery bills. Look for discounts online and in-store.

- Collect coupons from newspapers and websites.

- Use store loyalty programs for exclusive deals.

- Buy sale items and stock up on staples.

- Combine coupons with store sales for extra savings.

Remember, only use coupons for items you need. Don’t let a discount tempt you into buying unnecessary items.

Utility Savings: Reducing Household Bills

Utility Savings: Reducing Household Bills is key to saving money every month. Your home’s utilities can drain your wallet. But, small changes can lead to big savings. Let’s dive into how you can cut down those bills.

Energy Efficiency At Home

Making your home more energy efficient is a smart move. Start with these steps:

- Seal windows and doors to keep cool air in and hot air out.

- Switch to LED bulbs. They use less electricity.

- Use smart thermostats. They adjust the temperature for you.

- Unplug devices not in use. They still eat up energy.

These changes reduce your energy use. This means lower bills.

Negotiating Better Rates With Providers

Don’t settle for your current utility rates. You can get better deals. Here’s how:

- Call your providers. Ask for any current promotions or discounts.

- If your contract is ending, say you’re considering other options. They might offer you a lower rate to keep you.

- Compare rates from other companies. Use this as a bargaining chip.

- Consider bundle services if available. This can lead to savings.

Remember, companies want to keep you as a customer. Use that to your advantage.

Automating Savings

Saving money can be tough. It often slips our mind or gets pushed aside for immediate needs. Automating your savings changes that. It’s a set-and-forget method. This strategy ensures that part of your income is saved each month without any effort on your part. Let’s explore how direct transfers and apps can make saving money a seamless part of your life.

The Power Of Direct Transfers

Direct transfers work wonders for your savings goals. By setting up an automatic transfer, money moves from your checking to your savings account regularly. This happens each payday, before you spend on other things. You won’t miss what you don’t see, and your savings will grow over time.

- Choose a savings account with good interest rates.

- Set up an automatic transfer for payday.

- Adjust the amount to match your savings goals.

Using Apps To Save Without Thinking

Many apps round up your purchases to the nearest dollar, putting the change into savings. Others analyze your spending habits and automatically save small amounts for you. These apps make saving effortless and fun.

| App Name | Function |

|---|---|

| Digits | Tracks spending and saves money for you. |

| Acorns | Rounds up change and invests it. |

Check out these apps and choose one that suits your lifestyle. Before you know it, you’ll have a growing savings account without any extra effort. Start automating your savings today and watch your financial health improve.

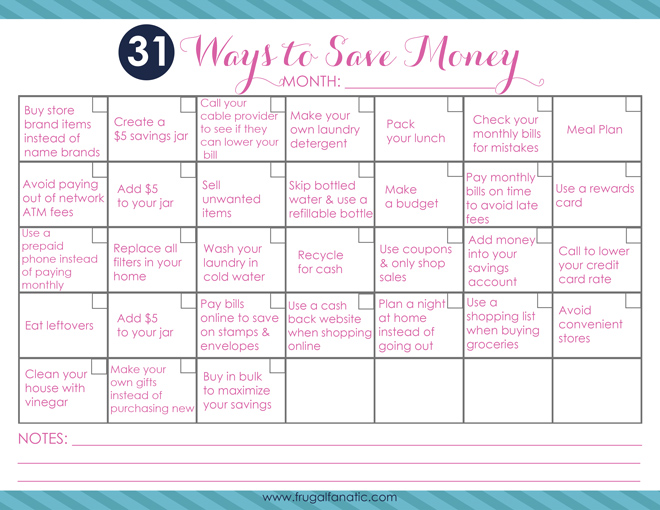

Credit: www.frugalfanatic.com

Earning More: Side Hustles And Passive Income

Want to save more each month? Boost your earnings. Side hustles and passive income can help.

Exploring Part-time Opportunities

Part-time jobs are a classic approach to earn extra cash. Ideal for weekends and evenings, these roles can complement a full-time position. Retail, food service, or tutoring offer flexible hours. Seek opportunities that match your skill set and interests.

- Check local job boards for listings.

- Use social media to find gigs.

- Network with friends and family.

Investing In Income-generating Assets

Assets can earn you money while you sleep. Consider stocks, bonds, or real estate. These require initial investment but can yield long-term returns.

| Asset Type | Pros | Cons |

|---|---|---|

| Stocks | Potential for growth | Market volatility |

| Bonds | Steady income | Lower returns |

| Real Estate | Rental income | Requires management |

Start with a small investment. Grow your portfolio over time.

Reviewing And Adjusting Your Budget Regularly

Smart budget management involves regular reviews and adjustments. This ensures your spending aligns with your financial goals. Let’s explore strategies to keep your savings on track and respond to any financial shifts.

Keeping Savings Goals On Track

Setting clear savings goals is crucial for financial health. Regular budget reviews help you stay focused. They also ensure you’re making progress towards your objectives.

- Check savings monthly

- Compare goals with current savings

- Adjust spending to meet targets

Use budgeting apps to monitor your savings. They make tracking your progress simple.

Adapting To Financial Changes

Life brings unexpected financial changes. Be ready to adapt your budget accordingly.

- Assess new expenses

- Adjust budget categories

- Prioritize essential spending

Review your budget when your financial situation changes. This keeps your finances flexible and resilient.

Credit: www.pinterest.com

The Psychology Of Spending

Understanding the psychology of spending is key to saving money. Our minds often push us to buy on impulse. This can hurt our wallets. Let’s explore ways to handle spending urges and save more.

Resisting Impulse Purchases

Impulse buys are often unplanned and driven by emotions. To resist, try these tips:

- Wait it out: Give yourself 24 hours before buying.

- List pros and cons: Is this item a need or a want?

- Avoid triggers: Stay away from tempting stores or websites.

- Stick to a list: Only buy what you planned beforehand.

Rewarding Yourself Responsibly

It’s okay to treat yourself. But do it without breaking the bank. Follow these steps:

- Set goals: Save for a reward after reaching a milestone.

- Choose wisely: Pick rewards that don’t cost much but bring joy.

- Use rewards: Use points or cash back for your treats.

Credit: www.pinterest.com

Frequently Asked Questions

How Do I Save Money Every Month?

To save money every month, create a budget and stick to it. Cut unnecessary expenses, like dining out. Automate savings to a separate account. Shop smarter, using discounts and comparing prices. Lastly, review and adjust your budget regularly to increase your savings over time.

How To Save $1,000 In 30 Days?

To save $1,000 in 30 days, set a daily saving goal of $34. Cut unnecessary expenses, sell unused items, and consider a temporary side job. Prioritize needs over wants and track your progress closely. Stay committed to your financial goal and adjust your budget as needed.

How Much Money Should I Be Saving Each Month?

Aim to save at least 20% of your monthly income, adjusting for personal goals and financial obligations.

What Is The 30 Day Rule?

The 30 day rule is a money-saving strategy where you wait 30 days before making a non-essential purchase, reducing impulse buying and promoting financial discipline.

Conclusion

Saving money each month is both empowering and rewarding. By implementing the strategies discussed, you’ll steadily boost your financial health. Remember, small changes can lead to significant savings. Start today, stay consistent, and watch your savings grow. Embrace the journey to a more secure financial future.