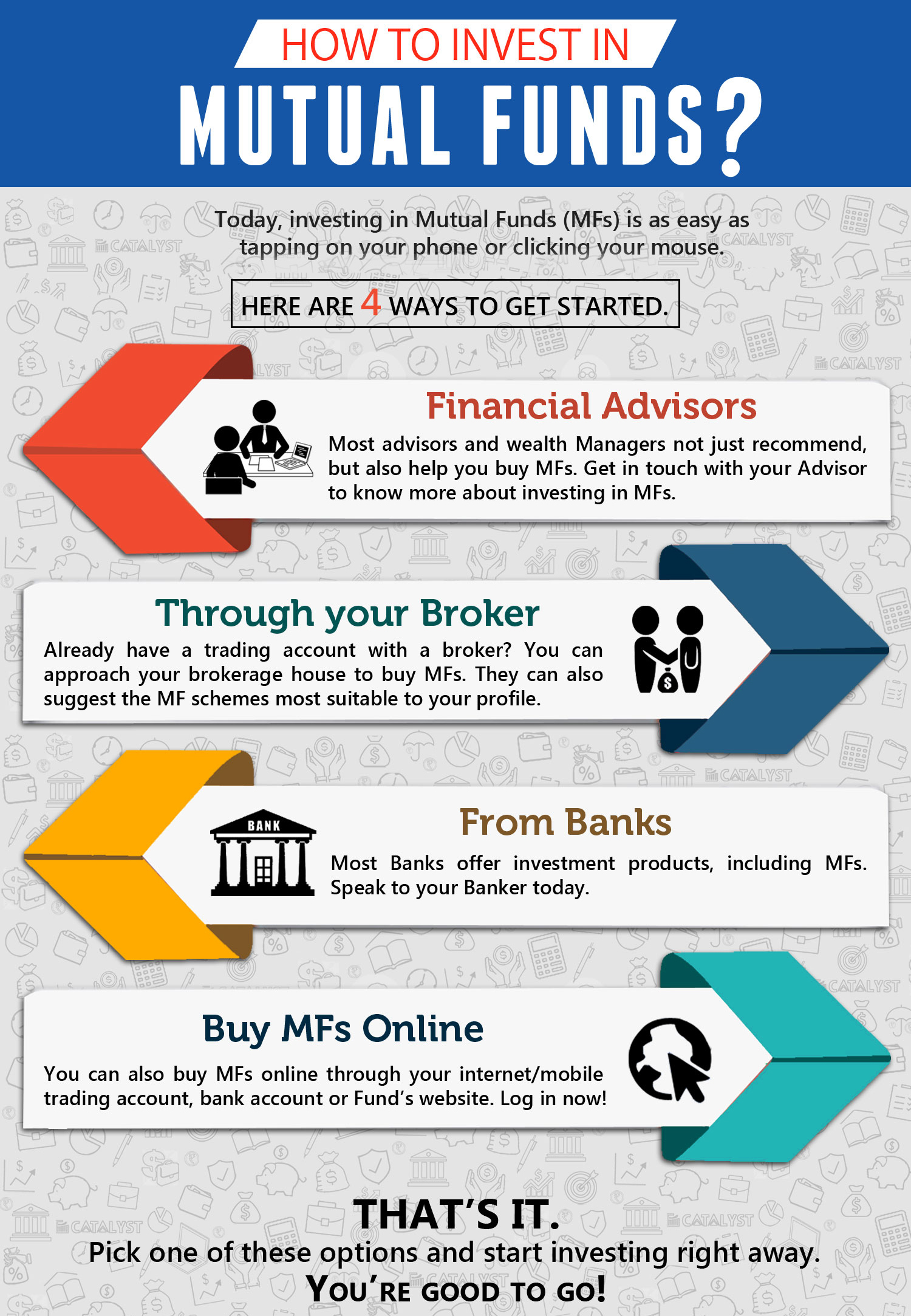

To invest in mutual funds, select a fund type and a brokerage or fund company. Complete an application and fund your account.

Mutual funds offer a compelling way to diversify your investment portfolio with ease. By pooling money from multiple investors, these funds can invest in a wide range of securities, managed by professional fund managers. This approach provides individual investors access to a diversified portfolio, even with limited capital.

Mutual funds are suitable for those looking to invest in a mix of stocks, bonds, or other assets without the need to manage each investment personally. With options ranging from aggressive growth funds to conservative income funds, investors can find a mutual fund that matches their risk tolerance and investment goals. Understanding the fees involved and the fund’s performance history is crucial before making an investment.

Introduction To Mutual Funds

Welcome to the world of mutual funds! This guide helps you start your investment journey. Mutual funds gather money from many people to invest in stocks, bonds, or other assets. They are a popular choice for investors looking to grow their wealth.

What Are Mutual Funds?

Mutual funds are an investment tool. They pool money from investors. This money buys stocks, bonds, or other assets. A professional manager makes the investment choices. This way, you own a piece of a large, diverse portfolio.

Benefits Of Mutual Fund Investments

- Diversification: Mutual funds invest in a range of assets. This reduces risk.

- Professional Management: Experts manage your investment. They aim to get the best returns.

- Liquidity: You can buy or sell your fund shares easily.

- Accessibility: Starting is easy. You can invest with a small amount of money.

Types Of Mutual Funds

Understanding the types of mutual funds is crucial. It helps investors match their goals with the right investment. Mutual funds come in various forms. Each serves different investor needs. Let’s explore these types.

Equity Funds

Equity funds focus on stocks. They aim for high returns. Risk levels vary. Funds target different sectors and company sizes. Examples include:

- Large-cap funds

- Mid-cap funds

- Small-cap funds

Debt Funds

Debt funds are low risk. They invest in bonds and other debt instruments. Investors get regular income. Debt funds suit conservative profiles. They include:

- Short-term bonds

- Corporate bonds

- Government securities

Hybrid Funds

Hybrid funds combine stocks and bonds. They balance risk and return. Investors get growth and income. Types include:

| Type | Description |

|---|---|

| Conservative | Lower risk, more bonds |

| Balanced | Equal stocks and bonds |

| Aggressive | Higher risk, more stocks |

Setting Investment Goals

Before diving into mutual funds, define your investment goals. Clear goals guide your decisions. They help balance risks and returns.

Short-term Vs Long-term Goals

Short-term goals span up to three years. Consider safer investments for these. Money market funds suit such needs.

Long-term goals exceed three years. Stocks or bonds in mutual funds fit here. They offer growth over time.

- Emergency funds: Short-term, high liquidity

- Retirement savings: Long-term, higher risk potential

Risk Tolerance And Assessment

Your comfort with risk matters. It shapes your mutual fund choices. Assess your risk tolerance accurately.

| Risk Level | Type of Investor |

|---|---|

| Low | Conservative |

| Medium | Moderate |

| High | Aggressive |

Match your risk level to the right mutual funds. Conservative investors prefer stability. Aggressive investors seek growth.

Researching Mutual Funds

Before investing in mutual funds, thorough research is crucial. This ensures informed decisions and better investment outcomes. The research process involves understanding performance metrics and reading fund prospectuses. Let’s dive into these aspects.

Fund Performance Metrics

Performance metrics are vital for comparing mutual funds. Look for these key indicators:

- Annualized Returns – Shows the fund’s yearly performance.

- Expense Ratio – Represents the cost of fund management.

- Alpha and Beta – Measure performance against a benchmark and market volatility, respectively.

- Sharpe Ratio – Helps assess risk-adjusted return.

Use tables for a clear comparison of these metrics across different funds:

| Fund Name | Annualized Return | Expense Ratio | Alpha | Beta | Sharpe Ratio |

|---|---|---|---|---|---|

| Fund A | 8% | 0.5% | 1.2 | 0.9 | 1.4 |

| Fund B | 7% | 0.7% | 1.0 | 1.1 | 1.3 |

Reading Fund Prospectuses

Prospectuses contain essential fund details. Key sections to focus on include:

- Investment Objectives – Defines the fund’s goals.

- Strategies – Describes the approach to achieving those goals.

- Risks – Outlines potential investment risks.

- Fees and Expenses – Details all associated costs.

- Past Performance – Provides historical data.

Prospectuses can be lengthy. Focus on sections that align with your investment goals. Bullet points can help summarize:

- Objectives: Growth over long term

- Strategies: Diversified portfolio, active management

- Risks: Market volatility, interest rate changes

- Fees: 0.6% annual, no load fees

Mutual Fund Fees And Expenses

Investing in mutual funds involves certain costs. Fees and expenses can eat into profits. It’s crucial to understand these charges. Smart investors factor them into their decisions.

Understanding Expense Ratios

Expense ratios reflect annual costs. They pay for fund management and operations. A lower ratio means fewer expenses. Look for funds with competitive expense ratios. This helps maximize investment returns.

A fund’s expense ratio gets deducted from its assets. It reduces overall investment returns. Comparing ratios across similar funds is important. Choose funds that align with financial goals and budget.

The Impact Of Load Fees

Load fees are sales charges. They come in two main types: front-end and back-end. Front-end loads get paid when buying shares. Back-end loads apply when selling shares.

- No-load funds don’t charge these fees.

- Loads can vary widely among funds.

- Assess whether potential returns justify these fees.

Investors should consider load fees when choosing funds. They can significantly affect net returns.

Asset Allocation Strategies

Investing in mutual funds involves smart planning. Asset Allocation Strategies are key. They help you decide where to put your money. Let’s explore how to use these strategies effectively.

Diversification Principles

Diversification means spreading your investments. This lowers risk. Think of it as not putting all your eggs in one basket. You invest in different assets. These can be stocks, bonds, or real estate. This way, if one investment does poorly, others might do well. This balance helps protect your money.

- Stocks – Offer growth potential.

- Bonds – Provide steady income.

- Real Estate – Can offer both income and growth.

Rebalancing Your Portfolio

Over time, your investments will change in value. This can shift how your money is spread out. Rebalancing is bringing your portfolio back to your original plan. You do this by buying or selling investments. The goal is to maintain your desired level of risk.

- Review your portfolio regularly.

- Decide if changes are needed to stay on track.

- Make the necessary buys and sells.

This keeps your investment strategy focused. It helps you stick to your goals.

Timing The Market Vs. Time In The Market

Investors often wonder whether they should try to time the market or maintain a steady investment plan. This choice can make a big difference in investment outcomes. Let’s explore the advantages and drawbacks of each approach.

The Pitfalls Of Market Timing

Market timing is tricky. It requires predicting future market movements. This is hard, even for seasoned professionals. Below are key reasons to be cautious about timing the market:

- High risk: Getting timing wrong can lead to significant losses.

- Missed opportunities: Being out of the market may mean missing out on sudden upswings.

- Increased costs: Frequent buying and selling increase transaction fees.

- Stressful: Constant monitoring of market fluctuations can be taxing.

The Benefits Of Dollar-cost Averaging

Dollar-cost averaging involves regular, fixed-amount investments. This strategy offers several benefits:

| Benefit | Description |

|---|---|

| Reduces impact of volatility | Investing the same amount over time smooths out purchase prices. |

| Disciplined saving | Encourages consistent investment behavior, building wealth over time. |

| Eliminates timing need | No need to predict market movements; invest at regular intervals. |

| Accessible | Suitable for all, regardless of experience or market knowledge. |

By investing regularly, you benefit from the market’s ups and downs. This approach is less stressful and often more rewarding in the long run.

Credit: www.etmoney.com

Tax Considerations

Understanding tax considerations is key when investing in mutual funds. Taxes can impact returns. Investors should know how to manage this. Here’s what to consider.

Tax-efficient Investing

Choose funds with low turnover rates. These funds trade less often. This means fewer taxable events. Index funds are often tax-efficient. They mimic market indexes, so they trade less. Consider holding investments in tax-advantaged accounts like IRAs or 401(k)s. These accounts offer tax benefits.

Handling Capital Gains And Dividends

Capital gains occur when selling investments for more than the purchase price. Short-term gains are taxed as regular income. Long-term gains have lower tax rates. Holding investments for over a year can reduce taxes.

Dividends are profits paid to investors. Funds distribute these yearly. Qualified dividends get taxed at lower rates. Reinvest dividends to buy more shares. This can compound growth over time.

| Investment Type | Tax Rate for Short-Term Gains | Tax Rate for Long-Term Gains | Dividend Tax Rate |

|---|---|---|---|

| Regular Mutual Funds | As per income tax bracket | 0%, 15%, or 20% | Qualified: 0%, 15%, or 20% |

| Index Funds | As per income tax bracket | 0%, 15%, or 20% | Qualified: 0%, 15%, or 20% |

Use loss harvesting to offset gains. Sell losing investments to reduce taxable income. Match losses against gains to lower tax bills.

Monitoring And Reviewing Your Investments

Investing in mutual funds is like planting a tree. You must nurture it. Your mutual fund investments need regular check-ups. This ensures they grow and meet your financial goals. Let’s explore how to keep track of your mutual funds effectively.

Regular Portfolio Reviews

Why should you review your portfolio? Markets change. Your life changes. Your investments should reflect that. A regular review keeps your financial plan on track. Check your mutual fund performance against benchmarks. Are they doing well? If not, find out why.

- Analyze gains or losses: Compare with market indexes.

- Asset allocation: Ensure it aligns with your risk appetite.

- Investment goals: Make sure they’re still relevant.

- Cost: Check if fees are eating into your profits.

How often should you review? Ideally, review your portfolio quarterly. At a minimum, do it annually. Life events like marriage or a new job also warrant a review.

When To Exit Or Adjust

Mutual funds are not ‘set it and forget it’ investments. Knowing when to exit or adjust is crucial. It can be the difference between achieving or missing your financial targets.

- Performance issues: Consistent underperformance may signal it’s time to sell.

- Change in goals: Adjust your portfolio if your goals evolve.

- Shift in management: A new fund manager might mean a new approach.

- Cost-benefit analysis: High fees with low returns are a red flag.

Remember, timing matters. Don’t rush to exit during temporary market dips. Consider tax implications before making any moves. A smart investor knows when to hold tight and when to let go.

Credit: www.wintwealth.com

Working With Financial Advisors

Investing in mutual funds can be complex. Financial advisors can guide you. They help you make informed decisions. Let’s explore how to choose an advisor.

Choosing The Right Advisor

Trust and credentials matter in selecting an advisor. Look for certified professionals. They should have a proven track record. Check their experience in mutual fund investments.

Ask about their approach to investing. Ensure their strategies align with your goals. They should communicate clearly and regularly.

Robo-advisors Vs. Human Advisors

Technology has changed investing. Robo-advisors offer automated advice. They are often cheaper. Human advisors provide a personal touch.

- Cost: Robo-advisors charge lower fees.

- Access: Robo-advisors are available 24/7.

- Personalization: Human advisors tailor advice.

Consider your needs when choosing. Some prefer human interaction. Others value cost savings with robo-advisors.

Common Mistakes To Avoid

Investing in mutual funds can be tricky. We all make mistakes. Yet, some errors can cost us a lot. It’s better to know these mistakes early. This way, we can avoid them. Let’s dive into some common mistakes investors make.

Chasing Performance

It’s tempting to pick funds with the highest returns. But, high past returns don’t guarantee future success. Chasing performance is risky. Instead, look at the fund’s long-term performance. Check its consistency over years. This approach is smarter.

Neglecting Portfolio Diversification

Some investors put all their money in one or two funds. This is risky. Diversifying your portfolio is key. It means spreading your investments across different types of funds. This strategy reduces risk. Your investment won’t depend on the success of a single fund.

- Don’t chase the latest top-performing fund.

- Spread your investments to reduce risk.

- Look at long-term performance, not just the past year.

Here are some tips to avoid these mistakes:

| Mistake | How to Avoid |

|---|---|

| Chasing Performance | Focus on long-term consistency. |

| Neglecting Diversification | Spread investments across various funds. |

Remember, avoiding these mistakes can help you invest smarter. It can lead to better results. Happy investing!

Credit: jamapunji.pk

Advanced Mutual Fund Strategies

Once you know the basics of mutual funds, try advanced strategies. These can help grow your money more. Let’s explore two important ones.

Using Mutual Funds For Retirement

Planning for retirement is key. Mutual funds can be a big help. They let you invest easily for the long term. Start early to see big benefits.

- Choose funds with a mix of stocks and bonds.

- Look for low-cost options to save more.

- Reinvest dividends to grow your investment.

Remember, it’s all about starting early and staying invested.

Strategic Asset Location

Where you keep your investments matters. It can affect your taxes.

| Type of Account | Investment Type |

|---|---|

| Taxable | Stocks, ETFs |

| Tax-Deferred | Bonds, High-Yield Investments |

Use this table to decide where to put different investments. It helps save on taxes.

Remember, strategic location can boost your returns.

Frequently Asked Questions

How Do Beginners Invest In Mutual Funds?

Beginners can invest in mutual funds by researching options, setting financial goals, choosing a reputable fund, starting with a small amount, and monitoring investments regularly.

Can I Invest In Mutual Funds Myself?

Yes, you can invest in mutual funds on your own by opening an account through a brokerage or a mutual fund company’s website.

How Much Money Should I Start With In A Mutual Fund?

The minimum investment for a mutual fund varies, typically ranging from $50 to $3,000. Check fund requirements and start with an amount you’re comfortable investing.

What Are The 4 Types Of Mutual Funds?

The four main types of mutual funds are equity funds, bond funds, money market funds, and balanced or hybrid funds. Each offers different risk levels and potential returns.

Conclusion

Embarking on your mutual fund investment journey can seem daunting, but with the right strategy, it’s a path to financial growth. Remember to research thoroughly, diversify your portfolio, and monitor performance regularly. Armed with these insights, you’re now equipped to navigate the world of mutual funds confidently.

Take that step towards securing your financial future!