To get started as a personal financial advisor, earn a relevant degree and obtain necessary certifications. Gain practical experience through internships or entry-level jobs.

Becoming a personal financial advisor requires a solid educational foundation, typically in finance, economics, or business. Earning a bachelor’s degree is often the first step. Certifications such as Certified Financial Planner (CFP) can enhance credibility and career prospects. Practical experience is crucial; internships or entry-level positions provide valuable insights and skills.

Building a network in the industry can open doors to opportunities and mentorship. Continual learning and staying updated with financial trends are essential for long-term success. Effective communication and analytical skills are vital for advising clients and making informed financial decisions.

Choosing The Right Education

Starting a career as a personal financial advisor requires the right education. This foundation helps you understand financial principles and build client trust. Below, we’ll explore the key educational steps to take.

Relevant Degrees

To become a personal financial advisor, earn a relevant degree. A Bachelor’s degree is the minimum requirement. Popular choices include:

- Finance

- Economics

- Accounting

- Business Administration

Each degree offers unique skills. For example, a Finance degree covers investment strategies and risk management. An Economics degree delves into market trends and economic theory. Choose a degree that aligns with your interests and career goals.

Certifications And Licenses

Certifications and licenses boost your credibility. They also open more job opportunities. Common certifications include:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Personal Financial Specialist (PFS)

Each certification has its requirements. For instance, the CFP needs a Bachelor’s degree, relevant coursework, and an exam. The CFA focuses on investment analysis and requires passing three exams. Research each certification to find the best fit.

In addition to certifications, you’ll need licenses to sell financial products. Common licenses are:

- Series 7

- Series 66

- Life and Health Insurance License

These licenses require passing exams. They allow you to offer a wider range of services to clients. Make sure to stay updated with licensing requirements in your area.

| Degree | Focus |

|---|---|

| Finance | Investment strategies, risk management |

| Economics | Market trends, economic theory |

| Accounting | Financial statements, tax planning |

| Business Administration | Management, organizational skills |

Credit: www.chase.com

Building Essential Skills

Starting as a personal financial advisor requires strong skills. These skills help you serve clients better. Focus on improving communication and analytical skills first.

Communication Skills

Good communication is key for any financial advisor. You need to explain complex financial terms simply. Use clear and concise language always. Listen actively to your clients. Understanding their needs is crucial.

- Active Listening: Pay attention to what clients say.

- Clarity: Avoid jargon and use simple words.

- Empathy: Show you understand and care about their concerns.

- Body Language: Use positive gestures and maintain eye contact.

Analytical Skills

Analytical skills help you make smart financial decisions. You need to evaluate financial data accurately. Use tools and software for better analysis.

- Data Analysis: Understand financial statements and market trends.

- Problem-Solving: Find solutions to financial challenges.

- Attention to Detail: Ensure accuracy in financial reports.

- Technical Skills: Use financial software efficiently.

Building these essential skills sets you up for success. Practice and refine them regularly.

Gaining Practical Experience

Starting as a personal financial advisor requires practical experience. This experience is crucial for building skills and confidence. There are several ways to gain this experience. Below are two effective methods: internships and entry-level positions.

Internships

Internships offer hands-on experience in the financial industry. Many firms offer internships to college students. Internships can be paid or unpaid.

Internship benefits include:

- Real-world experience

- Networking opportunities

- Learning from experienced professionals

Here are some tips for finding internships:

- Check your college’s career center.

- Look on job boards and company websites.

- Network with professionals in the field.

Entry-level Positions

Entry-level positions are another great way to gain experience. These roles often provide training and mentorship. Entry-level jobs can include:

- Financial analyst

- Client services representative

- Junior advisor

Benefits of entry-level positions:

- Building a professional network

- Gaining industry knowledge

- Learning company-specific practices

To find entry-level positions:

- Search on job boards and company sites.

- Attend job fairs and networking events.

- Use LinkedIn to connect with industry professionals.

Both internships and entry-level positions are valuable. They provide a solid foundation for a career as a personal financial advisor.

Creating A Professional Network

Creating a professional network is key to succeeding as a personal financial advisor. Building strong connections can open doors to new clients and growth opportunities. Engaging with industry peers helps you stay updated with the latest trends and best practices. Here, we’ll explore two crucial ways to build your network: Industry Events and Mentorship Opportunities.

Industry Events

Attending industry events is an excellent way to meet other professionals. These events include conferences, seminars, and workshops. They provide a platform to learn and share knowledge.

- Conferences: Large gatherings where experts speak on various financial topics.

- Seminars: Smaller, focused sessions on specific subjects.

- Workshops: Hands-on training sessions to improve your skills.

Participating in these events helps you gain insights and establish valuable contacts. Always carry business cards and be ready to introduce yourself. Join discussions and ask questions to show your interest and expertise.

Mentorship Opportunities

Finding a mentor can accelerate your career growth. A mentor offers guidance, shares experiences, and provides support. They help you navigate challenges and make informed decisions.

Consider these steps to find a mentor:

- Identify professionals you admire in your field.

- Attend events where these professionals speak.

- Introduce yourself and express your interest in learning from them.

- Schedule regular meetings to discuss your progress and seek advice.

Mentorship can be formal or informal. Some organizations offer structured mentorship programs. You can also approach someone you respect and build a mentor-mentee relationship organically.

Both industry events and mentorship opportunities are vital in building a robust professional network. They provide learning, growth, and support, essential for a thriving career as a personal financial advisor.

Setting Up Your Business

Starting a career as a Personal Financial Advisor is exciting and rewarding. Setting up your business is an essential step in ensuring success. This section will guide you through creating a solid foundation for your new venture.

Business Plan

A well-structured business plan is crucial for any new business. It outlines your goals, strategies, and financial forecasts. Here’s how to create a comprehensive business plan:

- Executive Summary: Summarize your business idea, mission, and vision.

- Market Analysis: Research your target market and competitors.

- Services Offered: List the financial advisory services you will provide.

- Marketing Plan: Detail how you will attract and retain clients.

- Financial Plan: Include startup costs, revenue projections, and funding needs.

Legal Requirements

Understanding and fulfilling legal requirements is vital for your business’s legitimacy. Here are the key steps:

- Business Structure: Decide whether you will be a sole proprietor, LLC, or corporation.

- Register Your Business: Register your business name with local authorities.

- Licensing: Obtain necessary licenses and certifications to operate legally.

- Insurance: Purchase insurance to protect your business and clients.

- Compliance: Ensure you comply with financial regulations and standards.

Setting up your business correctly will help you start on the right foot. This foundation will support your growth and success as a Personal Financial Advisor.

Marketing Your Services

Starting as a personal financial advisor can be exciting. Marketing your services effectively is crucial. Here are some strategies to help you attract clients.

Online Presence

An online presence is essential. Create a professional website. Include your services, credentials, and contact information. Make it easy to navigate.

Use social media platforms like LinkedIn, Facebook, and Twitter. Share valuable content regularly. Engage with your audience. This helps build credibility and trust.

| Platform | Purpose |

|---|---|

| Professional networking | |

| Community engagement | |

| Quick updates |

Consider starting a blog. Write about financial tips and industry news. This can improve your search engine ranking.

Client Referrals

Client referrals are a powerful marketing tool. Ask satisfied clients for referrals. Offer incentives like discounts on services.

Build strong relationships with clients. Provide exceptional service. Happy clients are more likely to refer you.

Use an email newsletter. Keep clients updated with financial news and tips. This keeps you top of mind.

Join local business groups. Network with other professionals. They can refer clients to you.

- Offer referral bonuses

- Provide excellent service

- Stay in touch with clients

Continuous Learning

Continuous learning is crucial for a successful career as a personal financial advisor. The financial industry changes rapidly, and staying current is necessary. You’ll need to keep your skills and knowledge up-to-date to provide the best advice to your clients.

Advanced Courses

Enroll in advanced courses to deepen your knowledge. Many institutions offer specialized courses in financial planning. These courses cover topics like investment strategies, tax laws, and retirement planning. Look for courses that offer certifications. Certifications add credibility to your profile. Some popular certifications include:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

These certifications require passing exams and meeting experience requirements. They show your commitment to the profession. They also demonstrate your expertise to clients.

Industry Trends

Keep an eye on industry trends. The financial world evolves quickly. Knowing the latest trends helps you stay ahead. Subscribe to financial journals and newsletters. Attend industry conferences and webinars. These resources provide valuable insights.

Here are some current trends:

- Robo-advisors: Automated financial planning tools

- ESG Investing: Focus on environmental, social, and governance factors

- Cryptocurrency: Digital currencies like Bitcoin and Ethereum

- Behavioral Finance: Understanding client behavior and decision-making

Understanding these trends helps you offer modern solutions. Clients appreciate advisors who are up-to-date.

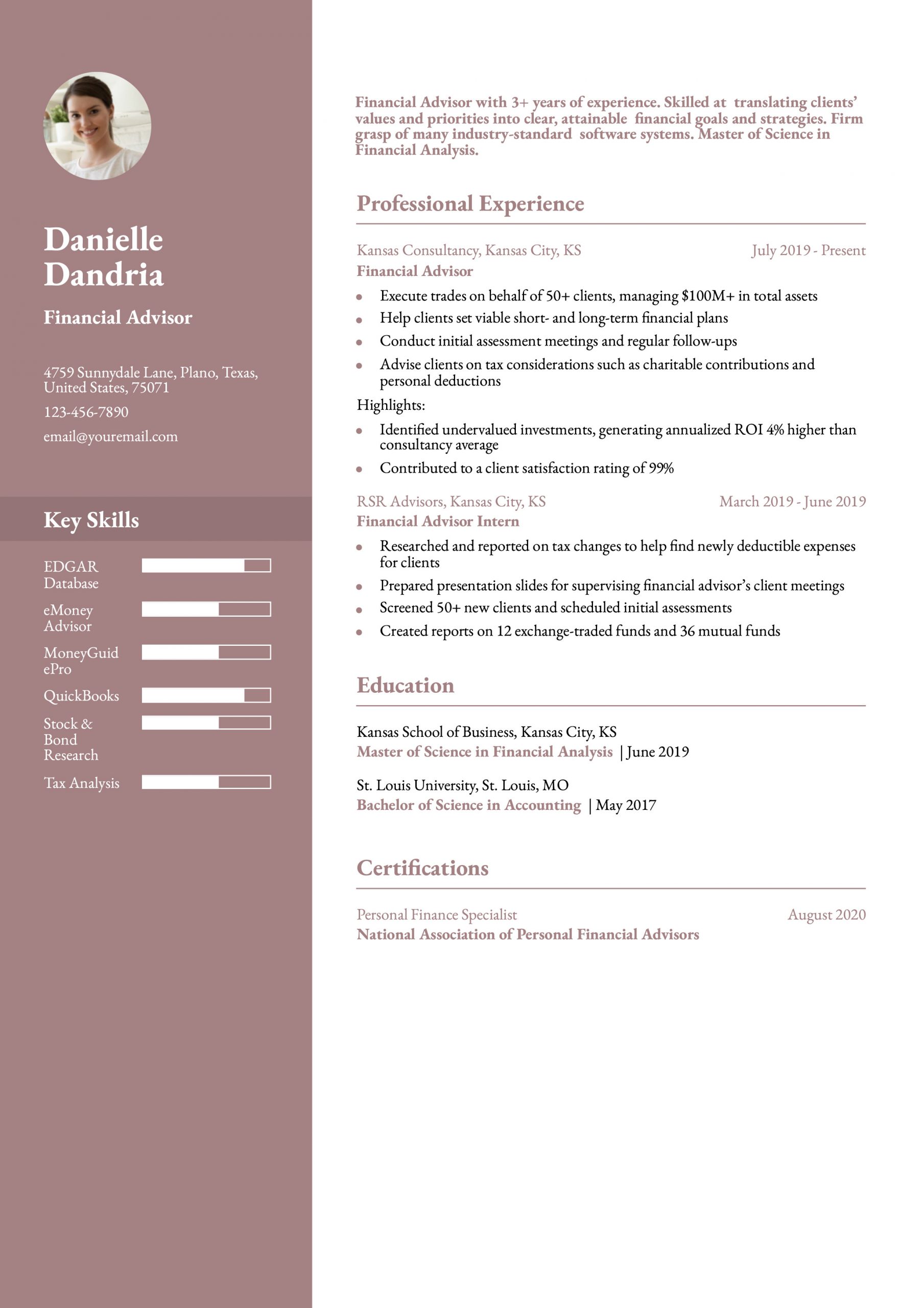

Credit: www.resumebuilder.com

Ethical Considerations

Starting as a personal financial advisor involves understanding ethical guidelines. Maintaining client trust and integrity is crucial. Let’s explore key ethical considerations.

Client Confidentiality

Client confidentiality is a cornerstone of financial advising. Protect your client’s sensitive information. Never share details without explicit permission.

Ensure all client data is secure. Use encryption and secure storage methods. This builds trust and maintains professionalism.

Transparent Practices

Transparency in your practices fosters client trust. Clearly communicate fees and services. Avoid hidden charges or unclear terms.

Provide honest advice based on client’s best interests. Disclose any potential conflicts of interest. Transparency ensures clients make informed decisions.

| Ethical Practice | Description |

|---|---|

| Client Confidentiality | Keep client data private and secure. |

| Transparent Practices | Communicate clearly and honestly. |

Remember, strong ethics build a strong reputation. Adhere to these principles for long-term success.

Credit: croatanquiltersguild.weebly.com

Frequently Asked Questions

How To Begin A Career As A Financial Advisor?

Start by earning a bachelor’s degree in finance or a related field. Obtain necessary licenses and certifications. Gain experience through internships or entry-level positions. Build a network and seek mentorship from established advisors. Continuously update your knowledge and skills.

Is It Hard To Be A Personal Financial Advisor?

Becoming a personal financial advisor can be challenging. It requires strong analytical skills, financial knowledge, and excellent communication abilities.

How To Survive Your First Year As A Financial Advisor?

Build a solid client base through networking. Stay updated on market trends. Offer personalized financial plans. Maintain excellent communication. Prioritize continuous learning and certification.

Can I Become A Financial Advisor At 40?

Yes, you can become a financial advisor at 40. Many firms value life experience and diverse backgrounds. With proper certification and training, transitioning into this career is achievable. Embrace continuous learning and networking to succeed. Age can be an asset in building trust and credibility with clients.

Conclusion

Starting as a personal financial advisor can be rewarding and fulfilling. Follow the steps mentioned to build a successful career. Focus on gaining relevant certifications and experience. Network with industry professionals and stay updated on financial trends. Your dedication and knowledge will pave the way to a thriving advisory business.