To file taxes online, choose a reputable tax software and gather your tax documents. Follow the software’s step-by-step guide to enter your information and submit your return electronically.

Navigating the world of online tax filing can be straightforward if you’re equipped with the right tools. Every year, millions of taxpayers opt for the convenience of digital tax preparation services. These platforms not only simplify the process but also help in maximizing deductions and credits to ensure you get the most out of your tax return.

With user-friendly interfaces, they guide you through each part of your tax return, making sure you input all the necessary information accurately. Many of these services also offer customer support to assist with any questions that may arise. By choosing a reliable tax software that fits your needs, you can complete your tax filing efficiently and with confidence, often with the added benefit of receiving your refund more quickly than with traditional paper filing.

Introduction To Online Tax Filing

Filing taxes online is now a breeze. Gone are the days of handling stacks of paper, mailing envelopes, and waiting weeks for confirmations. The digital age has simplified tax filing, making it accessible, efficient, and secure. This guide introduces online tax filing, highlighting its ease and advantages.

The Shift From Paper To Digital

The journey from paper to digital tax filing has transformed the process. People used to fill out forms by hand and mail them. Now, they can submit everything with a click. This shift saves time and trees.

- Speed: Online filing processes returns faster.

- Accuracy: Software checks for mistakes, reducing errors.

- Convenience: File taxes anywhere, anytime.

Benefits Of Filing Taxes Online

Filing taxes online comes with many perks. These benefits make the process smoother and more reliable. Let’s explore these advantages.

| Benefit | Description |

|---|---|

| Efficiency | Submit forms quickly, get faster refunds. |

| Accuracy | Software helps minimize errors. |

| Security | Advanced encryption protects data. |

| Accessibility | Access your tax history anytime. |

Credit: www.wikihow.life

Eligibility For Online Tax Filing

Are you ready to file your taxes with ease? With online tax filing, you can quickly complete your tax return from the comfort of your home. Before you start, let’s check if you are eligible to use this convenient method.

Who Can File Online?

Filing taxes online is open to many taxpayers. To determine if you’re eligible, consider these points:

- Income level: Most online tax services accommodate varying income levels.

- Residency: You should be a resident or citizen with a valid Social Security Number.

- Complexity of return: Simple to moderate tax situations are ideal for online filing.

Understanding Tax-filing Status

Your tax-filing status affects your eligibility for online filing. It’s crucial to know where you stand. Here are the main statuses:

| Status | Description |

|---|---|

| Single | Unmarried or legally separated individuals. |

| Married Filing Jointly | Couples who are married and filing a combined return. |

| Married Filing Separately | Married individuals filing separate returns. |

| Head of Household | Unmarried individuals paying for more than half of home costs. |

| Qualifying Widow(er) | Recent widows or widowers with a dependent child. |

Choosing The Right Tax Software

Filing taxes online can be simple with the right software. The key is to select one that fits your needs. This means evaluating features, ease of use, and pricing. Let’s explore how to choose the perfect tax software for your situation.

Popular Tax Software Options

A variety of tax software is available. Each offers unique benefits. Here are some top choices:

- TurboTax: Known for user-friendly interfaces.

- H&R Block: Offers in-person support.

- TaxAct: A cost-effective choice.

- Credit Karma Tax: Free for federal and state.

Comparing Features And Prices

Selecting tax software requires a feature and price comparison. Consider what you need:

| Software | Key Features | Price Range |

|---|---|---|

| TurboTax | Deduction finder, live support | $60-$120 |

| H&R Block | Physical offices, easy import | $0-$105 |

| TaxAct | Price lock guarantee, phone support | $0-$100 |

| Credit Karma Tax | Free audit defense, accurate calculations | $0 |

Match your needs with the right software. Check for hidden fees before deciding.

Gathering Your Tax Documents

Before you start filing taxes online, you need to gather your documents. This step is crucial for a smooth tax filing experience. Ensure you have all the necessary paperwork ready before you begin. A checklist can help you track what you need.

Essential Documents Checklist

Gather these important documents:

- Personal Information: Social Security numbers for you and your dependents

- Income Statements: W-2s from employers, 1099 forms for contract work

- Investment Income: Interest (1099-INT), dividends (1099-DIV), proceeds from sales (1099-B)

- Deductions: Receipts for charitable donations, medical expenses

- Credits: Education expenses, child care costs

- Direct Deposit: Bank account and routing numbers

Organizing Your Financial Information

Stay organized with these tips:

- Create a dedicated tax folder, either digital or physical

- Sort documents by category: income, deductions, credits

- Check off items on your checklist as you compile them

- Review last year’s return to ensure you don’t miss anything

Entering Your Information

Filing taxes online can be simple and efficient. It starts with entering your information correctly. This section provides a clear guide on how to input your data accurately.

Step-by-step Data Entry Process

Proper data entry ensures a smooth tax filing experience. Follow these steps:

- Sign in to your chosen tax software.

- Choose the correct tax year.

- Enter personal details: name, address, Social Security Number.

- Input your income information from W-2s and 1099s.

- Report any deductions like mortgage interest, charitable donations.

- Claim eligible tax credits.

- Double-check all entries before proceeding.

Common Mistakes To Avoid

Avoid errors that could delay your refund or trigger an audit. Note these common mistakes:

- Incorrect SSN: Triple-check your Social Security Number.

- Mismatched names: Ensure names match Social Security cards.

- Wrong filing status: Select the status that fits your situation.

- Inaccurate income: Report all income, double-check figures.

- Overlooked deductions: Don’t miss out on valid deductions.

- Math errors: Use calculators or tax software for accuracy.

Maximizing Deductions And Credits

Maximizing Deductions and Credits can greatly reduce your tax bill. This section helps you identify eligible deductions and claim various tax credits. Doing so ensures you pay only what you owe, or perhaps even less.

Identifying Eligible Deductions

Finding deductions you qualify for is the first step. Here’s how:

- Check the IRS website for a list of deductions.

- Gather your receipts for expenses like education, home mortgage interest, and charitable donations.

- Use tax software that suggests deductions based on your income and expenses.

How To Claim Various Tax Credits

Tax credits can save you more money than deductions. Here’s how to claim them:

- Identify credits you qualify for, such as the Earned Income Tax Credit or Child Tax Credit.

- Collect documentation that proves your eligibility, like income statements or child care receipts.

- Fill out the proper forms for each credit when you file your taxes online.

| Type | Example | Form Needed |

|---|---|---|

| Deduction | Mortgage Interest | Schedule A |

| Credit | Child Tax Credit | Form 1040 |

Remember, every deduction and credit you claim brings you one step closer to a lower tax bill. Use online tools and software to help identify and claim these benefits.

Securing Your Data

Securing Your Data is crucial when filing taxes online. It keeps your personal details safe. Let’s explore how to protect your information and ensure its safety.

Protecting Your Personal Information

- Use strong passwords for all your accounts.

- Change passwords regularly.

- Never share your passwords or personal info.

- Always log out after finishing your tax filing.

Data Encryption And Password Safety

Data encryption turns your information into a secret code. Only people with the key can read it.

- Choose tax filing services that offer data encryption.

- Make sure your computer’s antivirus is up-to-date.

- Use a strong, unique password for each account.

- Consider using a password manager to keep track.

Reviewing And Submitting Your Tax Return

Filing taxes online streamlines the process. Yet, accuracy remains crucial. The final steps involve reviewing and submitting your tax return. Errors can delay refunds or result in penalties. Take time to ensure everything is correct. Follow these steps for a smooth submission.

Double-checking Your Filing

Before submitting, double-check your tax return. Look for common mistakes. Ensure personal information is accurate. Verify income details and deductions. Review tax credits you claimed. Use tax software’s review feature for help. This step is vital for an error-free return.

- Personal Information: Confirm your name, SSN, and address.

- Income Details: Match them with your W-2 or 1099 forms.

- Deductions and Credits: Check eligibility and calculations.

Understanding The Submission Process

Understanding the submission process is key. Choose e-file for a faster, secure method. Confirm your method of payment or refund. Select direct deposit for quick access to refunds. Keep a copy of your filed return. Finally, click submit and await confirmation. A confirmation email will follow.

| Step | Action |

|---|---|

| 1 | Choose e-file option |

| 2 | Confirm payment details |

| 3 | Select refund method |

| 4 | Save a copy of your return |

| 5 | Click submit and wait for email |

File with confidence. Use these tips for a successful tax season.

Handling Tax Payments Or Refunds

Filing taxes online simplifies managing payments and refunds. Whether you owe money to the IRS or expect a refund, the process is straightforward. This section guides you through setting up payment plans and tracking refunds.

Setting Up Payment Plans

Can’t pay your tax bill in full? Set up a payment plan. This option allows you to pay over time. The IRS offers several plans to suit different financial situations. Here’s how to get started:

- Visit the IRS website to review your payment plan options.

- Choose a plan that fits your ability to pay.

- Apply online for an immediate response.

Remember, payment plans come with fees and interest. Always consider the total cost before you commit.

Tracking Your Refund Status

Expecting a tax refund? Track it online. The IRS ‘Where’s My Refund?’ tool provides updates. You will need:

| Your Social Security Number | Filing Status | Exact Refund Amount |

|---|

Updates are available 24 hours after e-filing. Check your refund status weekly for the latest information.

Tip: Direct deposit speeds up refund delivery. Provide accurate bank details when filing.

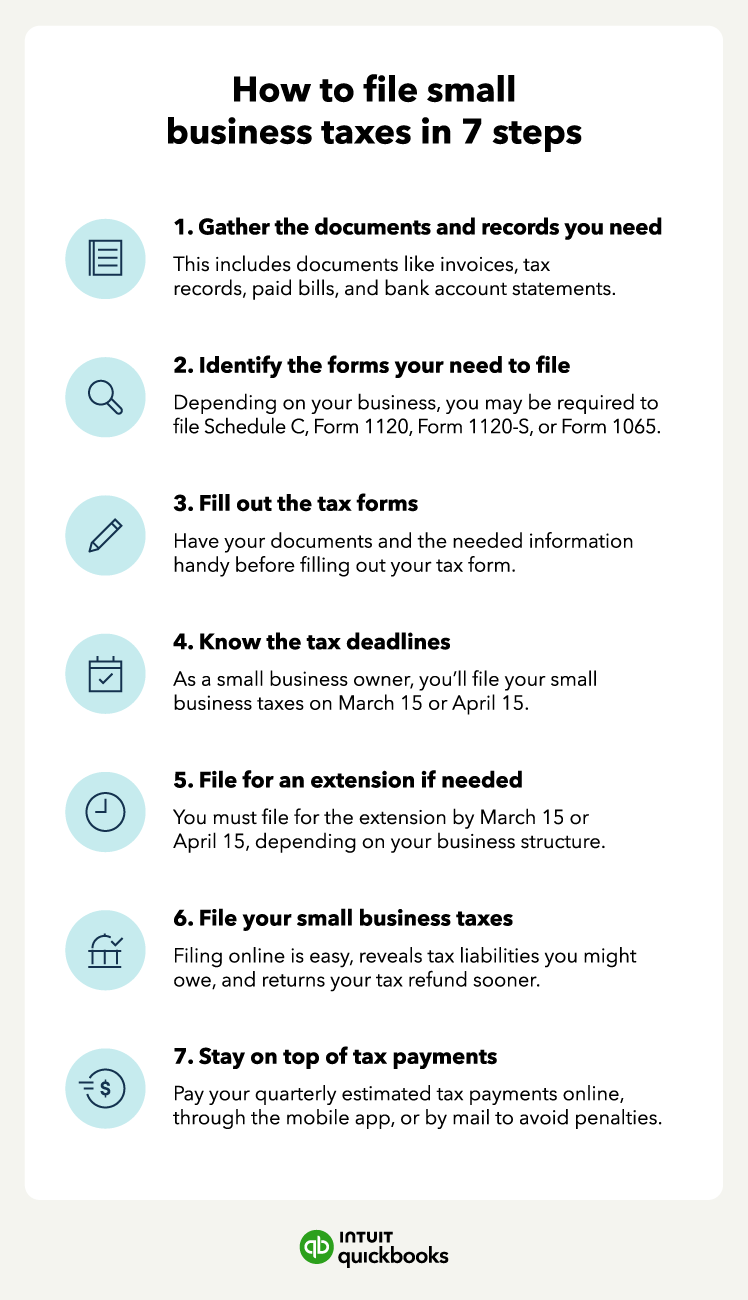

Credit: quickbooks.intuit.com

After Submission: Next Steps

Once you’ve filed your taxes online, it’s time to consider the next steps. Your tax journey doesn’t end at submission. Stay prepared for any IRS notices and plan for the upcoming tax year. These actions can save you time and stress later on.

Responding To Irs Notices

Receiving an IRS notice can be intimidating, but prompt action is crucial. Notices often require a response by a specific date. Failure to respond can lead to penalties or additional interest. Here’s how to handle them:

- Read the notice carefully. Understand what the IRS is requesting.

- Gather your documents. Collect any paperwork related to the notice.

- Respond on time. Use the provided contact information to reply before the deadline.

If you disagree with the notice, you can appeal the decision. The IRS provides instructions on how to do this within the notice itself.

Planning For The Next Tax Year

Proactive tax planning can lead to smoother filing next year. Consider these steps:

- Adjust your withholdings if you owed a lot or received a large refund.

- Organize your records. Keep receipts and documents sorted throughout the year.

- Contribute to retirement accounts like a 401(k) or IRA to reduce taxable income.

These strategies can lead to potential savings and a more streamlined tax process.

| Tip | Action | Benefit |

|---|---|---|

| Track Deductions | Maintain records | Maximize returns |

| Adjust Withholdings | Update W-4 form | Prevent surprises |

| Save for Retirement | Invest in IRA/401(k) | Lower taxes |

Credit: www.wikihow.life

Frequently Asked Questions

Can I File Taxes Online Myself?

Yes, you can file taxes online yourself using various IRS-approved e-filing services or software.

Can I File My Taxes Electronically?

Yes, you can file your taxes electronically using IRS e-file or authorized third-party services. It’s quick, secure, and often results in faster refunds.

What Is The Fastest Easiest Way To File Taxes?

The fastest and easiest way to file taxes is by using IRS Free File or trusted e-filing software online, ensuring quick and accurate tax returns.

How To File Taxes For The First Time By Yourself?

Gather your tax documents, including W-2s and 1099s. Use IRS Form 1040 or software like TurboTax. Claim any deductions or credits you’re eligible for. Submit your return electronically or by mail before the deadline. Keep copies for your records.

Conclusion

Filing taxes online streamlines the process, saving time and reducing errors. By choosing the right platform and following the steps outlined in this post, you’ll navigate tax season with ease. Embrace the digital convenience and tackle your tax filing confidently.

Remember, help is just a click away for any hiccups along the way.