To create a financial plan, assess your current financial situation and set clear, achievable goals. Develop a strategy to manage your income, expenses, and investments.

A sound financial plan is essential for achieving long-term financial stability and security. It helps you understand your financial status, set realistic goals, and devise strategies to achieve them. By managing your income, expenses, and investments effectively, you can secure your future and meet your financial aspirations.

A financial plan acts as a roadmap, guiding your financial decisions and helping you stay on track. Whether planning for retirement, saving for a big purchase, or managing debt, a well-structured financial plan is crucial for financial well-being.

Introduction To Financial Planning

Creating a financial plan is the first step towards financial security. It helps you manage your money effectively. Financial planning involves setting goals, tracking expenses, and investing wisely. This guide will introduce you to the basics of financial planning.

Importance Of Financial Planning

Financial planning is crucial for a stable and prosperous future. Here are some reasons why:

- Helps you save money for emergencies.

- Enables you to achieve your financial goals.

- Ensures you have enough funds for retirement.

- Protects your family in case of unforeseen events.

- Helps you avoid debt and manage loans better.

Planning gives you peace of mind and control over your finances. It allows you to make informed decisions and avoid financial pitfalls.

Common Misconceptions

There are many misconceptions about financial planning. Let’s debunk some of them:

| Misconception | Reality |

|---|---|

| Only for the wealthy | Everyone needs a financial plan, regardless of income. |

| Too complicated | Basic planning can be simple and straightforward. |

| Requires a financial advisor | You can start on your own with basic knowledge. |

| Only about saving money | It includes spending, investing, and managing debt. |

Understanding these misconceptions can help you take the first step. Financial planning is accessible and beneficial for everyone.

Setting Financial Goals

Creating a financial plan starts with setting financial goals. These goals guide your financial journey. They help you prioritize and allocate resources effectively. Understanding your goals ensures you stay on track.

Short-term Goals

Short-term goals are things you want to achieve soon. These goals usually take less than a year. They are easy to plan and achieve.

- Build an Emergency Fund: Save money for unexpected expenses.

- Pay Off Small Debts: Focus on clearing minor debts first.

- Create a Budget: Plan your monthly spending and savings.

- Save for a Vacation: Set aside funds for a holiday.

Short-term goals give you quick wins. These wins keep you motivated. They also form the foundation for bigger goals.

Long-term Goals

Long-term goals take more time and planning. These goals usually span several years or decades. They require dedication and discipline.

- Retirement Savings: Plan how much you need for retirement.

- Buy a House: Save for a down payment on a home.

- Children’s Education: Set aside money for your kids’ college.

- Investment Growth: Build a portfolio to grow your wealth.

Long-term goals ensure financial stability. They help you build a secure future. Start planning today for long-term success.

| Goal Type | Examples | Time Frame |

|---|---|---|

| Short-Term | Emergency Fund, Pay Off Small Debts | Less than 1 year |

| Long-Term | Retirement, Buy a House | Several years |

Setting clear goals is crucial. It helps you stay focused and organized. Write down your goals and review them regularly.

Assessing Your Current Financial Situation

Creating a financial plan starts with understanding your current financial situation. This step is crucial to identify your strengths and weaknesses. You need to know where your money comes from and where it goes. Assessing your financial situation involves evaluating income, expenses, assets, and liabilities.

Evaluating Income And Expenses

Your income is the money you earn from all sources. This includes your salary, bonuses, investments, and any other revenue streams. List all your income sources. You can use a table for better clarity:

| Income Source | Monthly Amount |

|---|---|

| Salary | $3000 |

| Investments | $500 |

| Freelancing | $400 |

Next, evaluate your expenses. List all your monthly expenses. These can include rent, groceries, utilities, and entertainment. You can also use a table for expenses:

| Expense Category | Monthly Amount |

|---|---|

| Rent | $1200 |

| Groceries | $400 |

| Utilities | $150 |

| Entertainment | $200 |

Subtract your expenses from your income to see your net income. This helps you understand if you are saving money or spending too much.

Reviewing Assets And Liabilities

Assets are what you own. This includes cash, property, investments, and personal belongings. List all your assets:

- Cash: $5000

- Property: $150,000

- Investments: $20,000

- Car: $10,000

Liabilities are what you owe. This includes mortgages, loans, and credit card debt. List all your liabilities:

- Mortgage: $100,000

- Car Loan: $8,000

- Credit Card Debt: $2,000

Subtract your liabilities from your assets to find your net worth. Knowing your net worth helps you understand your financial health. This will guide you in creating a realistic financial plan.

Creating A Budget

A well-structured budget is the cornerstone of any financial plan. It helps you manage your income and expenses. You can achieve your financial goals effectively. Let’s dive into the steps to create a budget.

Tracking Expenses

Tracking expenses is the first step in creating a budget. Keep a record of all your spending. This includes both small and large purchases.

Use a notebook or an app to log your expenses. Categorize them into groups like food, rent, and entertainment. This will help you see where your money goes.

| Category | Amount |

|---|---|

| Food | $200 |

| Rent | $800 |

| Entertainment | $100 |

Allocating Funds

Next, allocate funds based on your tracked expenses. Assign a specific amount to each category. Ensure you stay within your income limits.

Create a priority list. Ensure essential needs like rent and food come first. Then allocate funds for savings and non-essential spending.

- Rent: $800

- Food: $200

- Entertainment: $100

- Savings: $150

Review and adjust your budget regularly. Life changes can affect your financial needs.

Building An Emergency Fund

Creating an emergency fund is an essential step in any financial plan. This fund acts as a safety net during unexpected events. It provides peace of mind and financial security.

Importance Of Emergency Savings

An emergency fund is crucial. It helps cover unexpected expenses. These could be medical bills, car repairs, or job loss.

Without an emergency fund, you might rely on credit cards. This can lead to debt and financial stress.

A well-funded emergency account protects your financial health. It ensures you can handle surprises without derailing your budget.

How Much To Save

The amount to save depends on your monthly expenses. A good rule of thumb is to save three to six months’ worth of expenses.

This table can help you determine your savings goal:

| Monthly Expenses | Emergency Fund (3 months) | Emergency Fund (6 months) |

|---|---|---|

| $2,000 | $6,000 | $12,000 |

| $3,000 | $9,000 | $18,000 |

| $4,000 | $12,000 | $24,000 |

To build your emergency fund, start by setting small goals. Aim to save $500, then $1,000, and so on. This makes the task less daunting.

Consider these tips for saving effectively:

- Automate your savings with direct deposits.

- Cut unnecessary expenses.

- Sell unused items for extra cash.

Consistency is key. Even small contributions add up over time. Make your emergency fund a priority.

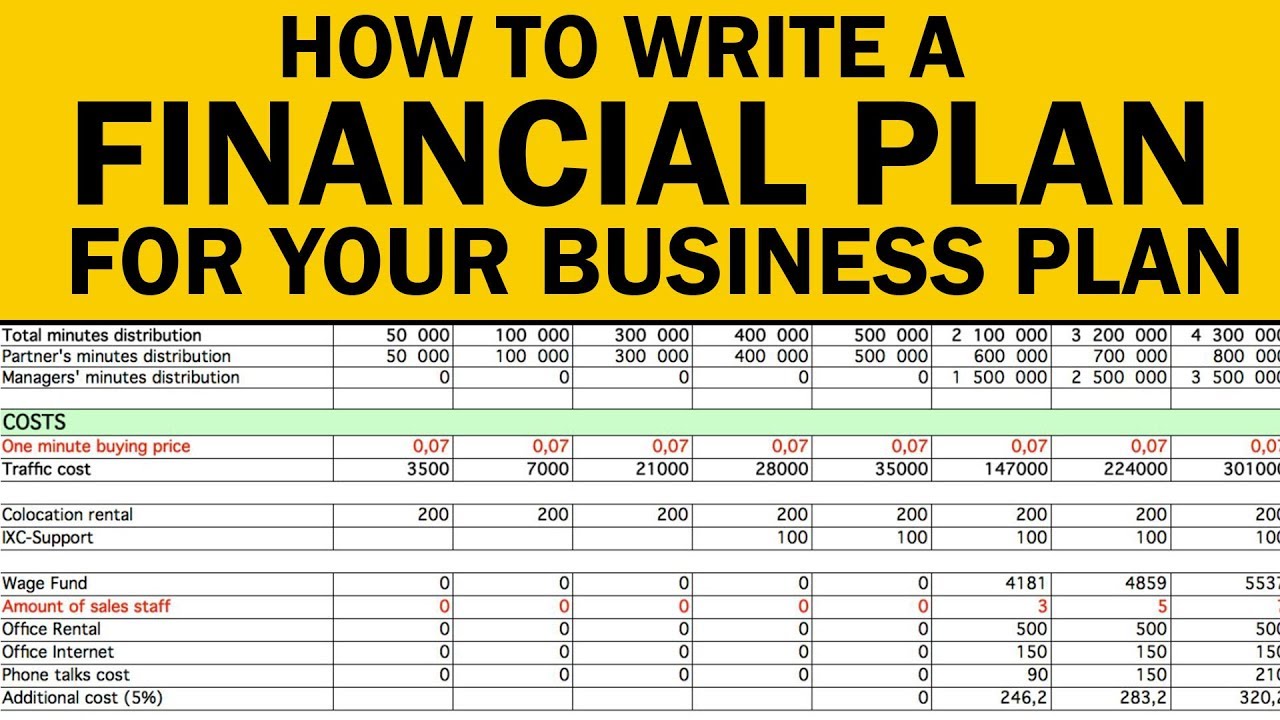

Credit: www.youtube.com

Investing For The Future

Investing for the future is a key part of any financial plan. It helps grow your wealth and secure your financial goals. Understanding different types of investments and knowing your risk tolerance can make all the difference.

Types Of Investments

There are many types of investments you can choose from. Each has its own benefits and risks. Here are some common investment options:

- Stocks: Owning shares of a company. They can offer high returns but come with high risk.

- Bonds: Loans to companies or governments. They are less risky but offer lower returns.

- Mutual Funds: Pools of money from many investors. They are managed by professionals and spread risk.

- Real Estate: Buying property. It can give rental income and appreciation in value.

- ETFs: Similar to mutual funds but traded like stocks. They offer liquidity and diversification.

- Gold: A safe haven asset. It holds value well during economic downturns.

Risk Tolerance

Knowing your risk tolerance helps you choose the right investments. Risk tolerance is how much risk you can handle without stress.

Factors affecting risk tolerance:

- Age: Younger people can take more risks. They have time to recover from losses.

- Financial Goals: Short-term goals need safer investments. Long-term goals can handle more risk.

- Experience: Experienced investors may feel comfortable with higher risks.

- Income: Higher income can allow for more risk. Lower income may need safer options.

Understanding these factors helps you match investments with your comfort level. This balance is key for long-term success and peace of mind.

Planning For Retirement

Planning for retirement is a crucial part of your financial journey. Early planning can ensure a comfortable and stress-free retirement. This section covers essential aspects like retirement accounts and savings strategies.

Retirement Accounts

Retirement accounts are key to building a secure future. 401(k) and IRA are two popular options.

| Account Type | Benefits |

|---|---|

| 401(k) | Employer match, tax benefits |

| IRA | Tax advantages, flexibility |

Understanding these accounts helps you choose the right one. Each has unique benefits and tax advantages. Consider your current financial situation and future needs.

Savings Strategies

Effective savings strategies are vital for a secure retirement. Here are some tips:

- Start early to maximize compound interest.

- Save a fixed percentage of your income.

- Set clear retirement goals.

- Automate your savings.

- Review and adjust your plan regularly.

These strategies ensure you stay on track. Small, consistent efforts make a big difference over time.

Credit: education.bankerstrust.com

Reviewing And Adjusting Your Plan

Creating a financial plan is a great start. But it’s not enough. Reviewing and adjusting your plan is essential for success. Your financial situation changes over time. So should your plan. Let’s explore how to keep your plan relevant.

Regular Financial Checkups

Regular financial checkups are crucial. Schedule them at least once a year. During these checkups, review your income and expenses. Compare them with your budget. If there’s a difference, find out why.

Use a simple table to track your finances:

| Category | Planned | Actual |

|---|---|---|

| Income | $5,000 | $5,500 |

| Expenses | $3,000 | $3,200 |

| Savings | $2,000 | $2,300 |

This table helps you see where you stand. Make adjustments if needed.

Adjusting Goals And Strategies

Your goals may change over time. Adjust them if necessary. For example, you may want to save more for retirement. Or, you may need to cut back on spending.

Follow these steps to adjust your goals:

- Review your current goals.

- Identify any changes in your life.

- Set new goals if needed.

- Update your financial plan accordingly.

Adjusting your strategies is also important. If your investments are not performing well, consider new options. Research different investment opportunities. Make sure they align with your goals.

Keep your financial plan flexible. Life is unpredictable. Your plan should adapt to changes. This ensures long-term success.

Seeking Professional Advice

Creating a financial plan can be challenging. Seeking professional advice can simplify the process. Professionals can offer expertise and guidance. They can help you achieve your financial goals efficiently.

When To Consult A Financial Advisor

Knowing when to consult a financial advisor is crucial. Here are some scenarios when you should consider professional help:

- Major Life Events: Marriage, having a baby, or buying a house.

- Complex Financial Situations: Managing large investments or debts.

- Retirement Planning: Ensuring a secure and comfortable retirement.

- Tax Planning: Navigating tax laws and maximizing returns.

Choosing The Right Advisor

Choosing the right advisor is essential for effective financial planning. Follow these steps to find the best fit:

- Credentials: Look for certified professionals like CFPs or CPAs.

- Experience: Check their experience in handling similar financial situations.

- Reputation: Read reviews and ask for references.

- Fees: Understand their fee structure and ensure it aligns with your budget.

| Criteria | Importance |

|---|---|

| Credentials | High |

| Experience | High |

| Reputation | Medium |

| Fees | Medium |

By following these guidelines, you can find a trustworthy advisor. This will help you create a strong financial plan.

Credit: dollarsprout.com

Frequently Asked Questions

How Do I Write A Financial Plan For Beginners?

Start by setting clear financial goals. Track your income and expenses. Create a budget to manage spending. Save regularly and build an emergency fund. Invest in diversified assets for long-term growth.

Can You Make Your Own Financial Plan?

Yes, you can create your own financial plan. Start by setting goals, budgeting, and tracking expenses.

How Is A Financial Plan Created?

A financial plan is created by assessing current finances, setting goals, analyzing options, and implementing strategies. Regular reviews ensure adjustments for changing circumstances.

What Should A Financial Plan Include?

A financial plan should include budgeting, saving, investments, insurance, retirement planning, tax strategies, and an emergency fund.

Conclusion

Crafting a financial plan is crucial for achieving your financial goals. It helps you manage your money wisely. Regularly review and adjust your plan to stay on track. By doing so, you can secure your financial future. Start today and take control of your financial destiny.