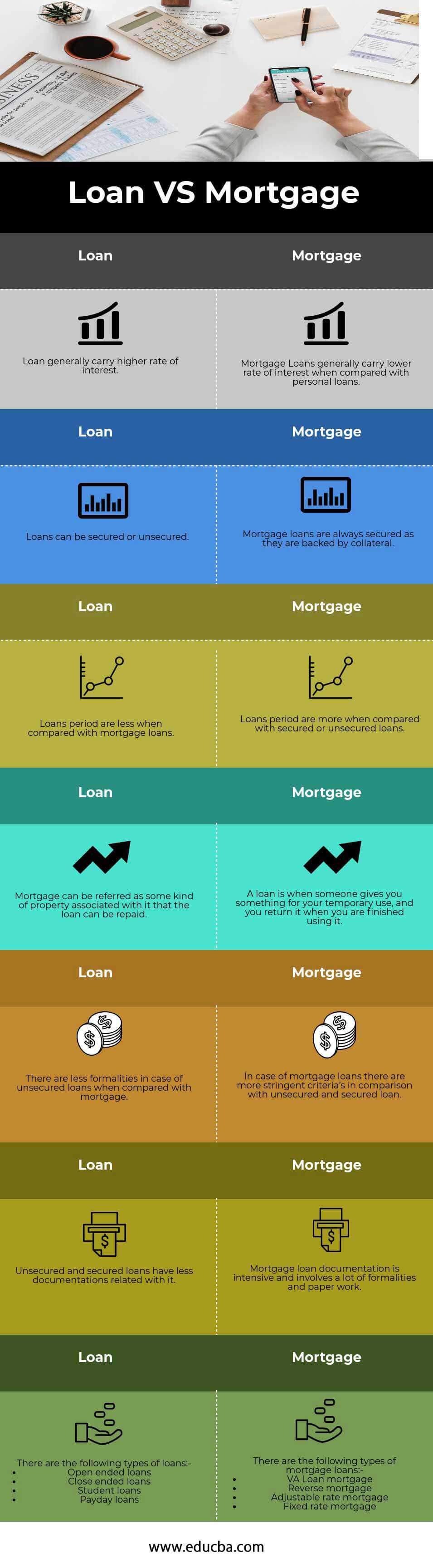

Home loans and mortgages are not identical; a home loan is a type of mortgage. Mortgages are broader financial agreements using property as security.

Navigating the realm of property financing can often seem daunting for both first-time buyers and seasoned investors. Understanding the difference between a home loan and a mortgage is crucial in making informed decisions. Essentially, all home loans fall under the umbrella of mortgages, which are legal agreements that secure a loan with real estate.

Yet, not all mortgages are for purchasing homes; they can also cover other real estate transactions. A home loan specifically refers to the borrowing of funds to buy a residence, where the property itself serves as collateral until the loan is fully repaid. This distinction is vital for anyone looking to dive into the property market, ensuring clarity on the financial commitments involved. By grasifying the nuances between these two terms, potential borrowers can better navigate their financing options and choose the solution that best suits their needs.

Introduction To Home Loans And Mortgages

Buying a house is a big step. You need money for it. Banks can help. They give you money to buy or fix a house. This is called a home loan or a mortgage. Let’s learn about them.

Purpose Of Home Loans

Home loans help you buy a house. You borrow money and pay back later. You can also use home loans to fix your house. It makes owning a home possible for many people.

- Buy a house: Get money to buy a home.

- Fix a house: Borrow money for home repairs.

- Refinance: Change your loan for better terms.

Mortgage Basics

A mortgage is a type of home loan. You promise your house to the bank. If you can’t pay back, the bank can take your house.

| Type | What It Means |

|---|---|

| Fixed-rate | Same interest rate always. |

| Adjustable-rate | Interest rate can change. |

Choosing the right type is important. It affects your payments.

Credit: www.reinbrechthomes.com

Securing A Property: Loan Vs. Mortgage

Understanding the difference between a home loan and a mortgage is crucial. Both terms often interchangeably used, but they differ significantly. This post will clarify these differences and help you make an informed decision when securing a property.

Collateral Differences

Home loans and mortgages involve different collateral conditions. With home loans, borrowers get funds to buy a property. The property itself acts as collateral. If the borrower fails to repay, the lender can seize the property.

In contrast, a mortgage is a legal agreement. It secures a loan with the borrower’s property. The property’s title remains with the lender until the loan is fully paid off.

Legal Implications

The legal implications of home loans versus mortgages are significant. With a home loan, the borrower holds the title from the start. They risk losing the home if they default on the loan.

With a mortgage, the lender holds the title until the final payment. If the borrower defaults, the foreclosure process begins. This allows the lender to take over the property.

Understanding these key points can guide you in choosing the right option for property financing.

Financial Commitments: Comparing Terms And Rates

Choosing between a home loan and mortgage is key. Each has unique terms and rates. It’s important to understand these differences. They affect your financial health. Let’s explore interest rates and repayment timeframes.

Interest Rate Variations

Interest rates can make a big difference. They vary between home loans and mortgages. Rates impact your monthly payments. Lower rates mean more savings. Rates change based on the market and your credit score.

- Fixed rates stay the same.

- Variable rates can change over time.

Different lenders offer different rates. It’s vital to compare these before deciding. Use online tools to compare rates easily. This helps you find the best deal.

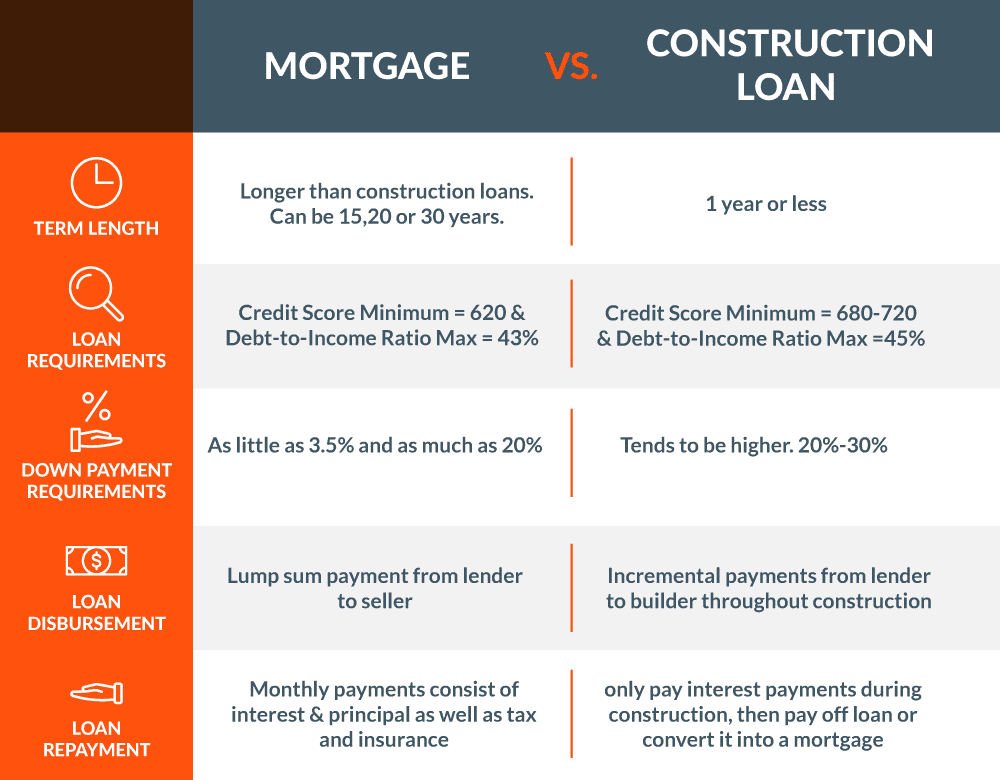

Repayment Timeframes

The length of your loan affects your finances. Shorter loans mean higher payments. But, you pay less interest over time. Longer loans lower monthly payments. Yet, they cost more in the long run.

| Loan Term | Monthly Payment | Total Interest |

|---|---|---|

| 15 Years | Higher | Lower |

| 30 Years | Lower | Higher |

Choose a term that fits your budget. Think about your long-term financial goals. A shorter term saves money on interest. A longer term eases your monthly budget.

Credit: www.diffen.com

Borrower Profiles: Who Chooses What?

Understanding different borrower profiles helps in making informed decisions between home loans and mortgages. Each financial product caters to specific needs and situations. Let’s explore who typically opts for which option and why.

Home Loan Eligibility

Home loans often attract first-time buyers. These individuals seek to purchase a primary residence. Eligibility criteria for a home loan can include:

- Credit score: A good score is crucial.

- Income: Stable income assures loan repayment.

- Debt-to-income ratio: Lower ratios are preferable.

- Employment history: Consistency is key.

Young families and professionals usually meet these criteria. They often have stable jobs and aim for their dream homes.

Mortgage Qualifications

Mortgages are chosen by those with different goals. These can include:

| Profile | Qualifications |

|---|---|

| Investors | Higher income, diverse portfolio |

| Business Owners | Assets for collateral, business records |

| Renovators | Equity in existing property, renovation plan |

Investors looking to expand portfolios often opt for mortgages. Business owners may leverage commercial properties. Renovators might use existing home equity to secure funds.

Lender’s Perspective: Risk And Return

Lender’s Perspective: Risk and Return are key in home loans and mortgages. Banks and financial institutions always evaluate the potential gains against the risks involved.

Risk Assessment In Lending

Lenders start by assessing the borrower’s ability to repay. They look at income, credit history, and job stability. Property value also plays a role. It must cover the loan if the borrower defaults. This assessment helps minimize the risk of non-payment.

Return On Investment For Lenders

The interest rate on a loan is the lender’s return. It reflects the risk they take. Higher risk may mean higher rates. Lenders balance rates with competitive offers to attract borrowers. This ensures a stable return on their investment.

| Risk Factor | Lender’s Measure |

|---|---|

| Credit Score | Higher score, lower risk |

| Loan-to-Value Ratio | Lower ratio, lower risk |

| Debt-to-Income Ratio | Lower ratio, better financial health |

- Risk is a lender’s chance of loss.

- Return is the profit made from interest.

- Evaluate borrower’s financial strength.

- Set interest rates to match risk levels.

- Ensure property value secures the loan.

Property Ownership And Control

Understanding Property Ownership and Control is key in Home Loan vs Mortgage. Each has unique rights and responsibilities. Let’s explore.

Rights Under Home Loan

- Ownership: The buyer owns the property outright.

- Control: The owner makes all decisions about the property.

- Flexibility: Owners can sell or renovate as they wish.

- Risks: Owners face all risks, including market downturns.

Mortgage Holding Rights

In a mortgage, both the lender and borrower have rights.

| Lender’s Rights | Borrower’s Rights |

|---|---|

| Interest collection | Use of property |

| Property claim if default | Ownership after full payment |

| Control over major decisions | Ability to refinance or sell with lender approval |

Lenders have a say in big property decisions. Borrowers use the property but must get lender approval for big changes.

Refinancing Options

Exploring refinancing options can save money over time. It involves replacing an existing loan with a new one. This new loan typically has better terms or interest rates. Homeowners may choose to refinance a home loan or mortgage for various reasons.

Refinancing A Home Loan

Refinancing a home loan may offer several benefits:

- Lower monthly payments due to reduced interest rates.

- Shorter loan terms can lead to paying off the loan faster.

- Cash-out refinance options provide extra cash for other needs.

It’s important to assess fees and potential savings. Lenders may charge for application, appraisal, and origination.

Mortgage Refinance Considerations

Before deciding to refinance a mortgage, consider these points:

| Credit Score | Equity | Debt-to-Income Ratio |

|---|---|---|

| A higher score can secure lower rates. | More equity means better loan terms. | A lower ratio leads to better refinance options. |

Remember to check break-even points and closing costs. These impact the overall savings of refinancing.

Credit: www.educba.com

Impact Of Credit Scores

The ‘Impact of Credit Scores’ is crucial when seeking a home loan or mortgage. A high credit score can open doors to better interest rates and loan terms. Conversely, a lower score may pose challenges. Understanding this impact helps in securing the best financial deal.

Credit Influence On Home Loan Approval

Your credit score plays a pivotal role in home loan approvals. Banks and lenders use this score to assess risk. A high score suggests responsible credit behavior. It increases your chances of loan approval. Lenders trust you more. A low score can lead to loan rejections or higher down payments. It reflects past credit struggles.

- High scores: Easier loan approvals, lower down payments.

- Low scores: Possible rejections, higher down payments.

Mortgage Rates And Credit History

A strong credit history often results in lower mortgage rates. Lenders offer competitive rates to borrowers with good scores. These rates are crucial over time. They can save thousands in interest. A weak credit history may increase rates. This can lead to more paid in interest over the loan’s life.

| Credit Score Range | Possible Interest Rate |

|---|---|

| 750+ | Lowest rates |

| 700-749 | Low rates |

| 650-699 | Higher rates |

| <650 | Highest rates |

Remember, even a small difference in rates impacts monthly payments. Improving your credit score before applying helps secure better rates.

Closing Costs And Fees

Understanding closing costs and fees is crucial when comparing home loans and mortgages. These expenses can impact your budget significantly. Let’s dive into the specifics of each to make informed decisions.

Home Loan Closing Costs

Home loan closing costs are one-time fees. Buyers pay these when finalizing a loan. Here’s what to expect:

- Appraisal Fee: For assessing the home’s value.

- Title Search: Ensures the property is free of liens.

- Escrow Deposit: Pre-pays taxes and insurance.

- Origination Fee: Covers lender’s processing work.

| Type of Cost | Description | Typical Range |

|---|---|---|

| Application Fee | For starting the loan process | $75 – $300 |

| Underwriting Fee | Covers the cost of evaluating the loan | $400 – $600 |

| Credit Report Fee | Pays for the credit history check | $30 – $50 |

Mortgage-related Fees

Mortgage fees vary by loan type and lender. Here are common ones:

- Loan Application Fee: It’s for processing your mortgage application.

- Points: Paid upfront to lower interest rates.

- Attorney Fees: For legal aspects of the mortgage process.

Both home loans and mortgages come with costs. It’s important to compare these expenses before deciding. Always ask lenders for a good faith estimate. This shows all the fees you’ll pay at closing.

Tax Implications And Benefits

Tax implications and benefits can greatly affect your decision between home loans and mortgages. Both options offer unique tax advantages. Understanding these can save you money.

Tax Deductions For Home Loans

Home loans can lead to significant tax savings. The government encourages homeownership through tax deductions. These deductions reduce taxable income, lowering tax bills.

Principal repayments qualify for deductions under section 80C. Interest payments also offer tax relief under section 24. These combined can add up to substantial savings.

Mortgage Tax Advantages

Mortgages can also provide tax benefits. Interest paid on mortgages may be tax-deductible. This deduction applies to the first and second homes.

Mortgage points paid upfront can also be deductible. This deduction occurs in the year points are paid. It can lead to immediate tax savings.

| Type of Benefit | Home Loan | Mortgage |

|---|---|---|

| Principal Repayment Deduction | Yes (Section 80C) | No |

| Interest Payment Deduction | Yes (Section 24) | Yes |

| Points Deduction | No | Yes |

Both home loans and mortgages have attractive tax benefits. These can impact your long-term financial planning. Choose the option that maximizes your tax advantages.

Default And Foreclosure Scenarios

Understanding Default and Foreclosure Scenarios is key in home financing. Both home loans and mortgages come with their risks. Knowing what happens if payments stop is crucial.

Consequences Of Home Loan Default

Not paying a home loan leads to serious steps. First, lenders send notices. Then, they may take back the home. This process is called foreclosure. Let’s break down the steps:

- Notice of Default: The lender sends a warning letter.

- Legal Action: The lender may start legal actions to take the home.

- Foreclosure: The home is sold to pay the loan.

A default impacts credit scores badly. It makes getting new loans hard.

Mortgage Default Outcomes

Mortgages work like home loans but are specific to buying homes. Defaulting on a mortgage also leads to foreclosure. Yet, the process can vary based on the loan type and state laws. Key outcomes include:

- Collection Attempts: Lenders try to collect the debt.

- Lawsuit: The lender might sue for the unpaid amount.

- Loss of Home: The home can be sold at auction.

Mortgage defaults also hurt credit scores. They make future finances tough.

Future Considerations

Choosing between a home loan and a mortgage impacts your future. Let’s dive into how these choices affect long-term financial planning and market trends.

Long-term Financial Planning

Long-term financial planning is crucial for both options. A home loan often has fixed interest rates, making budgeting easier. Mortgages, however, might offer lower rates but can vary, affecting monthly payments.

- Home loans provide stability with consistent payments.

- Mortgages can adjust, leading to potential payment increases.

Consider your job stability and income growth potential. These factors influence your ability to manage payments over time.

Market Trends And Loan Types

Understanding market trends helps in choosing the right loan type. Interest rates fluctuate based on economic conditions. Knowing when to lock in a rate is key.

| Loan Type | Pros | Cons |

|---|---|---|

| Fixed-Rate | Stable payments | Higher initial rates |

| Adjustable-Rate | Lower initial rates | Risk of increase |

Consider future market trends before deciding. An adjustable-rate mortgage (ARM) might start lower but can increase. A fixed-rate loan offers payment stability.

- Review your financial stability.

- Analyze market conditions.

- Choose a loan that fits your risk tolerance.

Frequently Asked Questions

Are Home Loans And Mortgages The Same?

Home loans and mortgages refer to the same financial product, with “mortgage” emphasizing the loan’s security against property.

Is A Loan Better Than A Mortgage?

A loan isn’t necessarily better than a mortgage; it depends on your needs. Mortgages are specifically for home purchases, often with lower interest rates, while loans can be for various purposes and might have higher rates. Choose based on your financial goal.

Why Is A House Loan Called A Mortgage?

A house loan is called a mortgage due to its secured nature, where the property acts as collateral until the loan is fully repaid.

Is A Loan To Buy A House Called A Mortgage?

Yes, a loan specifically taken out to purchase a home is known as a mortgage.

Conclusion

Deciding between a home loan and a mortgage depends on your financial situation and goals. Each option has its benefits, tailored to different needs. Carefully evaluate interest rates, repayment terms, and tax implications. Your choice can significantly impact your financial future.

Seek advice from a financial advisor to navigate this crucial decision.