Start with a low-limit credit card to manage spending and build your credit score. Always pay your balance in full each month.

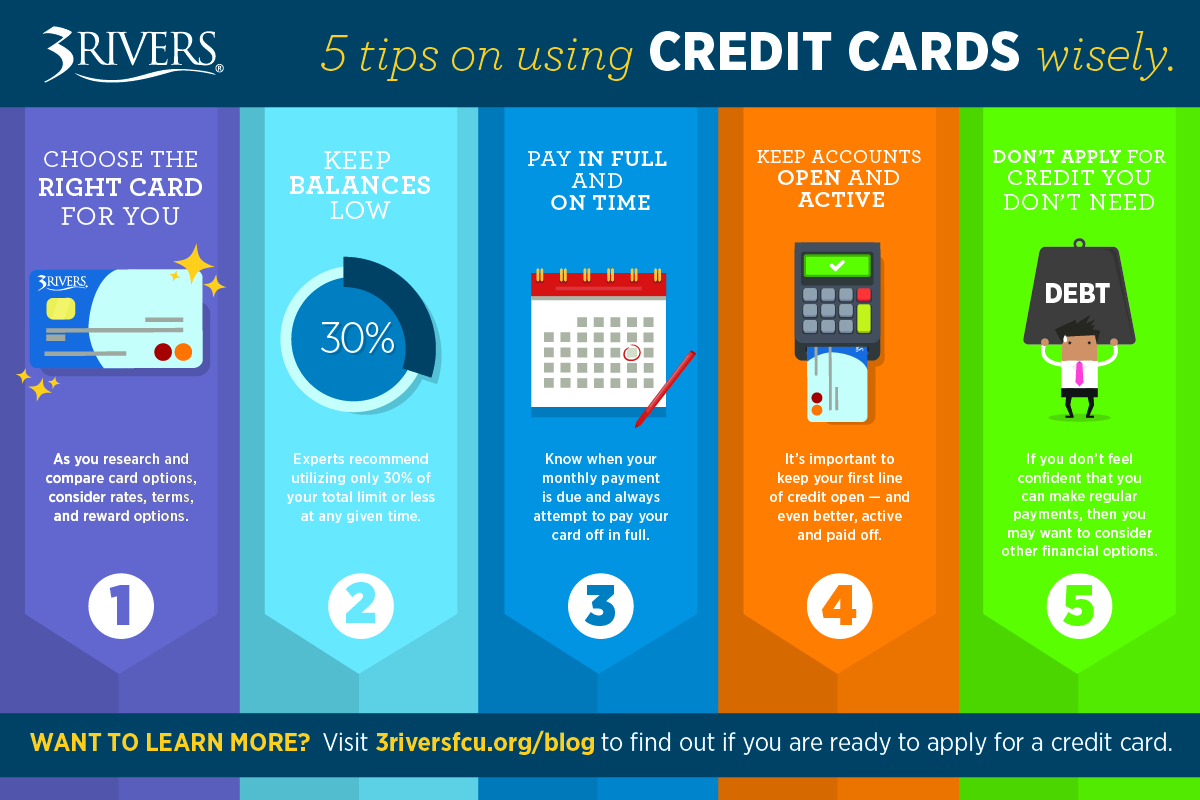

Using a credit card responsibly can be a powerful financial tool. Beginners should focus on understanding the terms and conditions. Choose a card that matches your spending habits and offers rewards you can use. Make timely payments to avoid interest charges and late fees.

Monitoring your credit card statements helps track spending and detect any fraudulent activities. Setting up automatic payments ensures you never miss a due date. Keep your credit utilization low by not maxing out your card. Over time, responsible use of a credit card can improve your credit score, opening up opportunities for better financial products.

Choosing The Right Card

Choosing the right credit card is important for beginners. It can save money and build credit. Many types are available, each with unique features. Understanding these features can help make the best choice.

Types Of Credit Cards

Credit cards come in many types. Each type serves different needs. Here’s a list of common credit card types:

- Secured Credit Cards: Great for building credit. Requires a deposit.

- Rewards Credit Cards: Earn points, miles, or cash back on purchases.

- Student Credit Cards: Designed for students. Easier approval and rewards for good grades.

- Balance Transfer Credit Cards: Transfer high-interest debt to a low-interest card.

- Business Credit Cards: For small business expenses. Offers higher credit limits.

Interest Rates And Fees

Interest rates and fees vary by card. Understanding these can save money. Look at the Annual Percentage Rate (APR). This is the interest charged on balances.

Common fees include:

| Fee Type | Description |

|---|---|

| Annual Fee | Yearly fee for using the card. |

| Late Payment Fee | Charged if a payment is late. |

| Balance Transfer Fee | Fee for transferring a balance. |

| Foreign Transaction Fee | Charged for purchases made abroad. |

Read the terms and conditions carefully. Compare different cards to find the best deal.

Understanding Credit Scores

Credit scores are very important for financial health. They show your creditworthiness. Banks and lenders use them to decide if you get loans. A good credit score means better chances for loans. It also means lower interest rates. Let’s understand more about what affects your score and how you can improve it.

What Affects Your Score

Many factors affect your credit score. Here are the main ones:

- Payment History: Late payments lower your score.

- Credit Utilization: High usage of your credit limits is bad.

- Length of Credit History: Longer history is better.

- New Credit: Many new accounts can hurt your score.

- Credit Mix: Having different types of credit helps.

How To Improve Your Score

Improving your credit score takes time. Follow these tips to boost your score:

- Pay Bills On Time: Never miss a payment.

- Reduce Debt: Keep your credit card balances low.

- Check Your Credit Report: Look for errors and fix them.

- Limit New Credit Requests: Only apply for credit if needed.

- Keep Old Accounts Open: Longer history helps your score.

| Factor | Impact on Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Understanding these factors is key. Use this knowledge to keep your credit score high.

Using Your Card Wisely

Using a credit card wisely can help you build a good credit score. It can also save you money and avoid debt. Here are some tips to use your card wisely.

Setting A Budget

Creating a budget is crucial. It helps you manage your spending. Follow these steps:

- Calculate your monthly income.

- List your essential expenses like rent and utilities.

- Set aside money for savings.

- Determine how much you can spend on your credit card.

Stick to your budget. Avoid buying things you can’t afford.

Avoiding Interest Charges

Interest charges can add up quickly. Here are ways to avoid them:

- Pay your full balance each month.

- Set up automatic payments to avoid missed due dates.

- Use a credit card with a 0% introductory APR.

Paying your balance in full each month is the best way to avoid interest.

Additional Tips

- Check your statements regularly for errors.

- Use alerts to monitor your spending.

- Only use your card for planned purchases.

Following these tips can help you use your credit card wisely. This can lead to better financial health and a higher credit score.

Credit: www.pinterest.com

Maximizing Rewards

Credit cards offer great rewards. Beginners can gain a lot. You can earn cash back, travel points, and more. Use these tips to get the most out of your card.

Cash Back Benefits

Cash back is a popular reward. It gives you money back on purchases. Look for cards with high cash back rates. Some cards offer up to 5% on certain items.

Here is a table to show typical cash back categories:

| Category | Cash Back Rate |

|---|---|

| Groceries | 3% |

| Gas | 2% |

| Dining | 1% |

Use your card for these categories. This way, you earn more cash back. Pay off your balance each month. This avoids interest charges.

Travel Rewards

Travel rewards are great for travelers. These cards offer points for flights and hotels. Some cards give bonus points on travel-related spending.

Here are some tips to maximize travel rewards:

- Book flights with your card.

- Use your card for hotel stays.

- Look for cards with no foreign transaction fees.

Travel rewards can save you money. They make trips more affordable. Always check the terms of your card. Know the points and how to redeem them.

Managing Your Debt

Managing your credit card debt is crucial for financial health. It helps you avoid excessive interest and maintain a good credit score. Let’s explore some effective strategies for managing debt as a credit card beginner.

Paying Off Balances

Paying off your credit card balances promptly is essential. Try to pay more than the minimum amount each month. This reduces the principal amount and interest charges. Consistent payments also improve your credit score.

Consider setting up automatic payments. This ensures you never miss a due date. Here’s a simple table to track your payments:

| Month | Due Amount | Paid Amount |

|---|---|---|

| January | $500 | $600 |

| February | $400 | $500 |

| March | $300 | $350 |

Consolidating Debt

Debt consolidation combines multiple debts into one. This can simplify your payments and reduce interest rates. Consider a balance transfer credit card. It often offers zero or low-interest rates for an introductory period.

Follow these steps for successful debt consolidation:

- List all your current debts.

- Research consolidation options.

- Choose the best option based on interest rates and terms.

- Transfer your balances to the new credit card.

- Make regular payments to clear the debt.

Debt consolidation can save you money. It also makes managing your finances easier.

Credit: www.bankrate.com

Protecting Against Fraud

Understanding your credit card statements is crucial for managing your finances. Knowing how to read and interpret these statements can help you avoid unnecessary charges and keep your credit in good standing.

Reading Your Statement

Your credit card statement is a summary of your recent transactions. It includes your balance, due date, and minimum payment. Here are some important sections to pay attention to:

- Statement Date: The date the statement was generated.

- Payment Due Date: The date by which you must pay at least the minimum amount due.

- Credit Limit: The maximum amount you can charge on your card.

- Available Credit: The amount of credit you have left to use.

- New Balance: The total amount you owe as of the statement date.

- Minimum Payment: The smallest amount you need to pay to avoid late fees.

Below is a sample table of a typical credit card statement:

| Transaction Date | Description | Amount |

|---|---|---|

| 01/01/2023 | Purchase at Grocery Store | $50.00 |

| 01/05/2023 | Online Shopping | $120.00 |

| 01/10/2023 | Restaurant | $30.00 |

Disputing Charges

Sometimes, you may find charges that you do not recognize. In such cases, it is important to dispute these charges promptly. Here is how to do it:

- Review the Charge: Confirm that the charge is indeed incorrect.

- Contact the Merchant: Reach out to the merchant to resolve the issue directly.

- Notify Your Credit Card Issuer: Inform your credit card issuer about the dispute.

- Provide Documentation: Submit any necessary documents to support your claim.

- Follow Up: Keep track of the dispute status until it is resolved.

Disputing charges can protect you from paying for unauthorized transactions. Always check your statements regularly to catch any errors early.

Understanding Statements

Emergencies can arise at any time. It’s essential to be prepared. Planning for emergencies ensures you won’t face severe financial stress. Here are some useful tips for beginners.

Building An Emergency Fund

An emergency fund is crucial. It acts as a financial safety net.

Start small. Aim to save at least $500. Gradually increase this amount. Ideally, save enough to cover three to six months of expenses.

Consider these tips to build your emergency fund:

- Set up a dedicated savings account.

- Automate your savings contributions.

- Cut non-essential expenses.

Using a table, you can track your progress:

| Month | Amount Saved | Target |

|---|---|---|

| January | $100 | $500 |

| February | $200 | $500 |

| March | $300 | $500 |

Using Credit In A Crisis

Credit cards can be helpful in emergencies. They provide immediate funds when needed.

Follow these tips to use credit wisely in a crisis:

- Keep your credit card available. Only use it for true emergencies.

- Pay off your balance as soon as possible. This avoids high interest charges.

- Avoid using your credit card for non-essential purchases.

Maintain a low balance. This ensures you have enough credit available for emergencies.

Consider the following:

- Choose a card with a low interest rate.

- Look for cards with emergency assistance features.

- Ensure your card has a sufficient credit limit.

Using credit responsibly helps you manage financial crises effectively.

Credit: www.3riversfcu.org

Frequently Asked Questions

What Are 5 Tips For Effective Credit Card Use?

1. Pay your balance in full each month. 2. Monitor your spending regularly. 3. Keep your credit utilization below 30%. 4. Avoid cash advances. 5. Use rewards and cashback wisely.

What Is The 2 3 4 Rule For Credit Cards?

The 2 3 4 rule for credit cards suggests waiting 2 months between applications, limiting to 3 cards per issuer, and 4 cards total per year.

What Is The Number 1 Rule Of Using Credit Cards?

The number 1 rule of using credit cards is to always pay your balance in full each month. This helps avoid interest charges and debt accumulation. Maintain a low credit utilization ratio to boost your credit score. Monitor your statements regularly for any unauthorized transactions.

What Is The 20% Credit Card Rule?

The 20% credit card rule suggests using only 20% of your credit limit. This helps maintain a good credit score.

Conclusion

Mastering credit cards can boost your financial health. Use these tips to manage your spending and build credit. Remember, responsible usage is key to reaping benefits and avoiding debt. Start with these basics, and you’ll be on your way to becoming a savvy cardholder.