Create a budget by tracking your income and expenses. Prioritize essential needs over wants to save money effectively.

Living on a low income requires careful financial planning. Budgeting helps you manage your money and avoid unnecessary debt. Start by listing all sources of income and tracking every expense. Identify areas where you can cut costs, such as dining out or entertainment.

Use budgeting tools or apps to simplify the process and stay organized. Allocate funds for essential needs first, such as rent, utilities, and groceries. Set aside a small amount for emergencies to avoid financial stress. By following these tips, you can take control of your finances and achieve your financial goals, even on a limited income.

Assess Financial Situation

Understanding your financial situation is the first step to effective budgeting. It helps you see where your money goes and where you can save.

Track Income Sources

Begin by tracking all sources of income. This includes:

- Salary or wages from your job

- Side hustles or freelance work

- Government assistance programs

- Child support or alimony

Create a table to list these sources clearly:

| Income Source | Monthly Amount |

|---|---|

| Job Salary | $1,500 |

| Freelance Work | $300 |

| Government Assistance | $200 |

| Child Support | $400 |

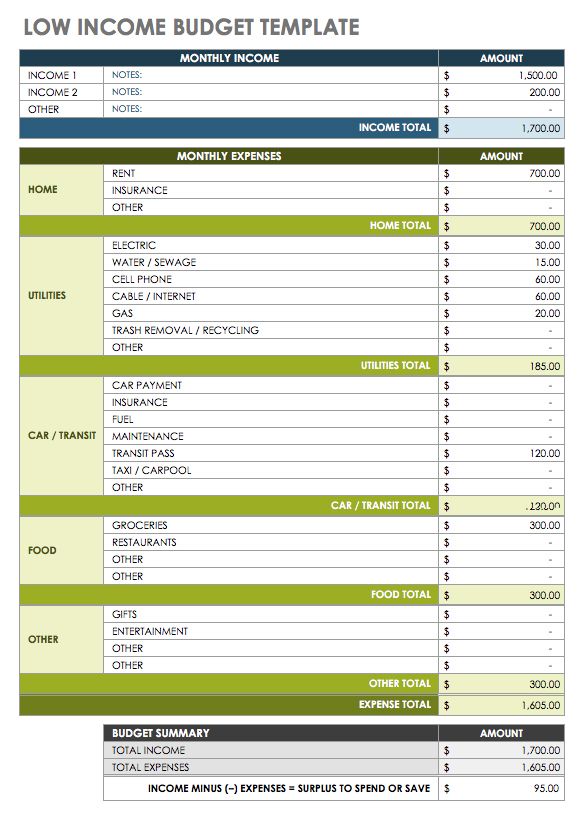

List Monthly Expenses

Next, list all your monthly expenses. Be thorough to avoid missing anything. Common categories include:

- Rent or mortgage

- Utilities like electricity, water, and gas

- Groceries and household supplies

- Transportation costs, such as gas or bus fare

- Insurance premiums

- Debt payments like credit cards or loans

- Entertainment and dining out

Here is an example table for better clarity:

| Expense | Monthly Cost |

|---|---|

| Rent | $800 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $100 |

| Insurance | $100 |

| Debt Payments | $200 |

| Entertainment | $50 |

This detailed list helps you identify areas to cut costs. Prioritize essentials like rent and groceries before non-essentials.

Credit: mydebtepiphany.com

Set Realistic Goals

Setting realistic goals is crucial for effective budgeting, especially for those with a low income. Achieving financial stability requires a clear understanding of your financial situation and what you can realistically achieve. This section will guide you through setting both short-term and long-term objectives to help you manage your finances effectively.

Short-term Objectives

Short-term objectives are goals you aim to achieve within a few weeks or months. These goals should be specific, measurable, and attainable. Here are some examples:

- Create a weekly budget to track your spending.

- Save $20 a week for an emergency fund.

- Reduce utility bills by 10% within a month.

By focusing on small, achievable goals, you can build confidence and momentum. This helps you stay on track and avoid feeling overwhelmed.

Long-term Planning

Long-term planning involves setting goals that you aim to achieve over several years. These goals require more time and discipline but are essential for financial stability. Consider the following long-term objectives:

- Pay off debt within five years.

- Save for retirement with a monthly contribution.

- Build a substantial emergency fund for future security.

It’s important to break these long-term goals into smaller, manageable steps. This makes them easier to achieve and keeps you motivated.

Here is a simple table to differentiate between short-term and long-term goals:

| Short-Term Goals | Long-Term Goals |

|---|---|

| Save $20 a week | Pay off debt in 5 years |

| Reduce utility bills by 10% | Save for retirement |

| Create a weekly budget | Build an emergency fund |

Remember, the key to successful budgeting is setting goals that are realistic and attainable. This ensures you remain motivated and on track to achieve financial stability.

Create A Budget Plan

Creating a budget plan is essential for managing finances on a low income. It helps you track your expenses and allocate funds wisely. A good budget plan allows you to see where your money goes and how you can save more. Follow these steps to create a budget plan that works for you.

Categorize Expenses

Start by listing all your expenses. Divide them into categories. Here are some common expense categories:

- Housing: Rent, mortgage, utilities.

- Transportation: Gas, public transit, car payments.

- Food: Groceries, dining out.

- Healthcare: Insurance, medications, doctor visits.

- Entertainment: Movies, hobbies, subscriptions.

- Miscellaneous: Clothing, gifts, emergencies.

Write down each expense under the appropriate category. This helps you understand where your money is going.

Allocate Funds Wisely

Once you have categorized your expenses, it’s time to allocate your funds. Use a table to outline your monthly budget:

| Category | Monthly Budget |

|---|---|

| Housing | $600 |

| Transportation | $150 |

| Food | $300 |

| Healthcare | $100 |

| Entertainment | $50 |

| Miscellaneous | $50 |

Make sure your total expenses do not exceed your income. If they do, adjust your budget. Reduce spending in non-essential categories.

Set aside a small amount for savings. Even $10 a month can add up over time.

Credit: www.smartsheet.com

Cut Unnecessary Costs

Managing a budget on a low income can be challenging. Cutting unnecessary costs can make a significant difference. It’s crucial to identify where your money is going and find ways to save.

Identify Luxuries

Start by identifying luxuries in your spending. These are items or services that aren’t essential.

- Daily coffee runs: Brew your own coffee at home.

- Streaming services: Limit to one or two subscriptions.

- Eating out: Cook meals at home instead.

Track your spending for a month. Note down all non-essential purchases. This makes it easier to see where you can cut back.

Opt For Alternatives

Once you’ve identified luxuries, explore cheaper alternatives.

| Expense | Alternative |

|---|---|

| Gym Membership | Home workouts or outdoor exercises |

| Expensive Cable TV | Streaming services with lower costs |

| Brand-name groceries | Generic or store-brand products |

Switching to these alternatives can lead to substantial savings. Always look for cheaper options without compromising quality.

By cutting unnecessary costs, you can stretch your budget further. This helps you manage your finances better and save more each month.

Boost Income

Boosting your income can make a big difference in your budget. It can be challenging, but there are ways to earn extra money without a full-time job. Here are some tips to help you get started.

Side Gigs

Side gigs are jobs you do in your spare time. They are great for earning extra cash. Here are some ideas:

- Ride-sharing: Drive for companies like Uber or Lyft.

- Delivery services: Deliver food or packages for companies like DoorDash or Amazon.

- Pet sitting: Take care of pets when their owners are away.

- Babysitting: Watch children in your neighborhood.

- House cleaning: Clean homes or offices for extra money.

Freelance Opportunities

Freelance work is another way to boost your income. You can use your skills to help others. Here are some options:

| Freelance Job | Description |

|---|---|

| Writing | Write articles, blog posts, or web content. |

| Graphic Design | Create logos, websites, or marketing materials. |

| Programming | Build websites, apps, or software. |

| Virtual Assistance | Help with administrative tasks online. |

Start by checking websites like Upwork, Fiverr, and Freelancer. These platforms connect freelancers with clients. You can create a profile and start applying for jobs.

Boosting your income with side gigs and freelance work can help you manage your budget better. Try some of these ideas and see what works best for you.

Utilize Community Resources

Struggling with a low income can be challenging. Utilizing community resources is a smart way to stretch your budget. These resources can provide essential help without costing you money. Below, we’ll explore two key areas: Food Banks and Government Assistance.

Food Banks

Food banks are a great way to save money on groceries. Many communities have local food banks that provide free food to those in need. This can significantly lower your grocery bills and ensure your family has enough to eat.

- Find a local food bank near you.

- Check their hours of operation.

- Bring identification or proof of residency if required.

Food banks often offer fresh produce, canned goods, and even household items. Make it a habit to visit regularly to keep your pantry stocked.

Government Assistance

Government assistance programs can help you manage various expenses. These programs are designed to support low-income families and individuals.

| Program | Type of Assistance |

|---|---|

| SNAP (Supplemental Nutrition Assistance Program) | Helps with food costs |

| LIHEAP (Low Income Home Energy Assistance Program) | Assists with heating and cooling bills |

| WIC (Women, Infants, and Children) | Provides food and nutrition education |

Applying for these programs is usually straightforward. Visit the official websites or local government offices to get started. Remember to gather necessary documents like pay stubs and proof of residency before applying.

Save On Essentials

Saving on essentials can help stretch your budget. Focus on reducing costs for necessary items like groceries and energy. Here are some practical tips to help you save money on these essentials.

Grocery Shopping Tips

- Make a list: Plan your meals for the week. Write down what you need.

- Use coupons: Look for coupons online and in newspapers. Use them to save money.

- Buy in bulk: Purchase items you use often in larger quantities. This can save you money.

- Compare prices: Check different stores for the best prices. Sometimes, one store is cheaper than another.

- Avoid processed foods: Processed foods can be more expensive. Stick to whole foods like fruits, vegetables, and grains.

- Shop sales: Look for sales on items you need. Stock up if the price is good.

Energy Saving Methods

- Turn off lights: Always turn off lights when you leave a room. This simple habit can save a lot on your electric bill.

- Use energy-efficient bulbs: Replace old bulbs with LED bulbs. They use less energy and last longer.

- Unplug devices: Unplug electronics when not in use. Many devices use power even when turned off.

- Wash clothes in cold water: Cold water cleans clothes just as well. It also uses less energy.

- Seal windows and doors: Use weather stripping or caulk to seal gaps. This keeps heat in during winter and cool air in during summer.

- Use a programmable thermostat: Set it to lower the heat or air conditioning when you are not home. This can save on heating and cooling costs.

Credit: www.cashfloat.co.uk

Plan For Emergencies

Emergencies can happen anytime. It’s important to have a plan. This helps you stay prepared. Planning helps you avoid stress when something unexpected happens. Below are some tips to plan for emergencies on a low income.

Emergency Fund

Start by building an emergency fund. Save a small amount every month. Even $10 can make a difference. Use a separate savings account for this fund. This helps you avoid spending it.

Consider setting a goal for your emergency fund. Aim for at least $500. This can cover small emergencies like car repairs. If possible, increase your goal to $1,000 or more.

Here are some ways to save for your emergency fund:

- Save your spare change in a jar.

- Cut down on unnecessary expenses.

- Sell unused items online.

Low-cost Insurance

Having low-cost insurance can save you money in emergencies. Look for affordable health insurance plans. Check if you qualify for government programs. These can provide coverage at a lower cost.

Consider other types of insurance too:

- Renter’s insurance: Protects your belongings if you rent.

- Auto insurance: Required if you own a car.

- Life insurance: Helps your family if something happens to you.

Compare different insurance plans. Look for the best value. Make sure you understand what each plan covers.

Planning for emergencies is crucial. It helps you manage unexpected events better. Start small and stay consistent. Your future self will thank you!

Frequently Asked Questions

How To Create A Budget With Low Income?

Start by tracking your expenses and income. Prioritize essential needs like rent, food, and utilities. Cut unnecessary costs. Use budgeting apps for assistance. Save a small amount each month.

What Is The 50/30/20 Rule?

The 50/30/20 rule is a budgeting guideline. Allocate 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This method helps manage personal finances effectively.

What Is The 70% Rule For Budgeting?

The 70% rule for budgeting suggests using 70% of your income for expenses. Save 20% and invest 10% for future needs. This method helps manage finances effectively, ensuring savings and investments.

How To Budget When You Don’t Make Enough Money?

Create a strict budget by prioritizing needs over wants. Track expenses, cut unnecessary costs, and seek additional income sources.

Conclusion

Managing finances on a low income can be challenging but achievable. With careful planning and smart choices, you can save and thrive. Implement these budgeting tips to improve your financial stability. Remember, every small step counts towards a better financial future.

Stay committed, and watch your savings grow.