Budgeting for college students is about managing expenses and saving money. It’s crucial for financial independence and avoiding debt.

Entering college marks a significant transition into adulthood, where financial independence becomes increasingly vital. For many students, it’s their first encounter with managing expenses, saving, and making critical decisions about money. Crafting a budget is not just about tracking every penny spent; it’s a strategic approach to ensure students can cover their educational costs, personal expenses, and still save for the future.

Effective budgeting helps students avoid the trap of debt, which can be a common pitfall due to tuition fees, textbooks, and living expenses. With the right budgeting strategies, college students can navigate their financial responsibilities more confidently, ensuring a smoother academic journey and a solid foundation for their financial future.

The Importance Of Budgeting In College

Understanding budgeting is key for college students. It helps manage money and prepare for the future. Let’s explore why budgeting is so important.

Financial Challenges For Students

College students face many money problems. These include tuition, books, and living costs. A budget helps track spending and save money. Here are ways students can face financial challenges:

- Track all expenses to see where money goes.

- Create a monthly budget to plan spending.

- Identify ways to cut unnecessary costs, like eating out less.

- Look for student discounts and deals.

Long-term Benefits Of Financial Literacy

Learning to manage money has lasting effects. Here are the benefits:

- Builds a habit of saving early in life.

- Improves credit scores by managing debts wisely.

- Prepares for unexpected expenses without stress.

- Encourages smart investment and spending choices.

Financial literacy leads to a secure future. Start budgeting today!

Credit: www.debt.org

Setting Up Your First Budget

Embarking on college life brings new financial challenges. Students must manage funds wisely. A budget acts as a financial compass. It guides spending and saving decisions. To start, students need to understand their income and expenses. Then, they can choose a budgeting method that fits their lifestyle.

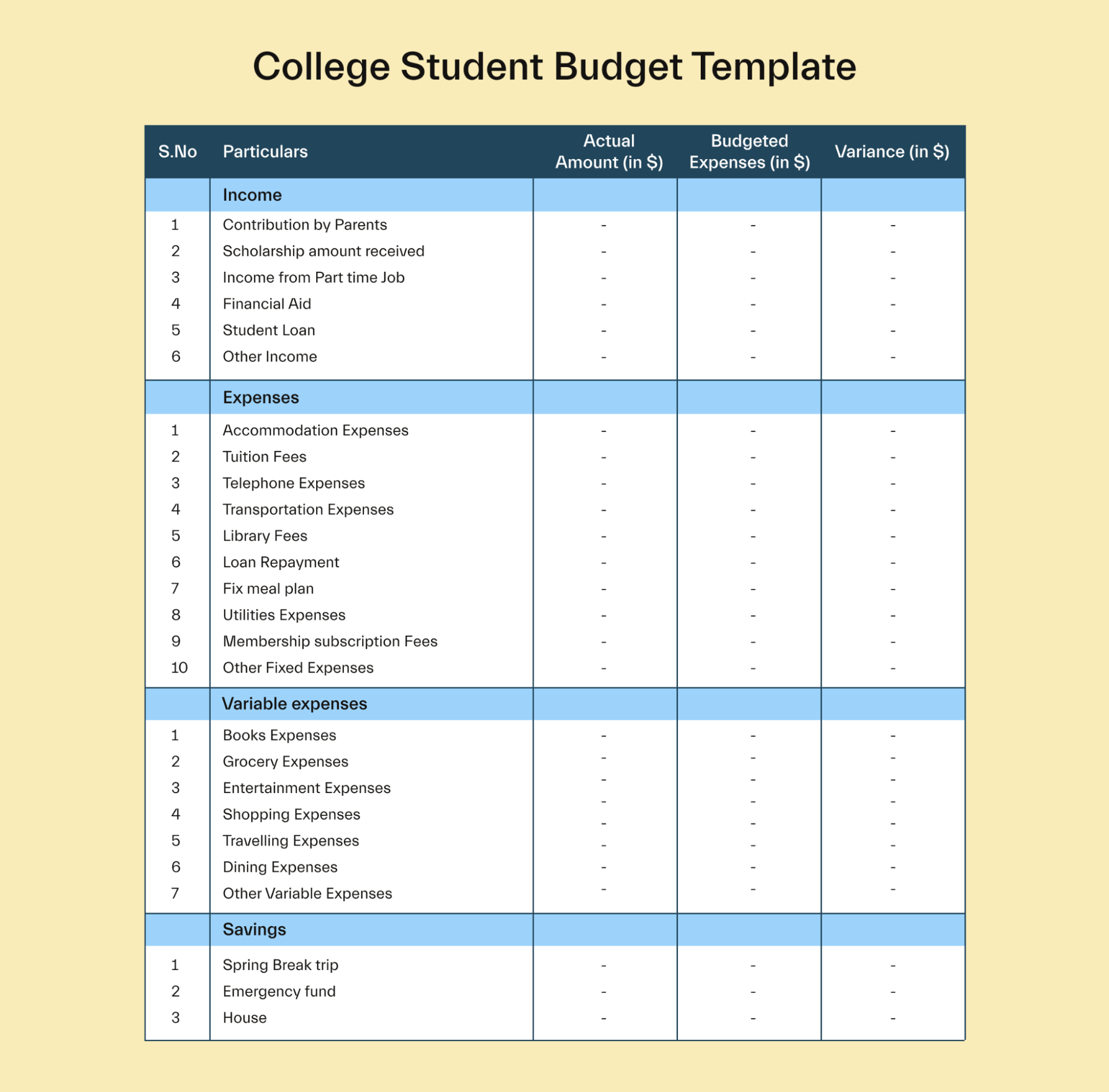

Assessing Income And Expenses

To create a budget, first list all income sources. These can include jobs, allowances, or scholarships. Next, track all expenses. This includes tuition, books, rent, and food. Don’t forget about leisure activities. Use a table to organize these details.

| Income Sources | Monthly Amount |

|---|---|

| Part-time Job | $500 |

| Scholarships | $300 |

| Expenses | Monthly Amount |

| Tuition | $1000 |

| Rent | $700 |

Choosing The Right Budgeting Method

There are many budgeting methods. The 50/30/20 rule is popular. It allocates funds to needs, wants, and savings. Envelope budgeting is great for cash users. It involves dividing cash into envelopes for different expenses. Digital tools offer automated tracking and reminders. Pick one that aligns with your financial habits.

- 50/30/20 Rule: Divide money into needs, wants, and savings.

- Envelope System: Assign cash to envelopes for specific expenses.

- Digital Tools: Use apps for tracking and managing money.

Students should review their budget regularly. Adjust as needed to stay on track. Setting up a budget is the first step towards financial independence. It helps avoid debt and builds a solid foundation for the future.

Money-saving Tips For Everyday Expenses

Going to college means managing expenses smartly. Let’s dive into money-saving tips for daily costs.

Cutting Down On Food Costs

Eating out drains wallets. Cooking at home saves money. Bulk-buying ingredients reduces costs. Here are simple steps:

- Plan meals weekly to avoid impulse buys.

- Use student discounts at grocery stores.

- Split bulk items with roommates.

- Master quick, affordable recipes.

Reducing Transportation Expenses

Getting around can be pricey. There are ways to save on transit:

| Mode of Transport | Tips to Save Money |

|---|---|

| Biking | Avoid parking fees, get exercise. |

| Public Transit | Use student passes for discounts. |

| Carpooling | Share costs with friends. |

Walk short distances. It’s free and healthy.

Smart Shopping Habits For Students

College life means smart budgeting. It’s key to save money. Students can shop smart and still enjoy college. Let’s explore how.

Finding Deals On Textbooks

Textbooks can be pricey. But, smart strategies can cut costs:

- Buy used textbooks online. Sites like Amazon offer them.

- Rent textbooks for a semester. Chegg is a good option.

- Share with classmates. Split the cost for savings.

- Check for e-books. They are often cheaper.

- Sell books back. Use that money for next term’s books.

Budget-friendly Clothing Options

Looking good doesn’t mean spending a lot. Here are tips for fashion on a budget:

- Thrift shops have unique finds. Prices are low, too.

- Clearance racks offer deals. End-of-season sales are best.

- Swap clothes with friends. Get a new look for free.

- DIY customizations can refresh old outfits. Be creative!

Utilizing Student Discounts And Benefits

College life comes with its share of expenses. Smart budgeting helps. A great way to save is by tapping into student discounts and benefits. Many companies offer special deals for students. These can cut costs on various products and services.

Tech And Software Deals

Students need the latest tech for their studies. Major brands offer discounts on laptops, tablets, and software. Look for these deals:

- Laptop discounts: Brands like Apple and Dell give price cuts to students.

- Software savings: Get Microsoft Office or Adobe Creative Cloud for less.

- Free antivirus: Keep your devices safe without spending extra.

Always use your student email to sign up for these tech deals.

Entertainment And Travel Perks

Besides studies, college life is about experiences. Students enjoy perks in entertainment and travel. Check these out:

| Category | Discounts |

|---|---|

| Movies | Reduced ticket prices at cinemas. |

| Music streaming | Spotify and Apple Music offer half-price plans. |

| Travel | Discounts on trains, buses, and flights. |

Show your student ID to unlock these perks. Plan trips and outings with friends. Enjoy your time without breaking the bank.

Managing Credit And Avoiding Debt

Managing credit and avoiding debt are key for college students. These skills help you enjoy your college life without money stress. Let’s dive into how you can handle credit cards and student loans wisely.

Understanding Credit Cards

Credit cards can be useful but also risky. They let you buy things now and pay later. Yet, it’s easy to spend more than you can afford. This leads to debt. To avoid this, follow these tips:

- Choose wisely: Pick a credit card with no annual fee and low interest.

- Pay on time: Always pay your bill on time to avoid extra fees.

- Limit use: Use your credit card for needs, not wants.

- Track spending: Keep an eye on how much you spend to avoid surprises.

Strategies To Minimize Student Loans

Student loans can help pay for college. But, they can also lead to big debt. Use these strategies to keep loans small:

- Apply for scholarships: They are free money for college.

- Choose an affordable school: Sometimes, less expensive schools are just as good.

- Work part-time: Earning money can help you borrow less.

- Consider community college: It’s often cheaper and you can transfer later.

Remember, the goal is to finish college with as little debt as possible. Plan carefully and make smart choices.

Saving Strategies While In College

College life brings new challenges. Smart saving strategies are key. Students can manage money better. Let’s explore some effective ways to save.

Opening A Savings Account

Students need a good savings account. Look for banks with no fees. Higher interest rates help savings grow. Online banks often offer great deals.

Benefits of a savings account:

- Earn interest on your money.

- Keep spending separate from savings.

- Track goals with online tools.

Automating Your Savings

Make saving effortless. Set up automatic transfers. A small amount each week adds up. This ensures consistent saving without stress.

Steps to automate:

- Choose a set amount to save.

- Set up a regular transfer from checking to savings.

- Watch your savings grow over time.

Credit: www.mos.com

Earning Extra Cash As A Student

College life calls for smart money management. Students find creative ways to boost their budgets. Let’s explore some practical options for earning extra cash.

Part-time Jobs And Gigs

Part-time jobs offer steady income for students. Local cafes, bookstores, and campus offices often hire students. Balancing work and study schedules is key. Work hours usually flex around class times. This setup helps students earn while they learn.

Gigs can mean short-term tasks or freelance work. Babysitting, dog walking, and tutoring are popular choices. Gigs fit into irregular schedules well. They can be a quick way to make money.

- Barista: Craft coffee and earn tips.

- Library assistant: Work in a quiet environment.

- Tutor: Share your knowledge.

Making Money Online

Online opportunities abound for tech-savvy students. Selling items on e-commerce platforms can turn a profit. Students create handmade goods or sell used textbooks online.

Freelancing is another route. Skills like writing, graphic design, or coding are in demand. Websites like Upwork or Fiverr connect freelancers with clients.

Here are ways to earn online:

| Activity | Potential Earnings |

|---|---|

| Online surveys | $1-$5 per survey |

| Virtual assistant | $10-$20 per hour |

| Content creation | Varies by project |

Remember, balance is essential. School comes first. Choose options that fit your academic goals.

Planning For Post-college Financial Success

College students often focus on immediate expenses. Yet, planning for life after graduation is key. A solid post-college financial plan sets you up for success. It involves saving for emergencies and investing in your future.

Building An Emergency Fund

Life is full of surprises. An emergency fund is your financial safety net. Start small if you must. Aim to save at least $500 at first. Then, grow it to cover three to six months of expenses.

Key steps include:

- Assess your monthly spending.

- Set a target for your emergency fund.

- Save regularly, even if it’s a small amount.

Investing In Your Future

Investing is not just for the wealthy. Start investing early, even with a small amount. Compound interest works magic over time. Think of it as planting a seed for your financial tree.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | Variable |

| Bonds | Low | Steady |

| Mutual Funds | Medium | Varies |

Options to consider:

- Retirement accounts like a Roth IRA.

- Index funds for diversified portfolios.

- Automated investing services for convenience.

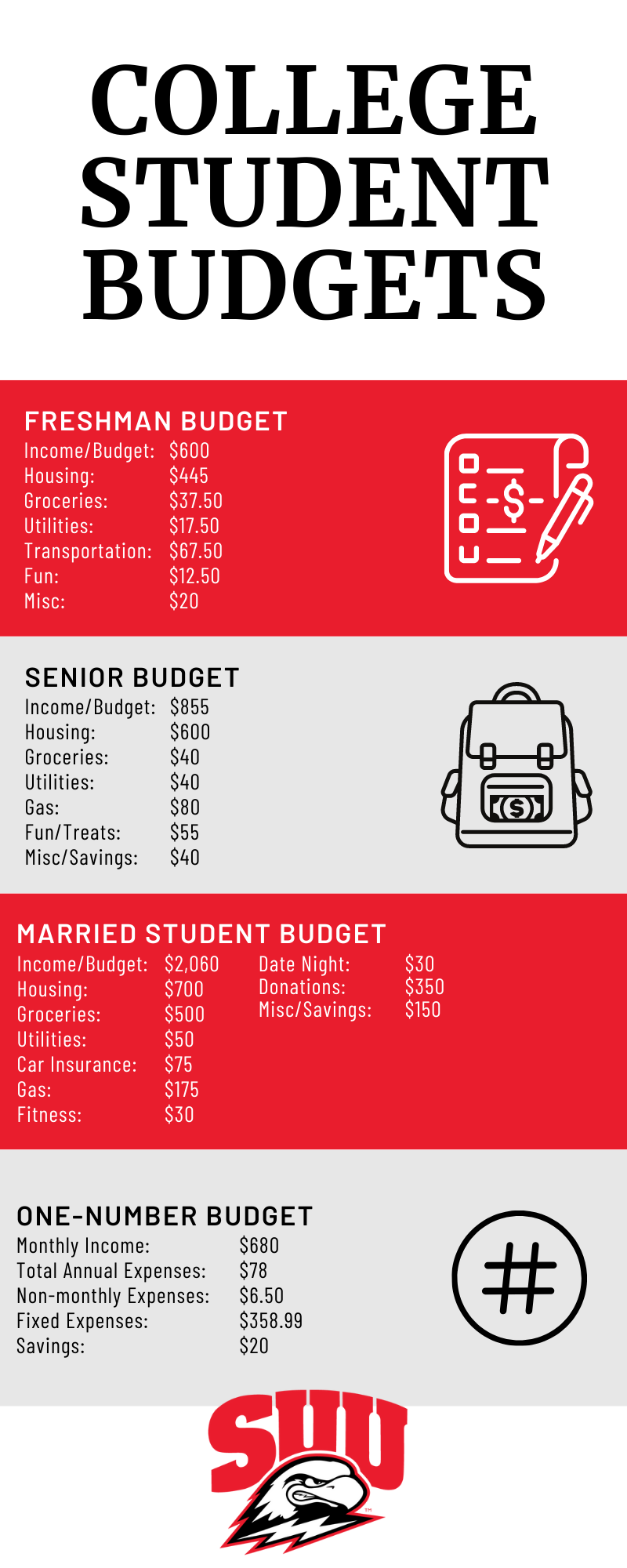

Credit: www.suu.edu

Frequently Asked Questions

What Is A Reasonable Budget For A College Student?

A reasonable budget for a college student typically ranges from $1000 to $1500 per month, covering essentials like food, housing, and books. Adjust based on location and personal needs.

What Is The 50 30 20 Rule For College Students?

The 50 30 20 rule for college students suggests budgeting 50% of income on needs, 30% on wants, and 20% on savings or debt repayment. This strategy helps manage finances effectively while in school.

How Much Spending Money Should A College Student Have?

A college student should budget $100-$200 per month for spending money. This range covers essentials and modest leisure activities. It’s crucial to track expenses and adjust as necessary.

What Is A Good Monthly Allowance For A College Student?

A suitable monthly allowance for a college student typically ranges between $300 and $1000, depending on location and personal needs.

Conclusion

Mastering the art of budgeting is a valuable skill for college students. By embracing smart financial habits now, you pave the way for a future of financial stability. Remember, every penny saved is a step toward your goals. Start your journey to financial savvy today and watch your savings grow.