Best budgeting tools include Mint and YNAB (You Need a Budget). These tools help manage finances efficiently and track expenses.

Budgeting tools are essential for effective financial management. They help individuals track their income and expenses, ensuring they stay within their budget. Mint offers a comprehensive view of your financial situation by linking to your bank accounts and credit cards.

YNAB focuses on proactive budgeting, encouraging users to allocate every dollar to a specific category. Both tools provide insights and reports to help users make informed financial decisions. Using these tools can lead to better savings, reduced debt, and improved financial health. Whether you are new to budgeting or an experienced planner, these tools can simplify the process and help achieve financial goals.

Introduction To Budgeting Tools

Managing money can be challenging. Budgeting tools simplify this task. These tools help track spending and saving. They provide a clear picture of finances.

Using the right budgeting tools can transform financial habits. They bring structure and discipline to money management. Discover the best options available.

Why Use Budgeting Tools

Budgeting tools are essential for financial health. They help in tracking expenses and savings. You can see where your money goes.

These tools offer insights into spending patterns. They highlight areas where you can save. This helps in making informed financial decisions.

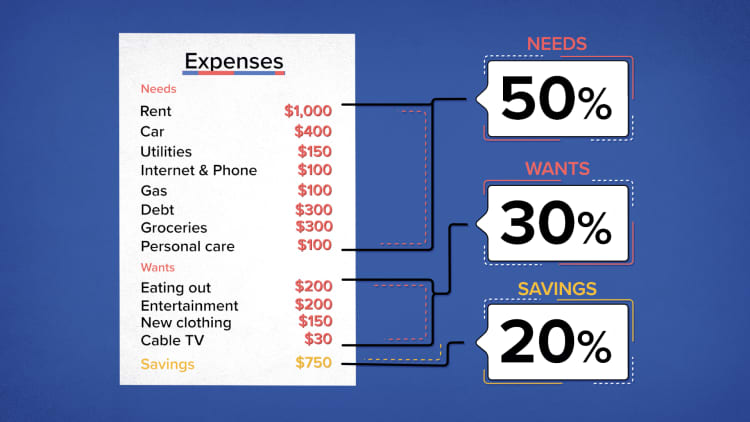

Benefits Of Budgeting

- Better Financial Control: Know exactly how much you spend.

- Improved Savings: Identify and cut unnecessary expenses.

- Debt Management: Plan to pay off debts efficiently.

- Goal Setting: Save for future goals with clear targets.

- Reduced Stress: Feel confident about financial stability.

Budgeting tools make managing money easier. They offer features like expense tracking, saving goals, and debt management.

| Tool Name | Main Feature | Cost |

|---|---|---|

| Mint | Expense Tracking | Free |

| YNAB (You Need A Budget) | Budget Planning | Paid |

| PocketGuard | Spending Limits | Free |

Choose the right tool for your needs. Whether free or paid, these tools can simplify budgeting.

Top Free Budgeting Apps

Managing your money can be easy with the right tools. Free budgeting apps help track expenses and save money. Here are some of the best options available.

Mint

Mint is a powerful app for budgeting. It offers a range of features to help you manage your finances.

- Automatic Expense Tracking: Mint connects to your bank and credit cards.

- Bill Reminders: Avoid late fees with timely alerts.

- Custom Budgets: Set limits for different spending categories.

Mint is easy to use and helps you see your spending habits. The app also provides tips on how to save money.

Ynab (you Need A Budget)

YNAB stands for You Need A Budget. This app teaches you how to budget effectively.

- Four Rules: YNAB uses four simple rules to help you budget.

- Goal Tracking: Set and track your financial goals.

- Reports: Detailed reports show your progress.

YNAB encourages mindful spending. It also offers educational resources to improve your financial skills.

Affordable Paid Budgeting Tools

Managing your finances doesn’t have to break the bank. Affordable paid budgeting tools offer powerful features without high costs. These tools help you track expenses, set budgets, and save money.

Everydollar

EveryDollar is a user-friendly budgeting tool created by Dave Ramsey. This tool follows the zero-based budgeting method.

- Easy to use interface

- Connects to your bank account

- Tracks expenses in real-time

With EveryDollar, you can create custom budget categories. It helps you allocate every dollar to a specific purpose. This ensures that no money is wasted.

EveryDollar offers a free version but the paid version provides more features. The EveryDollar Plus costs around $129.99 per year. It includes bank syncing and more detailed tracking.

Goodbudget

Goodbudget uses the envelope budgeting method. This tool is great for couples and families.

- Share budgets across devices

- Track spending together

- Plan and save for big expenses

Goodbudget offers a free version with limited features. The paid version, Goodbudget Plus, costs $7 per month or $60 per year. It includes unlimited envelopes and accounts.

The app is available on both iOS and Android. It also has a web version for easy access.

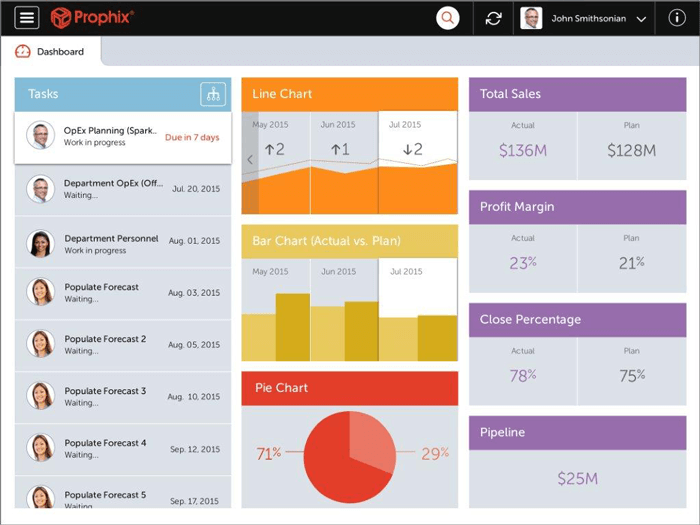

Features To Look For

Finding the best budgeting tools can be tricky. There are many options out there, each claiming to be the best. Knowing what features to look for can make a big difference. Here are some important features to consider:

Expense Tracking

Expense tracking is a key feature in any budgeting tool. It helps you keep track of where your money goes. A good tool will allow you to:

- Record daily expenses

- Organize expenses by categories

- Generate detailed reports

Some tools even offer automatic tracking by linking to your bank accounts. This saves you time and ensures accuracy.

Goal Setting

Another vital feature is goal setting. Budgeting tools should help you set and reach financial goals. Look for tools that allow you to:

- Set short-term and long-term goals

- Track progress towards these goals

- Adjust goals as needed

Having clear goals can motivate you to save more money. It also helps you stay focused on what’s important.

In summary, finding the right budgeting tool involves looking for essential features like expense tracking and goal setting. These features can help you manage your finances better and reach your financial goals faster.

Customizable Budget Templates

Budgeting can be a challenge, but customizable budget templates make it easier. They help you track spending and save money. Below are two popular tools for creating these templates: Excel Sheets and Google Sheets.

Excel Sheets

Excel Sheets offer powerful features for customizable budget templates. You can use built-in functions and formulas to manage finances.

Here are some benefits:

- Pre-made templates: Excel offers various pre-made budget templates.

- Custom formulas: Tailor calculations to meet your needs.

- Charts and graphs: Visualize your spending habits easily.

| Feature | Description |

|---|---|

| Pre-made Templates | Choose from various budget templates |

| Custom Formulas | Create your own calculations |

| Charts and Graphs | Visualize spending and savings |

Google Sheets

Google Sheets is another great tool for customizable budget templates. It offers easy collaboration and cloud storage.

Key features include:

- Real-time collaboration: Work with others simultaneously.

- Access anywhere: Use Google Sheets on any device.

- Add-ons: Enhance functionality with various add-ons.

Google Sheets also provides:

- Templates: Pre-made budget templates for quick setup.

- Formulas: Custom formulas to fit your financial goals.

- Data visualization: Create charts and graphs to see patterns.

| Feature | Description |

|---|---|

| Real-time Collaboration | Work with others in real-time |

| Access Anywhere | Use on any device |

| Add-ons | Enhance functionality |

With these tools, managing your budget becomes less stressful. Both Excel and Google Sheets offer unique features to fit your needs.

Credit: www.cnbc.com

Integrating Budget Tools With Banks

Integrating budgeting tools with banks can make managing finances easier. These tools help track spending and save money. By connecting directly to your bank, they can offer real-time updates. This means you can see where your money goes without extra work.

Automatic Bank Sync

Many budgeting tools offer automatic bank sync. This feature connects your bank account to the tool. It downloads your transactions automatically. This saves time and ensures accuracy.

- Easy to set up

- Reduces manual entry errors

- Provides real-time updates

Some popular tools with this feature include:

| Tool | Bank Sync |

|---|---|

| Mint | Yes |

| YNAB | Yes |

| Personal Capital | Yes |

Automatic sync is great for those who want ease and efficiency. It ensures your budget is always up to date. No more guessing where your money went.

Manual Entry Options

Some users prefer manual entry options. This method requires you to input transactions yourself. It can be more hands-on but offers certain advantages.

- Greater control over data

- Ideal for cash transactions

- Customizable categorization

Tools that offer manual entry include:

| Tool | Manual Entry |

|---|---|

| EveryDollar | Yes |

| Goodbudget | Yes |

| YNAB | Yes |

Manual entry is perfect for those who like detailed control. It’s also useful for tracking expenses that don’t show up in bank statements.

Security And Privacy

Security and privacy are crucial factors in choosing the best budgeting tools. Users want to ensure their financial data remains safe. This section explores key aspects, including Data Encryption and User Privacy Policies.

Data Encryption

Data encryption is essential for protecting sensitive information. Top budgeting tools use strong encryption methods. This ensures that your data stays secure from unauthorized access.

- AES-256 encryption is a common standard.

- Bank-level security protocols are often employed.

- Data is encrypted both in transit and at rest.

User Privacy Policies

User privacy policies outline how your data is used and protected. It’s vital to read these policies carefully.

| Tool | Privacy Policy Highlights |

|---|---|

| Tool A | Does not sell your data to third parties. |

| Tool B | Provides detailed data usage reports. |

| Tool C | Offers easy opt-out options for data sharing. |

Ensure the tool you choose respects your privacy. Look for clear, transparent policies. This guarantees your data remains private and secure.

Credit: thesavvymama.com

Tips For Effective Budgeting

Managing your money can be tough. Using the right budgeting tools can help. Here are some tips for effective budgeting to get you started.

Regular Reviews

Review your budget every week. This helps you stay on track. Look at your spending and see where your money goes. Use a spreadsheet or a budgeting app. Write down all your expenses.

- Track spending

- Check income

- Compare with budget

If you see any problems, fix them quickly. This keeps your budget healthy.

Adjusting Budgets

Sometimes things change. You might need to adjust your budget. Maybe you got a raise, or your bills went up. Make changes to your budget to reflect this.

Here’s how to adjust your budget:

- Identify new expenses or income

- Update your budget in your tool

- Test the new budget for a month

Adjusting your budget helps you stay in control. It makes sure you always have enough money.

| Old Budget | New Budget |

|---|---|

| $200 for groceries | $250 for groceries |

| $100 for entertainment | $80 for entertainment |

Make adjustments as needed. This keeps your budget accurate.

Credit: www.scoro.com

Frequently Asked Questions

What Is A Good Tool To Use When Budgeting?

A good tool for budgeting is Mint. It tracks expenses, sets goals, and provides financial insights. Mint is user-friendly and free.

What Is The #1 Budgeting App?

The #1 budgeting app is You Need a Budget (YNAB). It helps users manage finances, track expenses, and save money effectively.

Is Mint A Good Budget App?

Yes, Mint is a good budget app. It helps track expenses, create budgets, and monitor financial goals. Users find it user-friendly and comprehensive.

Is Rocket Money Better Than Mint?

Rocket Money and Mint offer different features. Rocket Money excels in bill negotiation, while Mint provides comprehensive budgeting tools. Choose based on your needs.

Conclusion

Choosing the best budgeting tools can simplify your financial management. With these tools, track expenses effortlessly and save more. Make informed decisions and achieve your financial goals. Explore the various options and find the perfect fit for your needs. Happy budgeting and take control of your finances today!