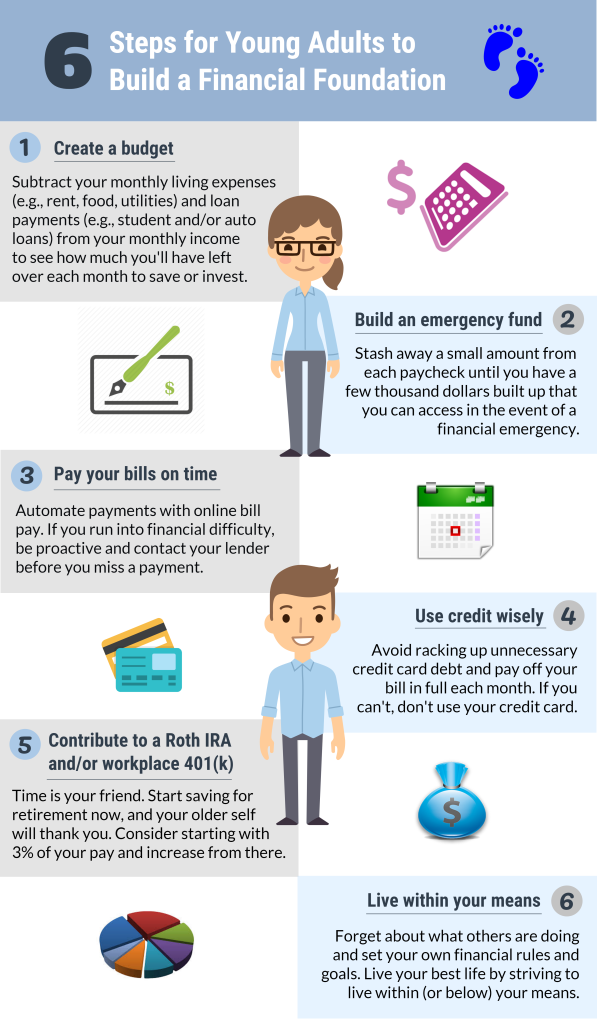

Financial planning for young adults involves budgeting, saving, and investing early. It sets the foundation for future financial stability.

Starting financial planning early is crucial for young adults. Building a budget helps track income and expenses, ensuring money is spent wisely. Setting financial goals, such as saving for a car or a house, provides direction and motivation. Investing in retirement accounts like a 401(k) or IRA can yield long-term benefits.

Emergency funds offer a safety net for unexpected expenses. Understanding and managing debt, including student loans, is essential. Financial literacy empowers young adults to make informed decisions, paving the way for a secure financial future. Establishing good financial habits early can lead to lifelong financial health.

Setting Financial Goals

Financial planning is crucial for young adults. Setting clear financial goals helps create a roadmap for financial success. These goals fall into two main categories: short-term and long-term. Understanding the difference between them is key to effective financial planning.

Short-term Goals

Short-term goals are objectives you aim to achieve within one year. These goals help build a foundation for your financial future. Examples include:

- Saving $1,000 for an emergency fund.

- Paying off credit card debt.

- Saving for a vacation.

Setting these goals requires discipline and focus. Start by creating a budget. Track your income and expenses. This helps identify areas to cut back and save more. Use budgeting apps or spreadsheets to stay organized. Celebrate small milestones to stay motivated.

Long-term Goals

Long-term goals require planning for the future, usually beyond five years. These goals often involve significant life events. Examples include:

- Buying a home.

- Saving for retirement.

- Paying for children’s education.

Investing is crucial for achieving long-term goals. Consider opening a retirement account like a 401(k) or IRA. Diversify your investments to spread risk. Regularly review your progress and adjust your strategy as needed.

Here is a simple comparison of short-term and long-term goals:

| Short-Term Goals | Long-Term Goals |

|---|---|

| Savings for emergencies | Retirement savings |

| Paying off small debts | Buying a house |

| Budgeting for vacations | Children’s education fund |

Setting financial goals is a step-by-step process. Start with short-term goals to build momentum. Move on to long-term goals to secure your future. Consistency and planning are key.

Creating A Budget

Creating a budget is the first step to financial independence. It helps you manage your money wisely. By tracking expenses and allocating income, you can achieve your financial goals. Here’s how to get started with creating a budget.

Tracking Expenses

Start by keeping track of all your expenses. Use a notebook or a budgeting app. List every purchase, no matter how small. This gives you a clear picture of where your money goes.

Divide your expenses into categories. Examples include:

- Housing

- Food

- Transportation

- Entertainment

Review your list at the end of the month. Identify areas where you can cut back. Small changes can lead to big savings.

Allocating Income

Next, allocate your income to different categories. Use the 50/30/20 rule. Allocate 50% for needs, 30% for wants, and 20% for savings.

Here’s a simple example:

| Category | Percentage | Amount (if income is $1,000) |

|---|---|---|

| Needs | 50% | $500 |

| Wants | 30% | $300 |

| Savings | 20% | $200 |

Adjust these percentages based on your personal needs. Ensure you save a portion of your income.

Creating a budget doesn’t have to be hard. Start simple and adjust as needed. The key is to stay consistent.

Building An Emergency Fund

Building an emergency fund is essential for young adults. Unexpected expenses can disrupt financial stability. A well-prepared emergency fund acts as a safety net.

Importance Of Savings

Savings are crucial for financial security. They help cover unexpected costs. These costs might be medical bills or car repairs.

Without savings, young adults may rely on credit cards. This can lead to debt. Debt can be hard to manage and stressful.

Having an emergency fund reduces stress. It ensures that money is available when needed. Savings provide peace of mind.

How Much To Save

The amount to save depends on individual needs. A common goal is three to six months of living expenses. This amount covers essential costs.

Start by saving a small amount each month. Gradually increase the savings amount. Consistent saving builds a significant fund over time.

| Monthly Income | Suggested Emergency Fund |

|---|---|

| $2,000 | $6,000 – $12,000 |

| $3,000 | $9,000 – $18,000 |

| $4,000 | $12,000 – $24,000 |

Track your expenses to understand your needs. Create a budget to manage your savings. Stick to the budget to achieve your goal.

- Set a savings goal.

- Track your expenses.

- Create a budget.

- Save consistently.

Building an emergency fund takes time. Stay committed to your savings plan. Your future self will thank you.

Credit: www.condorcapital.com

Managing Debt

Managing debt is a crucial part of financial planning for young adults. Understanding different types of debt and strategies to reduce them helps maintain financial health. This section will guide you through the essentials of managing debt efficiently.

Types Of Debt

Debt comes in various forms. Understanding each type is important. Here are the common types of debt:

- Credit Card Debt: High-interest debt due to credit card usage.

- Student Loans: Loans taken to pay for education.

- Auto Loans: Loans taken to purchase a vehicle.

- Personal Loans: Unsecured loans for various personal expenses.

- Mortgage: Loans taken to buy a home.

Strategies To Reduce Debt

Reducing debt requires a strategic approach. Here are some effective strategies:

- Create a Budget: Track income and expenses to manage money better.

- Pay More than Minimum: Paying more than the minimum reduces debt faster.

- Snowball Method: Pay off small debts first, then tackle larger ones.

- Debt Avalanche: Focus on high-interest debts first, then lower-interest ones.

- Consolidate Debt: Combine multiple debts into one with lower interest.

| Strategy | Benefit |

|---|---|

| Create a Budget | Helps track spending and save money. |

| Pay More than Minimum | Reduces debt faster and saves on interest. |

| Snowball Method | Gives a sense of accomplishment quickly. |

| Debt Avalanche | Saves money on interest in the long run. |

| Consolidate Debt | Simplifies payments and may lower interest rates. |

Investing Early

Investing early can set the foundation for a secure financial future. Young adults have a unique advantage: time. Time allows investments to grow and compound, leading to substantial returns. Starting early means you can take smaller steps, yet achieve significant results over time. Let’s explore some key aspects of early investing.

Investment Options

Young adults have various investment options to consider. Each option carries different levels of risk and potential returns. Here are some popular choices:

- Stocks: Owning shares in companies can yield high returns over time.

- Bonds: These are lower-risk investments that provide steady interest payments.

- Mutual Funds: Pooled investments in stocks, bonds, or other assets, managed by professionals.

- Real Estate: Investing in property can offer rental income and value appreciation.

- Index Funds: These track market indices and offer diversified exposure with lower fees.

Benefits Of Compound Interest

One of the greatest benefits of investing early is compound interest. Compound interest means earning interest on your initial investment and on the interest that accumulates over time. Here’s an example to illustrate its power:

| Year | Initial Investment | Interest Earned (5%) | Total Value |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

| 2 | $1,050 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

Starting early allows your investments to grow exponentially. Even small amounts can grow significantly over time. This is why investing early is so crucial for young adults.

Understanding Credit Scores

Understanding your credit score is vital for financial health. Your credit score affects your ability to borrow money. It also influences the interest rates you receive. A good credit score can save you money over time. Let’s explore what affects your credit score and how to improve it.

Factors Affecting Credit Score

| Factor | Impact |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit History Length | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Payment History is the most important factor. Credit Utilization is the second most important. Keep balances low to improve this factor. Credit History Length looks at how long you’ve had credit. New Credit affects your score if you apply for many new accounts. Credit Mix considers the variety of credit types you have.

Improving Your Score

Improving your credit score takes time. Here are some simple steps:

- Pay bills on time: Always pay at least the minimum amount due.

- Keep balances low: Try to use less than 30% of your credit limit.

- Avoid opening new accounts: Too many new accounts can lower your score.

- Check your credit report: Look for errors and dispute them.

- Keep old accounts open: Long credit history helps your score.

By following these steps, you can gradually boost your credit score. This will open up more financial opportunities for you.

Planning For Retirement

Planning for retirement is a crucial step for young adults. Early planning ensures a comfortable and financially secure future. Let’s explore some key areas to focus on when planning for retirement.

Retirement Accounts

Retirement accounts are essential for building a nest egg. There are several types of accounts that young adults can consider:

- 401(k): Offered by employers with potential matching contributions.

- IRA: Individual Retirement Account with tax advantages.

- Roth IRA: Contributions are taxed now, but withdrawals are tax-free.

Choosing the right account depends on your employment status and tax situation. It’s wise to diversify your investments across different accounts.

Contribution Strategies

Effective contribution strategies can significantly impact your retirement savings. Here are some strategies to consider:

- Start Early: The sooner you start, the more you benefit from compound interest.

- Employer Match: Take full advantage of any employer matching in your 401(k).

- Increase Contributions: Gradually increase your contributions as your income grows.

- Automate Savings: Set up automatic transfers to ensure consistent contributions.

Consider creating a table to visualize your contribution plan:

| Year | Annual Contribution | Employer Match | Total Contribution |

|---|---|---|---|

| 2023 | $5,000 | $2,500 | $7,500 |

| 2024 | $5,500 | $2,750 | $8,250 |

Review your contributions regularly and adjust as needed. Staying consistent and proactive will help you reach your retirement goals.

Credit: www.linkedin.com

Insurance Needs

Understanding insurance needs is crucial for young adults. It helps protect against unexpected financial burdens. This section breaks down two essential types of insurance: health and life insurance.

Health Insurance

Health insurance is necessary for covering medical expenses. Without it, medical bills can become overwhelming. Here are a few key points to consider:

- Coverage: Ensure the plan covers essential health benefits.

- Premiums: Look for a plan that fits your budget.

- Networks: Check if your preferred doctors are in-network.

- Deductibles: Understand how much you pay before insurance kicks in.

Choosing the right plan can save you money and stress. It’s important to compare different plans and understand their benefits and limitations.

Life Insurance

Life insurance might not seem urgent, but it offers peace of mind. It’s about protecting your loved ones financially if something happens to you. Consider the following factors:

| Type | Benefits |

|---|---|

| Term Life Insurance | Provides coverage for a specific period. Lower premiums. |

| Whole Life Insurance | Covers you for life. Builds cash value over time. |

Term life insurance is generally cheaper for young adults. Whole life insurance can be beneficial if you want long-term security and savings.

Evaluate your financial situation and choose the best option. Remember, life insurance is about protecting those who depend on you.

Tax Planning

Tax planning can be overwhelming for young adults. With the right strategies, it becomes manageable. Proper tax planning helps you save money and avoid surprises. Let’s explore key aspects of tax planning for young adults.

Understanding Tax Brackets

Tax brackets determine how much tax you pay. Each bracket has a specific rate. The higher your income, the higher your tax rate. Understanding tax brackets helps you plan better.

Here’s a simple table to explain tax brackets:

| Income Range | Tax Rate |

|---|---|

| $0 – $9,950 | 10% |

| $9,951 – $40,525 | 12% |

| $40,526 – $86,375 | 22% |

| $86,376 – $164,925 | 24% |

| $164,926 – $209,425 | 32% |

| $209,426 – $523,600 | 35% |

| $523,601 and above | 37% |

Maximizing Deductions

Deductions lower your taxable income. This means you pay less tax. Common deductions include student loan interest, medical expenses, and charitable donations.

Here are some tips for maximizing deductions:

- Keep all receipts and records.

- Track your eligible expenses.

- Consult with a tax professional.

Using deductions wisely can save you a lot of money. Ensure you know all the deductions you qualify for.

Effective tax planning involves understanding brackets and maximizing deductions. This knowledge helps you make informed financial decisions.

Credit: www.tapmagonline.com

Financial Education

Understanding finances is crucial for young adults. Good financial habits start early. Financial education helps in building a secure future. It involves learning how to budget, save, and invest wisely. Let’s explore some key aspects of financial education.

Learning Resources

There are many resources available for young adults to learn about finances. Here are some of the most effective ones:

- Books: Books like “Rich Dad Poor Dad” offer valuable insights.

- Online Courses: Websites like Coursera and Khan Academy offer free courses.

- Podcasts: Podcasts such as “The Dave Ramsey Show” provide daily tips.

- Blogs: Financial blogs like “NerdWallet” are full of useful information.

Using these resources, young adults can gain a solid foundation in financial literacy. Learning from various formats helps in better understanding and retention.

Seeking Professional Advice

Sometimes, professional advice is necessary. Financial advisors can provide personalized guidance. They help create tailored financial plans based on individual goals. Here are some benefits of seeking professional advice:

- Expertise: Advisors have in-depth knowledge and experience.

- Personalized Plans: They create plans suited to your financial situation.

- Objective Advice: They offer unbiased guidance.

- Time-Saving: They save you time by managing complex tasks.

Consulting a professional can make a significant difference. It ensures you make informed decisions and stay on the right track.

| Resource Type | Example | Benefits |

|---|---|---|

| Books | “Rich Dad Poor Dad” | Provides foundational knowledge |

| Online Courses | Coursera, Khan Academy | Free and accessible learning |

| Podcasts | “The Dave Ramsey Show” | Daily financial tips |

| Blogs | NerdWallet | Current financial trends |

Frequently Asked Questions

What Is The Best Financial Advice For A Young Person?

Start saving early, create a budget, and avoid unnecessary debt. Invest in stocks and diversify your portfolio.

Where Should A 25 Year Old Be Financially?

A 25-year-old should have an emergency fund, start investing for retirement, manage debt, and budget effectively. Focus on saving and building credit.

How Do I Plan Finances In My 20s?

Start budgeting early. Track your expenses and save consistently. Build an emergency fund. Invest in retirement accounts. Avoid unnecessary debt.

What Are The 5 Financial Traps Awaiting Young Adults?

1. Accumulating credit card debt. 2. Ignoring student loan repayment. 3. Overspending on lifestyle. 4. Neglecting to save for emergencies. 5. Making impulsive investment decisions.

Conclusion

Securing your financial future starts with smart planning in your youth. Build a budget, save consistently, and invest wisely. Seek professional advice when needed to make informed decisions. Start early, stay disciplined, and watch your financial health improve over time.

Your future self will thank you for the proactive steps taken today.