Credit reports provide detailed information about an individual’s credit history. They are crucial for lenders to assess creditworthiness.

Understanding credit reports is essential for managing your financial health. These reports include your borrowing history, outstanding debts, and repayment behavior. Lenders, landlords, and even some employers use this information to make decisions. Having a good credit report can help you secure loans at favorable interest rates.

It’s important to regularly check your credit report for accuracy. Errors can negatively impact your credit score, so timely corrections are necessary. Knowing the contents of your credit report empowers you to take control of your financial future. Regular monitoring can also protect you from identity theft and fraud.

Credit: nfmlending.com

What Is A Credit Report?

A credit report is a detailed record of your credit history. It helps lenders decide if you are a good credit risk. Understanding your credit report is crucial for managing your financial health.

Definition And Components

A credit report contains several important components:

- Personal Information: Your name, address, and Social Security number.

- Credit Accounts: Details of your credit cards, loans, and payment history.

- Credit Inquiries: A list of entities that have checked your credit.

- Public Records: Information on bankruptcies and legal judgments.

Each component plays a significant role in your overall credit score. Lenders use this information to assess your creditworthiness.

Importance In Financial Health

Your credit report is vital for maintaining good financial health. Here are some reasons why:

- Loan Approval: Lenders check your credit report before approving loans.

- Interest Rates: A good credit score can get you lower interest rates.

- Employment: Some employers check credit reports before hiring.

- Insurance: Insurers may use credit reports to set premiums.

Regularly reviewing your credit report can help you spot errors and prevent identity theft.

| Component | Description |

|---|---|

| Personal Information | Your identification details like name and address. |

| Credit Accounts | Details of your credit history and payment behavior. |

| Credit Inquiries | List of entities that have checked your credit. |

| Public Records | Information on bankruptcies and legal judgments. |

Understanding these components can help you maintain a healthy financial life.

Credit: www.debt.org

How To Access Your Credit Report

Understanding your credit report is important. It shows your credit history. You can access your credit report in different ways. Let’s explore how to get your credit report.

Free Annual Credit Reports

Everyone can get a free credit report every year. This is a law. You can request your report from three main credit bureaus:

- Equifax

- Experian

- TransUnion

Visit AnnualCreditReport.com to request your free report. You can also call 1-877-322-8228. These are safe ways to get your credit report.

Credit Monitoring Services

Credit monitoring services can help you. They watch your credit report for changes. Some services are free, others cost money. Here are some popular credit monitoring services:

| Service | Free Plan | Paid Plan |

|---|---|---|

| Credit Karma | Yes | No |

| Experian | Yes | Yes |

| Identity Guard | No | Yes |

These services alert you to new activity. They help you spot identity theft early. Using credit monitoring can give you peace of mind.

Decoding Your Credit Score

Understanding your credit score is crucial for managing your finances. A credit score is a numerical representation of your creditworthiness. Lenders use this score to decide if they should lend you money. This section will help you decode your credit score.

Credit Score Ranges

Credit scores typically range from 300 to 850. Here’s a breakdown of the ranges:

| Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

A higher score means better credit. Aim for a score above 670.

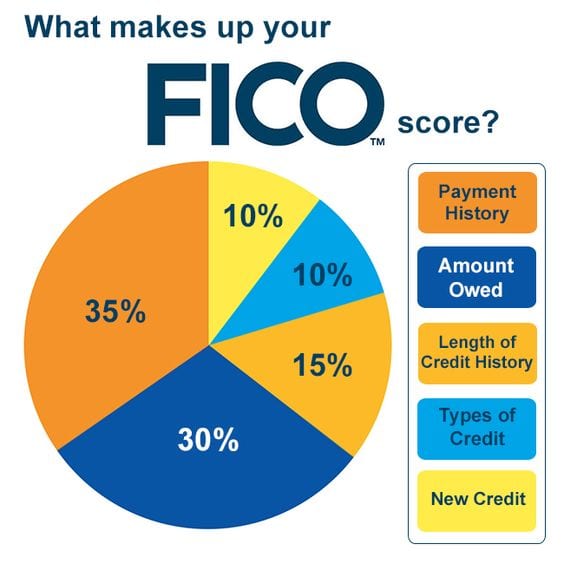

Factors Influencing Your Score

Several factors influence your credit score. Here are the main ones:

- Payment History: Timely payments boost your score.

- Credit Utilization: Use less than 30% of your credit limit.

- Length of Credit History: Longer history improves your score.

- New Credit: Too many new accounts can hurt your score.

- Credit Mix: Having different types of credit is beneficial.

Understanding these factors can help you manage and improve your credit score.

Common Errors In Credit Reports

Understanding your credit report is crucial. Common errors in credit reports can affect your credit score. These errors can lead to higher interest rates or loan rejections. Knowing how to spot and fix these errors is vital for your financial health.

Types Of Errors

Several types of errors can appear on a credit report. Here are some of the most common:

- Incorrect Personal Information: Misspelled names, wrong addresses, or incorrect social security numbers.

- Account Errors: Accounts that don’t belong to you, duplicate accounts, or incorrect account statuses.

- Balance Errors: Incorrect balance information or wrong credit limits.

- Payment History Errors: Misreported late payments or missing payments.

- Fraudulent Accounts: Accounts opened fraudulently in your name.

Impact On Your Score

Errors on your credit report can significantly impact your credit score. Here’s how:

| Type of Error | Impact on Score |

|---|---|

| Incorrect Personal Information | May cause identity confusion, affecting your score. |

| Account Errors | Can show more debt than you have, lowering your score. |

| Balance Errors | High balances can indicate high credit usage. |

| Payment History Errors | Late payments can drastically lower your score. |

| Fraudulent Accounts | Can show unauthorized debts, harming your score. |

Fixing these errors can improve your credit score. Regularly check your credit report for accuracy.

How To Dispute Credit Report Errors

Credit report errors can damage your credit score. Fixing these errors is essential. This guide will help you understand how to dispute credit report errors.

Filing A Dispute

Follow these steps to file a dispute:

- Get a copy of your credit report from all three bureaus.

- Check for errors such as wrong addresses or inaccurate account information.

- Gather documents that prove the error. These could be bank statements or payment receipts.

- Write a dispute letter. Clearly explain the mistake and include copies of your evidence.

- Send the dispute letter to the credit bureau. Use certified mail to track it.

Follow-up Actions

After filing a dispute, take these steps:

- Wait for a response. The credit bureau must reply within 30 days.

- Review the results. The bureau will send you the investigation results.

- Check your updated credit report. Ensure the error is fixed.

- If the error remains, consider contacting the creditor directly. Provide the same evidence.

- File a complaint with the Consumer Financial Protection Bureau if needed.

Keeping track of these steps ensures your credit report stays accurate. An accurate credit report helps maintain a good credit score.

Improving Your Credit Score

Understanding your credit report is crucial. It helps you improve your credit score. A higher credit score opens doors to better financial opportunities. Here’s how you can boost your credit score.

Paying Bills On Time

Paying bills on time is essential. Late payments can hurt your credit score. Set reminders to avoid missing due dates. You can also set up automatic payments. This ensures your bills are always paid on time.

Timely payments show lenders you are responsible. This improves your credit score over time. Even small bills, like utilities, count. Make sure they are paid promptly.

Reducing Debt

Reducing debt is another way to boost your score. High balances can lower your credit score. Aim to pay more than the minimum payment. This helps reduce your debt faster.

Consider creating a budget to manage your expenses. This helps you allocate funds to pay off debt. Using a debt repayment plan can also be helpful. Here is a simple table to show how you can plan:

| Debt Type | Amount Owed | Monthly Payment |

|---|---|---|

| Credit Card | $2000 | $100 |

| Personal Loan | $5000 | $200 |

Focus on paying off high-interest debts first. This saves you money in the long run. Reducing debt improves your credit score significantly.

How Credit Reports Affect Your Life

A credit report is a record of your financial behavior. It shows lenders how you handle credit. This report can influence many areas of your life. It can affect your ability to get loans, the interest rates you pay, and even your job opportunities.

Loan Approvals

Lenders use your credit report to decide if they will give you a loan. They look at your credit history to see if you pay bills on time. They also check how much debt you have. A good credit report can help you get a loan easily. A poor credit report can make it hard to get approved.

| Credit Score | Loan Approval Chances |

|---|---|

| Excellent (750+) | Very High |

| Good (700-749) | High |

| Fair (650-699) | Moderate |

| Poor (600-649) | Low |

| Very Poor (<600) | Very Low |

Interest Rates

Your credit report also affects the interest rates you pay. Lenders see good credit as low-risk. They offer lower interest rates to people with good credit. If your credit is poor, you might pay higher interest rates.

- Good credit = lower interest rates

- Poor credit = higher interest rates

Lower interest rates mean you pay less money over time. Higher interest rates mean you pay more. This can affect your monthly budget and long-term financial health.

Tips For Maintaining A Healthy Credit Report

Maintaining a healthy credit report is crucial for your financial well-being. A good credit report opens doors to better loan terms, lower interest rates, and more financial opportunities. Follow these tips to ensure your credit report stays in top shape.

Regular Monitoring

Regular monitoring of your credit report helps you spot errors and potential fraud early. You can request a free credit report from each of the three major credit bureaus once a year.

- Check for errors: Ensure all your personal information is correct.

- Look for unfamiliar accounts: These might be signs of identity theft.

- Review your credit history: Confirm that all accounts are accurately reported.

Use free tools and apps to monitor your credit score regularly. This practice helps you understand your credit health better.

Avoiding Common Pitfalls

Many people make mistakes that can harm their credit report. Knowing these pitfalls can help you avoid them.

- Late Payments: Always pay your bills on time. Late payments can significantly affect your credit score.

- High Credit Utilization: Keep your credit card balances low. Aim to use less than 30% of your available credit.

- Too Many Credit Inquiries: Applying for too many credit accounts in a short time can lower your score.

- Ignoring Debt: Address outstanding debts. Ignoring them can lead to collections, harming your credit.

By avoiding these common pitfalls, you can maintain a healthier credit report. This will ensure better financial opportunities and a stronger credit history.

Credit: www.rategenius.com

Frequently Asked Questions

How To Read A Credit Report For Dummies?

Start with identifying personal information. Check credit accounts for accuracy. Review inquiries made by lenders. Look for negative items like late payments. Monitor your credit score.

What Are The 5 Levels Of Credit Scores?

Credit scores have 5 levels: poor (300-579), fair (580-669), good (670-739), very good (740-799), and excellent (800-850).

What Are The 4 C’s Of Credit Score?

The 4 C’s of credit score are Character, Capacity, Capital, and Collateral. These factors assess creditworthiness.

What Do The Numbers Mean On A Credit Report?

The numbers on a credit report represent your credit score. They reflect your creditworthiness and financial behavior. Higher numbers indicate better credit.

Conclusion

Understanding your credit report is crucial for financial health. Regularly check and review your report for errors. This helps maintain a good credit score. Stay informed and proactive to ensure financial stability. A healthy credit report opens doors to better financial opportunities.

Keep learning and stay ahead in your financial journey.