The best financial planning tools include Mint, YNAB, and Personal Capital. These tools help manage budgets, track expenses, and plan investments.

Financial planning is essential for achieving long-term financial stability and goals. Using the right tools can simplify this process and make it more effective. Mint offers comprehensive budgeting and tracking features. YNAB (You Need a Budget) focuses on proactive budgeting techniques.

Personal Capital provides robust investment tracking and retirement planning. These tools are user-friendly, accessible on multiple devices, and often come with free versions. They offer insights into spending habits and help in making informed financial decisions. Leveraging these tools can lead to better financial health and peace of mind.

Introduction To Financial Planning Tools

Managing finances can be challenging. Financial planning tools simplify this task. They help you track, budget, and invest your money wisely. These tools offer a clear view of your financial health.

Importance Of Financial Planning

Financial planning helps you achieve your goals. It ensures you save and spend wisely. With a plan, you can avoid unnecessary debt. You can also prepare for emergencies.

Planning your finances helps you understand your spending habits. It allows you to set realistic goals. It also helps you stay on track to achieve those goals. You can also plan for major life events.

Types Of Financial Planning Tools

There are various tools available. Each serves a different purpose. Here are some common types:

- Budgeting Tools: These help you track your income and expenses.

- Investment Tools: They assist in managing your investments.

- Retirement Planning Tools: These help you plan for retirement.

- Debt Management Tools: They help you manage and pay off debts.

- Tax Planning Tools: These assist in planning your taxes.

Each tool offers unique features. Some tools are free. Others may require a subscription. Choose a tool that fits your needs. Ensure it is user-friendly and reliable.

| Tool Type | Purpose | Examples |

|---|---|---|

| Budgeting Tools | Track income and expenses | Mint, YNAB |

| Investment Tools | Manage investments | Robinhood, ETRADE |

| Retirement Planning Tools | Plan for retirement | Fidelity, Vanguard |

| Debt Management Tools | Manage and pay off debts | Debt Payoff Planner, Tally |

| Tax Planning Tools | Plan and file taxes | TurboTax, H&R Block |

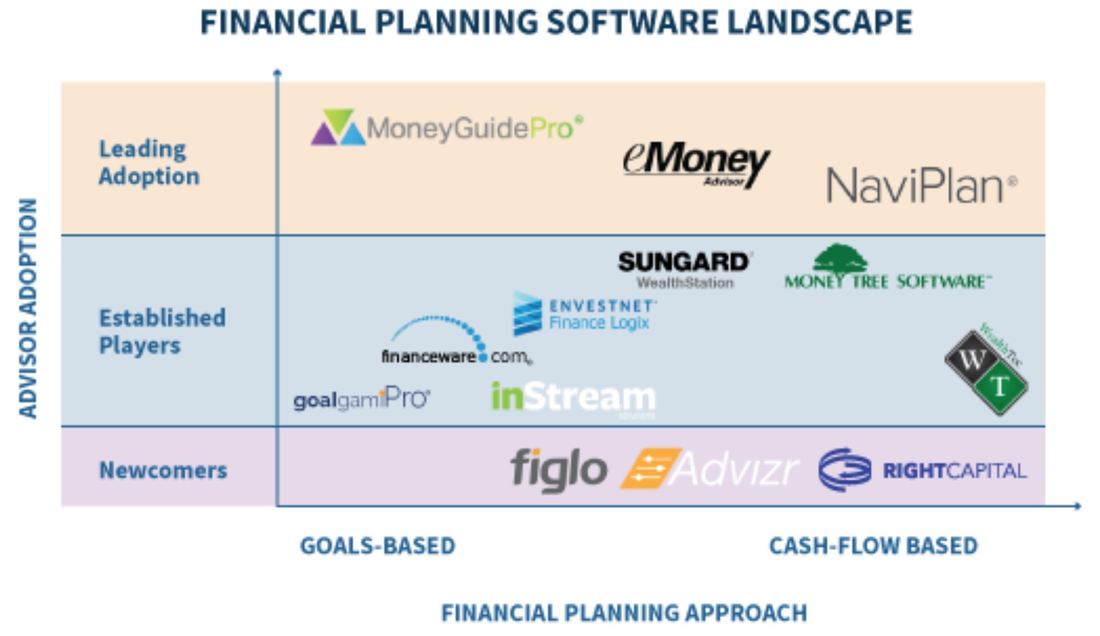

Credit: www.pfwise.com

Budgeting Tools

Managing finances can be tough. Budgeting tools simplify this task. They help track expenses, plan savings, and achieve financial goals.

Top Budgeting Apps

Here are some top budgeting apps:

- Mint: Tracks expenses and categorizes them.

- YNAB (You Need a Budget): Focuses on proactive budgeting.

- PocketGuard: Shows how much you can spend.

- Goodbudget: Uses the envelope budgeting method.

- Personal Capital: Combines budgeting with investment tracking.

Features To Look For

Important features in budgeting tools include:

| Feature | Importance |

|---|---|

| Expense Tracking | Monitors where your money goes. |

| Goal Setting | Helps set and achieve financial goals. |

| Alerts and Reminders | Notifies you of upcoming bills. |

| Reports and Insights | Offers insights on spending patterns. |

| Security | Ensures your financial data is safe. |

Choosing the right budgeting tool helps manage money effectively. Always consider your needs before selecting an app.

Investment Trackers

Investment trackers are essential for anyone serious about managing their money. They help you keep a close eye on your investments, ensuring you stay informed and can make timely decisions. The right tracker can save you time and provide peace of mind.

Best Platforms For Investments

Choosing the best platform can make a huge difference. Here are some of the top options:

- Personal Capital: Offers a comprehensive view of your finances.

- Mint: Great for budgeting and tracking investments.

- Morningstar: Excellent for detailed investment analysis.

- Yahoo Finance: Provides real-time data and market news.

Real-time Portfolio Tracking

Real-time tracking helps you stay updated with market changes. Here are some tools that provide this feature:

| Tool | Key Features |

|---|---|

| SigFig | Real-time updates, personalized advice, and detailed analysis. |

| Quicken | Syncs with your accounts, providing real-time tracking. |

| Google Finance | Offers real-time stock quotes and news. |

Using these tools can help you make informed decisions. They provide instant updates, keeping you in the loop. This ensures you never miss an important market shift.

Credit: savology.com

Retirement Calculators

Planning for retirement can be challenging without the right tools. Retirement calculators help estimate how much money you need to save. These tools consider various factors like age, income, and savings goals. They offer a clear picture of your financial future.

Planning For Retirement

Retirement planning requires careful consideration. You need to account for living expenses, healthcare, and inflation. A good retirement calculator simplifies this process. It provides a step-by-step guide to estimate your retirement needs.

Here are key factors to consider:

- Current Age

- Retirement Age

- Annual Income

- Savings Rate

- Expected Retirement Expenses

Popular Retirement Tools

Several popular retirement tools can assist you in planning:

| Tool | Features | Cost |

|---|---|---|

| Fidelity Retirement Score | Provides a personalized retirement score | Free |

| Vanguard Retirement Nest Egg Calculator | Estimates how long savings will last | Free |

| Personal Capital Retirement Planner | Integrates with your financial accounts | Free |

These tools help create a robust retirement strategy. They offer insights based on your financial data. Use them to ensure a comfortable retirement.

Debt Management Tools

Managing debts can be challenging without the right tools. Debt management tools help you keep track of loans, credit card balances, and other debts. These tools provide insights to help you stay on top of your financial obligations.

Managing Loans And Debts

Effective debt management begins with understanding your loans and debts. Here are some tips for managing them:

- Track Your Debts: Know the total amount you owe.

- Set Payment Reminders: Avoid late fees by setting reminders.

- Create a Budget: Allocate funds for debt repayment.

- Prioritize Debts: Pay off high-interest debts first.

- Seek Professional Help: Consult a financial advisor if needed.

Highly Recommended Tools

Here are some of the best tools for debt management:

| Tool | Features | Pricing |

|---|---|---|

| Mint | Budgeting, bill tracking, free credit score | Free |

| You Need a Budget (YNAB) | Budgeting, debt tracking, financial planning | $11.99/month |

| Debt Payoff Planner | Debt repayment plans, payoff date calculator | Free, with in-app purchases |

| Credit Karma | Credit monitoring, debt tracking, personalized recommendations | Free |

| Unbury.me | Debt repayment plans, snowball and avalanche methods | Free |

Savings Apps

Savings apps have revolutionized personal finance management. These tools help users save money efficiently. With automated features, saving becomes effortless. Let’s explore how these apps can boost your financial health.

Automated Savings Features

Automated savings features simplify the saving process. These apps link to your bank accounts. They automatically transfer small amounts to your savings. This process occurs daily, weekly, or monthly. It helps build your savings without thinking. Some apps even round up your purchases. The spare change goes into your savings account.

| Feature | Description |

|---|---|

| Round-Up Transfers | Automatically save spare change from purchases. |

| Scheduled Transfers | Set regular transfers to your savings. |

| Smart Algorithms | Analyze spending and save accordingly. |

Best Apps For Saving Goals

Several apps excel at helping you meet saving goals. Each offers unique features and benefits. Here are some top picks:

- Qapital: Set saving goals and rules. Automate savings based on your habits.

- Digit: Uses smart algorithms. Transfers small amounts to your savings.

- Chime: Offers round-up transfers. Automatically saves your spare change.

- Simple: Provides goal-based savings. Easy to set and track goals.

These apps make saving easy and fun. Pick one that suits your needs. Start building your savings today!

Tax Preparation Software

Tax preparation software can simplify the annual task of filing taxes. These tools help users calculate their taxes accurately and efficiently. They offer a range of features, from basic calculations to advanced tax strategies. This section explores the best tax preparation software options available.

Top Tax Software Options

Several top tax software options stand out for their features and reliability. Here are some of the best choices:

- TurboTax: Known for its user-friendly interface and comprehensive guidance.

- H&R Block: Offers both online and in-person tax filing options.

- TaxSlayer: Provides affordable plans with various features.

- TaxAct: A cost-effective option with robust tools for all tax situations.

- FreeTaxUSA: Great for those who need basic tax filing services for free.

Ease Of Use And Accuracy

Ease of use and accuracy are critical factors in choosing tax preparation software. These tools should be simple to navigate and provide accurate results.

- TurboTax: Uses a Q&A format to guide users step by step. High accuracy rate.

- H&R Block: Offers clear instructions and helpful tips throughout the process.

- TaxSlayer: Features a clean interface with easy-to-follow prompts.

- TaxAct: Provides detailed explanations and double-checks for errors.

- FreeTaxUSA: Straightforward design but may lack some advanced features.

Choosing the right tax preparation software can save time and reduce stress. These tools ensure that users file their taxes accurately and efficiently.

Financial Planning Services

Financial planning services help people manage their money better. They offer advice on saving, investing, and budgeting. Professional guidance ensures your financial goals are met.

Choosing A Financial Advisor

Picking the right financial advisor is crucial. They should be trustworthy and knowledgeable. Look for advisors with certifications like CFP (Certified Financial Planner).

Consider the advisor’s experience in the field. A good track record means they can handle your finances well. Ask for recommendations from friends and family.

Check their fee structure. Some charge a flat fee, others take a percentage. Understand what you are paying for.

A table might help you compare different advisors:

| Advisor | Certifications | Experience | Fees |

|---|---|---|---|

| Advisor A | CFP, CFA | 10 Years | Flat Fee |

| Advisor B | CFP | 5 Years | Percentage |

| Advisor C | CFA | 15 Years | Flat Fee |

Benefits Of Professional Guidance

Professional guidance offers many benefits. An expert can create a personalized financial plan. This plan helps you achieve your goals faster.

Advisors can offer investment advice tailored to your needs. They help you understand the risks and rewards of different options.

A professional can also assist with tax planning. This ensures you pay the least amount of tax legally possible. They keep you updated on new tax laws and regulations.

Professional guidance provides peace of mind. You know your finances are in good hands. This lets you focus on other important things in life.

- Personalized financial plan

- Tailored investment advice

- Tax planning assistance

- Peace of mind

Using financial planning services is a smart move. It helps you manage your money better and achieve your goals.

Conclusion And Future Trends

Financial planning tools have evolved. They now offer many features for users. These tools help manage budgets, track expenses, and plan for the future. In this section, we will explore emerging financial tools and provide final thoughts on financial planning.

Emerging Financial Tools

New financial tools are constantly being developed. These tools use advanced technologies to provide better services. Here are some trends in financial tools:

- Artificial Intelligence: AI helps analyze spending patterns. It offers personalized advice based on user behavior.

- Blockchain: Blockchain ensures secure and transparent transactions. It helps in managing investments and tracking assets.

- Robo-Advisors: Robo-advisors offer automated investment advice. They help users make informed decisions without needing a financial expert.

- Mobile Apps: Mobile apps provide on-the-go financial management. They offer features like budget tracking, bill reminders, and savings goals.

These emerging tools are transforming the way people manage their finances. They provide more convenience and accuracy.

Final Thoughts On Financial Planning

Financial planning is crucial for a secure future. Using the right tools can make this process easier and more effective. Here are some final tips:

- Choose tools that fit your needs. Look for features that help you achieve your goals.

- Stay updated with new financial technologies. Emerging tools can offer better solutions.

- Use a combination of tools. This can provide a more comprehensive financial plan.

Effective financial planning tools simplify managing your money. They help you achieve your financial goals with ease.

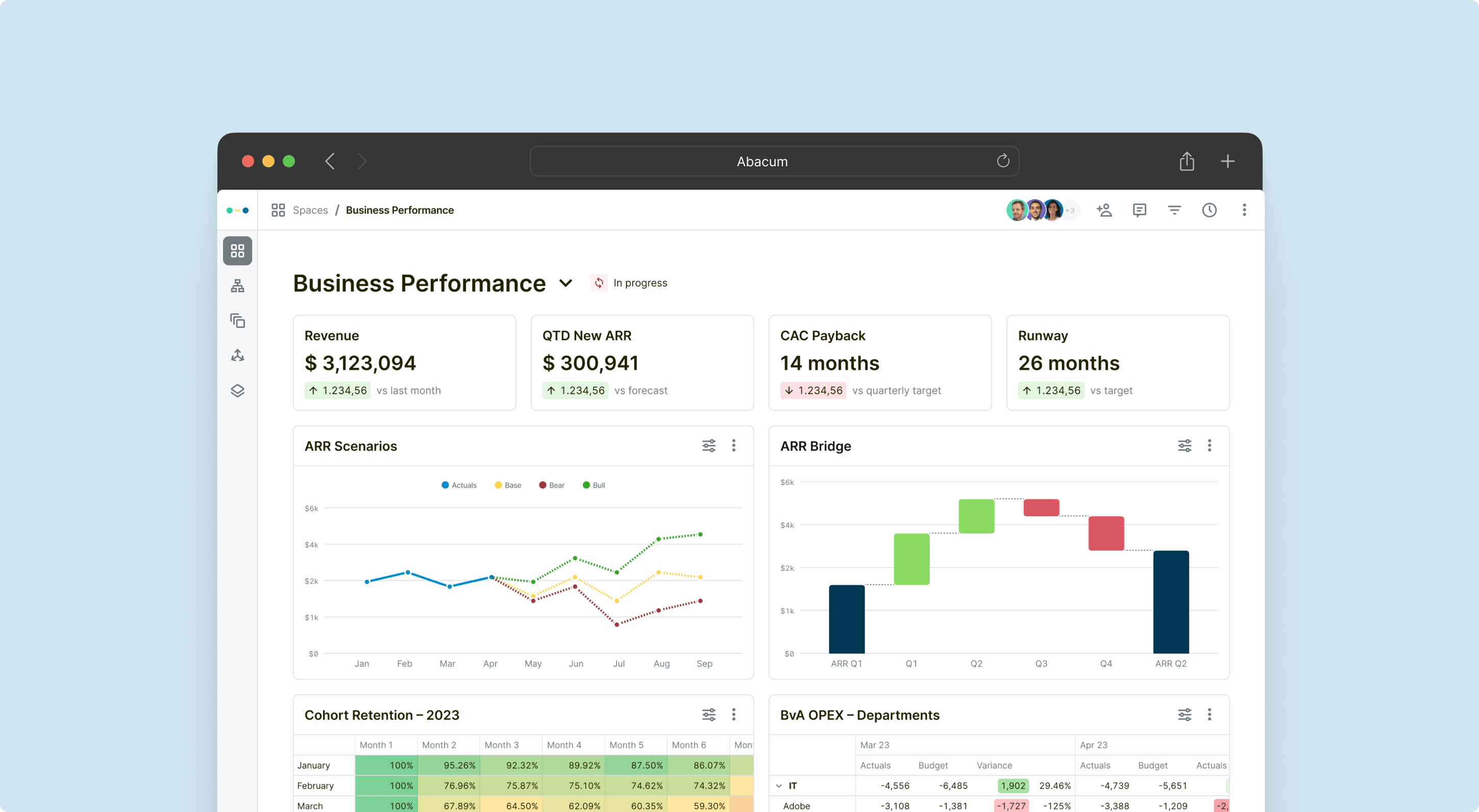

Credit: www.abacum.io

Frequently Asked Questions

What Is A Widely Used Financial Planning Tool?

A widely used financial planning tool is budgeting software. It helps track expenses, manage income, and plan savings efficiently.

What Is The Best Software For Financial Advisors?

The best software for financial advisors includes eMoney Advisor, MoneyGuidePro, and Advyzon. These tools offer comprehensive planning, analytics, and client management features.

What Are The Four Main 4 Types Of Financial Planning?

The four main types of financial planning are cash flow management, investment planning, insurance planning, and retirement planning. Each type addresses specific financial needs and goals. Cash flow management ensures proper budgeting. Investment planning focuses on growing wealth. Insurance planning provides risk protection.

Retirement planning secures future financial stability.

What Is The Best Software For Financial Management?

The best software for financial management is QuickBooks. It offers comprehensive features for budgeting, invoicing, and expense tracking. QuickBooks is user-friendly and widely trusted by businesses and individuals.

Conclusion

Selecting the best financial planning tools can transform your financial future. Use these tools to manage budgets, investments, and goals effectively. With the right tools, financial planning becomes more accessible and stress-free. Start exploring these options today to take control of your financial health and secure your future.