The best financial planning tools for small businesses are QuickBooks, Xero, and FreshBooks. These tools offer essential features like invoicing, expense tracking, and budgeting.

Small businesses need reliable financial planning tools to manage their finances effectively. QuickBooks, Xero, and FreshBooks stand out for their user-friendly interfaces and comprehensive features. QuickBooks is popular for its robust accounting capabilities and seamless integration with other apps. Xero offers excellent invoicing and real-time data tracking, ideal for businesses needing up-to-date financial insights.

FreshBooks excels in simplifying invoicing and expense management, making it perfect for freelancers and small business owners. These tools help streamline financial operations, ensuring small businesses can focus on growth and profitability.

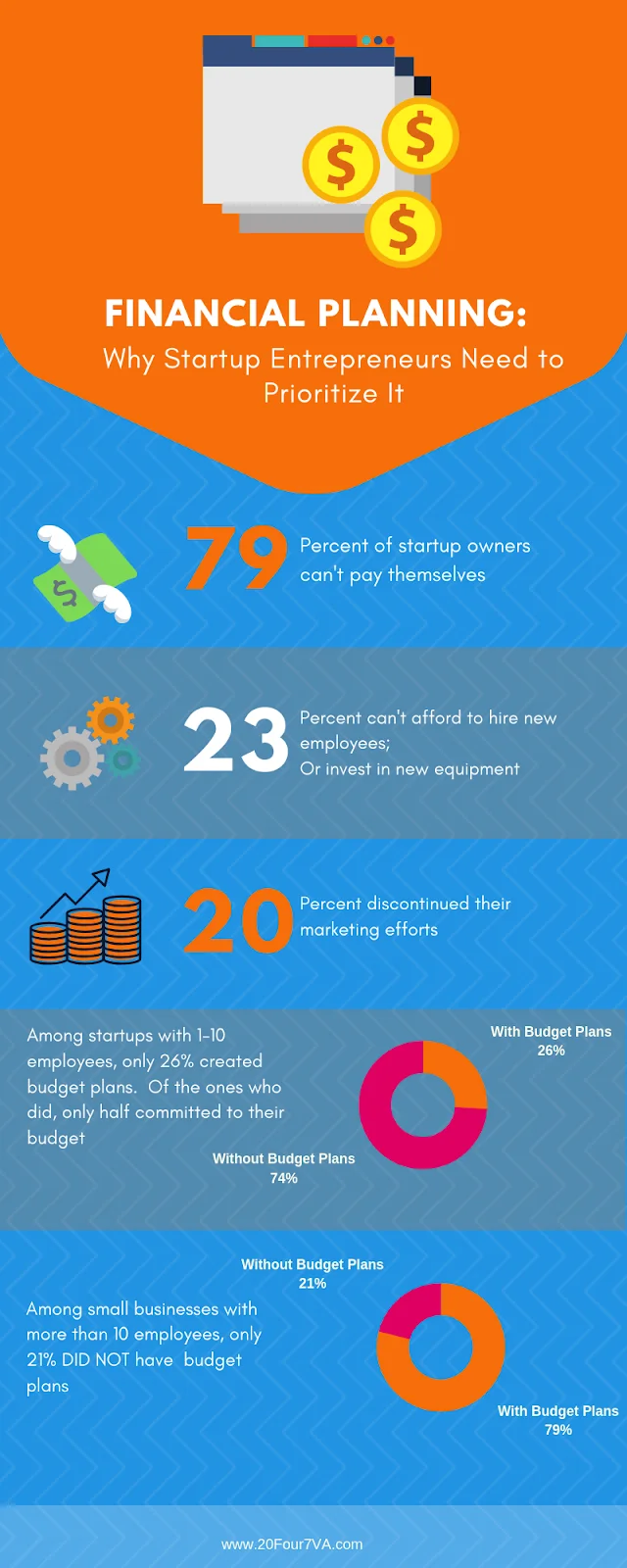

Credit: 20four7va.com

Introduction To Financial Planning

Financial planning is crucial for small businesses. It helps manage resources, forecast future needs, and ensure sustainability. Effective financial planning can lead to business growth and stability.

Importance For Small Businesses

Small businesses often operate on tight budgets. Effective financial planning helps allocate resources wisely. It ensures all expenses are covered.

- Prevents cash flow issues

- Helps in setting realistic financial goals

- Assists in making informed business decisions

- Enables tracking of financial performance

Small businesses face unique challenges. A solid financial plan can mitigate these risks.

Common Challenges

Many small businesses struggle with financial planning. Here are some common challenges:

- Limited Resources: Small businesses often lack financial expertise.

- Cash Flow Management: Maintaining a stable cash flow is difficult.

- Budgeting: Creating and sticking to a budget is challenging.

- Forecasting: Predicting future financial needs is complex.

Addressing these challenges requires the right tools and strategies. The right financial planning tools can help small businesses thrive.

| Challenge | Solution |

|---|---|

| Limited Resources | Utilize financial planning software |

| Cash Flow Management | Implement cash flow tracking tools |

| Budgeting | Use budgeting apps |

| Forecasting | Leverage forecasting software |

Budgeting Tools

Effective budgeting is crucial for small businesses. It helps track income and expenses, ensuring financial health. Using the right budgeting tools can make this process simpler and more efficient. Let’s explore some top options and key features to look for in budgeting tools.

Top Software Options

Here are some of the best budgeting tools for small businesses:

| Software | Price | Key Features |

|---|---|---|

| QuickBooks | Starts at $25/month | Expense tracking, invoicing, payroll |

| FreshBooks | Starts at $15/month | Time tracking, project management, reporting |

| Wave | Free | Accounting, invoicing, receipt scanning |

| Xero | Starts at $11/month | Bank reconciliation, expense claims, project tracking |

Features To Look For

When choosing a budgeting tool, consider these important features:

- Ease of Use: The tool should be user-friendly.

- Expense Tracking: It should track all expenses accurately.

- Reporting: Look for detailed and customizable reports.

- Integration: The tool should integrate with other software you use.

- Security: Ensure it has strong security features to protect your data.

- Scalability: It should grow with your business.

Accounting Software

Small businesses need efficient accounting software to manage finances. These tools help in tracking expenses, generating invoices, and ensuring tax compliance. Below are some key aspects of accounting software.

Popular Solutions

There are many popular accounting software solutions available for small businesses. Here are a few:

- QuickBooks Online: Known for its user-friendly interface.

- Xero: Popular for its robust features and integrations.

- FreshBooks: Ideal for invoicing and payment tracking.

- Wave: Free tool with basic accounting features.

Integration Capabilities

Integration capabilities are crucial for accounting software. They allow seamless data flow between different tools. Here’s a comparison of integration features:

| Software | Integration Options |

|---|---|

| QuickBooks Online | Connects with over 650 business apps. |

| Xero | Integrates with 700+ third-party apps. |

| FreshBooks | Works with 200+ apps including payment gateways. |

| Wave | Limited integrations, but includes PayPal and Shoeboxed. |

Choosing the right accounting software can save time and improve accuracy. Evaluate your business needs and select the best fit.

Cash Flow Management

Effective cash flow management is crucial for small businesses. It ensures you have enough cash to cover expenses. Proper management helps avoid financial pitfalls and keeps your business healthy.

Best Practices

Implementing best practices can significantly improve your cash flow:

- Regularly Monitor Cash Flow: Keep a close eye on your cash inflows and outflows.

- Create Cash Flow Forecasts: Predict future cash needs and plan accordingly.

- Manage Receivables Efficiently: Follow up on unpaid invoices promptly.

- Control Expenses: Identify and cut unnecessary costs.

- Build a Cash Reserve: Save a portion of your profits as an emergency fund.

Recommended Tools

Several tools can assist with effective cash flow management:

| Tool | Description |

|---|---|

| QuickBooks | Comprehensive accounting software for tracking income and expenses. |

| FreshBooks | Easy-to-use tool for invoicing and expense tracking. |

| Wave | Free accounting software suitable for small businesses. |

| Float | Helps in creating detailed cash flow forecasts. |

| PlanGuru | Offers advanced budgeting and forecasting features. |

Using these tools can streamline your cash flow management process. They provide accurate data and forecasts, helping you make informed decisions.

Tax Preparation

Tax preparation can be a daunting task for small business owners. Proper planning can save time and reduce stress. Utilize the best financial planning tools to streamline the tax process. These tools help you stay compliant and organized.

Essential Software

Using the right software makes tax preparation easier. Here are some essential tools:

- QuickBooks: Simplifies expense tracking and tax filing.

- TurboTax: User-friendly for filing business taxes.

- FreshBooks: Great for invoicing and expense management.

- H&R Block: Offers professional tax assistance and software.

These tools offer features like automatic tax calculations, expense tracking, and reminders. They also integrate with other financial tools, making them versatile and efficient.

Compliance Tips

Staying compliant with tax laws is crucial. Here are some tips:

- Keep Accurate Records: Maintain all receipts and financial documents.

- Understand Deductions: Know which expenses are deductible.

- File on Time: Avoid penalties by meeting deadlines.

- Consult Professionals: Seek advice from tax experts if needed.

Using the right software and following these tips will help you stay compliant. This ensures your business avoids any legal issues or penalties.

| Software | Key Features |

|---|---|

| QuickBooks | Expense tracking, tax filing |

| TurboTax | User-friendly, business tax filing |

| FreshBooks | Invoicing, expense management |

| H&R Block | Professional assistance, tax software |

Choose the right tools and stay compliant to simplify tax preparation for your small business.

Investment Tracking

Investment tracking is crucial for small businesses. It helps manage and monitor investments effectively. By using the right tools, businesses can make informed decisions.

Tools For Small Businesses

There are several tools available for small businesses. These tools help track investments easily. Here are some popular options:

- QuickBooks: This tool offers comprehensive financial tracking. It helps manage investments and expenses.

- Mint: Mint provides an easy way to track your finances. It offers a clear overview of your investments.

- Personal Capital: This tool is great for small businesses. It combines investment tracking with financial planning.

- Expensify: Expensify makes it easy to track expenses. It also helps manage investment-related costs.

Benefits Of Automation

Automation offers several benefits for investment tracking. It saves time and reduces errors. Here are some key advantages:

- Efficiency: Automated tools make tracking faster and more accurate.

- Real-time Updates: Automation provides real-time data. This helps in making timely decisions.

- Cost Savings: Reducing manual work saves money. Automation minimizes the need for extra staff.

- Data Integration: Automated tools integrate various data sources. This provides a holistic view of investments.

Using these tools and embracing automation can significantly improve investment tracking. Small businesses can achieve better financial management and growth.

Risk Management

Risk Management is crucial for small businesses. Understanding and mitigating risks can save money and prevent losses. Proper risk management ensures business continuity and growth.

Identifying Risks

Identifying risks involves recognizing potential threats to your business. These threats can be internal or external. Common risks include:

- Market Risks

- Operational Risks

- Financial Risks

- Compliance Risks

Market Risks relate to changes in the market environment. Operational risks involve day-to-day business activities. Financial risks concern cash flow and investments. Compliance risks are related to legal requirements.

Mitigation Tools

Once risks are identified, use mitigation tools to manage them. Here are some effective tools:

- Insurance: Provides coverage for various risks.

- Contracts: Clearly outline terms and conditions.

- Reserves: Set aside funds for unexpected events.

- Training: Educate employees on risk management practices.

Using these tools can help reduce the impact of potential risks. For example, insurance can cover losses from accidents or natural disasters. Contracts ensure business agreements are legally binding. Reserves provide financial support during tough times. Training ensures employees know how to handle risky situations.

| Tool | Purpose |

|---|---|

| Insurance | Provides coverage for various risks |

| Contracts | Outline terms and conditions |

| Reserves | Funds for unexpected events |

| Training | Educate employees on risk management |

In summary, identifying and managing risks is vital. Using the right tools can protect your business and ensure long-term success.

Credit: www.tridant.com

Financial Reporting

Effective financial reporting is crucial for small businesses. It helps in tracking performance, making informed decisions, and ensuring compliance. Accurate reports provide insights into revenue, expenses, and profitability.

Creating Reports

Creating financial reports can be straightforward. Here are some steps:

- Gather all financial data such as sales, expenses, and payroll.

- Organize the data into categories for easy analysis.

- Use templates or software to create the reports.

- Review the reports for accuracy and completeness.

Regularly updating reports helps in monitoring financial health. It allows small business owners to adjust strategies promptly.

Software Solutions

Several software solutions can aid in financial reporting. They simplify the process and provide accurate results.

| Software | Features | Cost |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, and financial reporting | Starts at $25/month |

| FreshBooks | Time tracking, invoicing, and financial reporting | Starts at $15/month |

| Xero | Bank reconciliation, invoicing, and reporting | Starts at $11/month |

Using software like QuickBooks and FreshBooks saves time. They provide real-time data and generate accurate reports.

Financial planning tools are essential for small businesses. They ensure accurate financial reporting and help in strategic decision-making.

Choosing The Right Tools

Choosing the right financial planning tools can transform your small business. The right tools streamline processes, save time, and enhance accuracy. Below, we delve into factors to consider and cost vs. benefit analysis.

Factors To Consider

- Ease of Use: Opt for tools that are user-friendly.

- Scalability: Choose tools that can grow with your business.

- Integration: Ensure the tool integrates with existing systems.

- Security: Prioritize tools with strong data protection.

- Customer Support: Look for tools with reliable support services.

Cost Vs. Benefit Analysis

Evaluating the cost vs. benefit is crucial for small businesses. Here is a simple table to guide your decision:

| Tool | Monthly Cost | Key Benefits |

|---|---|---|

| Tool A | $50 |

|

| Tool B | $30 |

|

| Tool C | $20 |

|

Assess each tool’s benefits against its cost. The right tool provides maximum value for your investment.

Credit: allevents.in

Frequently Asked Questions

What Is The Best Financial Planning Tool?

The best financial planning tool is Personal Capital. It offers robust features for budgeting, investment tracking, and retirement planning.

How Do I Set Up A Financial Plan For A Small Business?

To set up a financial plan for a small business, start by defining clear financial goals. Create a detailed budget, track expenses, and monitor cash flow. Use financial software for accuracy. Regularly review and adjust your plan based on performance.

Seek advice from financial advisors if needed.

What Is The Best Fp&a Software For Excel?

The best FP&A software for Excel is Vena. It integrates seamlessly, enhances data analysis, and streamlines financial planning.

What Do Managers Use For Financial Planning?

Managers use budgets, financial statements, forecasting tools, and financial software for effective financial planning. They analyze cash flow, revenue, and expenses to make informed decisions.

Conclusion

Choosing the right financial planning tools can transform your small business. These tools simplify budgeting, forecasting, and financial tracking. Streamline operations, improve decision-making, and drive growth by leveraging these resources. Start exploring these financial tools today and set your small business on the path to financial success.