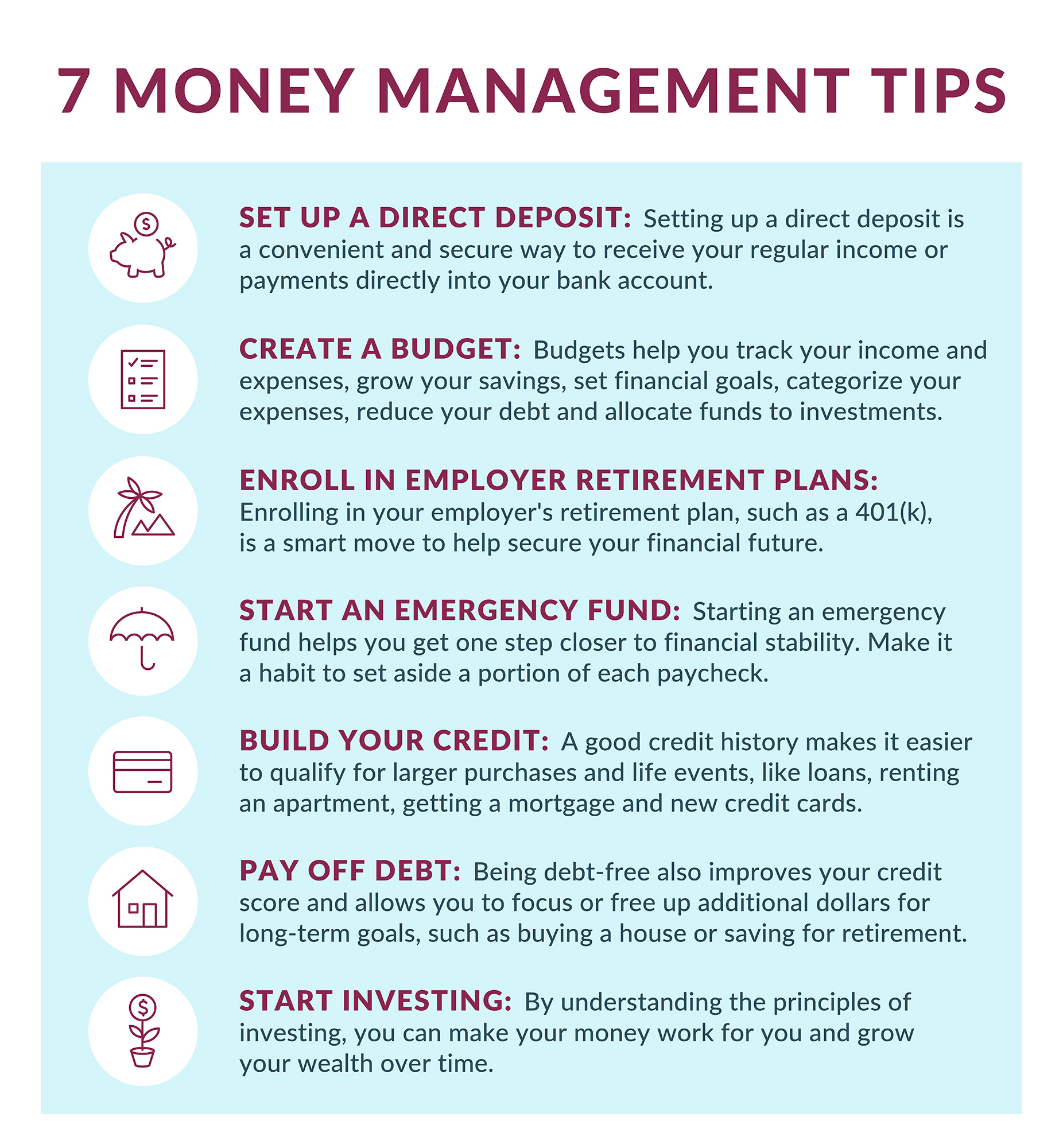

To set financial goals for stable income and wealth, identify your objectives and create a detailed plan. Prioritize saving, investing, and budgeting effectively.

Setting financial goals is essential for achieving stability and building wealth. Clear objectives guide your financial decisions, ensuring you stay on track. Start by assessing your current financial situation, including income, expenses, and debts. Establish short-term and long-term goals, such as saving for emergencies, investing in retirement, or purchasing a home.

Create a realistic budget that aligns with your goals, cutting unnecessary expenses and increasing savings. Consider consulting a financial advisor for personalized advice. Consistently monitor your progress and adjust your plan as needed. By staying disciplined and focused, you can achieve financial stability and grow your wealth over time.

Importance Of Financial Goals

Setting financial goals is essential for achieving a stable income and wealth. It helps you plan for the future and make informed financial decisions. By setting clear financial goals, you can manage your money better and ensure a secure financial future.

Why Set Financial Goals

Financial goals give you a sense of direction and purpose. They help you prioritize your spending and saving habits. With clear goals, you can track your progress and stay motivated.

- Clarity: Knowing exactly what you want to achieve.

- Motivation: Goals keep you focused and driven.

- Control: Better control over your finances.

Impact On Personal Life

Setting financial goals positively impacts your personal life. It reduces stress and provides peace of mind. You know you are working towards a secure future.

Financial goals help you make better life choices. You can plan vacations, buy a home, or save for retirement. This planning ensures you live a balanced and fulfilling life.

| Aspect | Impact |

|---|---|

| Health | Less financial stress improves mental health. |

| Relationships | Financial stability strengthens relationships. |

| Opportunities | More opportunities for growth and investment. |

In summary, setting financial goals is crucial for a stable income and wealth. It brings clarity, motivation, and control over your finances. It also positively impacts your personal life, ensuring a secure and fulfilling future.

Credit: foolwealth.com

Assessing Current Financial Situation

Setting financial goals is essential for achieving a stable income and wealth. The first step is assessing your current financial situation. This helps you understand where you stand and how to plan for the future.

Analyzing Income And Expenses

To start, create a detailed list of your monthly income. Include all sources like salaries, freelance work, or side gigs. Use a table for better clarity:

| Source | Amount |

|---|---|

| Salary | $3000 |

| Freelance Work | $500 |

| Side Gig | $200 |

Next, list all your monthly expenses. This includes rent, groceries, utilities, and entertainment. Categorize them to spot any unnecessary spending:

| Category | Amount |

|---|---|

| Rent | $1000 |

| Groceries | $300 |

| Utilities | $150 |

| Entertainment | $200 |

Compare your income and expenses. If expenses exceed income, find ways to cut costs. Prioritize needs over wants to save more.

Understanding Net Worth

Your net worth is the difference between what you own and what you owe. Calculate it by listing your assets and liabilities:

| Assets | Value |

|---|---|

| Home | $150,000 |

| Car | $10,000 |

| Savings | $5,000 |

| Liabilities | Amount |

|---|---|

| Mortgage | $100,000 |

| Car Loan | $5,000 |

| Credit Card Debt | $2,000 |

Subtract total liabilities from total assets to get your net worth. Aim to increase assets and decrease liabilities over time. This will improve your financial health.

Understanding your current financial situation is the foundation for setting and achieving financial goals. Take the time to analyze income, expenses, and net worth carefully.

Setting Short-term Goals

Setting short-term financial goals is crucial for achieving stable income and wealth. These goals provide direction and motivation. Short-term goals often focus on managing immediate financial needs.

Emergency Fund

An emergency fund is essential for financial stability. It helps cover unexpected expenses without disrupting your budget. Aim to save at least three to six months’ worth of living expenses.

- Start by setting a monthly savings goal.

- Automate your savings to ensure consistency.

- Keep the fund in a separate, easily accessible account.

Building an emergency fund provides peace of mind. It acts as a financial cushion in times of need.

Debt Repayment

Paying off debt is another critical short-term goal. High-interest debt can hinder your financial progress. Prioritize debts with the highest interest rates first.

- List all your debts with their interest rates.

- Focus on paying off high-interest debts first.

- Make minimum payments on other debts to avoid penalties.

Consider using the debt snowball or debt avalanche method. These strategies help in reducing debt effectively.

| Debt Type | Interest Rate | Strategy |

|---|---|---|

| Credit Card | 15% | Avalanche |

| Student Loan | 5% | Snowball |

| Car Loan | 7% | Avalanche |

By setting these short-term goals, you create a strong financial foundation. This foundation is essential for long-term stability and wealth building.

Credit: www.facebook.com

Establishing Long-term Goals

Setting financial goals for stable income and wealth is essential. It’s crucial to have a clear direction to achieve success. Long-term goals provide a roadmap for a secure financial future. They help to prioritize actions and allocate resources effectively.

Retirement Planning

Retirement planning ensures a comfortable life after your working years. Start by calculating how much you need to retire. Consider your current expenses and future needs. Use retirement calculators for accurate estimations.

Create a retirement savings plan. Contribute regularly to retirement accounts like 401(k) or IRA. Take advantage of employer matching contributions if available. Automate your savings to stay consistent.

Invest in diverse assets to grow your retirement fund. Include stocks, bonds, and mutual funds. Diversification reduces risk and increases potential returns.

Investment Strategies

Effective investment strategies are vital for building wealth. Begin by setting clear investment goals. Determine your risk tolerance and time horizon.

Consider various investment options:

- Stocks: Higher risk, higher return potential.

- Bonds: Lower risk, steady income.

- Mutual Funds: Diversified portfolios managed by experts.

- Real Estate: Long-term appreciation and rental income.

Regularly review and adjust your investment portfolio. Stay informed about market trends and economic factors.

Utilize dollar-cost averaging to minimize risk. Invest a fixed amount regularly, regardless of market conditions.

| Investment Type | Risk Level | Return Potential |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Moderate |

| Mutual Funds | Moderate | Varies |

| Real Estate | Moderate | High |

By establishing long-term goals like retirement planning and investment strategies, you pave the way for a stable financial future. These goals help manage income and build wealth over time.

Creating A Realistic Budget

Creating a realistic budget is the first step toward financial stability. A well-planned budget helps you track your income and expenses. This ensures you save effectively and build wealth over time.

Tracking Spending

To create a budget, start by tracking your spending. Record every expense, big and small. Use a notebook or an app. This helps you see where your money goes.

- Write down daily purchases

- Note monthly bills

- Include annual expenses

After tracking, categorize your expenses. Divide them into needs and wants. This helps you understand spending patterns.

Adjusting For Savings

Next, adjust your budget to include savings. Aim to save at least 20% of your income. Start by setting small, achievable goals.

- Set a savings target

- Cut down on non-essential expenses

- Automate your savings

Use a table to visualize your budget:

| Category | Monthly Expense |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $150 |

| Groceries | $300 |

| Entertainment | $100 |

| Savings | $500 |

Review your budget monthly. Adjust it as your financial situation changes. This keeps you on track and helps you achieve your financial goals.

Building Multiple Income Streams

Building multiple income streams is essential for financial stability. Diversifying your income sources can protect you from unexpected financial setbacks. Let’s explore two effective strategies: side hustles and passive income.

Side Hustles

Side hustles are additional jobs you do outside your main job. They can help you earn extra money quickly. Here are some popular side hustles:

- Freelancing: Offer your skills online, like writing or graphic design.

- Ridesharing: Drive for companies like Uber or Lyft.

- Pet Sitting: Take care of pets while owners are away.

- Online Tutoring: Teach subjects you know well.

Side hustles can be flexible and fit around your schedule. They provide immediate income and can grow into a full-time business.

Passive Income

Passive income is money earned with little effort. It continues to flow with minimal work. Here are some popular passive income streams:

- Real Estate: Rent out a property you own.

- Investments: Earn dividends from stocks or interest from bonds.

- Online Courses: Create and sell educational content.

- Royalties: Get paid for books, music, or patents.

Passive income requires an initial investment of time or money. Over time, it can become a significant source of wealth.

| Income Stream | Example | Benefit |

|---|---|---|

| Side Hustle | Freelancing | Quick cash |

| Passive Income | Real Estate | Long-term wealth |

By combining side hustles and passive income, you can build a stable financial future. Start small and grow your income streams over time.

Investing For Wealth Growth

Investing is key to growing your wealth. It involves putting money into assets. These assets can generate returns over time. Understanding different investment options helps in making informed decisions. Two popular investment choices are stocks and real estate.

Stock Market Basics

The stock market allows you to buy shares of companies. Stocks represent ownership in a company. When the company grows, your stock value increases. This can provide capital gains. Stocks also pay dividends, which are regular payments to shareholders.

To invest in stocks, you’ll need a brokerage account. There are two main types of stocks: common stocks and preferred stocks. Common stocks offer voting rights. Preferred stocks provide fixed dividends but no voting rights.

Diversification is crucial in stock investing. It means spreading your investments across different sectors. This reduces risk. For example, you can invest in technology, healthcare, and consumer goods.

| Stock Type | Benefit |

|---|---|

| Common Stocks | Voting rights, potential for high returns |

| Preferred Stocks | Fixed dividends, less risk |

Real Estate Investment

Real estate involves buying property to generate income. You can invest in residential or commercial properties. Real estate can provide rental income and capital appreciation.

There are different ways to invest in real estate:

- Direct ownership: Buying properties yourself

- Real Estate Investment Trusts (REITs): Investing in companies that own real estate

- Real estate crowdfunding: Pooling money with others to buy properties

Real estate investments require careful planning. Consider location, property condition, and market trends. Maintenance costs and property management are also important factors.

Real estate offers tax benefits such as deductions for mortgage interest and depreciation.

Credit: twitter.com

Regularly Reviewing Financial Goals

Regularly reviewing your financial goals is key to achieving stable income and wealth. This practice keeps you on track and aware of your progress. It also helps you adapt to changes and make necessary adjustments.

Progress Tracking

Tracking your progress helps you see how close you are to your goals. It motivates you to stay focused and disciplined. Here are some methods for tracking your financial progress:

- Use a budget planner or app to record expenses and income.

- Set monthly reminders to review your financial status.

- Keep a journal or spreadsheet of your savings and investments.

| Method | Benefits |

|---|---|

| Budget Planner/App | Tracks income and expenses easily |

| Monthly Reminders | Ensures regular reviews |

| Journal/Spreadsheet | Detailed record of savings and investments |

Adjusting Goals As Needed

Sometimes, your financial situation changes. You might get a raise or face unexpected expenses. Adjusting your goals is crucial in these cases. Here are some tips for adjusting financial goals:

- Re-evaluate your financial priorities regularly.

- Set new timelines if needed.

- Adjust your savings or investment plans.

Remember, flexibility is key to achieving long-term financial stability. Regularly reviewing and adjusting your goals ensures you stay on the right path.

Frequently Asked Questions

What Is The Best Way To Set Financial Goals?

Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. Track progress regularly. Adjust plans as needed.

What Is Your Goal To Be Financially Stable?

My goal is to achieve financial stability by saving, investing wisely, and managing expenses effectively. This ensures long-term security.

How Do You Manage Wealth To Have Financial Stability?

To manage wealth for financial stability, create a budget, save regularly, invest wisely, diversify assets, and monitor expenses.

What Are Examples Of Well-written Financial Goals?

Examples of well-written financial goals include saving $10,000 for an emergency fund in one year and paying off $5,000 in credit card debt within six months. Another goal is investing 15% of your monthly income into a retirement account.

Conclusion

Achieving financial goals requires careful planning and discipline. Start by setting realistic, measurable objectives. Track your progress regularly. Adjust strategies as needed to stay on course. Building a stable income and wealth is a gradual process. Stay committed, and you’ll see long-term success.

Financial stability is within your reach.