Yes, you can use QuickBooks for personal finance. While designed for businesses, it also manages personal finances effectively.

QuickBooks is a powerful tool primarily used for business accounting. Many individuals find it equally useful for personal finance management. It helps track expenses, create budgets, and monitor financial goals. Users can categorize transactions, generate reports, and stay on top of their financial health.

With its user-friendly interface, QuickBooks simplifies complex financial tasks. Although it might be more advanced than typical personal finance apps, it offers robust features that can streamline your financial life. Whether managing household budgets or personal investments, QuickBooks provides a comprehensive solution for personal financial management.

Introduction To Quickbooks

QuickBooks is a versatile tool. It helps manage your finances. Many people use it for business. But can you use QuickBooks for personal finance? Let’s find out.

What Is Quickbooks?

QuickBooks is accounting software. It helps keep track of money. You can record expenses and income. It also helps with budgeting. Many small businesses use it. But it can also help individuals.

History And Evolution

QuickBooks was launched in 1983. It was created by Intuit. The software has evolved over time. Each new version brings improvements.

| Year | Milestone |

|---|---|

| 1983 | QuickBooks was launched |

| 1994 | First Windows version released |

| 2000 | Introduced online banking features |

| 2010 | Cloud version introduced |

Over the years, QuickBooks has added many features. Now, it offers cloud storage. You can access your data from anywhere. This makes it very convenient.

QuickBooks is not just for businesses. You can use it for personal finance too. Track your expenses and create a budget. Manage your money better with QuickBooks.

Credit: www.saasant.com

Features Of Quickbooks

QuickBooks is popular for personal finance management. It offers many useful features. These features help users track and manage their finances efficiently.

Key Tools

QuickBooks provides several key tools for managing personal finances:

- Expense Tracking: Keep track of all your expenses in one place.

- Income Management: Record and categorize your income.

- Budgeting: Create and monitor your budget with ease.

- Bill Management: Schedule and pay bills on time.

- Reporting: Generate detailed financial reports.

User Interface

QuickBooks features a user-friendly interface:

- Dashboard: Get an overview of your financial status.

- Navigation: Easily navigate through different sections.

- Customization: Customize the layout to fit your needs.

- Mobile App: Access QuickBooks on the go with the mobile app.

| Feature | Description |

|---|---|

| Expense Tracking | Monitor all your spending in one place. |

| Income Management | Record and categorize your earnings. |

| Budgeting | Create and follow a budget easily. |

| Bill Management | Schedule and pay your bills on time. |

| Reporting | Generate detailed financial reports. |

QuickBooks is a powerful tool for personal finance management. Its key tools and user-friendly interface make it an excellent choice.

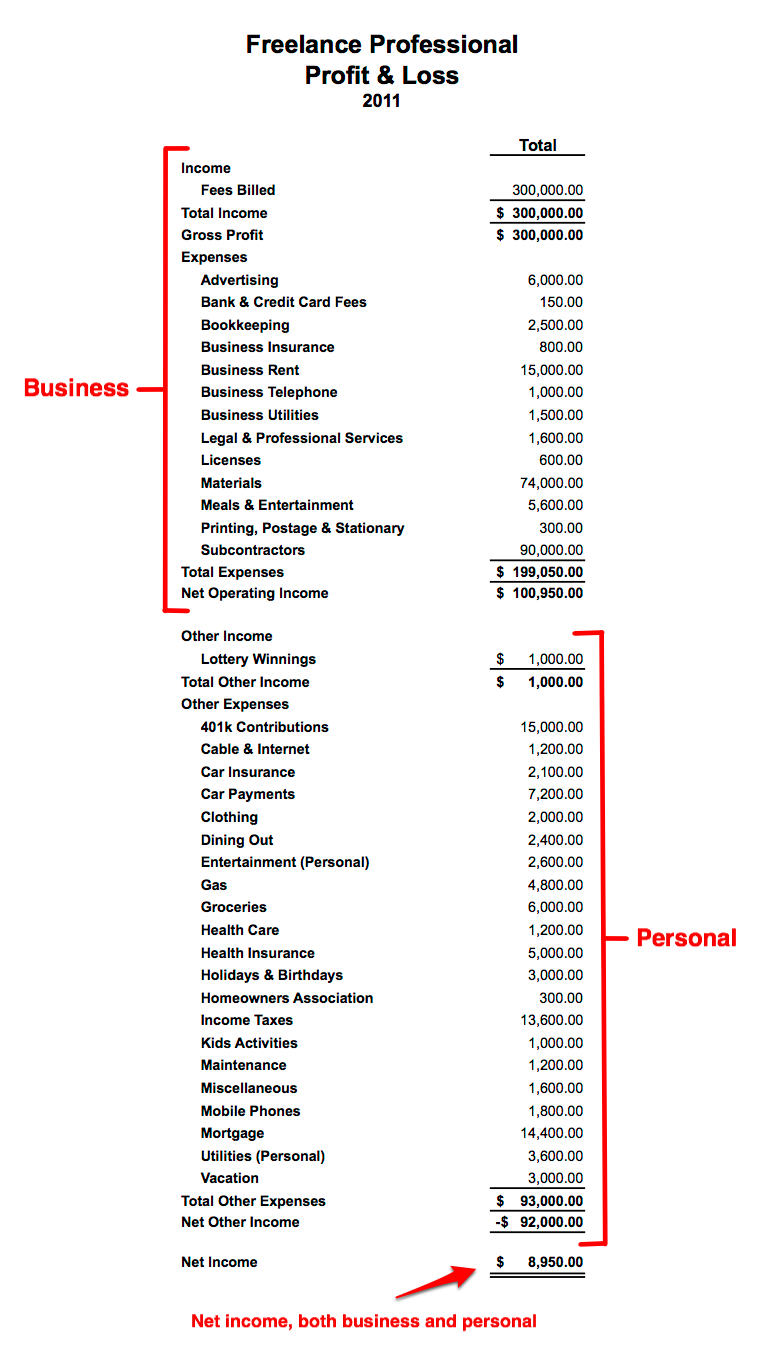

Personal Vs Business Finance

Understanding the distinction between personal and business finance is crucial. This knowledge helps manage both areas effectively. QuickBooks, known for business finance, can also help with personal finance. Let’s explore the differences and similarities.

Differences And Similarities

Personal finance focuses on managing individual or family money. It includes budgeting, saving, and investing. Business finance handles money for a business. It involves managing cash flow, expenses, and profits.

| Aspect | Personal Finance | Business Finance |

|---|---|---|

| Goal | Financial security and growth | Profitability and sustainability |

| Tools | Budget apps, savings accounts | Accounting software, business loans |

| Management | Personal budgeting and tracking | Financial statements and reports |

Both types of finance involve tracking income and expenses. Both require planning and management skills.

Why Personal Finance Matters

Personal finance matters because it ensures financial stability. It helps in achieving personal goals. It also prepares for emergencies and retirement.

- Budgeting: Keeps spending within limits.

- Saving: Builds a safety net for future needs.

- Investing: Grows wealth over time.

Managing personal finance well can reduce stress. It can improve overall quality of life.

Credit: www.quora.com

Setting Up Quickbooks For Personal Use

QuickBooks is a powerful tool for managing finances. It is known for its business applications. But can it be used for personal finance? Absolutely! With a few tweaks, you can manage your personal finances efficiently. This guide will help you set up QuickBooks for personal use.

Initial Setup

To start, download and install QuickBooks. Follow the on-screen instructions. Once installed, create a new company file. Name it something relevant, like “Personal Finances”. This keeps your personal and business finances separate.

Next, set up your accounts. This includes your bank accounts, credit cards, and loans. Go to the ‘Chart of Accounts’ section. Click ‘New’ and select the type of account you want to add. Fill in the required details and save.

Customizing Preferences

QuickBooks allows you to customize preferences. This helps tailor the software to your needs. Start by going to the ‘Edit’ menu and selecting ‘Preferences’.

- General Preferences: Set your home currency, time zone, and date format.

- Banking: Enable online banking if you plan to link your accounts. This feature helps you download transactions directly.

- Reminders: Set up reminders for bill payments, due dates, and other important tasks.

- Reports: Customize reports to track your spending, savings, and investments.

These preferences help you stay organized. They ensure QuickBooks works the way you need it to.

By setting up QuickBooks properly, you can manage your personal finances with ease. The software’s features will help you track spending, create budgets, and save money.

Tracking Income And Expenses

Managing your personal finances can be challenging. QuickBooks offers a powerful solution to streamline this process. By tracking your income and expenses, you gain a clear picture of your financial health. This section will guide you through adding income sources and recording expenses.

Adding Income Sources

To start tracking income, you need to add your income sources in QuickBooks. Follow these simple steps:

- Open QuickBooks and navigate to the Income section.

- Click on Add New Income Source.

- Enter the name of your income source, such as Salary or Freelance Work.

- Specify the amount and frequency of the income.

- Save the details to include this income in your reports.

QuickBooks allows you to categorize different types of income. This helps you understand where your money is coming from. You can visualize your income streams with easy-to-read charts.

Recording Expenses

Tracking expenses is equally crucial for effective personal finance management. QuickBooks simplifies this with an intuitive interface. Here’s how to record your expenses:

- Go to the Expenses section in QuickBooks.

- Click on Add Expense.

- Enter the details, such as Category, Amount, and Date.

- Attach any relevant receipts or documents.

- Save the expense to update your financial records.

To help you stay organized, QuickBooks allows you to create custom categories for expenses. This way, you can track specific types of spending, such as Groceries, Utilities, or Entertainment.

QuickBooks also provides insights into your spending habits. You can generate reports to see where your money is going. This helps you make informed decisions about your budget.

| Feature | Description |

|---|---|

| Income Tracking | Add and categorize income sources to monitor earnings. |

| Expense Recording | Log expenses and attach receipts for detailed tracking. |

| Custom Categories | Create categories for specific expenses and income. |

| Financial Reports | Generate reports to analyze income and expenses. |

Using QuickBooks for personal finance can simplify your life. It provides a clear view of your financial situation. Start tracking your income and expenses today to achieve your financial goals.

Credit: www.blakeoliver.com

Budgeting With Quickbooks

QuickBooks is a powerful tool for managing finances. Many people think it’s only for businesses. But, you can also use QuickBooks for personal finance. One key feature is budgeting. Let’s explore how to budget with QuickBooks.

Creating A Budget

First, create a budget in QuickBooks. Open the software and go to the Budgeting section. Click on “Create New Budget”. Choose the year and type of budget. You can select personal or family budget. Then, add your income sources. Include salary, bonuses, and any other income.

Next, list all your expenses. Break them into categories like housing, food, and entertainment. QuickBooks allows you to add custom categories. Make sure you cover every expense. This helps you see where your money goes.

Once you enter all data, QuickBooks shows a summary. You can see your total income and expenses. Adjust your entries if needed. Make sure your budget is realistic. Save your budget once done. Now, you have a clear financial plan.

Monitoring Progress

After creating a budget, monitor your progress. QuickBooks makes this easy. Go to the Budgeting section again. Click on “Budget vs. Actuals”. This report shows how you are doing compared to your budget. You can see where you overspend or save money.

Track your spending regularly. Update your entries in QuickBooks. This helps you stay on track. If you overspend in one category, cut back in another. Use QuickBooks reports to adjust your budget. This keeps your finances healthy.

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Housing | $1500 | $1450 | +$50 |

| Food | $500 | $600 | -$100 |

| Entertainment | $200 | $180 | +$20 |

QuickBooks helps you keep an eye on your finances. Use its tools to make better decisions. Budgeting with QuickBooks is easy and efficient.

Managing Investments

Using QuickBooks for personal finance offers numerous benefits. One key advantage is managing investments. QuickBooks provides tools to track and monitor your investment portfolio efficiently. This helps you stay informed and make better financial decisions.

Tracking Stocks And Bonds

QuickBooks allows you to track stocks and bonds with ease. You can enter details about each investment, such as:

- Purchase date

- Purchase price

- Number of shares or bonds

This information helps you keep a detailed record of your investments. You can use QuickBooks to update the current value of your stocks and bonds regularly. This helps you see the growth or decline in your investments over time.

QuickBooks also allows you to categorize your investments. You can group them by type, sector, or risk level. This makes it easier to analyze your portfolio and make informed decisions.

Monitoring Portfolio

QuickBooks provides tools to monitor your portfolio efficiently. You can generate reports to see the performance of your investments. These reports can include:

- Profit and loss statements

- Balance sheets

- Investment summaries

These reports help you understand how your investments are performing. You can see which investments are profitable and which are not. This information helps you adjust your investment strategy as needed.

QuickBooks also allows you to set up alerts for your investments. You can receive notifications when the value of a stock or bond changes. This helps you stay updated on your portfolio’s performance without constantly checking it.

| Feature | Description |

|---|---|

| Tracking Stocks and Bonds | Enter and categorize investment details. |

| Monitoring Portfolio | Generate reports and set up alerts. |

Using QuickBooks for managing investments helps you stay organized. It provides tools to track and monitor your stocks and bonds effectively.

Reporting And Analysis

QuickBooks isn’t just for businesses. It’s also great for personal finance. It helps track your money. You can generate reports and analyze your financial health.

Generating Reports

With QuickBooks, you can generate various reports. These reports help you see where your money goes. You can create:

- Income Statements

- Expense Reports

- Cash Flow Statements

Reports show your financial status. They help you make better choices.

Analyzing Financial Health

Reports help analyze your financial health. You can see your income and expenses. This helps you understand your money habits.

| Report Type | Benefit |

|---|---|

| Income Statement | Shows total earnings |

| Expense Report | Shows where you spend |

| Cash Flow Statement | Tracks money in and out |

QuickBooks helps you find spending patterns. This lets you save more. It also helps you plan for the future.

Pros And Cons Of Using Quickbooks

QuickBooks is a powerful tool for business finance. But can it also help with personal finance? Let’s explore the pros and cons of using QuickBooks for managing your personal money.

Advantages

QuickBooks offers many benefits for personal finance. Below are some of the key advantages:

- Comprehensive Financial Tracking: QuickBooks tracks all your expenses and income. This helps you see where your money goes.

- Budgeting Tools: QuickBooks offers tools to create and manage budgets. You can set spending limits and track progress.

- Bill Management: You can set up reminders for bill payments. This helps avoid late fees.

- Investment Tracking: Track your investments and their performance. This keeps you informed about your financial health.

- Reports and Insights: Generate detailed reports on your finances. These reports help you make informed decisions.

Limitations

While QuickBooks is powerful, it has some limitations for personal finance:

- Complexity: QuickBooks can be complex for personal use. It has many features that may not be needed.

- Cost: QuickBooks is not free. There are cheaper alternatives for personal finance.

- Business Focused: The software is designed for businesses. Personal finance features may not be as robust.

- Learning Curve: It takes time to learn how to use QuickBooks effectively. This can be a barrier for some users.

- Lack of Personal Finance Features: It lacks some specific personal finance tools. For example, it does not include retirement planning features.

Alternatives To Quickbooks

While QuickBooks is a powerful tool for managing finances, it is primarily designed for business use. For personal finance, there are other tools that might be more suitable. These alternatives can offer features specifically tailored to personal budgeting, expense tracking, and savings goals.

Other Personal Finance Tools

Several personal finance tools can help manage your money effectively. Here are a few popular options:

- Mint: Mint is a free tool that connects to your bank accounts. It helps you track spending, create budgets, and set financial goals.

- YNAB (You Need A Budget): YNAB focuses on helping users allocate every dollar they earn. It promotes proactive budgeting to avoid debt.

- Personal Capital: Personal Capital offers a suite of tools for tracking spending, budgeting, and investing. It’s a good choice for those with more complex financial needs.

- EveryDollar: Created by Dave Ramsey, EveryDollar helps users create monthly budgets. It focuses on a zero-based budgeting approach.

Comparison

Below is a comparison table of the key features of these tools:

| Feature | Mint | YNAB | Personal Capital | EveryDollar |

|---|---|---|---|---|

| Budgeting | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Investment Tracking | No | No | Yes | No |

| Free Version | Yes | No | Yes | Yes |

| Proactive Budgeting | Limited | Yes | No | Yes |

Choosing the right personal finance tool depends on your individual needs. If you need investment tracking, Personal Capital might be the best choice. For straightforward budgeting, Mint or EveryDollar are excellent options.

Frequently Asked Questions

Does Anyone Use Quickbooks For Personal Finance?

Yes, some people use QuickBooks for personal finance. It helps manage budgets, track expenses, and monitor financial goals effectively.

What Is The Quickbooks Equivalent For Personal Finances?

The QuickBooks equivalent for personal finances is Quicken. Quicken helps manage personal budgets, track expenses, and monitor investments efficiently.

Can Quickbooks Be Used For Personal Expenses?

Yes, QuickBooks can track personal expenses. Create a separate account to keep personal and business finances distinct.

Can I Use Quickbooks Without A Business?

Yes, you can use QuickBooks for personal finances. It helps manage expenses, track income, and create budgets.

Conclusion

QuickBooks can be a powerful tool for managing personal finances. Its features simplify budgeting, tracking expenses, and financial planning. While designed for businesses, individuals can benefit greatly. Customize it to fit personal needs and enhance your financial health. Consider exploring QuickBooks to streamline your financial management today.