To stick to a budget, track your expenses and set clear financial goals. Prioritize your spending to match these objectives.

Creating and sticking to a budget can often feel like a daunting task, yet it’s a fundamental step toward financial freedom and stability. It involves understanding your income, distinguishing between wants and needs, and being mindful of your spending habits.

Staying within a budget requires discipline, planning, and a bit of creativity, especially when unexpected expenses arise. By following a few simple strategies, you can manage your money more effectively, reduce stress, and achieve your financial goals. This process not only helps in saving money but also in making informed decisions about future investments and expenditures. Embracing the budgeting journey can lead to a more organized financial life, where every dollar is accounted for and works in your favor.

Credit: bookkeepers.com

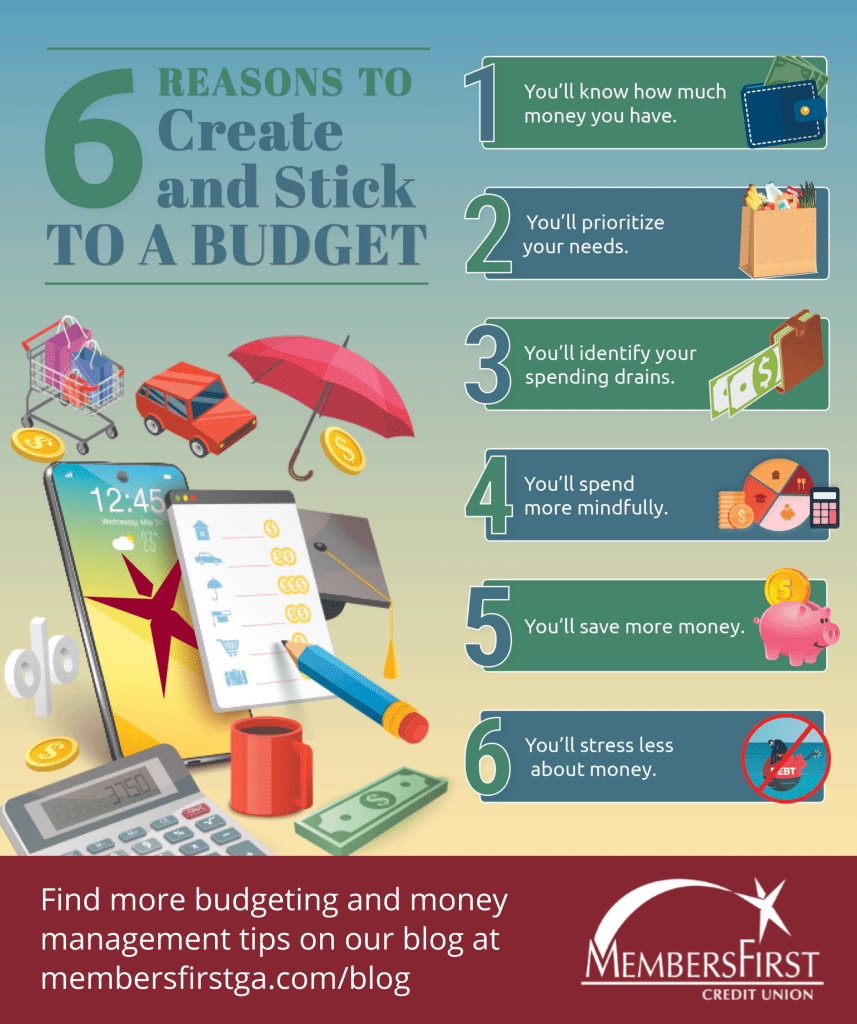

The Importance Of Budgeting

The Importance of Budgeting lies at the heart of managing finances. It’s the roadmap that guides us to spend wisely, save consistently, and prepare for the future. Without a budget, it’s easy to lose track of where our money goes. This can lead to stress and financial trouble. A well-planned budget helps avoid this, ensuring peace of mind and financial security.

Cultivating Financial Discipline

Budgeting teaches us to control spending. It’s like a fitness plan but for money. Just as exercise strengthens muscles, budgeting strengthens willpower. This discipline is crucial. It helps us resist the urge to spend on things we don’t need.

- Track every penny: Know where your money goes.

- Set clear goals: Save for a car, home, or vacation.

- Avoid debt: Spend less than you earn.

Long-term Financial Health

A strong budget ensures a brighter financial future. It’s not just about saving for next month. It’s about securing your financial well-being for years to come. This includes retirement, emergencies, and even fun things like vacations.

- Build an emergency fund for tough times.

- Invest in your future with retirement savings.

- Enjoy life without financial stress.

Remember, budgeting isn’t about restricting freedom. It’s about creating financial freedom. Start budgeting today for a better tomorrow.

Credit: membersfirstga.com

Setting Realistic Budget Goals

Creating a budget starts with setting goals that match your financial situation. Goals should be clear and reachable. This balance is key to sticking to a budget. Let’s dive into how you can set yourself up for success.

Assessing Income And Expenses

Knowing what you earn and spend is the first step. Start by listing all income sources. Include your salary, side gigs, and any passive income. Next, track every expense. Think rent, utilities, groceries, and entertainment. Use a simple table to see everything clearly:

| Income Sources | Monthly Amount |

|---|---|

| Main Job | $3000 |

| Side Hustle | $500 |

| Other Income | $200 |

For expenses, categorize them to see where money goes:

- Rent/Mortgage: $1200

- Utilities: $300

- Groceries: $400

- Entertainment: $100

Balancing Aspirations With Practicality

Set goals that inspire yet are achievable. Dream of a vacation? Include a savings category for it. Want to reduce debt? Add a monthly payoff goal. Ensure these targets don’t exceed your income. Here’s an example:

- Determine the cost of your goal.

- Divide the cost by months left in the year.

- Adjust your expenses to save for the goal.

This approach helps you see progress and stay motivated. Remember, goals can change. Review and adjust them regularly. With realistic goals, your budget becomes a tool for financial freedom, not a burden.

Tracking Your Spending

Knowing where your money goes is key to sticking to a budget. Tracking your spending shines a light on your financial habits. You see what you really spend, not just what you think you spend. With this insight, you can make smart decisions to stay within your budget.

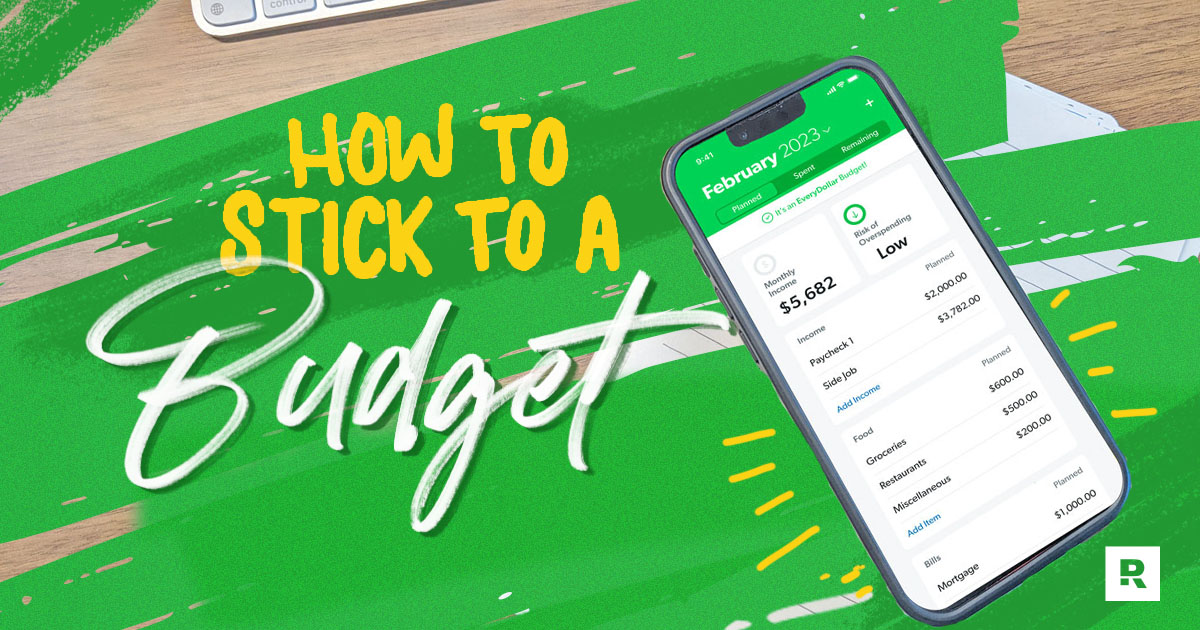

Effective Use Of Budgeting Apps

Budgeting apps simplify tracking every penny. They link to your bank accounts and categorize your transactions. You see your spending in real-time. Many apps also set alerts for budget limits. This keeps you on track. Some popular apps include Mint, YNAB (You Need A Budget), and PocketGuard.

- Real-time tracking shows spending habits.

- Alerts notify you before overspending.

- Categories help identify spending areas.

The Envelope System

The envelope system is a hands-on method for managing cash spending. Label envelopes for different budget categories like groceries, dining out, and entertainment. Each month, fill the envelopes with the budgeted cash amount. Once an envelope is empty, you stop spending in that category. It’s a simple, effective way to avoid overspending.

| Category | Monthly Budget |

|---|---|

| Groceries | $300 |

| Dining Out | $150 |

| Entertainment | $100 |

With the envelope system, you see and feel your spending. It makes you think twice before parting with your cash. This tactile approach can be more effective for some than digital tracking.

- Physical envelopes represent budget categories.

- Cash limits control spending.

- Tactile experience teaches money value.

Credit: www.ramseysolutions.com

Cutting Unnecessary Expenses

Managing money wisely often means trimming the fat from your budget. This involves a deep dive into your spending habits to locate and eliminate wasteful expenses. Let’s explore how you can identify financial leaks and find smart alternatives to your usual spending.

Identifying Financial Leaks

Financial leaks silently drain your wallet. Spot these by reviewing bank statements and tracking daily spending. Look for patterns in your behavior that lead to unnecessary purchases. Common leaks include unused subscriptions, daily coffee runs, or frequent take-out meals.

- Cancel subscriptions you rarely use.

- Limit dining out to special occasions.

- Cut back on impulse buys by making a shopping list.

Smart Alternatives To Common Expenditures

Embracing smart alternatives can save you a bundle. Instead of buying new, consider second-hand items. Swap out pricey brands for generic ones. Share plans like streaming services with family or friends to split the cost.

| Expense | Traditional Choice | Smart Alternative |

|---|---|---|

| Gym Membership | High-end gym | Free workout videos online |

| Cable TV | Expensive package | Streaming services |

| Books | New purchases | Library or e-books |

- Opt for cooking at home over eating out.

- Use public transport rather than a personal vehicle.

- Choose free entertainment options like parks and community events.

Prioritizing Savings

Sticking to a budget isn’t just about cutting expenses. Saving money should take priority. This ensures a secure financial future. Let’s dive into how to make savings a top priority.

Automating Your Savings

Automating your savings is like putting your financial goals on autopilot. Choose a fixed amount. Set it to transfer from your checking to your savings account each month. This way, you save without thinking about it.

- Decide on a savings goal. Think about what you’re saving for.

- Set up automatic transfers. Use online banking to make this easy.

- Check regularly. Make sure transfers are going smoothly.

Creating A Savings Buffer

A savings buffer acts as a financial cushion. It can protect you from unexpected costs. Aim to build a buffer that covers 3-6 months of living expenses.

| Step | Action |

|---|---|

| 1 | Calculate monthly expenses. |

| 2 | Set a buffer goal. |

| 3 | Start small. |

| 4 | Grow your buffer over time. |

Remember, these steps build a safety net. Your financial health improves.

Dealing With Debt

Dealing with debt is a crucial step in sticking to a budget. It’s about finding the right balance. Tackling debt head-on can free up more of your money. This means more cash for savings or spending on things you enjoy. Let’s dive into how you can manage and reduce your debt effectively.

Strategies To Reduce Debt

Reducing debt may seem tough, but it’s doable with the right plan. Here are some tried-and-true strategies:

- Pay more than the minimum – Always try to pay a bit extra on your debts.

- Use the snowball method – Pay off small debts first, then tackle the bigger ones.

- Consider debt consolidation – Combine multiple debts into one with a lower interest rate.

- Negotiate lower interest rates – Call your creditors and ask for a rate reduction.

Avoiding New Debt Traps

To truly stick to your budget, it’s crucial to avoid falling back into debt. Here are some tips:

- Stick to a strict budget – Know what you can afford and don’t go over that.

- Save for emergencies – Build an emergency fund to cover unexpected expenses.

- Use cash or debit cards – Avoid using credit cards for everyday purchases.

- Research before big purchases – Always look for the best deal and save up before buying.

Shopping Smart

Shopping smart means making wise choices to stretch your budget. It’s about getting the best deals and timing your purchases. This approach helps you save money. You can still enjoy quality items without overspending. Let’s dive into how you can leverage discounts and plan your shopping.

Leveraging Discounts And Coupons

Discounts and coupons reduce your spending. They are easy to find and use. Look for coupons online, in newspapers, or in store apps. Always check for discounts before you buy. Sign up for loyalty programs at your favorite stores. They often provide members-only coupons. Buy items in bulk during sales to save more. Remember, use coupons for products you need, not just because they are on sale.

- Check online for promo codes before shopping.

- Use cashback apps to earn money back.

- Sign up for newsletters to get exclusive deals.

Timing Purchases Strategically

Strategic timing is key for saving money. Learn the best times to buy items. For example, buy holiday decor after the holiday. This is when stores drop prices. Purchase winter clothes in spring and summer clothes in fall. Prices are lower as stores clear out old stock. Use price tracking tools to monitor deals. This way, you can buy when prices hit their lowest.

| Item | Best Time to Buy |

|---|---|

| Electronics | Black Friday Sales |

| Furniture | Late Winter |

| Clothing | End of Season Sales |

Plan big purchases around sales events. These include Black Friday, Cyber Monday, and end-of-season sales. Set reminders for these dates. Track prices before sales to ensure you get real deals.

By shopping smart, you can make your budget work harder for you. Use these strategies to shop effectively. Save money while enjoying the things you love.

Staying Motivated

Sticking to a budget can be tough. Motivation is key. Without it, the best-laid financial plans can fall apart. Here are some ways to stay motivated.

Setting Milestones And Rewards

Break your financial goals into smaller milestones. This makes them more manageable. Set a reward for each milestone you reach. It could be as simple as a coffee out or a movie night. Make sure these rewards don’t break your budget. Celebrate every victory. It keeps you driven towards your next goal.

- Write down each milestone

- Choose affordable rewards

- Celebrate small wins

The Role Of Financial Literacy

Understanding money management is crucial. Financial literacy helps you make informed decisions. It keeps you motivated. Knowing the impact of each financial choice can inspire you to stick to your budget.

| Topic | Resource |

|---|---|

| Budgeting Basics | Online Courses |

| Saving Strategies | Books |

| Investment Tips | Workshops |

Find resources that suit your learning style. Keep expanding your financial knowledge. Use what you learn to improve your budgeting skills.

- Attend workshops

- Read books

- Take online courses

Frequently Asked Questions

Why Do I Struggle To Stick To A Budget?

Struggling to stick to a budget often stems from unrealistic planning, lack of discipline, unexpected expenses, and insufficient tracking of spending habits. Prioritizing needs over wants and reviewing budget plans regularly can help overcome these challenges.

What Is The 50/30/20 Rule?

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment.

How To Stay Committed To A Budget?

To stay committed to a budget, track your spending regularly. Set realistic goals and prioritize them. Adjust your budget as needed for flexibility. Reward yourself for small successes to stay motivated. Use budgeting tools or apps for easier management.

How Do I Stop Obsessing Over My Budget?

To stop obsessing over your budget, set realistic goals and track spending weekly instead of daily. Prioritize expenses, allowing for small treats. Embrace flexibility and adjust as needed. Remember, perfection isn’t the goal; financial health is. Seek support from budgeting communities or apps for guidance and motivation.

Conclusion

Sticking to a budget can transform your financial health. By setting clear goals, tracking expenses, and adjusting habits, you’ll manage money with confidence. Remember, consistency is key. Start small and stay committed—your future self will thank you for the fiscal discipline and peace of mind.

Let’s make smart budgeting a lifestyle!