To withdraw from retirement accounts, first determine the type of account and then follow the specific withdrawal rules. Contact your financial institution or plan administrator for guidance.

Planning for retirement is crucial, but understanding how to access your funds once you’ve reached this milestone is equally important. Navigating the maze of retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, can seem daunting. Each type of account has its own set of rules regarding withdrawals, taxes, and penalties.

Early preparation and knowledge can help you avoid common pitfalls, ensuring that your retirement savings are working for you in the most efficient way possible. This brief guide aims to demystify the process, offering you a clear path to accessing your hard-earned money when you need it most. Remember, making informed decisions about your retirement accounts can significantly impact your financial security in your golden years.

Introduction To Retirement Withdrawals

Understanding retirement withdrawals is key for a secure future. It’s about knowing when and how to access your funds without facing high taxes or penalties. This guide simplifies the process, focusing on why a smart withdrawal strategy matters and explaining key terms.

Why Withdrawal Strategy Matters

Choosing the right time to withdraw from your retirement accounts can save you money. It affects your taxes, penalties, and how long your savings will last. A good strategy helps ensure you have enough funds throughout retirement.

- Lower Taxes: Withdraw at the right time to pay less tax.

- Avoid Penalties: Know the rules to dodge early withdrawal fees.

- Make Savings Last: Smart withdrawals mean money when you need it.

Key Terms Simplified

Let’s break down some important terms:

| Term | Definition |

|---|---|

| IRA | Individual Retirement Account, a saving tool with tax benefits. |

| RMD | Required Minimum Distribution, the minimum you must withdraw annually after a certain age. |

| 401(k) | A retirement savings plan offered by many employers. |

Age Matters: Know The Rules

Planning your retirement withdrawals is crucial. Your age determines when you can access funds without penalties. Understanding the rules protects your savings and ensures financial stability during retirement.

Minimum Age Requirements

Retirement accounts have specific age rules. The IRS sets minimum ages for withdrawal without penalties. Know these ages to plan effectively.

- Traditional IRAs and 401(k)s: Age 59½ is key.

- Roth IRAs: Contributions can be withdrawn anytime.

- Earnings in Roth IRAs follow different rules.

Penalties For Early Withdrawal

Withdrawing early often leads to penalties. Avoid these to protect your retirement funds.

| Account Type | Early Withdrawal Penalty |

|---|---|

| Traditional IRA/401(k) | 10% penalty plus taxes |

| Roth IRA | 10% penalty on earnings before 59½ |

Special circumstances may waive penalties. These include medical expenses and first-time home purchases.

Types Of Retirement Accounts

Understanding retirement accounts is key to smart financial planning. Let’s explore the different types that can help you save for the future.

401(k) And Ira Basics

- 401(k) plans are employer-sponsored retirement savings accounts.

- Employees can contribute a portion of their paycheck before taxes.

- Many employers offer a match to employee contributions, boosting the savings potential.

- Individual Retirement Accounts (IRAs) are personal savings plans.

- IRAs offer tax benefits for retirement savings.

- Contributions can be made with pre-tax or after-tax dollars, depending on the account type.

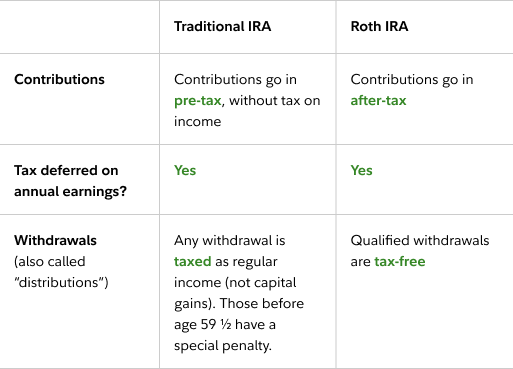

Differences Between Roth And Traditional Accounts

| Roth Accounts | Traditional Accounts |

|---|---|

| Contributions are made with after-tax dollars. | Contributions are made with pre-tax dollars. |

| Withdrawals during retirement are generally tax-free. | Withdrawals are taxed as income during retirement. |

| No required minimum distributions (RMDs) during the owner’s lifetime. | RMDs must start at age 72, as per IRS rules. |

| Income limits may restrict eligibility to contribute. | No income limits to contribute, but there are limits on tax deductions. |

Selecting the right account depends on your current tax rate, expected future income, and retirement goals.

Credit: www.fool.com

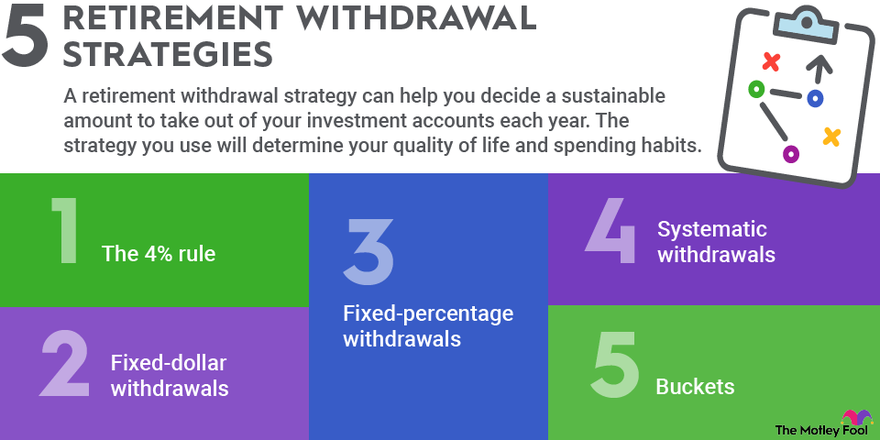

Determining How Much To Withdraw

Retirement is a time for relaxation, not stress. Knowing how much money to withdraw from retirement accounts is crucial. It’s about balance and making smart choices. Let’s dive into the best methods to determine the right amount for you.

Calculating Required Minimum Distributions

Required Minimum Distributions (RMDs) are withdrawals you must make. The IRS sets these rules. RMD amounts depend on your account balance and age. Use IRS tables to find your factor. Divide your account balance by this factor. This gives your annual RMD.

| Age | Distribution Period | Year-End Account Balance | Minimum Withdrawal |

|---|---|---|---|

| 70 | 27.4 | $100,000 | $3,649.64 |

| 80 | 18.7 | $100,000 | $5,347.59 |

RMDs ensure you withdraw funds at a steady pace. This helps avoid a heavy tax burden later. Start these withdrawals by April 1 after turning 72.

Assessing Your Financial Needs

Create a budget to assess your financial needs. List all monthly expenses. Include bills, food, healthcare, and leisure. Subtract this from your monthly income. The result is your needed withdrawal.

- Monthly Income: Pensions, Social Security, other earnings.

- Monthly Expenses: Housing, utilities, insurance, groceries.

- Leisure: Travel, hobbies, gifts, memberships.

Consider inflation and unexpected costs. Withdraw enough for a comfortable lifestyle. Avoid depleting your savings too quickly. Review and adjust your plan yearly. This keeps your withdrawals in line with your needs.

Tax Implications Of Withdrawals

When planning retirement withdrawals, understanding the tax impact is crucial. Each withdrawal can affect your annual tax bill. Knowing how taxes apply helps manage your retirement savings effectively.

Understanding Tax Rates

Retirement account withdrawals can be taxable. The rate depends on the account type and your income. Traditional IRAs and 401(k)s often lead to taxes at your current income tax rate. Roth accounts provide tax-free withdrawals in retirement.

Strategies To Minimize Taxes

Several strategies can help reduce taxes on withdrawals. Consider these:

- Withdrawal timing: Align withdrawals with lower income years to reduce tax rates.

- Roth conversions: Convert traditional IRAs to Roth IRAs during low-income years.

- Account type usage: Use taxable accounts first, then tax-deferred, and lastly tax-free accounts.

Employing these strategies can save on taxes and stretch retirement funds.

Credit: www.fidelity.com

Timing Your Withdrawals

Timing your withdrawals from retirement accounts is key. It impacts your finances greatly. Let’s explore smart strategies for when and how to withdraw.

The Pros And Cons Of Lump Sum Vs. Annuity

Choosing between a lump sum and an annuity can be tough. Here’s a breakdown:

- Lump Sum: Get all your money at once.

- Pros: Full control over investments. Potential for higher returns.

- Cons: Risk of spending too fast. Possible tax hits.

- Annuity: Payments spread over time.

- Pros: Steady income. Less worry about running out of money.

- Cons: Less control. Lower potential for growth.

Seasonal And Market Timing Considerations

When you withdraw can also depend on the market and the season. Let’s see why:

- Seasonal Timing: Taxes and holidays matter.

- Withdraw in lower-income years. Save on taxes.

- Consider holidays and expenses. Plan withdrawals accordingly.

- Market Timing: It’s about the economy’s ups and downs.

- Withdraw when the market is high. Your investments are worth more.

- Avoid selling in a down market. It can hurt your savings.

Impact On Government Benefits

The Impact on Government Benefits is a crucial aspect to consider when withdrawing from retirement accounts. It’s important to understand how these withdrawals can affect Social Security and Medicare benefits. Let’s delve into the specifics.

Social Security And Medicare Effects

Taking money out of retirement accounts can change your benefit amounts. Social Security and Medicare could see effects based on your income. Higher income can mean more taxes on Social Security benefits. It can also lead to higher Medicare Part B and D premiums. Careful planning is key to managing these potential impacts.

Avoiding Reductions In Benefits

It’s possible to minimize the effect on your benefits. Start by understanding the income limits. Keep your withdrawals below these levels. Consider spreading large withdrawals over multiple years. This can help keep your reported income lower. Use Roth accounts for tax-free withdrawals. These don’t count towards your income. This way, you can reduce or avoid extra taxes and benefit reductions.

- Know income thresholds: Stay under the limits to protect benefits.

- Spread out withdrawals: Avoid income spikes by planning withdrawals.

- Use Roth IRAs: Tax-free withdrawals keep income lower.

Investment Strategies For Retirees

Retirees need smart investment strategies. These strategies help maintain wealth. They also provide needed income. Let’s discuss balancing risk and return. We’ll also cover portfolio rebalancing.

Balancing Risk And Return

Risk tolerance changes after retirement. Stable income becomes crucial. Investments must align with this need.

- Stocks offer growth potential. They carry higher risk.

- Bonds are less risky. They provide steady income.

- Mutual funds can balance both. They diversify investments.

Consider your living expenses. Factor in health care costs. Choose investments wisely.

Rebalancing Your Portfolio

Market shifts affect investment balance. Rebalancing restores original investment goals.

- Review your portfolio regularly. Aim for semi-annual check-ins.

- Assess performance against goals. Adjust as needed.

- Sell overperforming assets. Buy underperforming ones. Maintain your strategy.

Rebalancing helps manage risk. It keeps your strategy on track. Seek professional advice if needed.

Life Events And Withdrawal Adjustments

Retirement savings need careful management. Life events often require adjustments to how you withdraw funds. This section explains how to adapt your retirement withdrawals due to changes in health and marital status, and estate planning considerations.

Adapting To Changes In Health

Health shifts impact retirement funds. A diagnosis or improved health can change financial needs. Review your plan annually. Adjust withdrawals to match current health expenses. Consider longevity and potential long-term care costs. Use flexible accounts for unexpected health-related expenses.

Adapting To Changes In Marital Status

Marriage or divorce affects retirement accounts. Update beneficiaries after marital changes. Joint accounts may need division or consolidation. Seek professional advice to navigate these changes. Ensure your withdrawal strategy reflects your new status.

Leaving A Legacy: Estate Planning Considerations

- Name beneficiaries to streamline asset transfer.

- Review estate plans regularly for changes in law or family dynamics.

- Consider taxes on retirement account inheritances.

- Use trusts for more complex situations.

Effective estate planning secures your legacy. Your retirement account is part of this plan. Make sure loved ones understand your wishes.

Credit: barbarafriedbergpersonalfinance.com

Professional Advice And Tools

Understanding when and how to withdraw from retirement accounts is crucial. The right professional advice and tools can guide you. They ensure you make informed decisions for your future. Let’s explore how financial advisors and retirement calculators can help.

When To Consult A Financial Advisor

Retirement planning can seem daunting. A financial advisor simplifies this process. They offer tailored advice based on your unique situation. Below are instances when a financial advisor becomes essential:

- Complex financial situations: Advisors unravel the complexities.

- Major life changes: Marriage, divorce, or job loss impact retirement plans.

- Nearing retirement: Advisors help with the transition.

- Investment choices: They suggest the right mix for your portfolio.

Utilizing Retirement Calculators

Retirement calculators are powerful tools. They project your retirement savings growth. They also estimate how long your funds will last. Here’s how to use them:

- Enter personal data: age, income, savings, and investment return rates.

- Adjust scenarios: see how changes affect your retirement outlook.

- Plan contributions: calculate how much to save each month.

These calculators offer a glimpse into your financial future. They are simple to use and available online. Use them regularly to stay on track.

Common Mistakes To Avoid

Withdrawing from retirement accounts needs careful planning. Avoid common mistakes to keep your future secure.

Overlooking Inflation

Many people forget about inflation. It reduces money value over time. This mistake can lead to not having enough money later. Think about inflation when you withdraw. This will help your savings last longer.

Ignoring Longevity Risks

People live longer now. Ignoring this can make you run out of money. Make sure your money lasts as long as you do. Plan withdrawals thinking you might live longer.

- Review your plan yearly.

- Consider inflation rates.

- Think about healthcare costs.

Conclusion: Creating A Sustainable Withdrawal Plan

Crafting a sustainable withdrawal plan is crucial for retirement. It ensures your savings last. Let’s explore key steps to achieve this.

Recap Of Smart Withdrawal Tips

- Start early: Planning ahead gives more flexibility.

- Know the rules: Understand taxes and penalties.

- Use a budget: Track spending to avoid running out.

Following these tips can help avoid common pitfalls. It keeps your finances healthy.

Staying Flexible And Informed

The market changes. Your needs might too. Staying flexible is key.

- Review your plan yearly.

- Adjust withdrawals as needed.

- Keep learning about finance.

This approach helps tackle unexpected challenges. It ensures your retirement fund grows with you.

Frequently Asked Questions

How Do You Take Money Out Of Your Retirement Account?

To withdraw funds from your retirement account, contact your plan provider, complete the required forms, and choose your withdrawal amount. Be mindful of potential taxes and early withdrawal penalties.

Can I Withdraw My Retirement Account?

Yes, you can withdraw from your retirement account, but consider potential penalties and tax implications. Check specific rules for your account type and age before proceeding.

In What Order Should I Withdraw From My Retirement Accounts?

Start with taxable accounts, followed by tax-deferred retirement accounts like 401(k)s, and lastly, withdraw from Roth IRAs due to their tax-exempt status.

Can I Take Money Out Of My Retirement Account Without Penalty?

You can withdraw money from your retirement account without penalty after age 59½. Certain exceptions, like medical expenses, may also allow penalty-free withdrawals.

Conclusion

Navigating the maze of retirement account withdrawals can be daunting. By understanding the rules and penalties, you can make informed decisions that protect your financial future. Remember, planning and timing are everything. Seek guidance, stay informed, and ensure your golden years are truly golden.