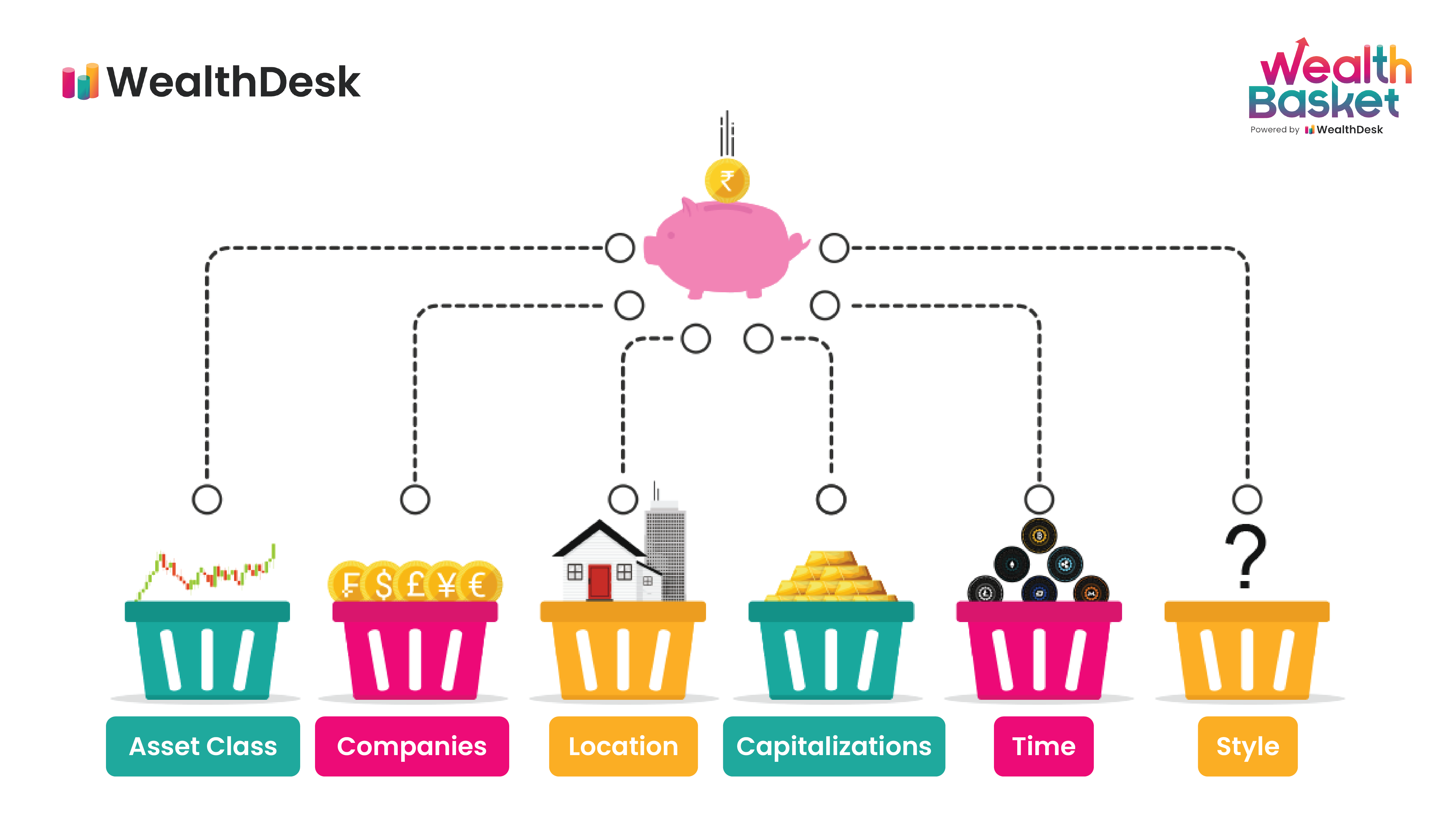

To diversify your investment portfolio, spread your assets across various investment types and sectors. Aim for a mix of stocks, bonds, and real estate.

Diversifying your investment portfolio is like creating a safety net for your finances. It’s the strategic allocation of your assets across different types of investments, such as stocks, bonds, real estate, and even cash or cash equivalents. This method aims to reduce risk and increase the potential for returns.

Each investment type reacts differently to market conditions, so when one might be underperforming, another could be thriving. By spreading your investments, you’re less likely to feel the full impact of a downturn in any single sector or asset class. Think of it as not putting all your eggs in one basket. A well-diversified portfolio can help you achieve more stable and potentially more profitable investment outcomes over time.

The Importance Of Portfolio Diversification

The Importance of Portfolio Diversification is clear to savvy investors. It spreads out your investment risks. It can also help you earn more money from your investments. Think of it as not putting all your eggs in one basket.

Mitigating Risks

Diversification helps to lower your investment risks. If one investment does poorly, others might do well. This balance can protect your money.

- Spread investments across different sectors.

- Include various asset classes in your portfolio.

- Consider geographical diversification to reduce regional risks.

Enhancing Potential Returns

Diversifying your portfolio can also increase your chances of earning more. Different investments perform well at different times.

- Stocks offer growth opportunities.

- Bonds provide steady income.

- Real estate can offer both income and growth.

Combining these can give you a balance of growth and income.

Credit: navi.com

Assessing Your Current Investment Mix

Before diving into new investments, assess your current portfolio. This process lays the groundwork for diversification success. Let’s explore the essentials of evaluating your existing investments.

Understanding Asset Allocation

Asset allocation is key in diversification. It involves spreading your investments across various asset classes. A balanced mix reduces risk and improves potential returns. Consider these main types:

- Stocks: Shares in companies, high growth potential

- Bonds: Government or corporate debt, offer regular income

- Real Estate: Property investment, can appreciate over time

- Cash: Low risk, provides liquidity

Check your current balance. Does it match your risk tolerance? Use this insight to adjust accordingly.

Reviewing Investment Performance

Analyze each asset’s performance. Identify winners and underperformers. This review helps you make informed decisions.

| Investment | Performance (%) | Time Frame |

|---|---|---|

| Stocks | +10 | 1 Year |

| Bonds | +3 | 1 Year |

| Real Estate | +5 | 1 Year |

| Cash | +1 | 1 Year |

Compare past performance with current goals. Adjust your investments to stay on track. Regular reviews ensure your portfolio aligns with your financial objectives.

Asset Classes To Consider

Diversifying your investment portfolio is key to managing risk. It involves spreading your investments across different asset classes. This can help you balance your risks and rewards. Here are some asset classes you should consider.

Stocks: Different Sectors And Sizes

Stocks represent ownership in companies. They can grow in value over time. You should look at different sectors like technology, healthcare, and finance. Also, consider company sizes. These range from large, established firms to small, growth-focused ones. This mix can offer stability and growth potential.

Bonds: Government Vs. Corporate

Bonds are loans you give to the issuer. Government bonds are often safer. They have lower returns. Corporate bonds can be riskier. They may offer higher returns. Choose a mix of both to balance safety and yield.

Real Estate And Commodities

Real estate can provide rental income and value appreciation. Commodities like gold and oil can hedge against inflation. They can also add diversity to your portfolio.

Cash And Cash Equivalents

Cash and cash equivalents include savings accounts and money market funds. They offer low returns. But, they are very safe. They give you liquidity. This means you can access your money when you need it.

The Role Of Alternative Investments

Diversifying an investment portfolio is key to managing risk and maximizing returns. Traditional stocks and bonds are familiar to most investors, but alternative investments can play a critical role. These assets do not correlate closely with standard market movements, offering balance during volatility. Let’s explore two categories: private equity with hedge funds, and the emerging world of cryptocurrencies and art.

Private Equity And Hedge Funds

Private equity involves investing directly into companies not listed on public exchanges. These investments often aim for higher returns than the public market can offer. They also require longer commitment periods, known as “lock-up” times. Private equity can bring substantial rewards, but it comes with higher risk and less liquidity.

Hedge funds are pooled investment funds that employ different strategies to earn active returns for their investors. Hedge funds may trade in public stocks, but they also engage in more complex trades such as derivatives, swaps, and arbitrage. They aim to generate returns regardless of market conditions, making them a valuable portfolio addition during uncertain times.

Cryptocurrencies And Art

The digital age has introduced cryptocurrencies as a novel investment class. These digital assets use blockchain technology to secure transactions. Cryptocurrencies can be highly volatile, but they offer an uncorrelated asset class to traditional markets. This makes them an intriguing option for portfolio diversification.

Investing in art can also enhance a portfolio. Art holds value over time, often appreciating regardless of stock market conditions. While it requires a keen eye for potential and an understanding of the art market, art can serve as a long-term investment with cultural and aesthetic value.

Both private equity with hedge funds and the pairing of cryptocurrencies with art represent opportunities for investors to broaden their horizons. These alternative investments can complement traditional assets, potentially leading to a stronger, more resilient investment portfolio.

Geographical Diversification

Geographical Diversification is key to a balanced investment portfolio. It spreads risk across different regions. Diverse economies react differently to the same event. This can protect your investments.

Investing In Emerging Markets

Emerging markets offer growth potential. They include countries like Brazil, India, and China. These markets can yield high returns. But they carry higher risks too.

- Economic Growth: Emerging markets often grow fast.

- Demand Increase: New technologies boost these markets.

- Portfolio Impact: They can add significant value to portfolios.

Developed Markets Vs. Frontier Markets

| Developed Markets | Frontier Markets |

|---|---|

| Stable and well-established. | Less mature than emerging markets. |

| Lower growth, lower risk. | High potential growth, high risk. |

| Examples: USA, UK, Japan. | Examples: Vietnam, Kenya, Argentina. |

Investing in both developed and frontier markets can balance your risks. Developed markets bring stability. Frontier markets offer growth.

Credit: wealthdesk.in

Timing The Market Vs. Time In The Market

Many people talk about Timing the Market vs. Time in the Market. This idea is key for investors. Let’s dive into what each means for your wallet.

The Pitfalls Of Market Timing

Market timing means trying to guess when stocks will go up or down. It’s like trying to catch a fast-moving train. Very risky!

- It’s hard to predict market highs and lows.

- Missed opportunities can cost you. Even experts get it wrong.

- Fees add up. Buying and selling a lot eats into profits.

Imagine missing the best market days. Your gains could be much smaller.

Benefits Of Long-term Investment

Putting your money in the market for a long time is smart. It’s like planting a seed and watching it grow.

- Markets tend to go up over time. You ride out the lows.

- Compounding works magic. Your money makes more money.

- Less stress. You don’t worry about daily changes.

Long-term investing means being patient. It’s a proven path to wealth.

| Strategy | Risk Level | Potential for Return |

|---|---|---|

| Market Timing | High | Variable |

| Long-term Investment | Lower | Higher over time |

Diversification Strategies For Different Investor Profiles

Smart investors know that diversifying their portfolio is key. This strategy involves spreading investments across various assets. It can reduce risk and improve returns. Each investor has unique goals and risk tolerance. This calls for tailored diversification strategies.

Conservative Vs. Aggressive Investors

Diversification varies with investment style. Conservative investors prefer stability and lower risk. They often choose bonds and high-dividend stocks. These provide regular income and less volatility.

Aggressive investors aim for higher returns. They may opt for growth stocks, emerging markets, and technology ventures. These assets offer potential for significant growth but come with higher risk.

Here’s how both profiles might diversify:

- Conservative: Bonds (50%), Dividend Stocks (30%), Cash (20%)

- Aggressive: Growth Stocks (40%), Emerging Markets (30%), Real Estate (20%), Bonds (10%)

Age-based Portfolio Adjustments

Age impacts how one should diversify. Younger investors often take more risk. They have time to recover from market dips. Older investors usually seek security as retirement nears.

Here’s a simple age-based guide:

| Age | Risk Level | Diversification Example |

|---|---|---|

| 20-30 | High | Growth Stocks (60%), International Stocks (20%), Bonds (10%), Alternatives (10%) |

| 40-50 | Medium | Equities (50%), Bonds (30%), Real Estate (10%), Cash (10%) |

| 60+ | Low | Bonds (40%), High-Dividend Stocks (30%), Cash (20%), Growth Stocks (10%) |

Monitoring And Rebalancing Your Portfolio

Monitoring and Rebalancing Your Portfolio ensures your investments stay aligned with your goals. Regular checks and adjustments keep risks low and growth steady.

Setting Rebalancing Triggers

Investors should establish clear rules for when to rebalance. These are known as triggers. Common triggers include:

- Time-based: Review your portfolio at regular intervals, like semi-annually or annually.

- Threshold-based: Make changes when asset allocations shift a certain percentage from your target.

Use tables to track triggers:

| Trigger Type | Description | Frequency |

|---|---|---|

| Time-based | Set calendar reminders | Bi-annual/Annual |

| Threshold-based | Rebalance when allocations vary by 5-10% | As needed |

Adjusting To Life Changes And Financial Goals

Life events impact financial goals. Revisit your portfolio when:

- You get married or divorced.

- You have a child.

- Your career changes.

- You near retirement.

Align your investments with new goals. Make adjustments to stay on track.

Using Technology To Diversify

Technology shapes how we invest today. Using technology to diversify an investment portfolio helps investors access tools and data once exclusive to professionals. Let’s explore tech’s role in diversification.

Robo-advisors And Automated Platforms

Robo-advisors are reshaping investing. They use algorithms to build diverse portfolios. Investors get a hands-off experience. Automated platforms cater to various risk levels. They adjust portfolios as markets change.

- Easy setup

- Low cost

- Customizable strategies

The Impact Of Big Data And Ai

Big Data and AI drive smarter investment decisions. They analyze vast data sets. This helps spot trends and diversify investments. AI uses this data to predict market movements. Investors gain insights for balanced portfolios.

| Big Data | AI |

|---|---|

| Trend Analysis | Market Prediction |

| Risk Assessment | Portfolio Management |

Common Diversification Mistakes To Avoid

Investors often seek to diversify their portfolios. This strategy spreads risk across various investments. Yet, some common mistakes can hinder your diversification efforts. Let’s explore these pitfalls and learn how to avoid them.

Overdiversification And Dilution

Too many assets can weaken your portfolio’s impact. It’s crucial to find a balance. Aim for a well-rounded mix of investments. This strategy maximizes returns without spreading your capital too thin.

- Assess your assets – Check if each one contributes to your goals.

- Simplify if needed – Consider reducing the number of investments.

Ignoring Fees And Tax Implications

Investors often overlook costs associated with diversification. These include management fees and taxes. Both can eat into your returns significantly.

| Investment Type | Average Fee | Tax Consideration |

|---|---|---|

| Mutual Funds | 1-3% | Capital Gains |

| ETFs | 0.1-1% | Lower Taxes |

Review all fees before investing. Consider tax-efficient funds to keep more of your earnings.

Credit: www.bankrate.com

Frequently Asked Questions

How Should My Investment Portfolio Be Diversified?

Diversify your investment portfolio across asset classes, including stocks, bonds, and real estate. Balance risk by mixing high and low-risk investments. Regularly review and adjust based on market changes and personal goals. This approach helps mitigate risk and optimize returns.

What Is A Good Portfolio Mix?

A good portfolio mix balances risk and return by diversifying across asset classes, industries, and geographies. Aim for a blend of stocks, bonds, and other investments tailored to your financial goals, risk tolerance, and investment horizon. Regularly reviewing and adjusting your portfolio is crucial for long-term success.

How Do I Diversify My 100k Portfolio?

To diversify a $100k portfolio, consider a mix of stocks, bonds, ETFs, and real estate. Balance across sectors and geographic regions. Include both growth and value investments, and periodically rebalance to maintain your desired asset allocation.

How Many Stocks Are Needed For A Diversified Portfolio?

A diversified portfolio typically includes around 20 to 30 different stocks to effectively spread out risk.

Conclusion

Diversifying your investment portfolio is a strategic approach to managing risk. By spreading your assets across various investment types, you mitigate potential losses and set the stage for more stable financial growth. Remember, a well-balanced portfolio is key to weathering market fluctuations and achieving long-term investment success.

Embrace diversity in your investments and watch your financial goals come within reach.