Top investment apps like Robinhood and Acorns revolutionize how individuals manage their finances. These platforms offer user-friendly interfaces and diverse investment options.

Entering the realm of investment has never been more accessible, thanks to the proliferation of investment apps. These applications cater to both seasoned investors and novices, demystifying the complex world of stocks, bonds, and ETFs. They empower users with real-time data, educational resources, and tools for automatic investing, making financial growth achievable from the palm of your hand.

With secure, innovative features, they provide a personalized investing experience, catering to individual financial goals and risk tolerances. As the demand for financial independence and literacy grows, these apps stand at the forefront, offering solutions that are both effective and convenient.

Introduction To Investing In 2024

Welcome to the world of investing in 2024. Times have changed. So have ways to invest money. Today, we dive into how investment apps shape our future. Let’s explore the evolution and why mobile investing is a hit.

The Evolution Of Investment Apps

Investment apps are not new. But, they have grown a lot. In the past, investing was tough. You needed a broker. Now, apps make it easy. You can buy stocks with a click. These apps also teach about investing. It’s like having a financial advisor in your pocket.

- Easy access: No more calls to brokers.

- Learning tools: Apps offer tutorials and tips.

- Low fees: Investing is cheaper than ever.

Why Mobile Investing Is Trending

Everyone has a smartphone. So, it makes sense to invest through one. Young people love this. They can start with little money. They check their investments anytime. Mobile investing makes finance fun and easy.

- Convenience: Invest on the go.

- Accessibility: Start with a small amount.

- Engagement: Fun ways to learn about money.

Investment apps are the future. They make investing simple and accessible. Ready to start? Choose the right app and watch your money grow.

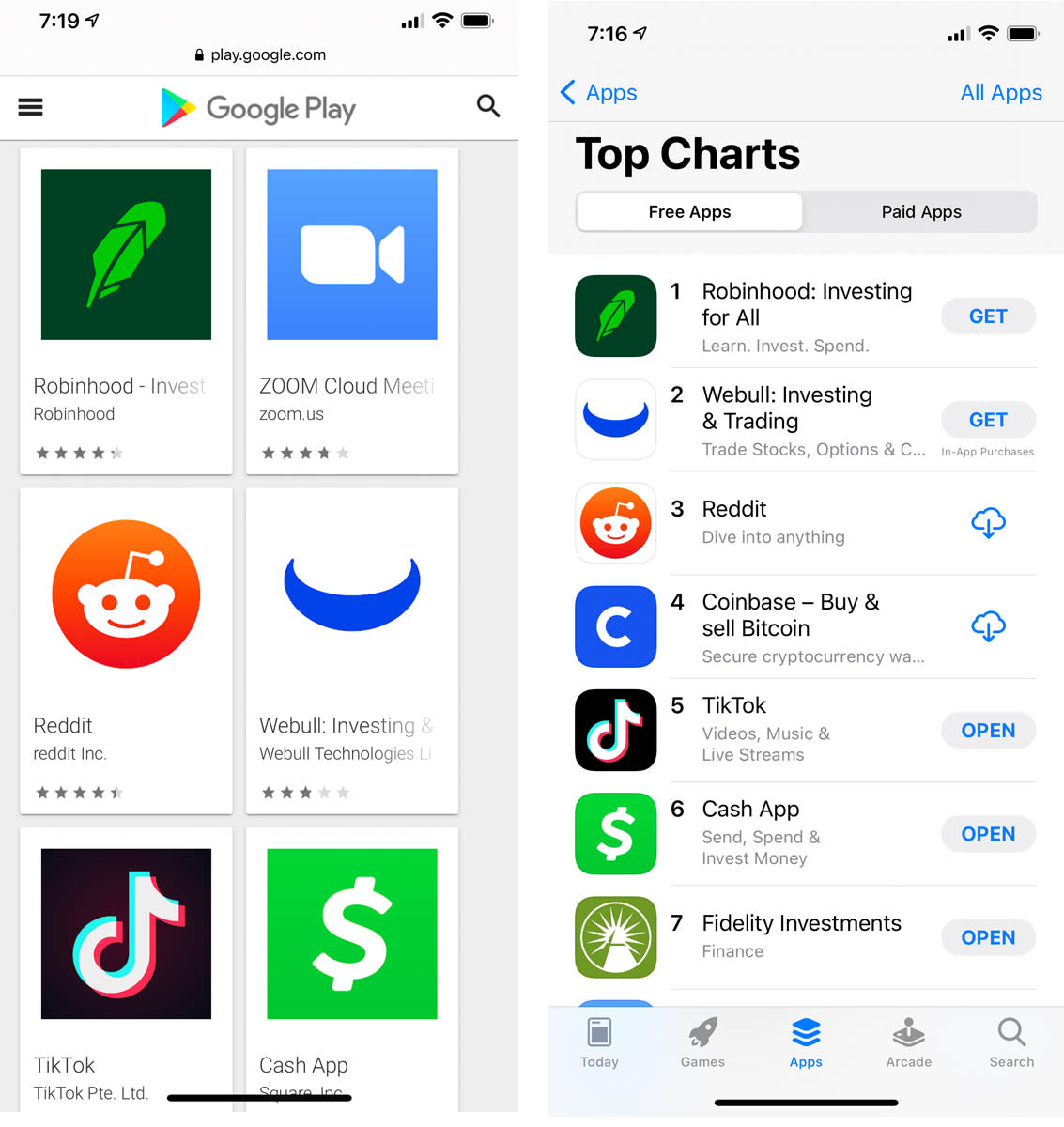

Credit: www.businessinsider.com

Criteria For Choosing Investment Apps

Investors today have a wealth of tools at their fingertips. Choosing the right investment app is crucial. Let’s explore key criteria to consider.

Security Measures

Security is paramount in online investing. Look for apps with strong encryption. Two-factor authentication (2FA) is a must. Apps should comply with financial regulations. Check for security certifications and privacy policies.

User Experience

Investment apps must be user-friendly. Navigation should be intuitive. Clear design helps users make informed decisions. Apps need to work well on various devices. Customer support should be accessible and helpful.

Fees And Commissions

Understanding fees is vital. Look for transparent pricing. Some apps offer zero commissions on trades. Others charge for premium features. Compare costs with services provided. Consider long-term value over upfront costs.

Leading Investment Apps For Beginners

Embarking on the investment journey can feel overwhelming. Fear not! Certain apps make investing accessible and less daunting for beginners. Let’s explore investment apps tailored for newcomers, focusing on their user-friendly features and educational support.

Features Simplifying The Investment Process

Top apps streamline investing for rookies. They offer intuitive interfaces, making navigation a breeze. Users enjoy features like:

- Automated Investing – Set and forget monthly contributions.

- Diversified Portfolios – Access pre-built investment mixes.

- Low Fees – Keep more of your investment gains.

- Mobile Access – Manage investments on the go.

With these features, new investors can start with confidence. They can build their portfolios without needing deep financial knowledge.

Educational Resources Provided

Learning is key to investment success. Leading apps offer robust resources:

| App Name | Resource Type | Topics Covered |

|---|---|---|

| App A | Interactive Guides | Stocks, Bonds, ETFs |

| App B | Video Tutorials | Risk Management, Diversification |

| App C | Webinars | Market Analysis, Investment Strategies |

These apps bridge the knowledge gap for beginners. They provide step-by-step guides and informative content, making complex topics digestible.

Advanced Apps For Seasoned Investors

Advanced Apps for Seasoned Investors cater to experienced individuals seeking sophisticated functionalities. These platforms provide in-depth analysis, complex trading options, and real-time data. Let’s explore some of the top apps that match the criteria of veteran market players.

Complex Trading Tools

For investors who demand more from their trading experience, certain apps stand out. They offer advanced features like algorithmic trading, options strategies, and futures contracts. Here’s a list of tools designed for complex trading:

- Automated Trading: Set custom parameters and let the app execute trades.

- Options Trading: Access to a wide range of options strategies.

- Futures Trading: Platforms that facilitate trading in futures markets.

Real-time Market Data Analysis

Real-time data is crucial for making informed decisions. Apps equipped with this feature provide instant market insights. They allow seasoned investors to act quickly. Below are key aspects of real-time data analysis:

| Feature | Description |

|---|---|

| Live Charts | Visual representation of price movements as they happen. |

| Market News | Latest financial news to stay updated on market conditions. |

| Economic Calendars | Important dates and events that could impact the markets. |

Investment Apps With Robo-advisors

Robo-advisors have revolutionized investing. These digital platforms offer automated, algorithm-driven financial planning. Users receive tailored advice with minimal human intervention. The rise of investment apps with robo-advisors caters to both novice and seasoned investors. These apps simplify the investment process, making it accessible and efficient.

Benefits Of Automated Investing

- Low entry barriers: Start investing with small amounts.

- Reduced costs: Pay fewer fees than traditional investments.

- Time-saving: Algorithms manage your portfolio, no manual input needed.

- Emotion-free decisions: Strategy based on data, not feelings.

- 24/7 portfolio management: Continuous monitoring, no breaks.

Top Picks For Automated Portfolio Management

| App Name | Key Feature | Minimum Investment |

|---|---|---|

| App One | User-friendly interface | $0 |

| App Two | Advanced tax optimization | $500 |

| App Three | Diverse asset classes | $50 |

Socially Responsible Investing On Apps

Today, we dive into Socially Responsible Investing on Apps. This trend is hot! People love investing with their values. They pick stocks and funds that care about the planet and people. Let’s explore apps that make this easy.

Apps Promoting Esg Investing

ESG investing stands for Environmental, Social, Governance. It means investing in companies that do good things for the world. Many apps now help us find these companies. They offer tools and info to pick the best ESG investments.

- Earthfolio: This app focuses on green and ethical funds.

- Betterment: It offers a Socially Responsible Investing portfolio.

- Wealthsimple: Users can choose from various ESG options.

Impact Of Socially Responsible Choices

Making socially responsible choices has a big impact. It’s not just about money. It’s about helping the planet and its people. By choosing ESG investments, we encourage companies to be better. This can lead to positive changes worldwide.

| Choice | Impact |

|---|---|

| Investing in green energy | Reduces carbon footprint |

| Choosing ethical companies | Improves workers’ rights |

| Supporting eco-friendly brands | Encourages sustainable practices |

Every investment choice sends a message. It tells companies what we care about. Let’s make choices that build a better world. Happy investing!

Cryptocurrency Investment Apps

Investing in digital currencies has never been easier. With the rise of cryptocurrency investment apps, you can now buy, sell, and manage your crypto portfolio with just a few taps. These apps offer a range of tools and services designed to help both beginners and seasoned investors navigate the often-volatile crypto market. From real-time tracking to enhanced security features, let’s explore the best apps for your crypto journey.

Navigating The Crypto Market

Market fluctuations in cryptocurrency can be overwhelming. Reliable investment apps offer live data and analytics to help. These apps provide insightful charts and news updates. They ensure you make informed decisions. Many also feature educational resources. They help users understand crypto trends. Here are key features to look for:

- Real-time price alerts

- Historical data analysis

- News and market updates

- Educational content for learning

Apps With Secure Crypto Wallets

Security is a top priority in crypto investments. Select apps with robust security measures. These apps offer two-factor authentication and backup options. Some provide insurance on digital assets. They keep your investment safe. Consider these security features:

- Two-factor authentication (2FA)

- Multi-signature support

- Biometric login options

- Secure backup protocols

Remember, a secure wallet protects your investment. Choose apps that prioritize your digital safety.

Comparing Fees Across Top Apps

Smart investors seek the best tools for their trades. Investment apps have risen to the occasion, offering a variety of services. Yet, fees can take a bite out of profits. It’s vital to understand and compare these costs.

Understanding Fee Structures

Fees vary widely among investment apps. Some charge per trade, while others offer a subscription model. Many promote “free trades,” but look out for hidden fees. These could include inactivity fees or charges for premium services.

- Per-trade fees might range from $0 to $6.99.

- Monthly subscriptions could be $1 to $10, depending on the app.

- Other fees may apply for advanced features.

Users should review the app’s fee schedule. This ensures no surprises eat into your investment gains.

Balancing Costs And Features

Choosing the right app involves balancing costs against features. Higher fees may come with valuable tools, like real-time data, expert analyses, or enhanced security. Lower-cost apps might be more basic.

| App Name | Basic Fee | Premium Features |

|---|---|---|

| App A | $0 per trade | Real-time data |

| App B | $1 per month | Expert stock picks |

| App C | $5 per trade | Enhanced security |

Investors should weigh these features against their investment goals. Choose an app that aligns with your strategy and budget.

Integrating Investment Apps With Personal Finance

Smart investing means staying informed about your finances. Investment apps are now a key part of personal finance management. They offer more than just trading options. They sync with your budgeting tools. They provide a comprehensive financial overview. Let’s explore how integrating these apps can make managing money simpler and smarter.

Syncing With Budgeting Tools

Investment apps work hand in hand with budgeting tools. This integration helps users track their spending and investments in one place. With seamless syncing:

- Users see a real-time view of their finances.

- It becomes easy to adjust budgets based on investment performance.

- Financial goals are easier to set and track.

Comprehensive Financial Overview

A 360-degree view of your finances? That’s what you get with integrated apps. These apps combine:

| Financial Aspect | Benefits |

|---|---|

| Investments | Track growth over time |

| Savings | Ensure emergency funds are in place |

| Debts | Monitor and strategize repayment |

Users enjoy a complete snapshot of their wealth. This clarity helps in making informed decisions.

Credit: chief-mag.com

User Reviews And Ratings

Investors rely on user reviews and ratings to choose apps. These insights help users gauge reliability and performance. Let’s explore what investors are saying about top investment apps.

What Investors Are Saying

Users often share their experiences online. These narratives provide valuable information about app usability and effectiveness. Common points include:

- User Interface: Is the app easy to navigate?

- Customer Support: Do they offer prompt assistance?

- Features: Are the provided tools helpful?

- Cost: Is the app priced fairly?

Analyzing App Performance Through Feedback

Feedback reflects an app’s real-world performance. Positive reviews can indicate high satisfaction. Negative feedback often leads to improvements. Here’s how to analyze it:

| Rating | Significance |

|---|---|

| 4-5 stars | High satisfaction |

| 3 stars | Mixed opinions |

| 1-2 stars | Room for improvement |

Look for patterns in feedback. They reveal strengths and weaknesses. Analyze reviews regularly to stay informed.

The Future Of Investment Apps

The world of investment apps is evolving fast. New technologies are changing how we invest. In the future, these apps will offer more features and smarter ways to grow our money. Let’s explore what’s next in this exciting journey.

Predicting Trends In App-based Investing

- Artificial Intelligence (AI) will make smarter investments.

- Blockchain technology will make investing safer and faster.

- More people will use apps to invest, even with little money.

Innovations On The Horizon

Investment apps are not stopping here. They are getting better every day. Here are some innovations we might see soon:

- Apps that teach investing while you use them.

- Virtual reality to explore investments in a new way.

- Personal robots as investment advisors.

Credit: www.cnbc.com

Conclusion: Making The Most Of Investment Apps

Investment apps offer a path to financial growth. They provide easy access to the stock market, mutual funds, and other investment opportunities. With the right strategy, these apps can help you build wealth over time. Let’s explore how to maximize their potential.

Key Takeaways

- Choose apps wisely: Look for apps with low fees and good reviews.

- Set clear goals: Know what you want to achieve with your investments.

- Diversify: Spread your investments to reduce risk.

- Start small: You don’t need a lot of money to begin.

- Stay informed: Keep up with financial news and app updates.

Continued Learning And Investment Growth

Success in investing doesn’t happen overnight. It requires patience, learning, and making informed decisions. Investment apps often provide educational resources to help you grow your knowledge. Take advantage of these tools.

Remember, the goal is long-term growth. Reinvest your returns to harness the power of compounding. As your understanding deepens, consider exploring more advanced investment strategies.

Follow these steps to make the most of your investment apps:

- Regularly check your investments.

- Adjust your portfolio as needed.

- Never stop learning about the market.

By staying engaged and informed, you can turn investment apps into powerful tools for financial growth.

Frequently Asked Questions

What Is The Best App To Start Investing On?

The best app for beginning investors is subjective, but Robinhood and Acorns are popular for their user-friendly interfaces and educational resources.

What Is The $1 Investment App?

The $1 investment app refers to mobile applications like Acorns or Stash, which allow users to start investing with as little as one dollar. These apps aim to make investing accessible to everyone, regardless of their financial status.

Which App Is Safe To Invest Money?

Choosing a safe app for investing money depends on personal needs and research. Consider reputable apps like TD Ameritrade, Fidelity, and Robinhood, known for strong security measures and regulatory compliance. Always check app reviews and ensure proper licensing before investing.

What Is The Best Investment Platform To Use?

The best investment platform varies based on individual needs, including fees, investment options, and user experience. Popular choices include Vanguard, Fidelity, and Charles Schwab for their comprehensive services and reliability. Always consider personal investment goals and research thoroughly before deciding.

Conclusion

Choosing the right investment app can streamline your financial journey, aligning with your goals and preferences. Whether you’re a seasoned investor or just starting, these top apps offer tailored solutions to grow your wealth. Take the next step, select an app, and embark on your investment adventure with confidence.