Student loan repayment options vary, including standard, graduated, and income-driven plans. Borrowers can choose based on their financial situation and future income prospects.

Navigating through student loan repayment options can seem daunting at first, but understanding your choices is crucial for managing debt effectively. With several plans available, you can tailor your repayment strategy to fit your current and anticipated financial circumstances. From standard plans that keep payments consistent to graduated plans allowing payments to grow over time, there’s a solution for nearly every borrower.

Income-driven repayment plans adjust monthly dues based on your earnings, offering relief to those with fluctuating incomes. Selecting the right plan not only helps in managing your monthly budget but also in reducing the total interest paid over the life of the loan. Taking control of your student debt by choosing the most suitable repayment option sets a strong foundation for your financial future.

Introduction To Student Loan Repayment

Introduction to Student Loan Repayment is a crucial step for graduates. It shapes their financial future. Knowing your options can save you money and stress.

Navigating The Basics

Understanding student loan repayment starts with knowing the types of loans. Federal and private loans offer different plans. Repayment plans can be standard, graduated, or income-driven.

- Standard Repayment Plan: Fixed payments over 10 years.

- Graduated Repayment Plan: Payments start low, then increase.

- Income-Driven Repayment Plans: Payments based on your income.

Choosing the right plan impacts your monthly budget. It affects long-term savings.

Impact On Graduates’ Lives

Student loans affect life choices. They impact buying a home or saving for retirement. A suitable repayment plan can ease this burden.

| Repayment Plan | Monthly Payment | Total Paid Over Time |

|---|---|---|

| Standard | $300 | $36,000 |

| Graduated | Starts at $175 | $38,000 |

| Income-Driven | Varies | Depends on income |

Choosing wisely saves money. It helps graduates achieve their dreams faster.

Credit: www.youtube.com

Federal Vs. Private Loans

Choosing the right student loan repayment plan is crucial. It impacts your financial future. Federal and private loans offer different options. Let’s explore these.

Key Differences

Federal loans come with fixed rates and terms set by law. Private loans vary in rates and terms, set by lenders. Federal loans offer income-driven repayment plans. Private loans do not.

| Federal Loans | Private Loans |

|---|---|

| Fixed Interest Rates | Variable Interest Rates |

| Set Repayment Terms | Flexible Lender Terms |

| Income-Driven Plans | No Income-Based Plans |

Repayment Flexibility

Federal loan repayment comes with flexibility. Borrowers can change plans as needed. Private loans often lack this. They have less forgiving terms.

- Federal loans allow deferment and forbearance.

- Private loans might not offer these options.

Borrowers with federal loans may qualify for Public Service Loan Forgiveness. This is not available with private loans. Know your options to make the best choice.

Standard Repayment Plans

Exploring the Standard Repayment Plan is key for managing student loans. This plan provides a clear path to becoming debt-free. It is a popular choice among graduates. Let’s delve into the specifics of what this plan offers.

Fixed Payments

The Standard Repayment Plan ensures your monthly payments stay the same. You pay a fixed amount every month. This makes budgeting simpler. You know exactly what to pay and when.

Term Lengths

Under this plan, loans have a set term length. Terms usually last 10 years. Some loans may extend up to 30 years. Your term length affects your monthly payment size.

| Loan Type | Term Length | Monthly Payment |

|---|---|---|

| Direct Subsidized | 10 Years | $300 |

| Direct Unsubsidized | 10 Years | $300 |

| Direct PLUS | 10-30 Years | Varies |

- Payments are constant over time.

- Interest rates do not change.

- Total interest paid may be lower.

Choose the Standard Repayment Plan for predictability in loan repayment. Check your loan terms for exact details. Always contact your loan servicer with questions. They provide guidance tailored to your situation.

Income-driven Repayment Plans

Struggling with student loans? Income-Driven Repayment Plans can help. They adjust payments based on income and family size. This means more manageable bills for borrowers. Let’s explore these plans further.

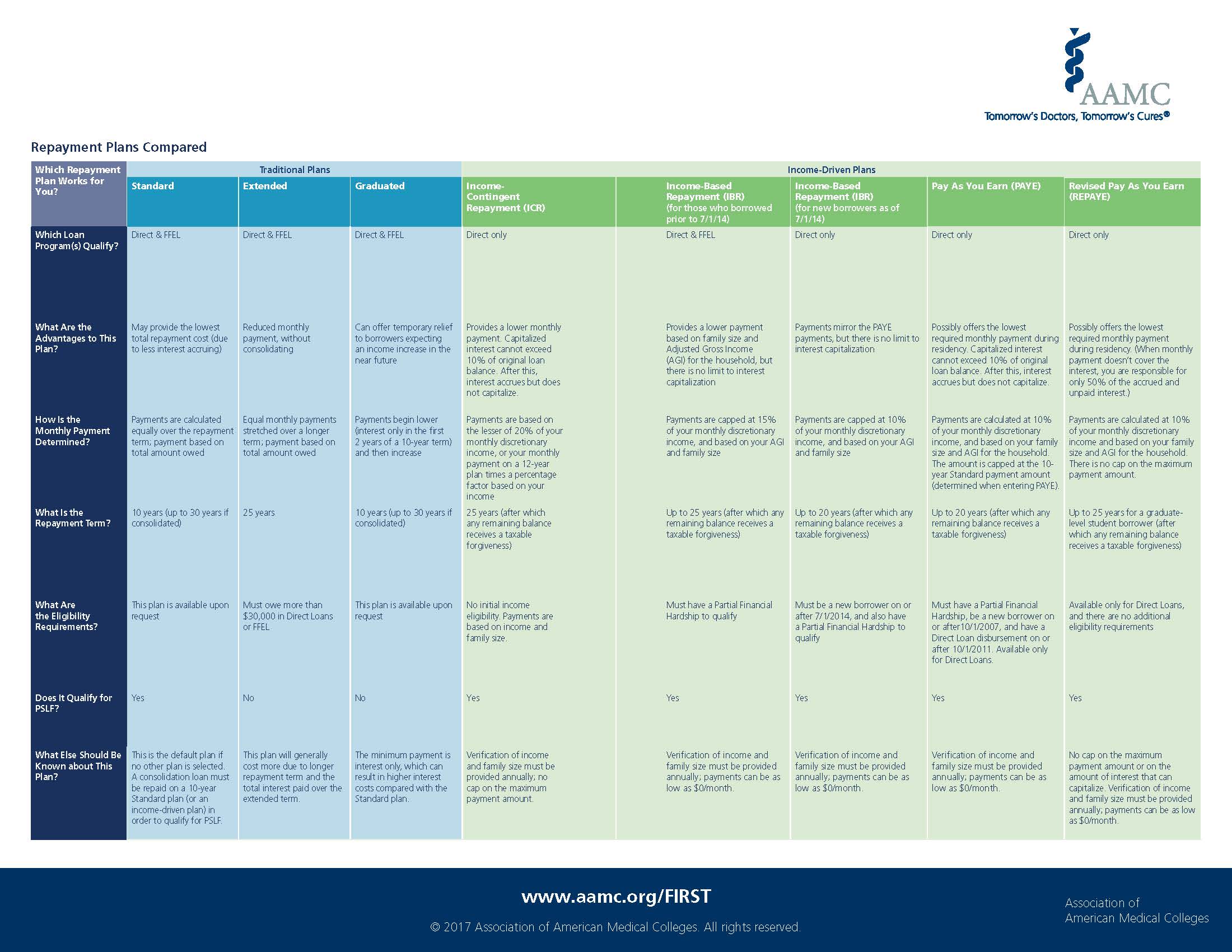

Types And Eligibility

Income-Driven Repayment Plans come in four main types:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Eligibility varies for each plan. Generally, you need federal student loans. Your debt must be high relative to income and family size.

Pros And Cons

Pros:

- Lower Monthly Payments: Payments fit your budget.

- Forgiveness Opportunity: Remaining balance may be forgiven after 20-25 years.

- Subsidy Benefit: Government might pay part of the interest on some loans.

Cons:

- Increased Interest: Lower payments can mean more interest over time.

- Required Annual Recertification: You must update your income and family size each year.

- Tax Implications: Forgiven amounts might be taxable income.

Refinancing Student Loans

Refinancing student loans can be a smart choice. It may lead to better terms. Many graduates use it to manage their debt. Let’s explore how refinancing can benefit you.

Lowering Interest Rates

Refinancing might lower your rates. A lower rate means you pay less over time. Your credit score plays a part in this. A strong credit history helps secure lower rates. Consider this option to save money.

- Check your credit report for errors.

- Compare rates from multiple lenders.

- Choose a fixed or variable interest rate wisely.

Choosing The Right Lender

The right lender makes a difference. Look for good customer service. Transparent terms are important too. Always read reviews and ask questions.

| Lender Feature | Why It Matters |

|---|---|

| Reputation | Indicates reliability and service quality. |

| Flexibility | Helps when facing financial hurdles. |

| Extra Fees | Avoids unexpected costs. |

Loan Forgiveness Programs

Navigating student loan repayment can feel overwhelming. A beacon of hope shines through Loan Forgiveness Programs. These programs offer a path to reduce or erase student loan debt for qualified individuals. Understanding these options can transform the burden of loans into manageable steps towards financial freedom.

Qualification Criteria

To benefit from Loan Forgiveness Programs, meeting specific criteria is essential. These criteria vary across programs but often include:

- Employment in a public service or non-profit job

- Regular payments made while employed in qualifying roles

- A certain number of years in service

Eligibility hinges on these factors. They ensure that those who contribute significantly to society receive support in return.

Application Process

The journey to loan forgiveness begins with a clear process. Follow these steps:

- Confirm your loan type. Only federal student loans qualify.

- Research to find the program that fits your career and loan type.

- Complete the necessary application forms for your chosen program.

- Submit documentation of your qualifying employment and payments.

- Stay in touch with your loan servicer to track your application’s progress.

Patience and diligence play key roles in successfully navigating this process.

Deferment And Forbearance

Struggling with student loan payments? Deferment and Forbearance might help. These options pause payments for a time. Yet, they work differently. Let’s explore how they can impact your finances.

Situations And Requirements

Each option suits different scenarios.

- Deferment: This is for enrollees or graduates in specific situations.

- Examples include going back to school or facing unemployment.

- Forbearance: This is for temporary financial hardships.

- It helps when you can’t make your regular payments.

Both need you to meet set criteria.

| Option | Criteria |

|---|---|

| Deferment | Enrollment, unemployment, or military service |

| Forbearance | Financial difficulties, medical expenses, or job changes |

Impact On Loan Balances

These options affect loan balances differently.

- Deferment: Government may pay interest on some loans.

- Others might accumulate interest.

- Forbearance: Interest typically adds up.

- This can increase total debt over time.

Choose wisely to manage your loan balance.

Budgeting And Extra Payments

Managing student loans can feel overwhelming. Yet, smart budgeting and extra payments can help. These strategies ensure loans don’t control your finances. Let’s explore how to ease this burden.

Effective Budget Strategies

Create a budget to track your spending. Know where every dollar goes. Start by listing your income and expenses. Use apps or spreadsheets for help.

Highlight fixed costs like rent and utilities. Then, identify variable expenses. These might include eating out or shopping.

Set goals for savings and loan payments. Prioritize needs over wants. Cut unnecessary costs to free up cash for loans.

Reducing Principal Faster

Extra payments shave time and interest off your loans. Pay more than the minimum due each month. Even small amounts make a difference.

Consider bi-weekly payments. This trick means one extra full payment a year. It reduces the principal balance faster.

| Payment Frequency | Total Annual Payments |

|---|---|

| Monthly | 12 |

| Bi-weekly | 13 |

Use tax refunds, bonuses, or side hustles. Put these extra earnings toward your loan principal. This strategy lowers overall interest.

Avoiding Default

Avoiding Default on student loans is crucial. Students face tough choices after graduation. Knowing repayment options helps avoid financial trouble. Let’s explore how to dodge default and its consequences.

Consequences Of Default

Defaulting on a student loan triggers serious outcomes:

- Credit damage occurs, lasting years.

- Loan balances increase due to late fees.

- Wages can be garnished, meaning less take-home pay.

- Tax refunds may be seized.

- Eligibility for aid is lost for future education.

Getting Back On Track

To recover from default:

- Contact your loan servicer.

- Discuss repayment plans.

- Consider loan rehabilitation.

- Explore loan consolidation.

- Set up affordable payments.

These steps lead to financial recovery.

Credit: www.med.unc.edu

Credit: www.debt.org

Frequently Asked Questions

What Is The Best Repayment Plan For Student Loans?

The best repayment plan for student loans depends on your financial situation. Income-driven repayment plans offer flexibility for lower earnings, while standard or graduated plans may suit stable, higher income levels. Always consider your unique circumstances and consult a financial advisor.

What Is The Best Option To Pay Student Loan?

The best option to pay off a student loan is using a repayment plan that fits your financial situation. Prioritize higher interest loans first and consider refinancing for better rates. Setting up automatic payments can also reduce interest rates and ensure timely payments.

How Many Repayment Options Are There For Federal Student Loans?

Federal student loans offer four main repayment plans: Standard, Graduated, Extended, and Income-Driven. Each plan caters to different financial needs, allowing borrowers flexibility in managing their loans.

Which Repayment Plan Qualifies For Student Loan Forgiveness?

Income-driven repayment plans are generally eligible for student loan forgiveness programs. These include IBR, PAYE, REPAYE, and ICR plans.

Conclusion

Navigating student loan repayment can be daunting, yet manageable with the right plan. Exploring various options empowers borrowers to take control of their financial future. Commit to a strategy that suits your lifestyle and budget, and watch your debt diminish.

Remember, a debt-free life isn’t just a dream—it’s an achievable goal with informed decisions.