Budgeting for beginners involves tracking income and expenses to manage money effectively. It’s crucial for financial stability and growth.

Entering the world of budgeting can seem daunting at first, but it’s a fundamental step towards taking control of your financial future. This process allows individuals to set realistic financial goals, identify unnecessary expenditures, and allocate funds towards savings and debt repayment.

By understanding where your money goes each month, you can make informed decisions that align with your financial objectives. A well-structured budget acts as a roadmap, guiding you towards financial health and enabling you to achieve your dreams without the burden of financial stress. Embracing budgeting as a beginner paves the way for a secure and prosperous financial journey.

Embracing The Budgeting Mindset

Embracing the budgeting mindset is a game-changer for beginners. It’s not just about cutting costs. It’s about making smart choices with your money. Let’s dive into how shifting your perspective on spending and understanding the psychological benefits can make budgeting a powerful tool for financial freedom.

Shifting Perspectives On Spending

Viewing spending through a new lens is crucial. Start by categorizing your expenses. This simple act can reveal surprising spending habits.

- Needs vs. Wants: Separate essentials from non-essentials.

- Quality over Quantity: Invest in items that last longer.

- Experiences over Things: Value memories more than material possessions.

This shift encourages mindful spending, making every dollar count.

The Psychological Benefits Of Budgeting

Budgeting brings peace of mind. It’s true. Knowing where your money goes reduces stress. Let’s explore some benefits:

- Control: You dictate your financial future, not your impulses.

- Confidence: Making informed decisions boosts self-esteem.

- Clarity: Clear goals lead to a focused financial strategy.

These benefits reinforce the positive impact of adopting a budgeting mindset.

Credit: m.youtube.com

Setting Realistic Financial Goals

Embarking on the journey of budgeting begins with setting goals. Goals guide your spending patterns. They help you stay focused. Let’s break down how to set achievable financial goals.

Short-term Vs. Long-term Planning

Short-term goals are your immediate needs. Think of them as stepping stones. They include saving for a vacation, an emergency fund, or a new gadget. Long-term goals require more time and commitment. These are your milestones. Examples are retirement savings, buying a house, or funding education.

- Short-term: Within the next year

- Long-term: Several years to achieve

Balance is key. Work on both types of goals. This ensures progress and motivation. Use a table to track your goals:

| Goal Type | Examples | Time Frame |

|---|---|---|

| Short-term | New phone, Holiday gifts | 0-1 Year |

| Long-term | Home ownership, Retirement fund | 1+ Years |

Prioritizing Financial Objectives

Not all goals are equal. Prioritize them. Start with necessities. These are your “must-haves”. Next, focus on “nice-to-haves”. These are less urgent but still important.

- Identify essential expenses

- Set aside funds for emergencies

- Plan for big purchases

Use a budgeting app or a spreadsheet. Track your progress. Adjust your plan as needed. Celebrate small wins. They keep you moving toward bigger goals.

- Track: Monitor your savings

- Adjust: Change plans when necessary

- Celebrate: Reward your achievements

Understanding Your Cash Flow

Understanding Your Cash Flow is vital for financial health.

It’s the total amount of money being transferred in and out of your pocket.

This section will guide beginners through the basics of tracking money.

You’ll learn to spot where your cash goes each month. Let’s dive in.

Tracking Income And Expenses

Income means money you earn.

Expenses are what you spend money on.

Knowing both helps manage your budget well.

- Record every paycheck you receive.

- List all bills and daily purchases.

- Use apps or spreadsheets for help.

See where every dollar comes from and goes to.

It’s the first step to take control of your finances.

Identifying Spending Leaks

Spending leaks are small, often unnoticed expenses that add up.

They can drain your wallet over time.

| Common Spending Leaks | Monthly Cost |

|---|---|

| Coffee to go | $30 |

| Unused subscriptions | $25 |

| Late fees | $15 |

Check your expenses.

Find patterns in your spending.

Spot areas to cut back on.

Keep more money in your pocket.

Choosing The Right Budgeting Method

Getting your finances in order is a game-changer. It starts by picking a budgeting method that fits your needs. There are many ways to budget, but let’s explore two popular ones. These methods help track spending and save money.

Envelope System Explained

The Envelope System is a hands-on way to manage money. It involves dividing cash into envelopes. Each envelope is for a different expense category.

- Rent

- Groceries

- Utilities

When an envelope is empty, you stop spending in that category. It’s a simple, effective way to control overspending.

50/30/20 Rule For Budget Allocation

The 50/30/20 Rule simplifies budgeting. It breaks down spending into three categories:

- Needs: 50% of income

- Wants: 30% of income

- Savings: 20% of income

This rule is great for beginners. It gives a clear plan for where money should go.

Tools And Apps To Simplify Budgeting

Mastering money management skills is essential for financial health. Budgeting stands at the core of these skills. Yet, many find budgeting challenging. Thankfully, modern tools and apps make this task easier and more efficient. From tracking expenses to automating savings, technology can be a budgeter’s best friend. Let’s explore some of the best tools available.

Digital Envelopes And Expense Trackers

Digital envelopes revolutionize the traditional budgeting method. They help you allocate funds for different spending categories. Expense trackers monitor where every dollar goes. This visibility is key to staying on budget.

- GoodBudget – Digital envelopes for easy categorization

- Mint – Tracks expenses and provides insights

- YNAB (You Need A Budget) – Links bank accounts for real-time tracking

Automating Savings With Apps

Automating savings takes the effort out of setting money aside. Apps can round up purchases to the nearest dollar and save the change. They can also transfer set amounts regularly into savings. This makes saving almost invisible yet highly effective.

| App Name | Feature |

|---|---|

| Digit | Automatically saves an optimal amount daily |

| Acorns | Invests spare change from purchases |

| Chime | Sets aside a percentage of each paycheck |

Cutting Costs Without Cutting Joy

Managing money doesn’t mean giving up fun. Cutting costs without cutting joy is about making smart choices. It’s about spending wisely but still enjoying life. Let’s explore how to do this.

Smart Shopping Habits

Smart shopping saves money. It means buying what you need, not just what you want. Here are ways to shop smart:

- Compare prices online before buying.

- Use coupons and discount codes.

- Buy quality items on sale.

- Shop during off-peak seasons for deals.

These habits help you keep more money. You still enjoy shopping but spend less.

Frugal Living With A Twist

Living frugally doesn’t mean living without joy. It’s about finding value in simpler things. Here’s how:

- Eat at home more. It’s cheaper and can be fun.

- Enjoy free or low-cost activities. Like parks or hikes.

- DIY projects can be both fun and cost-saving.

- Use public transport or carpool to save on travel.

These steps offer a joyful life. They keep your wallet happy too.

Debt Management And Avoidance

Managing debt is crucial for financial health. It involves understanding how to handle owed money wisely. Avoiding debt helps maintain a stable budget. Let’s explore effective strategies to achieve this.

Strategies To Reduce Debt

Reducing debt starts with a solid plan. Follow these steps for a lighter financial load:

- List all debts: Create a clear debt overview.

- High interest first: Pay off costly debts quickly.

- Extra payments: Use spare cash to reduce debt.

- Debt consolidation: Combine debts for better management.

- Set milestones: Celebrate small victories in debt reduction.

Avoiding Common Financial Pitfalls

Staying debt-free means avoiding traps. Here are key pitfalls to dodge:

- Impulse purchases: Buy only what you need.

- Minimum payments: Aim higher to clear debt faster.

- Late fees: Pay on time, save money.

- Expensive credit: Opt for lower interest options.

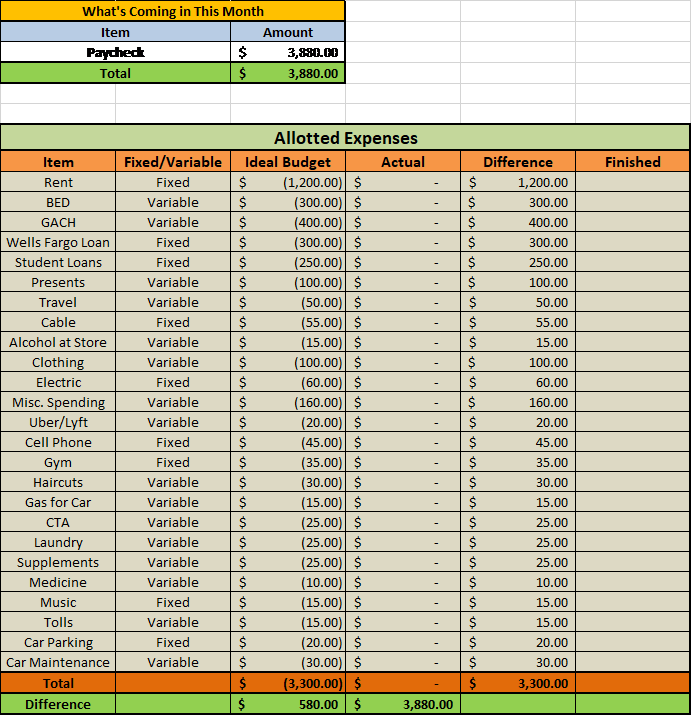

Credit: www.erincondren.com

Growing Your Savings

Growing Your Savings is a crucial step in achieving financial freedom. It’s not just about putting money aside; it’s about making that money work for you. This section will explore effective strategies to help your savings grow.

The Power Of Compound Interest

Compound interest is the engine behind growing savings. It earns interest on interest, boosting your balance over time. This effect can turn small, regular savings into significant amounts.

Start early to take full advantage of compound interest. Even modest amounts can grow substantially.

Regular Investment As A Savings Strategy

Investing regularly can help build your savings. This approach is known as ‘dollar-cost averaging’ and involves consistent investment over time.

- Set up automatic transfers to invest without thinking.

- Diversify your investments to reduce risk and enhance returns.

- Review and adjust your investments as needed.

Adjusting Your Budget Over Time

Mastering budgeting is a journey, not a one-time task. As life evolves, so should your budget. Recognizing when and how to adjust your budget is key to maintaining financial health. Let’s dive into the dynamics of keeping your budget aligned with your life’s ever-changing landscape.

Life Changes And Financial Reassessment

Life never stands still, and neither should your budget. Major events can shift your financial landscape significantly. These may include:

- Getting a job promotion

- Starting a family

- Buying a home

- Experiencing a medical issue

Such events call for a budget reassessment. This ensures your spending and savings align with your new financial picture.

When To Revise Your Budgeting Strategy

Specific triggers signal it’s time to update your budget. Look for changes in:

| Income | Expenses | Savings Goals |

|---|---|---|

| Job change | Rent or mortgage adjustment | New financial target |

| Pay raise | Utility cost increase | Emergency fund needs |

| Side hustle income | Childcare or education fees | Retirement plan shifts |

Review your budget monthly to catch these changes. This helps you stay on top of your finances and meet your goals.

Credit: einvestingforbeginners.com

Learning From Budgeting Mistakes

Budgeting is a skill, and like any skill, it requires practice. Mistakes are part of the learning curve. They provide valuable lessons that can shape a more effective budgeting strategy. Embrace the missteps and let them guide you to financial stability.

Common Pitfalls For Beginners

Starting your budgeting journey can be daunting. Awareness of potential pitfalls sets the stage for success. Here are frequent missteps:

- Overly optimistic spending limits can lead to frustration.

- Lack of emergency funds makes unexpected costs a crisis.

- Forgetting periodic expenses results in budget shortfalls.

- Impulse purchases disrupt planned spending.

- Inconsistent tracking hides true financial health.

Turning Failures Into Learning Opportunities

Every budgeting error offers a chance to grow. Transform your failures into stepping stones:

- Analyze the mistake: Identify what went wrong.

- Adjust your budget: Make changes that reflect reality.

- Set small, achievable goals: Build confidence with easy wins.

- Review regularly: Keep your budget in line with your habits.

- Seek advice: Learn from others who have succeeded.

Turning setbacks into success stories is key. Your budget will evolve as you do. Keep learning and adapting to pave the way for a brighter financial future.

Frequently Asked Questions

What Is The 50 30 20 Budget Rule?

The 50 30 20 budget rule divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. This strategy helps manage finances effectively, ensuring essential expenses are covered while still allocating funds for personal enjoyment and financial growth.

How To Start Budgeting For Beginners?

To start budgeting, track your spending first. Set clear, realistic goals. Prioritize essential expenses. Allocate savings for emergencies. Review and adjust your budget monthly.

What Are The 5 Basics To Any Budget?

The five basics to any budget are: 1. Identify income sources, 2. List and categorize expenses, 3. Set savings and debt repayment goals, 4. Allocate funds accordingly, and 5. Monitor and adjust as needed.

What Is A Good First Step When Budgeting?

A good first step in budgeting is to track your income and expenses to understand your financial flow.

Conclusion

Embarking on a budgeting journey can transform your financial health. Short, simple steps today lead to long-term prosperity. Remember, mastering money management is within reach. Start small, stay consistent, and watch your savings grow. Let’s make smart budgeting a life-changing habit together!