Retirement accounts are savings plans designed to offer individuals income after they cease working. They benefit from tax advantages to grow wealth over time.

Navigating the world of retirement accounts can seem daunting at first glance. These financial vehicles are essential for ensuring a comfortable and secure retirement. They come in various forms, including 401(k)s, IRAs, and Roth IRAs, each with its own set of rules and benefits.

Understanding the basics of these accounts helps individuals make informed decisions about their future. Early planning and regular contributions can significantly impact one’s financial stability in later years. This introduction to retirement accounts aims to demystify the subject, making it accessible and actionable for everyone, regardless of their financial literacy level.

Introduction To Retirement Accounts

Let’s dive into the world of Retirement Accounts. It’s a way to save money for the time you stop working. Think of it as a big piggy bank. But, it’s not just any piggy bank. It helps your money grow over time. This guide will help you understand how these accounts work. You’ll learn about different types and how they help save for your future.

The Role Of Retirement Savings

Saving for retirement is key. It’s like planting a seed today to enjoy the tree’s shade later. These savings give you money when you no longer work. They also offer tax benefits. This means you might pay less tax now or when you take the money out. It’s a smart way to make sure you have enough money to enjoy your later years.

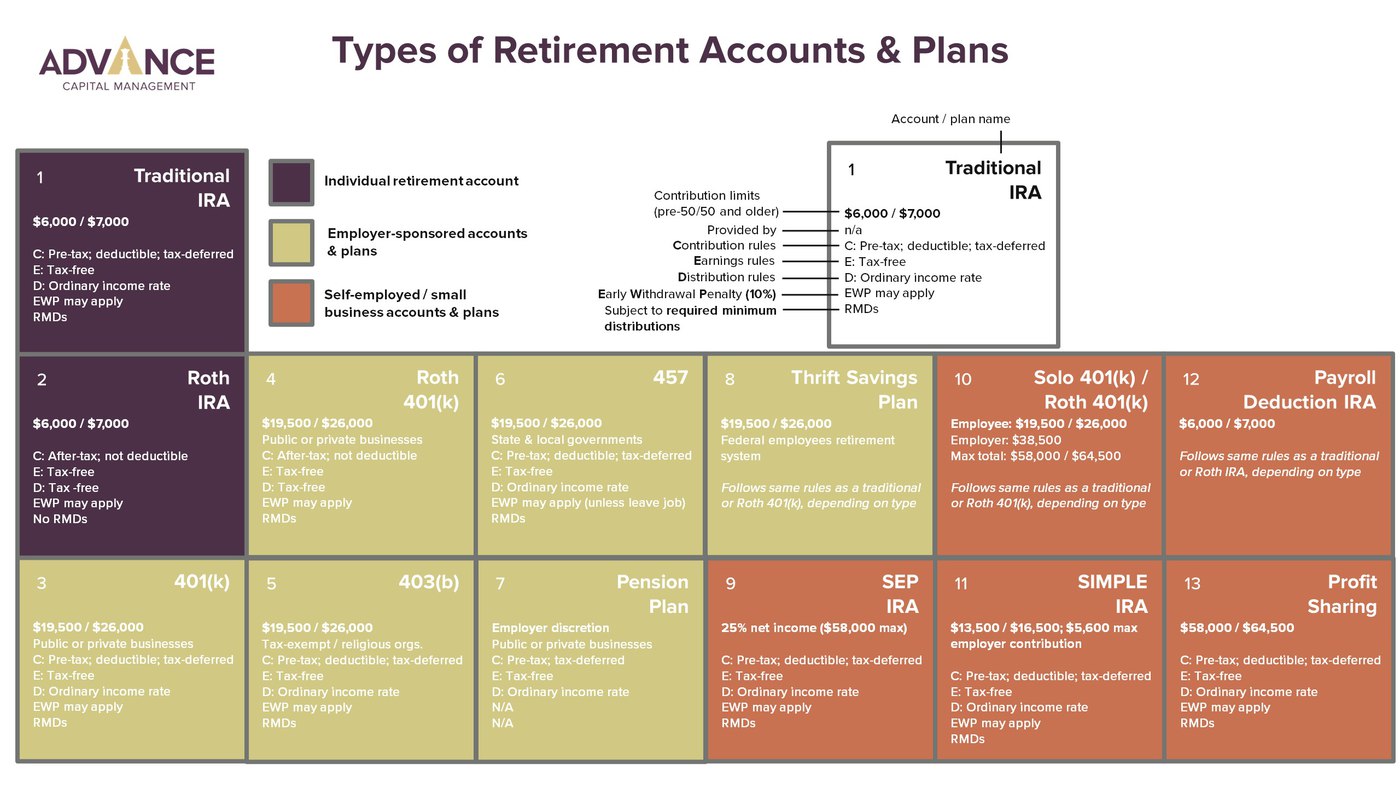

Types Of Retirement Accounts

- 401(k) Plans – Offered by employers. You can save part of your salary here. Often, employers add money too.

- IRA (Individual Retirement Account) – You open and control this account. It offers tax breaks too.

- Roth IRAs and 401(k)s – Special because you pay taxes now, not later. This means tax-free money when you retire.

- SEP IRAs – Great for self-employed people or small business owners. Lets you save a lot more.

Choosing the right type depends on your job, income, and when you want to pay taxes. Each account has rules about when and how much you can put in or take out. Knowing these can help you plan better for a happy retirement.

Credit: blog.acadviser.com

Benefits Of Early Planning

Planning for retirement early can lead to a secure future. Starting now reaps benefits that grow over time. Let’s explore the advantages of setting the stage for your golden years well in advance.

Compound Interest Magic

Compound interest works best with time. It’s the process where your savings generate earnings. These earnings then generate their own earnings. Think of it as a snowball effect for your money. The earlier you start, the bigger your snowball grows.

- Start with small deposits.

- Watch your balance grow faster over time.

- Benefit from interest on interest.

Even if contributions are modest, early starters often outpace late bloomers. This happens thanks to the magic of compounding.

Financial Security And Peace Of Mind

Early retirement planning secures your future. It provides a cushion against unexpected life events. With a solid plan, you ensure steady income when work becomes a choice, not a necessity.

| Years to Grow | Financial Impact |

|---|---|

| 30+ | Higher potential savings |

| 20-30 | Healthy financial growth |

| <10 | Limited growth, higher pressure |

By planning early, you set yourself up for a worry-free retirement. You ensure you have the funds to enjoy life to the fullest. You also protect your loved ones from financial burdens.

Traditional Vs Roth Iras

When planning for retirement, choosing the right account is key. Traditional IRAs and Roth IRAs are popular options. Each has unique benefits and rules. Let’s explore the differences to make informed decisions.

Tax Treatment Differences

Traditional IRAs offer tax deductions on contributions. Taxes apply on withdrawals. Roth IRAs are funded with after-tax dollars. This means no tax on withdrawals.

| Account Type | Contributions | Withdrawals |

|---|---|---|

| Traditional IRA | Pre-tax | Taxed |

| Roth IRA | After-tax | Tax-free |

Withdrawal Rules And Penalties

Traditional IRAs require withdrawals after age 72. Early withdrawals face penalties. Roth IRAs offer more flexibility with no mandatory withdrawals.

- Withdraw after 59½ to avoid penalties.

- Early withdrawals may incur a 10% penalty.

- Certain exceptions apply for both account types.

Credit: www.sofi.com

401(k) Plans Explained

Understanding 401(k) plans is key to retirement planning. This popular retirement account offers unique benefits for employees. Learn how these plans work and how to maximize your savings.

Employer-sponsored Advantages

401(k) plans are powerful retirement tools offered by employers. Employees benefit from tax advantages, leading to more savings. With a 401(k), you pay taxes on withdrawals, not contributions.

- Pre-tax contributions reduce taxable income

- Potential for employer matching contributions

- Tax-deferred growth on investments

Contribution Limits And Matching

The IRS sets annual contribution limits for 401(k) plans. For 2023, the limit is $20,500 for those under 50. Employees 50 or older can contribute an extra $6,500.

| Age | Contribution Limit | Catch-Up Limit |

|---|---|---|

| Under 50 | $20,500 | N/A |

| 50 or older | $20,500 | $6,500 |

Many employers offer a matching program. They match your contributions up to a certain percentage of your salary. This is free money added to your retirement savings.

Other Retirement Savings Options

Exploring beyond traditional retirement accounts opens up new savings horizons. Let’s delve into options that offer flexibility and benefits for diverse financial situations.

Sep Iras For Self-employed Individuals

Self-employed individuals and small business owners can benefit from Simplified Employee Pension (SEP) IRAs. These accounts allow larger annual contributions than traditional IRAs. Contributions are tax-deductible, aiding in immediate tax relief.

- High contribution limits compared to traditional IRAs

- Easy to set up and maintain

- Flexibility in annual contributions

SEP IRAs work well for those with variable income. They adapt to changing financial situations each year.

The Hsa As A Retirement Tool

Health Savings Accounts (HSAs) are not just for medical expenses. They double as retirement tools. After age 65, funds can be withdrawn for any purpose without penalty, only paying income tax.

| Feature | Benefit |

|---|---|

| Tax-deductible contributions | Lower taxable income |

| Tax-free growth | Maximize savings potential |

| Tax-free medical withdrawals | Cost-effective healthcare spending |

HSAs require a high-deductible health plan. They are ideal for those with good health and low medical costs.

Credit: www.sensefinancial.com

Investment Strategies For Growth

Let’s explore Investment Strategies for Growth within retirement accounts. These strategies help your money grow over time. Understanding them can lead to a comfortable retirement.

Asset Allocation For Longevity

Asset allocation balances your portfolio for long-term growth. It involves mixing different types of investments. This mix changes over time based on age and goals.

- Stocks for growth

- Bonds for stability

- Cash for liquidity

Younger investors might choose more stocks. Older investors prefer bonds and cash.

Diversification To Reduce Risk

Diversification spreads investments across various assets. This strategy reduces risk. If one investment falls, others might not.

| Type | Examples |

|---|---|

| Equities | Technology, Healthcare |

| Fixed Income | Government Bonds, Corporate Bonds |

| Real Estate | REITs, Commercial Property |

| Commodities | Gold, Oil |

Combining different types of investments can protect your portfolio.

Navigating Taxes And Retirement

Planning for retirement means understanding taxes. Taxes can impact how much you save and when you withdraw funds. Knowledge of tax rules helps you keep more of your money.

Strategies For Tax-efficient Withdrawals

Tax-efficient withdrawals can maximize retirement savings. Consider these strategies:

- Withdraw from taxable accounts first: Use funds from these accounts to lower tax bills.

- Move to Roth accounts later: These withdrawals are often tax-free. Save these for future years.

- Consider tax brackets: Keep withdrawals small to stay in a lower tax bracket.

These strategies aim to reduce taxes on retirement income. They help savings last longer.

Understanding Required Minimum Distributions

Required Minimum Distributions (RMDs) are withdrawals you must make each year from retirement accounts starting at a certain age. Here’s what to know:

| Account Type | Age to Start RMDs | Impact on Taxes |

|---|---|---|

| Traditional IRA | 72 | Taxes due on withdrawals |

| 401(k) | 72 | Taxes due on withdrawals |

| Roth IRA | No RMDs during owner’s lifetime | No taxes on withdrawals |

Ignoring RMDs can lead to high penalties. Always withdraw at least the minimum amount required.

Common Pitfalls To Avoid

Planning for retirement can be tricky. Even smart investors sometimes stumble. Knowing common mistakes helps avoid them. Let’s explore some pitfalls you should steer clear of.

Early Withdrawal Consequences

Retirement accounts like 401(k)s and IRAs offer tax benefits. But they come with rules. Withdrawing early often leads to penalties. It also means losing compound interest. This can significantly reduce your retirement savings.

Neglecting Inflation Impact

Inflation can erode your purchasing power. Your retirement savings might not be enough in the future. Always consider inflation when planning. Invest in options that outpace inflation. This ensures your savings maintain their value over time.

Preparing For The Unexpected

Preparing for the unexpected is key in retirement planning. Life throws curveballs. Plans must adapt. Retirement accounts are more than just saving. They are about foreseeing needs and securing futures. Insurance, health care, and estate planning are essential. Let’s explore these crucial topics.

Insurance And Health Care Costs

Medical expenses often rise as we age. Insurance helps manage these costs. Consider these points:

- Medicare is a start, but often not enough.

- Supplemental insurance can fill gaps.

- Long-term care insurance covers extended needs.

Review insurance options annually. Choose plans that fit changing health statuses.

Estate Planning Considerations

Proper estate planning ensures wishes are followed. Key elements include:

| Document | Purpose |

|---|---|

| Will | Distributes assets. |

| Trust | Manages assets for beneficiaries. |

| Power of Attorney | Grants decision-making power. |

| Health Care Directive | Outlines medical wishes. |

Seek legal advice. Update documents regularly. Ensure assets transfer smoothly.

Frequently Asked Questions

What Is The $1000 A Month Rule For Retirement?

The $1000 a month rule for retirement suggests saving $240,000 for every $1000 of monthly income you need. This rule helps estimate retirement savings goals.

What Is The 3% Rule In Retirement?

The 3% rule in retirement advises withdrawing 3% of your savings annually. This strategy aims to extend the lifespan of your retirement funds, ensuring financial stability.

Is It Better To Have A 401k Or Ira?

Choosing between a 401k or IRA depends on individual financial goals and circumstances. A 401k often comes with employer matching, boosting your savings. IRAs offer more investment flexibility. Both have tax advantages, but eligibility and contribution limits vary. Consulting a financial advisor can help determine the best option for you.

What Is The 4% Rule For Retirement Accounts?

The 4% rule is a retirement strategy suggesting you withdraw 4% of your savings in the first year of retirement, then adjust for inflation annually.

Conclusion

Navigating the landscape of retirement accounts can be complex. Yet, mastering this is crucial for a secure future. Remember, starting early and choosing the right plan pays off. Seek advice when needed and revisit your strategy regularly. Secure your golden years now with informed retirement planning.