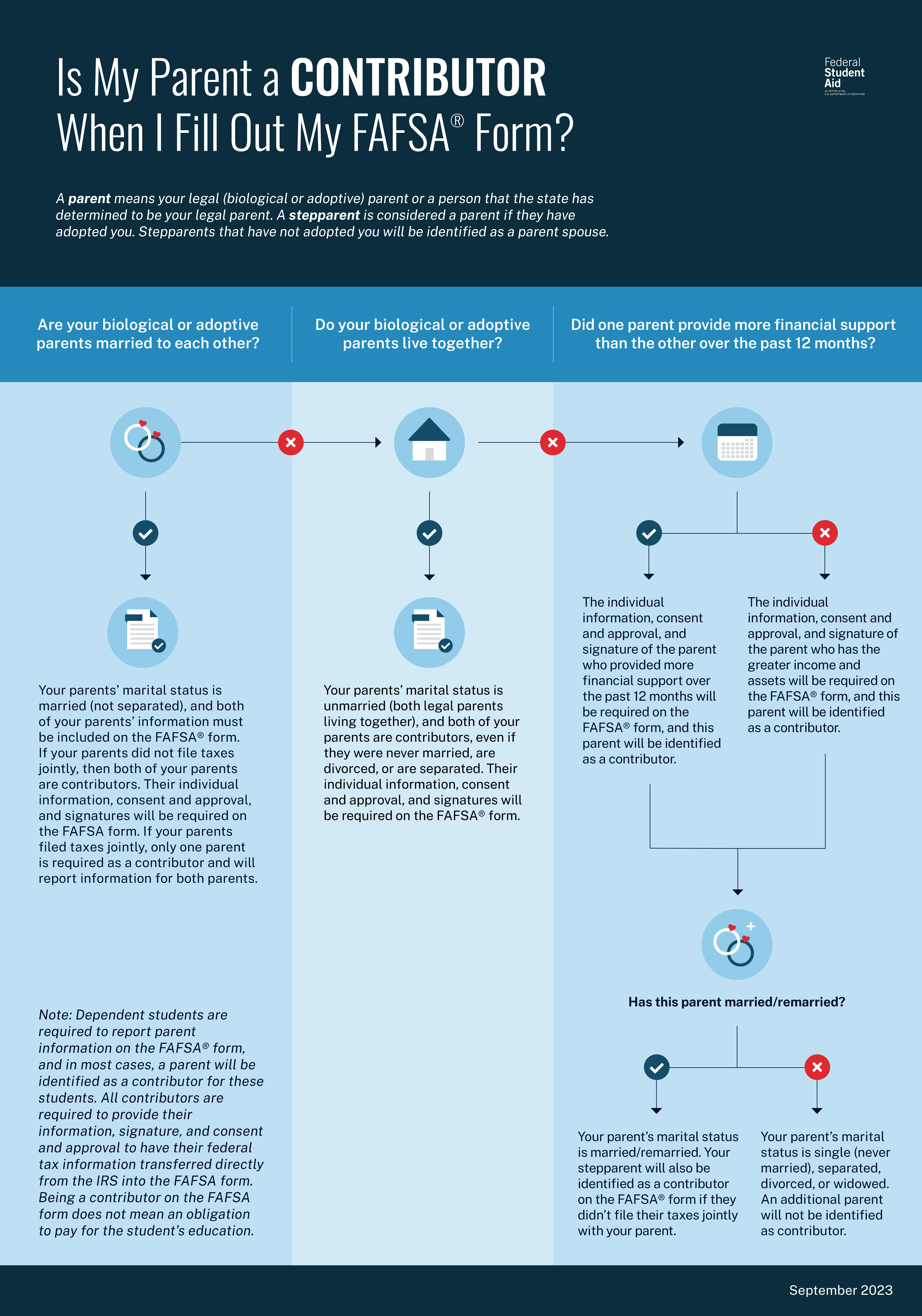

Review your budget and savings goals, then assess any subscriptions or memberships for necessity. Reflect on your financial habits and make necessary adjustments.

Managing your finances effectively is crucial for achieving long-term stability and success. In today’s fast-paced world, it’s easy to let financial management slip through the cracks, leading to missed opportunities for growth and savings. By dedicating time each month to focus on your financial well-being, you set the stage for a healthier economic future.

This proactive approach not only helps in keeping your budget in check but also in identifying areas where you can cut back or invest more. Engaging in these monthly financial activities ensures you stay on track towards your financial goals, making adjustments as needed to adapt to life’s ever-changing circumstances.

Introduction To Fiscal Fitness

Welcome to the world of Fiscal Fitness, a crucial aspect of managing your money wisely. Just like physical fitness keeps your body healthy, fiscal fitness keeps your finances in top shape. Let’s explore how to achieve financial well-being with monthly practices that ensure your money works hard for you.

The Importance Of Regular Financial Check-ups

Think of regular financial check-ups as health check-ups for your wallet. They help catch issues early, keeping your finances healthy and vibrant. Ignoring them can lead to financial troubles, just like neglecting your health can lead to illness.

- Track spending to find where your money goes.

- Set budget goals and adjust to stay on track.

- Review statements for errors or fraud.

- Ensure savings goals are met.

What Are Monthly Financial Musts?

Monthly financial musts are tasks you should complete every month to maintain fiscal health. These tasks keep you aligned with your financial goals and ensure you’re prepared for the future.

- Review your budget and adjust as needed.

- Check bank statements for unusual activity.

- Save a portion of your income.

- Pay bills on time to avoid late fees.

- Invest in your future with retirement contributions.

By incorporating these tasks into your monthly routine, you can achieve and maintain fiscal fitness, ensuring a healthier financial future.

Setting Financial Goals

Setting financial goals is crucial for money management. It shapes your saving and spending. Begin each month with clear, achievable targets. This practice ensures you stay on track. It also helps grow your wealth over time.

Short-term Vs Long-term Planning

Differentiate your financial plans. Short-term goals might include saving for a vacation. Long-term goals could be retirement or buying a home. Each requires a unique approach.

- Short-term goals: Achieve these within a year. They keep you motivated.

- Long-term goals: These take years. They demand commitment and patience.

Prioritizing Your Financial Objectives

Not all goals hold equal weight. Prioritize them monthly. This ensures you focus on the most important ones. Use a list to keep them in check.

- Identify your top financial needs.

- Assign each a level of importance.

- Direct funds to top-priority goals first.

Budget Review And Adjustment

Budget Review and Adjustment is a vital step in managing your finances. Like a compass guiding a ship, regular reviews ensure you stay on course toward your financial goals. Each month, dedicate time to analyze your budget, making adjustments as needed to stay aligned with your financial plan.

Tracking Your Spending

To keep your budget accurate, track where every dollar goes. Use apps or spreadsheets for a clear view of your finances. This visibility is key to financial control.

- Record all purchases

- Review weekly spending

- Adjust budget categories as needed

Identifying And Cutting Unnecessary Expenses

Regularly look for expenses you can eliminate. Subscriptions you no longer use or dining out too often can drain your budget.

| Expense Type | Action |

|---|---|

| Unused subscriptions | Cancel immediately |

| Frequent takeouts | Reduce by planning meals |

Cutting these expenses frees up money for savings or debt repayment. It’s a simple yet powerful step toward financial wellness.

Savings Strategies

Let’s dive into essential Savings Strategies to enhance your financial health.

Each month, taking steps to grow your savings can secure your future.

Building An Emergency Fund

An Emergency Fund acts as a financial safety net.

Life is unpredictable. Illness, job loss, or unexpected repairs can strain your budget.

Start small, aiming for one month’s living expenses. Increase this over time.

Target three to six months’ expenses for robust protection.

Automating Your Savings

Automating savings ensures consistency and builds wealth effortlessly.

Set up automatic transfers from checking to savings accounts.

Choose a date post-payday for automatic transfers. This makes saving a priority.

Even small, regular contributions can lead to significant savings over time.

Follow these steps every month to keep your finances on track.

Debt Management

Debt Management is crucial for financial health. It involves understanding and reducing what you owe. Tackling debts each month can prevent financial issues. Let’s explore key steps for managing debt effectively.

Evaluating Debt Levels

Knowing your total debt is step one. List all debts: credit cards, loans, and mortgages. Note interest rates and monthly payments. This clarity helps with making smart debt reduction plans.

Strategies For Debt Reduction

- Pay more than the minimum: Even small extra payments reduce debt faster.

- Debt avalanche method: Pay off high-interest debts first. Saves money long-term.

- Debt snowball method: Clear smallest debts first. Builds momentum and confidence.

- Consolidate debts: Combine debts into one loan with lower interest rates.

- Negotiate terms: Speak with lenders to lower interest rates or extend terms.

- Automate payments: Ensure you never miss a payment. Avoids late fees.

Choose strategies that fit your situation. Stick to your plan. Watch your debts shrink each month.

Credit: studentaid.gov

Investment Check-up

Taking care of your finances means regularly checking your investments. Let’s dive into the Investment Check-Up you should do every month.

Assessing Your Portfolio

Start by looking at what you own. Ask yourself a few questions:

- Are my investments growing?

- Do any investments worry me?

- Am I meeting my goals?

Keep track of the answers. They help you understand your money’s path.

Rebalancing Investment Allocations

Sometimes, you need to change where your money sits. This is called rebalancing.

Here’s why:

- Markets change. Your money needs to move with them.

- Risks can grow. Keep them in check by shifting funds.

- Goals evolve. Your money should follow your dreams.

Check your investment mix. Make sure it still fits your goals.

Credit Score Monitoring

Credit Score Monitoring is key to financial health. Check your credit score monthly. It helps you understand where you stand. A high score means better loan terms. Let’s explore credit reports and score improvement.

Understanding Your Credit Report

Your credit report holds your financial history. It shows debts and payment habits. Banks and lenders use it to judge creditworthiness. You should check for errors to protect your score. Spot identity theft early by reviewing your report regularly.

- Personal Information: Verify accuracy.

- Credit Accounts: Confirm account statuses.

- Inquiries: Check for unauthorized checks.

- Public Records: Look for legal actions affecting your score.

Ways To Improve Your Credit Score

A better credit score unlocks financial opportunities. Follow these steps for improvement:

- Pay bills on time. It shows lenders you’re reliable.

- Keep credit card balances low. High balances hurt your score.

- Don’t open new accounts too often. This can lower your average account age.

- Stay below credit limits. Using less credit boosts your score.

- Dispute inaccuracies. Correct mistakes to improve your score.

Expense Forecasting

Managing your finances means predicting expenses before they happen. Expense Forecasting is a crucial step. It helps you avoid surprises. You can plan your spending better. Let’s delve into two key areas of expense forecasting.

Planning For Upcoming Bills

Each month, certain bills are non-negotiable. Rent, utilities, and loan payments are examples. To manage these bills:

- Mark due dates on your calendar.

- Set up automatic payments when possible.

- Review bill amounts for any changes.

By planning, you ensure on-time payments. This avoids late fees. It also protects your credit score.

Preparing For Irregular Expenses

Some expenses don’t occur monthly. Yet, they can disrupt your budget. Here’s how to prepare:

- Identify irregular expenses like insurance premiums.

- Divide the total cost by 12 to save monthly.

- Set aside funds in a separate account.

This method smoothes out your financial year. It prevents stress from unexpected bills.

Tax Planning

Tax planning is a crucial aspect of financial health. It involves strategies to minimize tax liabilities and maximize savings. Effective planning ensures you keep more of what you earn. Let’s explore key monthly actions to optimize your tax situation.

Keeping Records For Tax Deductions

Meticulous record-keeping simplifies tax filing. Gather receipts, bills, and statements regularly. This habit ensures you claim all eligible deductions. Store these records safely for easy retrieval.

- Collect donation receipts

- Organize medical expenses

- Track business-related costs

Making Tax-efficient Investments

Investments can impact your tax bill. Choose options that offer tax benefits. Examples include retirement accounts and education savings plans.

| Investment Type | Tax Advantage |

|---|---|

| IRA | Deferred taxes on earnings |

| 529 Plan | Tax-free for education |

Insurance Coverage Review

Regularly reviewing your insurance coverage is a key step in managing your finances. It ensures you’re adequately protected and not overpaying for unnecessary coverage. Let’s delve into how to evaluate and adjust your policies monthly.

Evaluating Existing Policies

Start by listing all your current insurance policies. Check each policy’s details. Ensure your personal information is up-to-date. Look for changes in benefits or premiums. Confirm if your policy reflects your current needs. Bold the expiration dates to keep them in mind.

Adjusting Coverage As Needed

Analyze life changes like marriage, buying a home, or a new car. Adjust your insurance to cover these new assets or liabilities. If your situation has simplified, consider reducing coverage. This could lower your monthly expenses. Always compare quotes from different providers to find the best rates. Make adjustments to ensure optimal coverage and cost savings.

Professional Financial Advice

Professional Financial Advice can change how you view and manage your money. It helps you make smarter decisions and reach your financial goals faster. Let’s explore when to seek advice and the benefits of professional management.

When To Consult A Financial Advisor

Knowing when to seek financial advice is key. Here are some scenarios:

- Major life changes: Buying a home, marriage, or starting a business.

- Investment decisions: Unsure where to invest or need strategy help.

- Retirement planning: To ensure you’re on track for your golden years.

- Debt management: Strategies to reduce or eliminate debt effectively.

Benefits Of Professional Portfolio Management

Having an expert manage your investments can provide several benefits:

| Benefit | Description |

|---|---|

| Expertise | Access to professional knowledge and experience. |

| Time savings | Let experts manage your portfolio while you focus on other tasks. |

| Risk management | Professionals can help balance your portfolio to manage risk. |

| Customization | Your portfolio is tailored to your personal goals and needs. |

Remember, consulting a financial advisor and opting for professional portfolio management can significantly impact your financial health. It’s worth considering at least once every month.

:max_bytes(150000):strip_icc()/retention-bonus.asp-final-dce78f3e7dbb435db1d10d1c45292815.png)

Credit: www.investopedia.com

Conclusion: Staying Financially Fit

Keeping your finances in shape needs regular check-ups and action. Like staying healthy, it means doing small things often. Let’s wrap up our journey to financial fitness with a recap and some steps to keep the momentum.

Monthly Recap And Next Steps

Every month, take time to look back and plan ahead. This helps you stay on track. Here are key steps:

- Review your spending. See where your money went.

- Check savings goals. Are you getting closer?

- Adjust budgets. Found new expenses? Plan for them.

- Set one new goal. Keep it simple and achievable.

These steps make big goals feel small and easy to tackle.

Maintaining Momentum In Financial Health

Staying financially fit is a marathon, not a sprint. Keep your pace steady with these habits:

- Save first. Put money into savings as you get paid.

- Spend wisely. Ask, “Do I really need this?” before buying.

- Learn more. Read or watch one new thing about money monthly.

- Seek advice. Talk to someone smart about money if stuck.

These habits build a strong financial future, one step at a time.

Credit: www.tiktok.com

Frequently Asked Questions

What Is The 50/30/20 Rule?

The 50/30/20 rule is a budgeting technique where you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

What’s The 10 20 Rule In Finance?

The 10 20 rule in finance suggests saving 10% of your income for emergencies and allocating 20% to debt repayments and savings.

What Is A 30 Day No-spend Challenge?

A 30-day no-spend challenge involves avoiding unnecessary purchases for a month to save money and curb spending habits.

What Is A No Buy Month?

A no buy month is a period where individuals commit to not purchasing non-essential items, aiming to save money and reduce consumption.

Conclusion

Embracing these monthly financial habits can truly transform your money management game. Regular reviews and updates keep your goals on track. Remember, consistency is key to building financial stability. Start today, and watch your financial health thrive with each passing month.

Your future self will thank you.